Non Filer Tax Form 2022

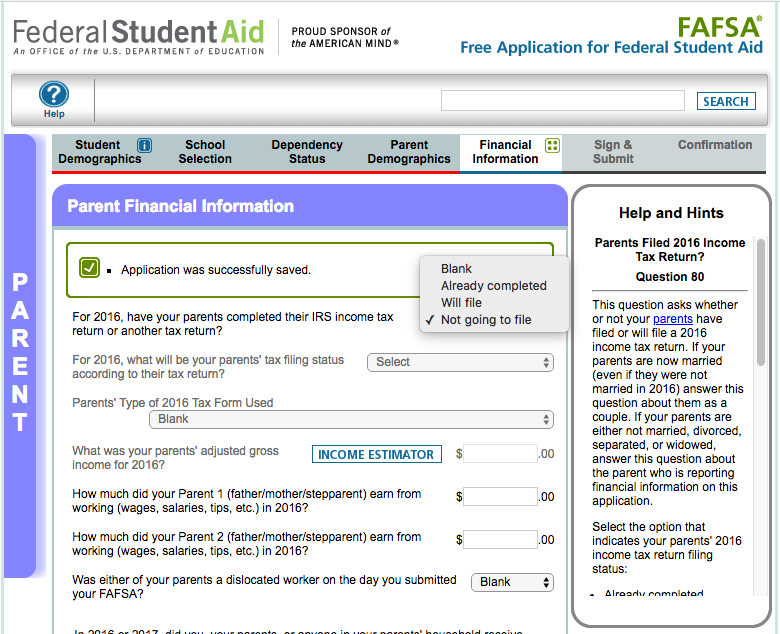

Non Filer Tax Form 2022 - Enter payment info is secure, and the information entered will be safe. List below your and/or your parent(s)’/spouse's employers and/or sources of income and the amount of income. Nonresident alien income tax return. You may file this return. Web if you have at least one qualifying child and earned less than $24,800 as a married couple, $18,650 as a head of household, or $12,400 as a single filer, you can use the code for. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web get tax records and transcripts online or by mail. Web select this box if you are filing under an extension. Web for those who don't normally file a tax return, the process is simple and only takes a few minutes. Enter payment info here. then provide basic information including social security number, name, address, and.

