Ny Form It 204

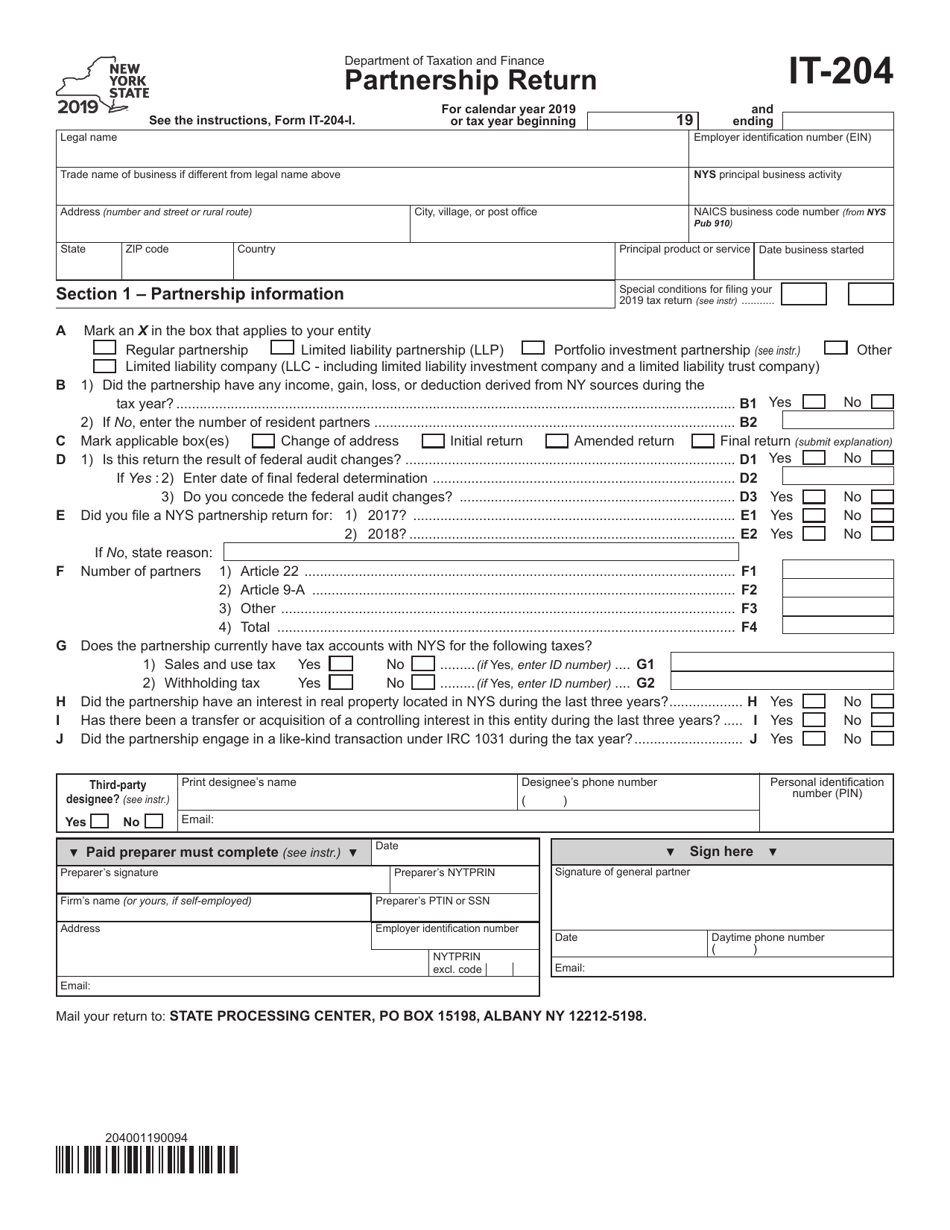

Ny Form It 204 - Returns for calendar year 2022 are due march 15, 2023. 116a 116b mctd allocation percentage (see instructions). 1 2 returns and allowances. Otherwise, new york state law does not currently require a Regular partnership limited liability company (llc) or limited liability partnership (llp) Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the ssn/ein of the taxpayer who sent it. 116a new york source gross income (see instructions). Used to report income, deductions, gains, losses and credits from the operation of a partnership. Web the instructions are for the partner.

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the ssn/ein of the taxpayer who sent it. Web the instructions are for the partner. Used to report income, deductions, gains, losses and credits from the operation of a partnership. 116a 116b mctd allocation percentage (see instructions). 1 2 returns and allowances. Regular partnership limited liability company (llc) or limited liability partnership (llp) Otherwise, new york state law does not currently require a Returns for calendar year 2022 are due march 15, 2023. 116a new york source gross income (see instructions).

