New Mexico Pit-1 Form

New Mexico Pit-1 Form - This form is for income earned in tax year 2022, with tax. All others must file by april 18, 2023. The document has moved here. 2 if amending use form 2021. Web fill, print & go. As a new mexico resident, you are required to fill it out and file it annually. Worksheet for computation of allowable credit for. The feature saves you the time. Taxes paid to other states by new mexico residents. The top tax bracket is 4.9% the.

The top tax bracket is 4.9% the. This form is for income earned in tax year 2022, with tax. 2 if amending use form 2016. • every person who is a new mexi co resident. Web fill, print & go. The document has moved here. If you are a new mexico resident, you must file if you meet any of the following conditions: The rates vary depending upon your filing status and income. As a new mexico resident, you are required to fill it out and file it annually. All others must file by april 18, 2023.

When you use our print, fill and go forms, you can walk into any of our district offices with a completed tax form in your hands. This form is for income earned in tax year 2022, with tax. The feature saves you the time. • every person who is a new mexi co resident. The form records your income. The top tax bracket is 4.9% the. All others must file by april 18, 2023. Web fill, print & go. The document has moved here. The rates vary depending upon your filing status and income.

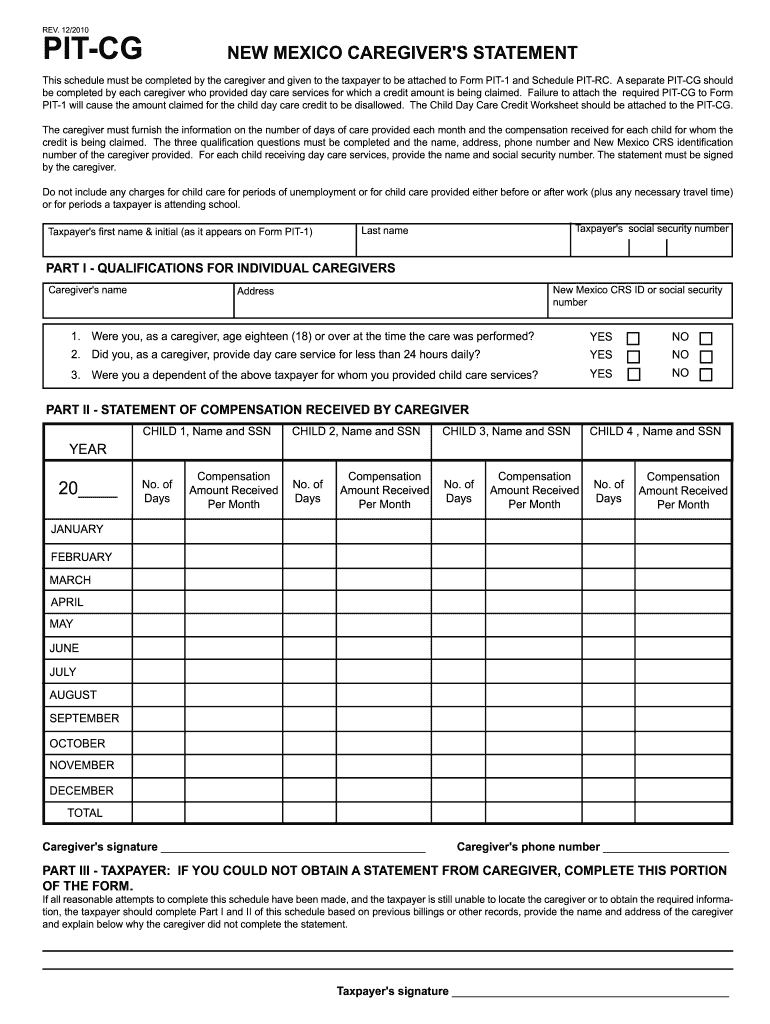

Download Pit Cg Form Tax Fill Out and Sign Printable PDF Template

The rates vary depending upon your filing status and income. 2 if amending use form 2021. • every person who is a new mexi co resident. Worksheet for computation of allowable credit for. Web fill, print & go.