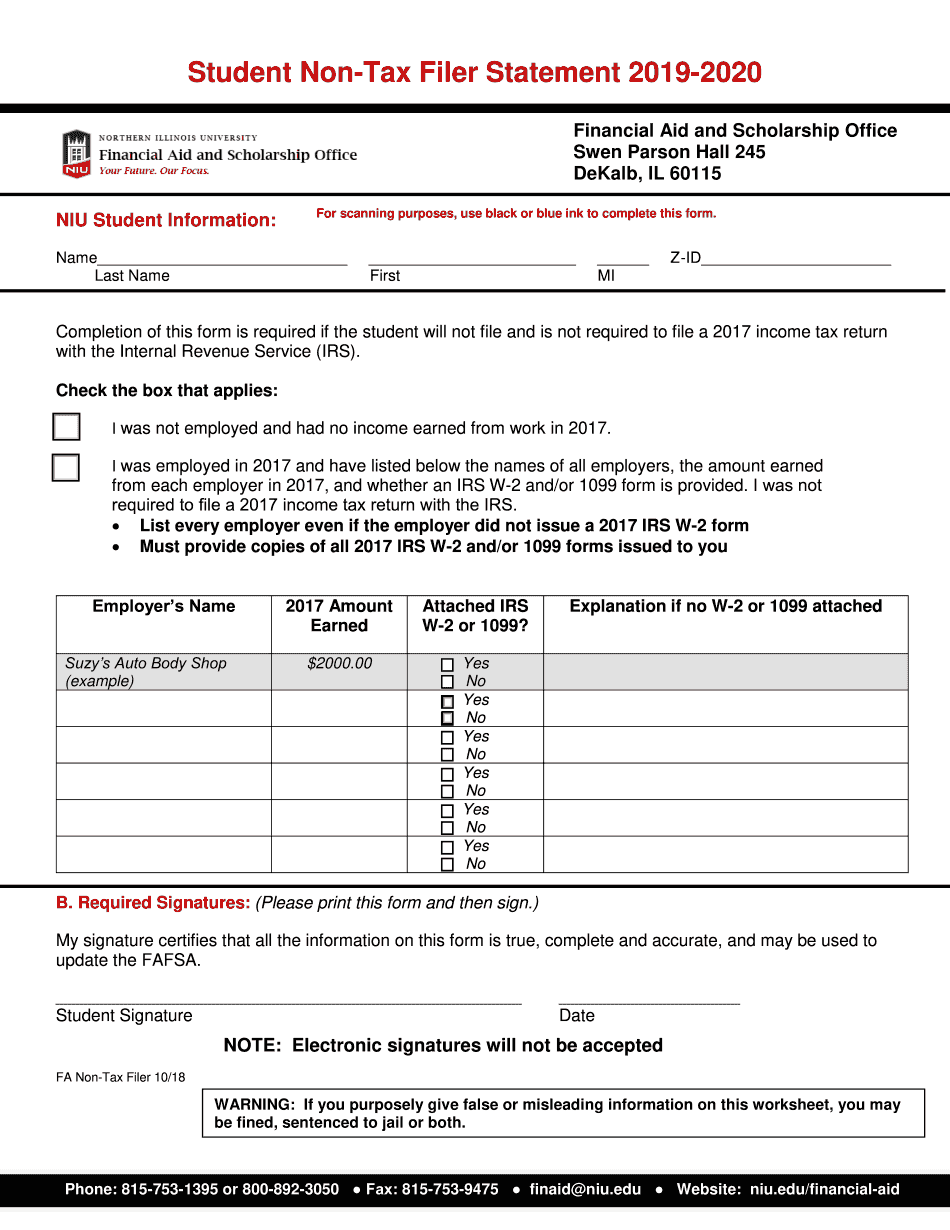

Nonresident alien income tax return. If you and/or your parent(s)/spouse did not and are not required by the u.s. If the net profit that you earned (your gross income,. Internal revenue service (irs) to file a 2020 federal. Enter the total distributive or pro rata share of tax. Tax clearance, please fill out a. The pte must file form 511 electronically to pass on a business tax credit from form 500cr or from form 502s. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Enter payment info is secure, and the information entered will be safe. List below your and/or your parent(s)’/spouse's employers and/or sources of income and the amount of income.