Web the instructions are for the partner. 1 2 returns and allowances. Regular partnership limited liability company (llc) or limited liability partnership (llp) Used to report income, deductions, gains, losses and credits from the operation of a partnership. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the ssn/ein of the taxpayer who sent it. Returns for calendar year 2022 are due march 15, 2023. 116a 116b mctd allocation percentage (see instructions). 116a new york source gross income (see instructions). Otherwise, new york state law does not currently require a

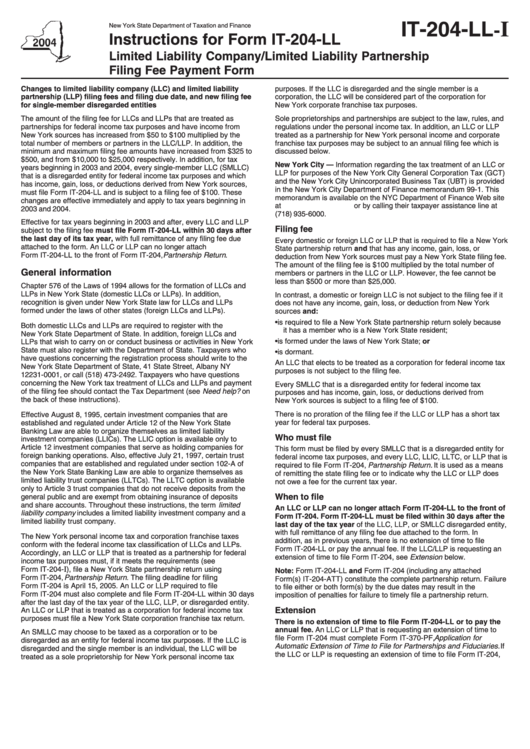

NY IT204LL 20152021 Fill and Sign Printable Template Online US

116a 116b mctd allocation percentage (see instructions). 116a new york source gross income (see instructions). Regular partnership limited liability company (llc) or limited liability partnership (llp) Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the ssn/ein of the taxpayer who.

Form IT204 Download Fillable PDF or Fill Online Partnership Return

Used to report income, deductions, gains, losses and credits from the operation of a partnership. Web the instructions are for the partner. 116a 116b mctd allocation percentage (see instructions). Regular partnership limited liability company (llc) or limited liability partnership (llp) Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department.

Instructions For Form It204Ll Limited Liability Company/limited

Web the instructions are for the partner. Otherwise, new york state law does not currently require a 116a 116b mctd allocation percentage (see instructions). Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the ssn/ein of the taxpayer who sent it..

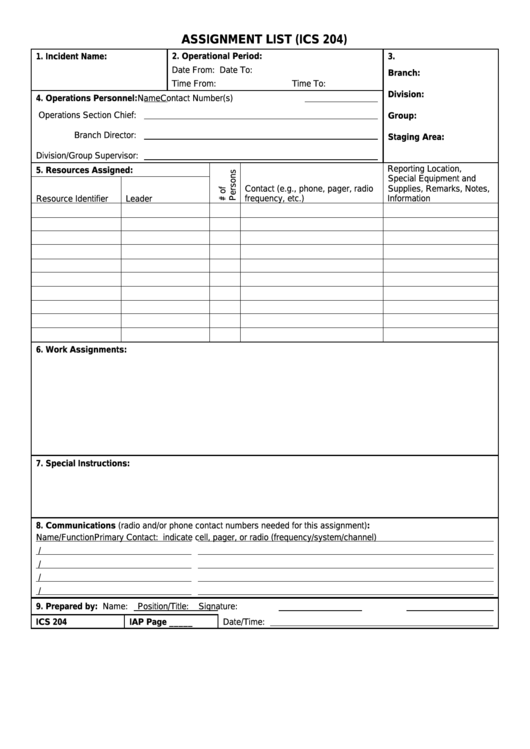

Fillable Ics Form 204 Assignment List printable pdf download

116a 116b mctd allocation percentage (see instructions). 1 2 returns and allowances. Regular partnership limited liability company (llc) or limited liability partnership (llp) Otherwise, new york state law does not currently require a Used to report income, deductions, gains, losses and credits from the operation of a partnership.