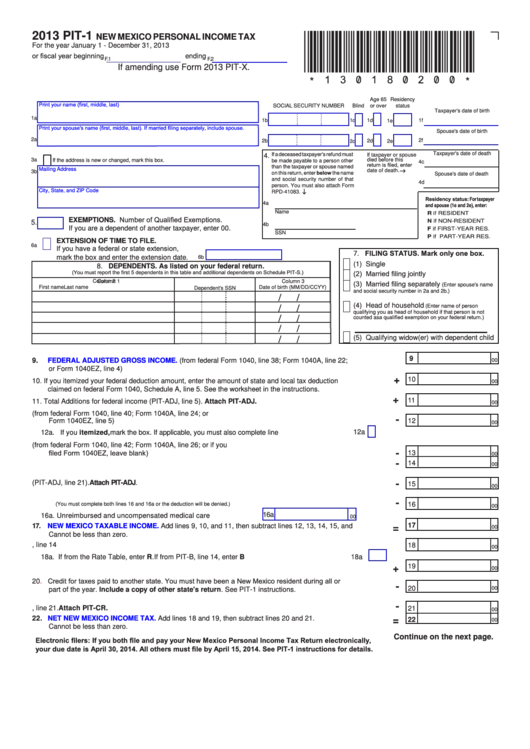

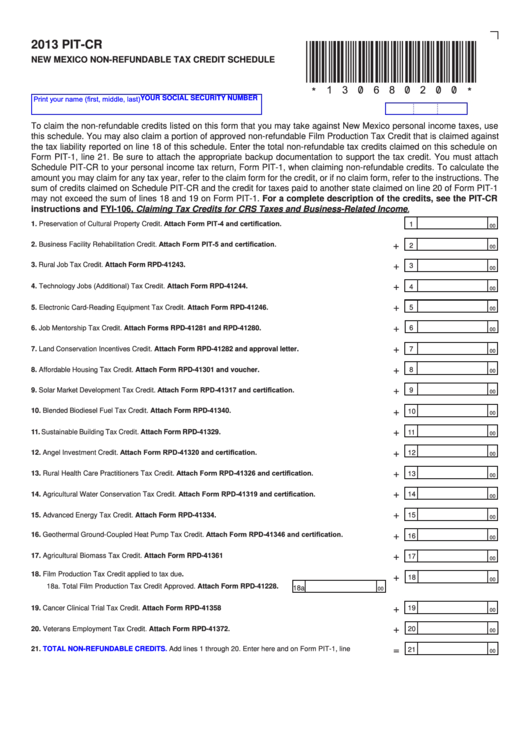

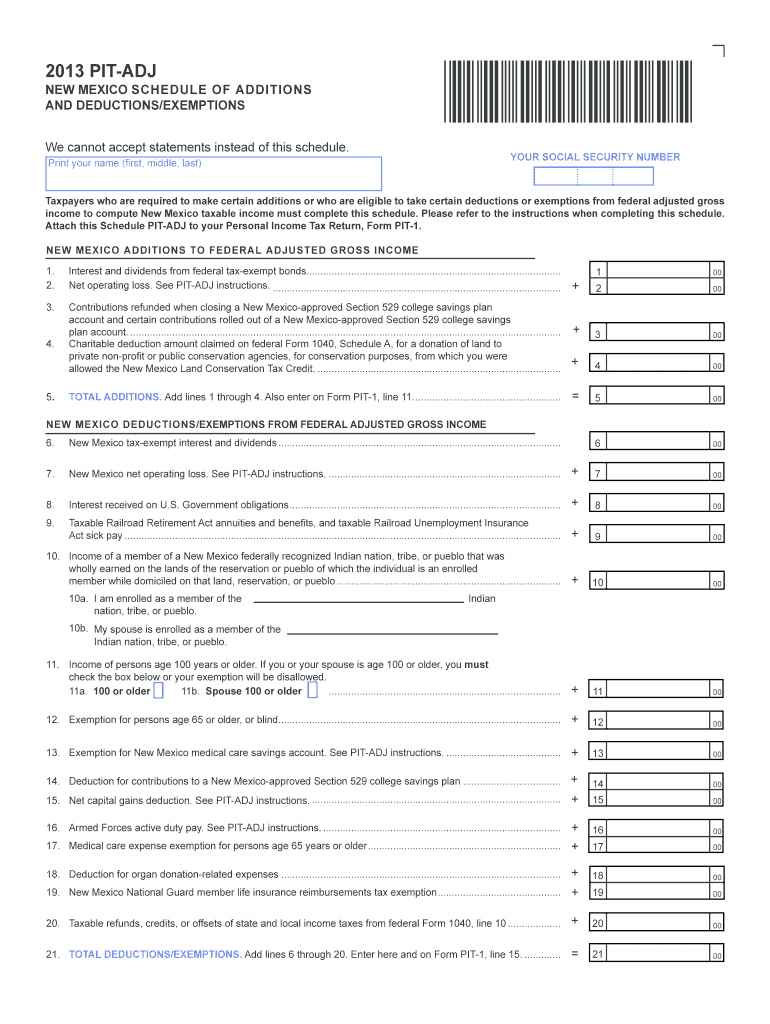

Fillable Form Pit1 New Mexico Personal Tax 2013 printable

All others must file by april 18, 2023. Worksheet for computation of allowable credit for. Taxes paid to other states by new mexico residents. The form records your income. The rates vary depending upon your filing status and income.