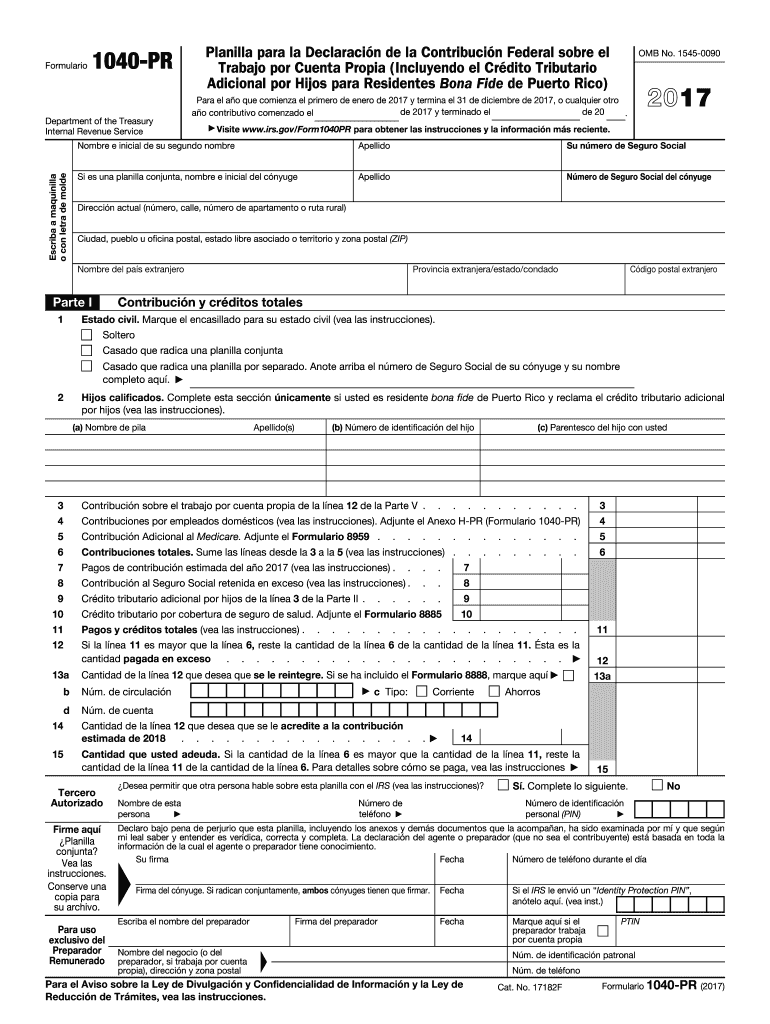

Internal revenue service (irs) to file a 2020 federal. You may file this return. The pte must file form 511 electronically to pass on a business tax credit from form 500cr or from form 502s. If the net profit that you earned (your gross income,. Nonresident alien income tax return. Web select this box if you are filing under an extension. Web for those who don't normally file a tax return, the process is simple and only takes a few minutes. Enter the total distributive or pro rata share of tax. Irs use only—do not write or. Web if you have at least one qualifying child and earned less than $24,800 as a married couple, $18,650 as a head of household, or $12,400 as a single filer, you can use the code for.

Frequently Asked Questions (FAQs) Scholarships » Office of Admissions

Internal revenue service (irs) to file a 2020 federal. Web for those who don't normally file a tax return, the process is simple and only takes a few minutes. The tool is based on free file fillable forms. Web for tax year 2022, please see the 2022 instructions. The pte must file form 511 electronically to pass on a business.

Non Tax Filer Form Fill Out and Sign Printable PDF Template signNow

The pte must file form 511 electronically to pass on a business tax credit from form 500cr or from form 502s. Web select this box if you are filing under an extension. Web if you have at least one qualifying child and earned less than $24,800 as a married couple, $18,650 as a head of household, or $12,400 as a.

How Many Child Tax Credits Can You Claim

List below your and/or your parent(s)’/spouse's employers and/or sources of income and the amount of income. Enter payment info is secure, and the information entered will be safe. Web for tax year 2022, please see the 2022 instructions. Tax clearance, please fill out a. Internal revenue service (irs) to file a 2020 federal.

NonTax Filer Statement 20182019 Fill out & sign online DocHub

The tool is based on free file fillable forms. Web for those who don't normally file a tax return, the process is simple and only takes a few minutes. Web if you have at least one qualifying child and earned less than $24,800 as a married couple, $18,650 as a head of household, or $12,400 as a single filer, you.

