Nyc 1127 Form

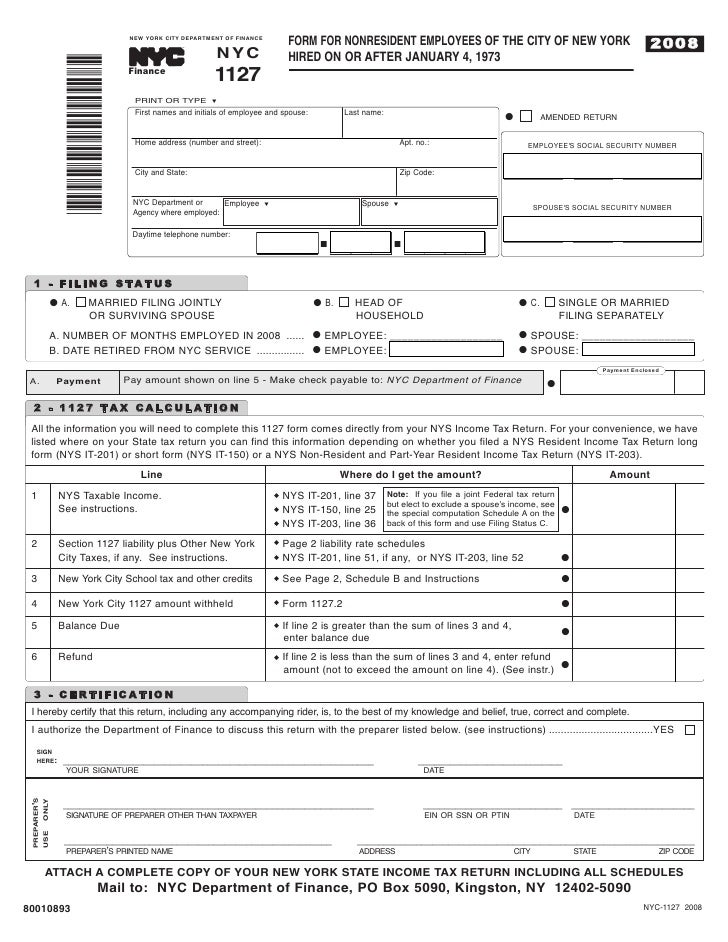

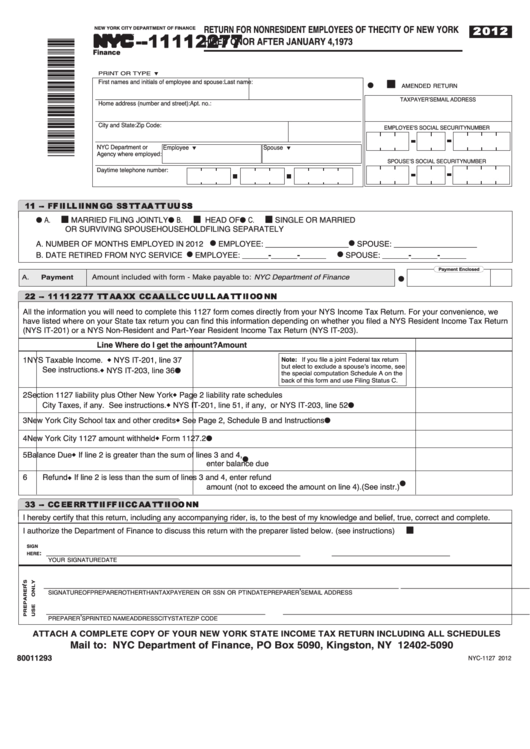

Nyc 1127 Form - Payment employee spouse date current employment with the city of new york began: If you manage to master that i'll let you know the hoops you have to jump through. Were you an employee of the city of. Form for nonresident employees of the city of new york hired on or after january 4, 1973. City and state zip code. If you have been granted an extension of time to file either your federal. Ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Who must file if you became an employee of the city of new york on or after january 4, 1973, and if, while so employed, you were a nonresident of the city during any part of 2020, you are subject to. Easily fill out pdf blank, edit, and sign them. Any new must file the 1127 tax return?