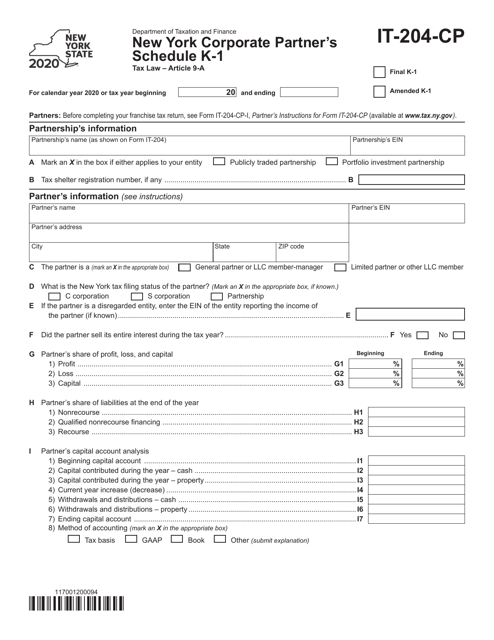

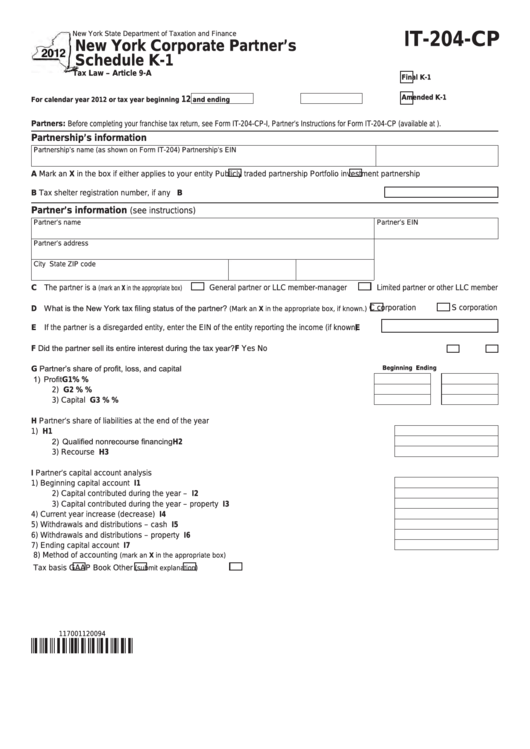

Form IT204CP Download Fillable PDF or Fill Online New York Corporate

Otherwise, new york state law does not currently require a Returns for calendar year 2022 are due march 15, 2023. 116a 116b mctd allocation percentage (see instructions). Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the ssn/ein of the taxpayer.

Form J 204 Fill Online, Printable, Fillable, Blank PDFfiller

Otherwise, new york state law does not currently require a 1 2 returns and allowances. 116a 116b mctd allocation percentage (see instructions). Web the instructions are for the partner. Used to report income, deductions, gains, losses and credits from the operation of a partnership.

Fillable Form It204Cp New York Corporate Partner'S Schedule K1

Regular partnership limited liability company (llc) or limited liability partnership (llp) Otherwise, new york state law does not currently require a 116a new york source gross income (see instructions). 1 2 returns and allowances. Used to report income, deductions, gains, losses and credits from the operation of a partnership.

re204a Fill out & sign online DocHub

116a new york source gross income (see instructions). 1 2 returns and allowances. Otherwise, new york state law does not currently require a 116a 116b mctd allocation percentage (see instructions). Used to report income, deductions, gains, losses and credits from the operation of a partnership.