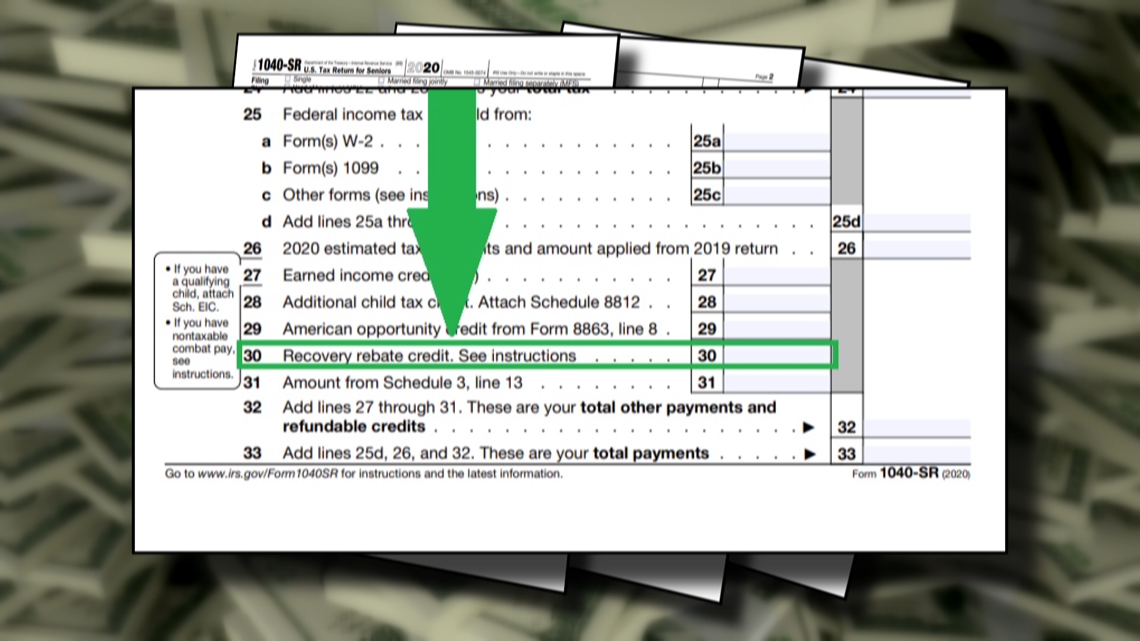

2020 tax filing Tips for people who got unemployment benefits

Nonresident alien income tax return. Enter the total distributive or pro rata share of tax. Web select this box if you are filing under an extension. Web for tax year 2022, please see the 2022 instructions. Tax clearance, please fill out a.

2017 Form IRS 1040PR Fill Online, Printable, Fillable, Blank pdfFiller

Irs use only—do not write or. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) The pte must file form 511 electronically to pass on a business tax credit from form 500cr or from form 502s. List below your and/or your parent(s)’/spouse's employers and/or sources of income and the amount of income. If the.