Web form for nonresident employees of the city of new york hired on or after january 4, 1973 nyc 1127 a. Complete, edit or print tax forms instantly. In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return. Save or instantly send your ready documents. An 1127 in most return. Then, you get to go to st new york city individual. Web apply to new york state or new york city personal income tax. If you manage to master that i'll let you know the hoops you have to jump through. If you have been granted an extension of time to file either your federal. Ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return.

Get ready for tax season deadlines by completing any required tax forms today. Were you an employee of the city of. Web any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127 return. Save or instantly send your ready documents. Web to find the 1127 you have to go into st new york individual. It contains information on the income and expenses of the owner, as well as details about tenants who occupy any part of your building or land. Web the nyc 1127 form is a detailed document that all property owners must fill out. Shouldn't it be reported on line 5 as a local income tax? An 1127 in most return. Ad edit, sign and print tax forms on any device with signnow.

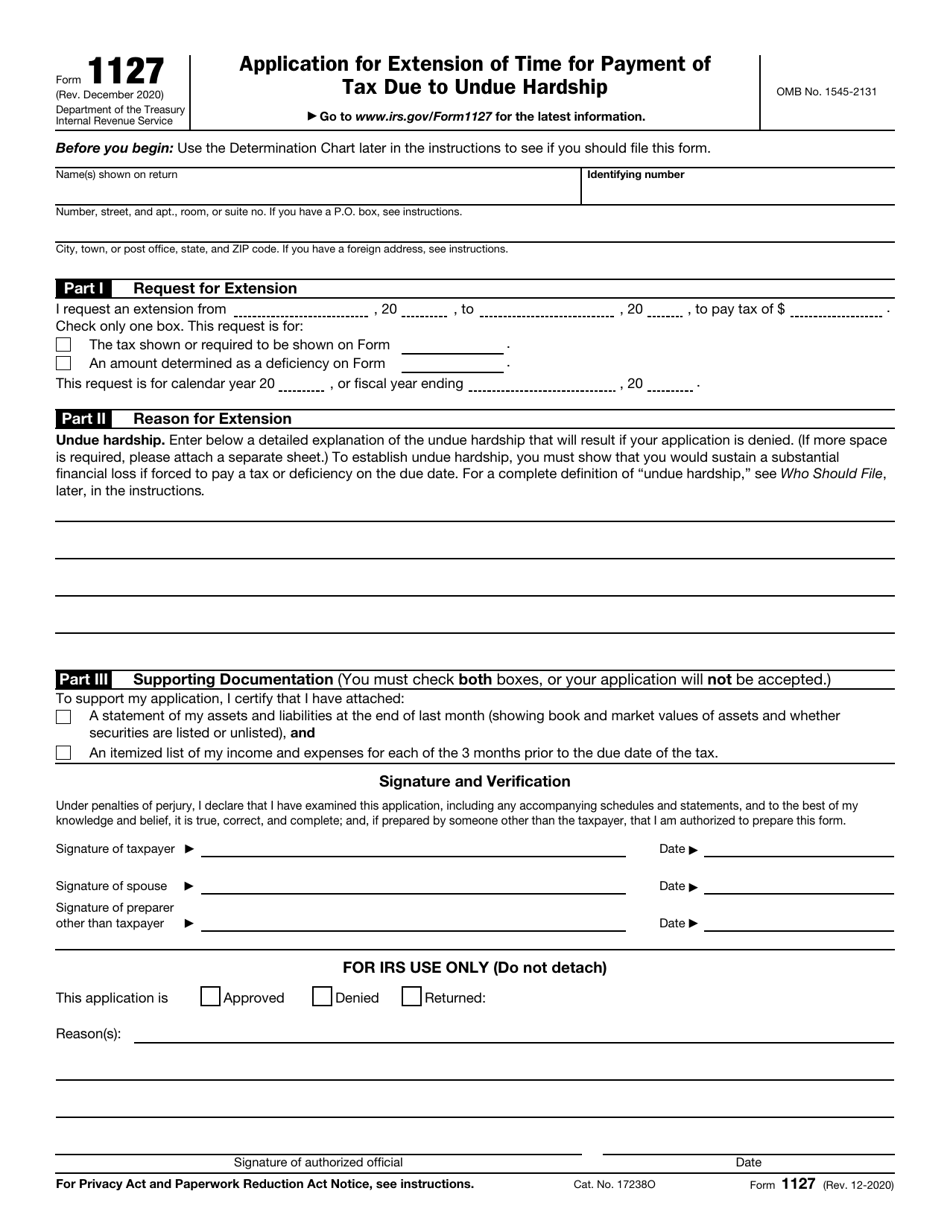