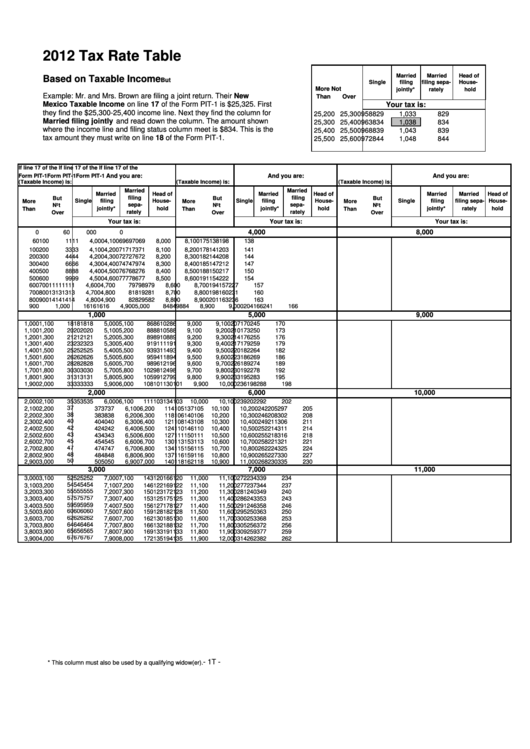

Tax Rate Table Form Based On Taxable State Of New Mexico

The form records your income. This form is for income earned in tax year 2022, with tax. 2 if amending use form 2016. As a new mexico resident, you are required to fill it out and file it annually. The rates vary depending upon your filing status and income.