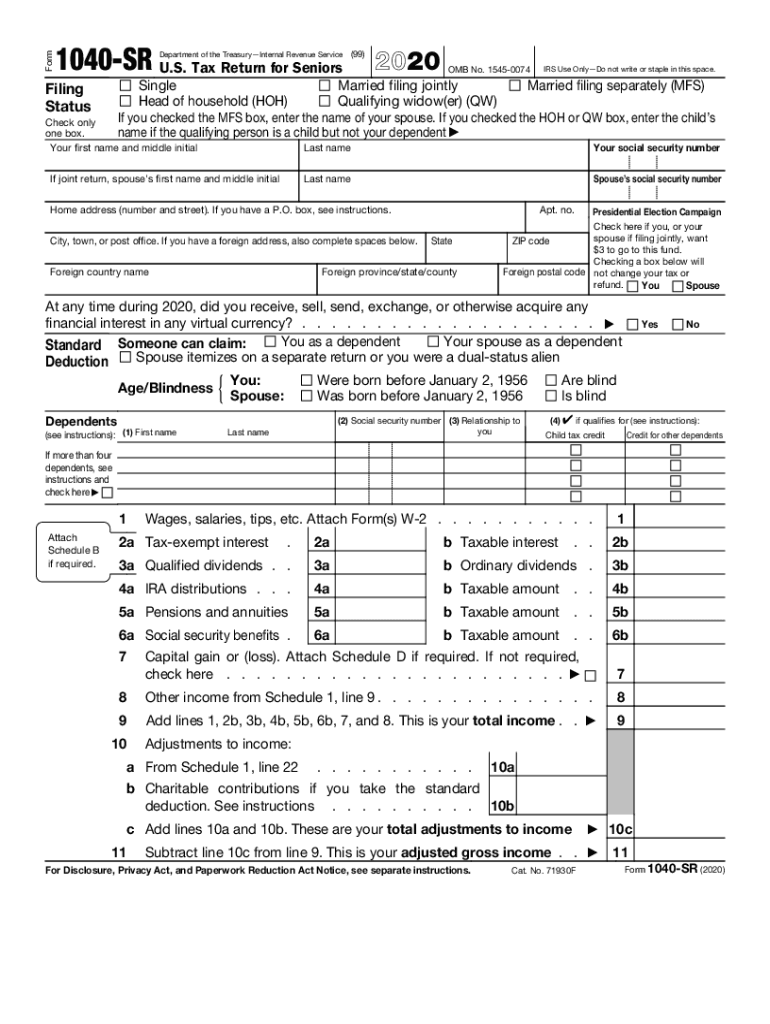

IRS 1040SR 20202022 Fill out Tax Template Online US Legal Forms

Web number, date of birth, and mailing addre ss from your latest tax return. Enter payment info here. then provide basic information including social security number, name, address, and. The pte must file form 511 electronically to pass on a business tax credit from form 500cr or from form 502s. Enter payment info is secure, and the information entered will.