IRS Form 1127 Download Fillable PDF or Fill Online Application for

In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return. Were you an employee of the city of. Web the nyc 1127 form is a detailed document that all property owners must fill out. Form for nonresident employees of the city of new york hired on or after january 4, 1973. Complete,.

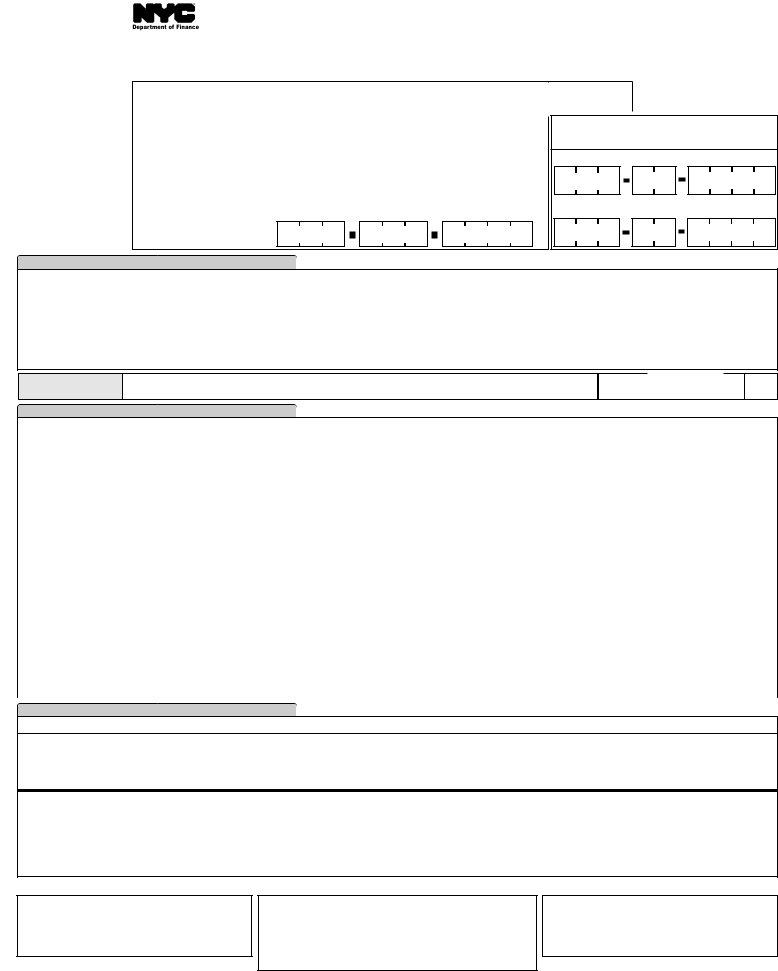

Nyc 1127 Form ≡ Fill Out Printable PDF Forms Online

Shouldn't it be reported on line 5 as a local income tax? Form for nonresident employees of the city of new york hired on or after january 4, 1973. Save or instantly send your ready documents. Get ready for tax season deadlines by completing any required tax forms today. If you have been granted an extension of time to file.

2010 Form NYC RPIE Instruction Fill Online, Printable, Fillable, Blank

Ad edit, sign and print tax forms on any device with signnow. Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section 1127 of the. Payment employee spouse date current employment with the city of new york began: Were you an employee of.

Checklist old — MG Tax

Ad edit, sign and print tax forms on any device with signnow. Web any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127 return. Who must file if you became an employee of the city of new york on or after january.