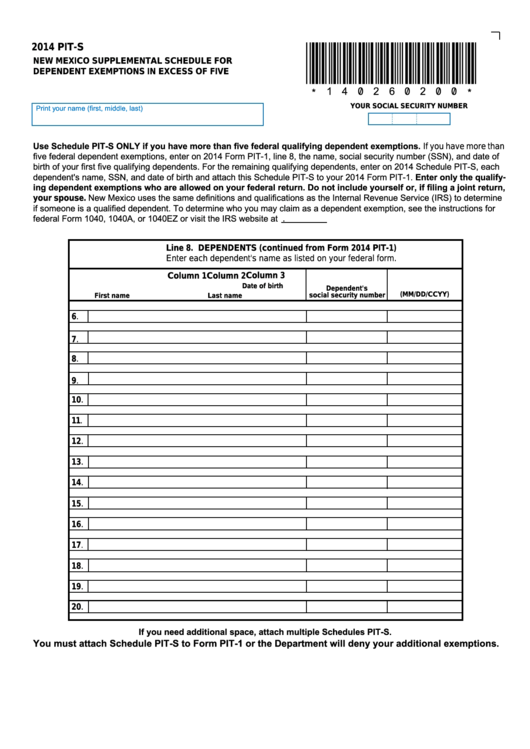

Form PitS New Mexico Supplemental Schedule For Dependent Exemptions

Worksheet for computation of allowable credit for. 2 if amending use form 2016. The form records your income. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. Web fill, print & go.

Fillable Form PitCr New Mexico NonRefundable Tax Credit Schedule

2 if amending use form 2021. As a new mexico resident, you are required to fill it out and file it annually. Taxes paid to other states by new mexico residents. • every person who is a new mexi co resident. Web fill, print & go.

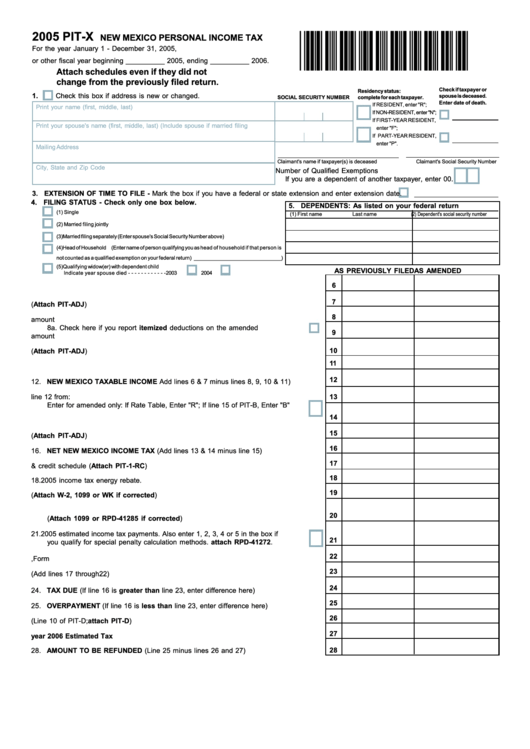

Form PitX New Mexico Personal Tax 2005 printable pdf download

The form records your income. The top tax bracket is 4.9% the. 2 if amending use form 2016. The rates vary depending upon your filing status and income. This form is for income earned in tax year 2022, with tax.

“The Pit” Renovation The University of New Mexico ChavezGrieves

All others must file by april 18, 2023. As a new mexico resident, you are required to fill it out and file it annually. The rates vary depending upon your filing status and income. Worksheet for computation of allowable credit for. 2 if amending use form 2016.

NM PITB 20192022 Fill out Tax Template Online US Legal Forms

The feature saves you the time. • every person who is a new mexi co resident. The document has moved here. Web fill, print & go. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023.

HD Time Lapse The Pit (Univ. of New Mexico) YouTube

The form records your income. When you use our print, fill and go forms, you can walk into any of our district offices with a completed tax form in your hands. 2 if amending use form 2021. The document has moved here. If you are a new mexico resident, you must file if you meet any of the following conditions:

Web Fill, Print & Go.

The form records your income. If you are a new mexico resident, you must file if you meet any of the following conditions: Taxes paid to other states by new mexico residents. 2 if amending use form 2016.

This Form Is For Income Earned In Tax Year 2022, With Tax.

The top tax bracket is 4.9% the. • every person who is a new mexi co resident. Worksheet for computation of allowable credit for. All others must file by april 18, 2023.

When You Use Our Print, Fill And Go Forms, You Can Walk Into Any Of Our District Offices With A Completed Tax Form In Your Hands.

The document has moved here. As a new mexico resident, you are required to fill it out and file it annually. 2 if amending use form 2021. The feature saves you the time.

The Rates Vary Depending Upon Your Filing Status And Income.

If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023.