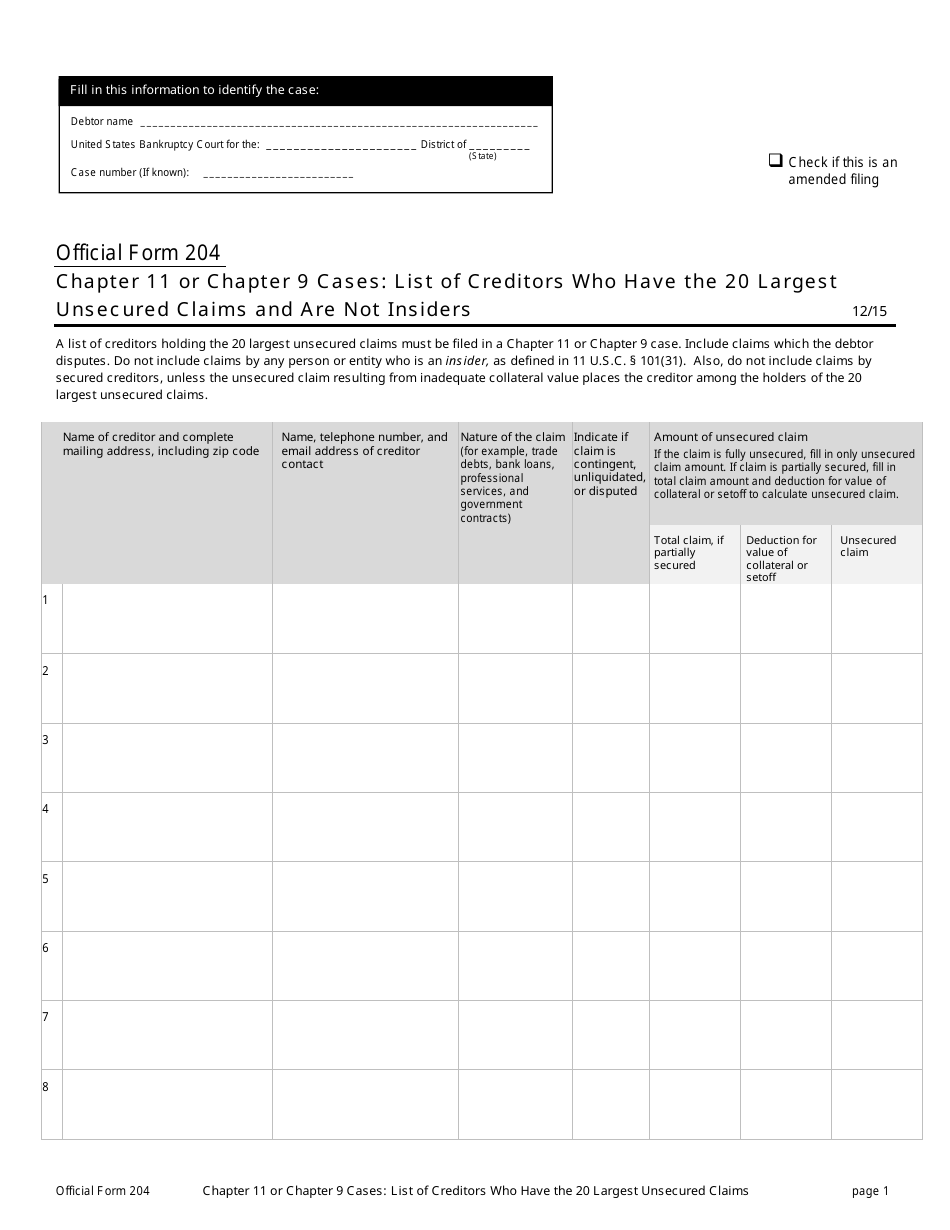

Official Form 204 Download Printable PDF or Fill Online Chapter 11 or

1 2 returns and allowances. Regular partnership limited liability company (llc) or limited liability partnership (llp) 116a 116b mctd allocation percentage (see instructions). Returns for calendar year 2022 are due march 15, 2023. Otherwise, new york state law does not currently require a

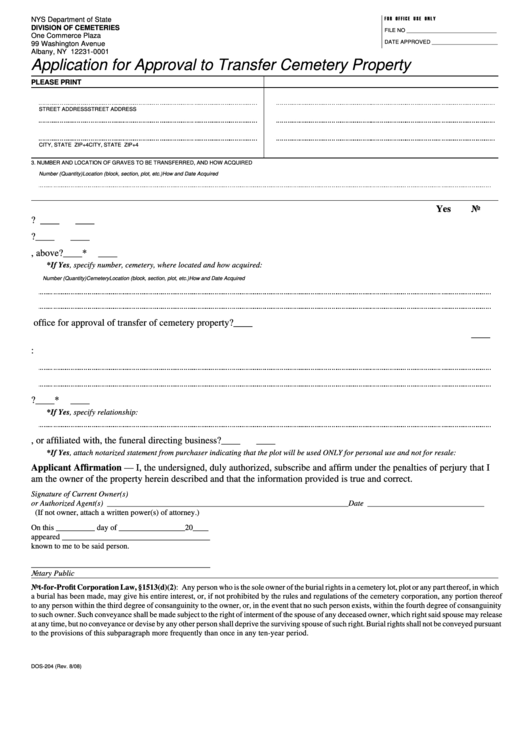

Form Dos204 Application For Approval To Transfer Cemetery Property

1 2 returns and allowances. Web the instructions are for the partner. 116a 116b mctd allocation percentage (see instructions). Returns for calendar year 2022 are due march 15, 2023. Regular partnership limited liability company (llc) or limited liability partnership (llp)

Web The Instructions Are For The Partner.

116a 116b mctd allocation percentage (see instructions). Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the ssn/ein of the taxpayer who sent it. Returns for calendar year 2022 are due march 15, 2023. 116a new york source gross income (see instructions).

Regular Partnership Limited Liability Company (Llc) Or Limited Liability Partnership (Llp)

Used to report income, deductions, gains, losses and credits from the operation of a partnership. Otherwise, new york state law does not currently require a 1 2 returns and allowances.