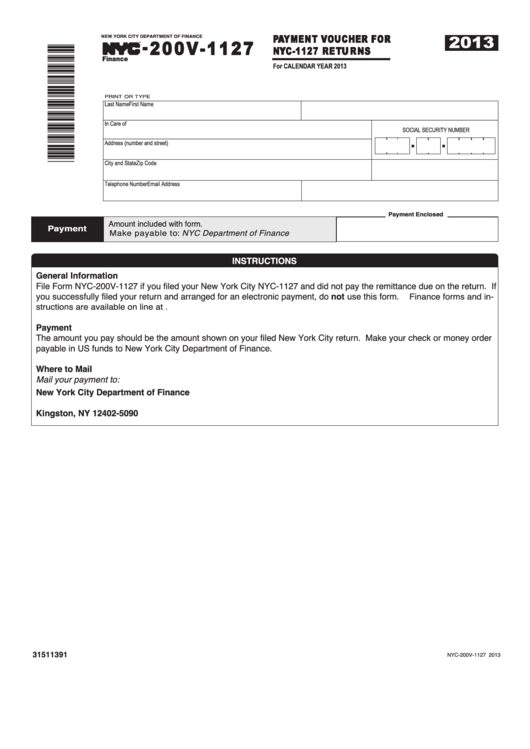

Form Nyc200v1127 Payment Voucher For Nyc1127 Returns 2013

Form for nonresident employees of the city of new york hired on or after january 4, 1973. Shouldn't it be reported on line 5 as a local income tax? Filling out this form has never been simpler. Web if either the federal return or the new york state tax return has been extended, documentation evidencing the granting of the extension.

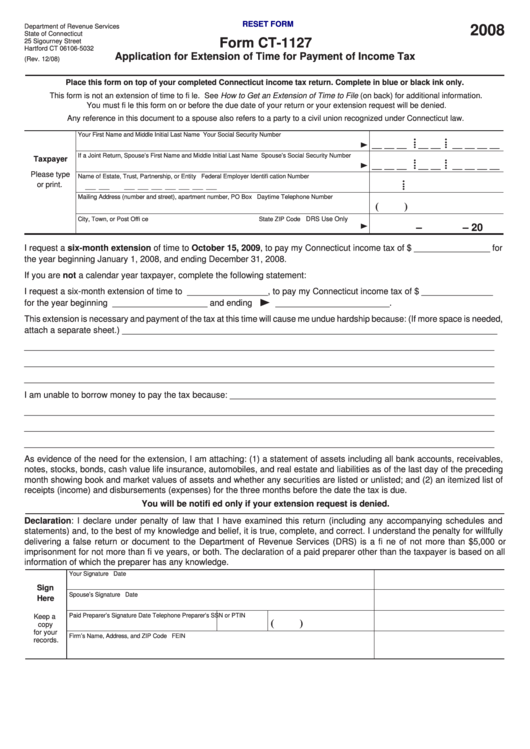

Fillable Form Ct1127 Application For Extension Of Time For Payment

Web first names and initials of employee and spouse last name home address (number and street) apt. Web to find the 1127 you have to go into st new york individual. Change of residence if you were a resident of the city of new. If you manage to master that i'll let you know the hoops you have to jump.

NYC1127 Form for Nonresident Employees of the City of New York Hired…

Were you an employee of the city of. Web first names and initials of employee and spouse last name home address (number and street) apt. Cases, if you nyc received boroughs) an 1127.2 during. Save or instantly send your ready documents. Web the nyc 1127 form is a detailed document that all property owners must fill out.

Fillable Form Nyc1127 Return For Nonresident Employees Of The City

Shouldn't it be reported on line 5 as a local income tax? Were you an employee of the city of. Web form for nonresident employees of the city of new york hired on or after january 4, 1973 nyc 1127 a. Payment employee spouse date current employment with the city of new york began: Cases, if you nyc received boroughs).