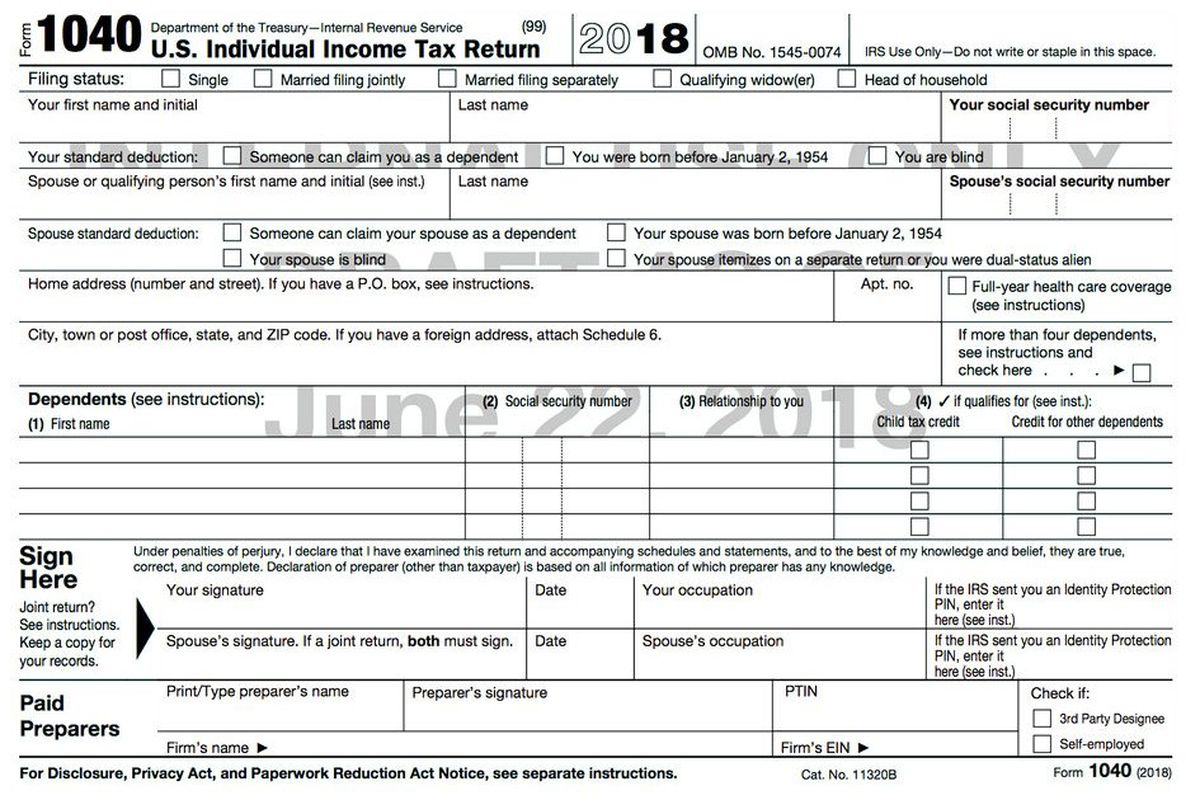

The IRS Shrinks The 1040 Tax Form But The Workload Stays 1040 Form

Web for those who don't normally file a tax return, the process is simple and only takes a few minutes. List below your and/or your parent(s)’/spouse's employers and/or sources of income and the amount of income. The tool is based on free file fillable forms. Web select this box if you are filing under an extension. Internal revenue service (irs).

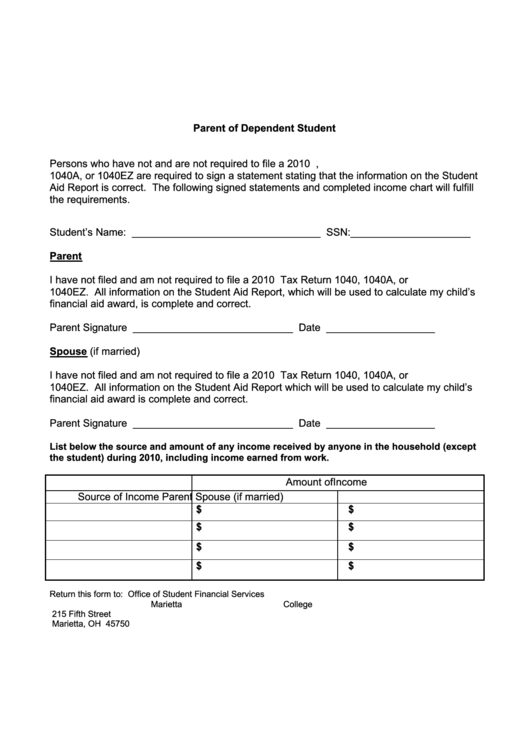

Fillable U.s. Tax NonFiler Statement Parent Of Dependent

Irs use only—do not write or. List below your and/or your parent(s)’/spouse's employers and/or sources of income and the amount of income. Enter payment info here. then provide basic information including social security number, name, address, and. Nonresident alien income tax return. If you and/or your parent(s)/spouse did not and are not required by the u.s.

20192023 Form Stony Brook University Verification of for Parent

You may file this return. If the net profit that you earned (your gross income,. Web number, date of birth, and mailing addre ss from your latest tax return. Internal revenue service (irs) to file a 2020 federal. If you and/or your parent(s)/spouse did not and are not required by the u.s.

The Tool Is Based On Free File Fillable Forms.

Enter payment info is secure, and the information entered will be safe. Enter the total distributive or pro rata share of tax. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) If you and/or your parent(s)/spouse did not and are not required by the u.s.

Tax Clearance, Please Fill Out A.

Web for those who don't normally file a tax return, the process is simple and only takes a few minutes. Web if you have at least one qualifying child and earned less than $24,800 as a married couple, $18,650 as a head of household, or $12,400 as a single filer, you can use the code for. You may file this return. List below your and/or your parent(s)’/spouse's employers and/or sources of income and the amount of income.

Nonresident Alien Income Tax Return.

Web number, date of birth, and mailing addre ss from your latest tax return. Web for tax year 2022, please see the 2022 instructions. The pte must file form 511 electronically to pass on a business tax credit from form 500cr or from form 502s. If the net profit that you earned (your gross income,.

Internal Revenue Service (Irs) To File A 2020 Federal.

Web select this box if you are filing under an extension. Enter payment info here. then provide basic information including social security number, name, address, and. Irs use only—do not write or. Web get tax records and transcripts online or by mail.