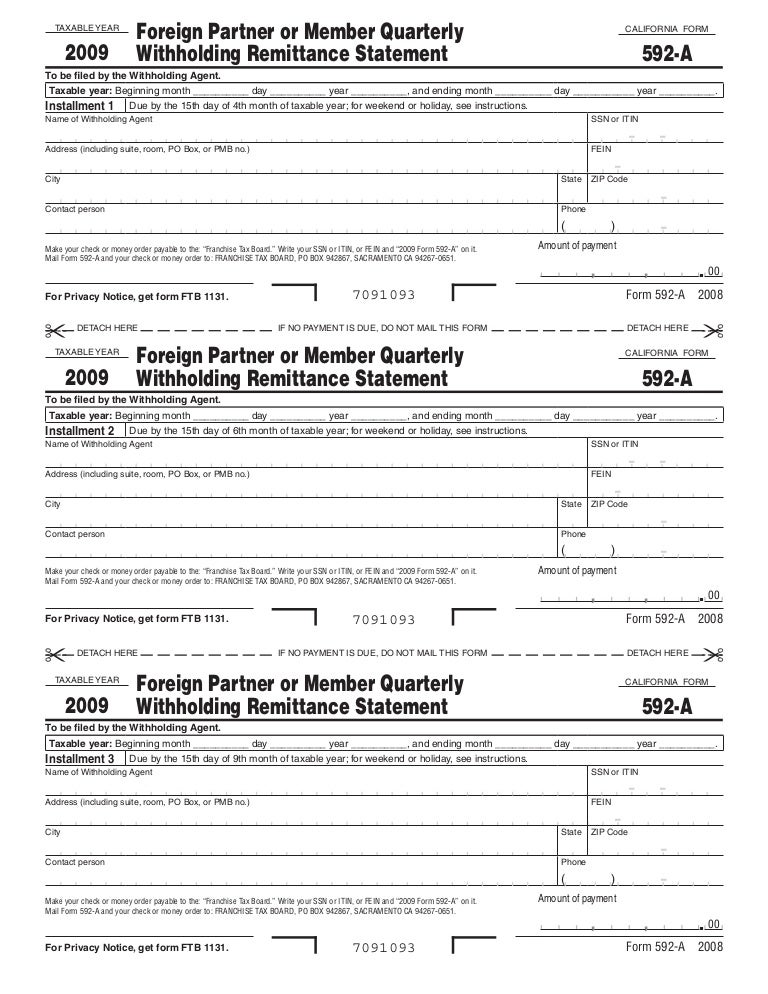

ftb.ca.gov forms 09_592a

In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return. Web to find the 1127 you have to go into st new york individual. Web first names and initials of employee and spouse last name home address (number and street) apt. Ad edit, sign and print tax forms on any device with.

NYC1127 Form for Nonresident Employees of the City of New York Hired…

Then, you get to go to st new york city individual. Web the nyc 1127 form is a detailed document that all property owners must fill out. Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section 1127 of the. Web form for.

Web If Either The Federal Return Or The New York State Tax Return Has Been Extended, Documentation Evidencing The Granting Of The Extension Must Be Submitted To The New York City Section 1127 Unit.

Any new must file the 1127 tax return? In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return. Then, you get to go to st new york city individual. Cases, if you nyc received boroughs) an 1127.2 during.

Save Or Instantly Send Your Ready Documents.

Web first names and initials of employee and spouse last name home address (number and street) apt. Shouldn't it be reported on line 5 as a local income tax? Ad edit, sign and print tax forms on any device with signnow. Payment employee spouse date current employment with the city of new york began:

Form For Nonresident Employees Of The City Of New York Hired On Or After January 4, 1973.

It contains information on the income and expenses of the owner, as well as details about tenants who occupy any part of your building or land. Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section 1127 of the. Were you an employee of the city of. Web form for nonresident employees of the city of new york hired on or after january 4, 1973 nyc 1127 a.

If You Manage To Master That I'll Let You Know The Hoops You Have To Jump Through.

Who must file if you became an employee of the city of new york on or after january 4, 1973, and if, while so employed, you were a nonresident of the city during any part of 2020, you are subject to. Were you an employee of the city of. Web to find the 1127 you have to go into st new york individual. Payment employee spouse date current employment with the city of new york began: