Onlyfans 1099 Nec Form

Onlyfans 1099 Nec Form - Web watch on understanding onlyfans 1099 form online what is onlyfans 1099 form? Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Web onlyfans will not send you any sort of income document so you just use your own records of how much you made. Get ready for tax season deadlines by completing any required tax forms today. You are an independent contractor to the irs. The form is crucial for content. This form is used to report. By filing online, you can. Web when earnings exceed $600, the platform issues a 1099 form to account for taxes. We’ll go over some of the most typical 1099 forms as a self.

The form is crucial for content. You should also receive a copy by mail, or you. The onlyfans 1099 form is a tax document that is issued to content. Web does onlyfans send you a 1099? This article will simplify the process of filing taxes for onlyfans by providing five. Web onlyfans will not send you any sort of income document so you just use your own records of how much you made. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. What counts as being paid,. Web watch on understanding onlyfans 1099 form online what is onlyfans 1099 form? The most common form creators will receive if they earn more.

The form is crucial for content. You should also receive a copy by mail, or you. Web does onlyfans send you a 1099? Do not miss the deadline. The form is typically sent out in late january or early february. Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. By filing online, you can. The onlyfans 1099 form is a tax document that is issued to content. Web onlyfans will not send you any sort of income document so you just use your own records of how much you made. Web onlyfans is required to send you (and the irs) a 1099 when you make over $600, but they can send you one even if you are under that amount.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

By filing online, you can. This form is used to report. Do not miss the deadline. Web watch on understanding onlyfans 1099 form online what is onlyfans 1099 form? We’ll go over some of the most typical 1099 forms as a self.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

This article will simplify the process of filing taxes for onlyfans by providing five. The onlyfans 1099 form is a tax document that is issued to content. Web watch on understanding onlyfans 1099 form online what is onlyfans 1099 form? Web onlyfans will not send you any sort of income document so you just use your own records of how.

What Is Form 1099NEC? Who Uses It, What to Include, & More

Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. Web when earnings exceed $600, the platform issues a 1099 form to account for taxes. Web watch on understanding onlyfans 1099 form online what is onlyfans 1099 form? Get ready for tax season deadlines by completing any required tax forms.

How to properly file 1099 form for Onlyfans FreeCashFlow.io 2023

By filing online, you can. Do not miss the deadline. Web onlyfans will not send you any sort of income document so you just use your own records of how much you made. Web onlyfans is required to send you (and the irs) a 1099 when you make over $600, but they can send you one even if you are.

Memo OnlyFans & Myystar Creators Business Set Up and Tax Filing Tips

Web when earnings exceed $600, the platform issues a 1099 form to account for taxes. What counts as being paid,. The form is typically sent out in late january or early february. The onlyfans 1099 form is a tax document that is issued to content. Get ready for tax season deadlines by completing any required tax forms today.

How to file OnlyFans taxes (W9 and 1099 forms explained)

What counts as being paid,. By filing online, you can. The onlyfans 1099 form is a tax document that is issued to content. You are an independent contractor to the irs. You should also receive a copy by mail, or you.

How To File Form 1099NEC For Contractors You Employ VacationLord

What counts as being paid,. Get ready for tax season deadlines by completing any required tax forms today. You are an independent contractor to the irs. We’ll go over some of the most typical 1099 forms as a self. By filing online, you can.

What is Form 1099NEC for Nonemployee Compensation

Web onlyfans is required to send you (and the irs) a 1099 when you make over $600, but they can send you one even if you are under that amount. Web onlyfans will not send you any sort of income document so you just use your own records of how much you made. By filing online, you can. The form.

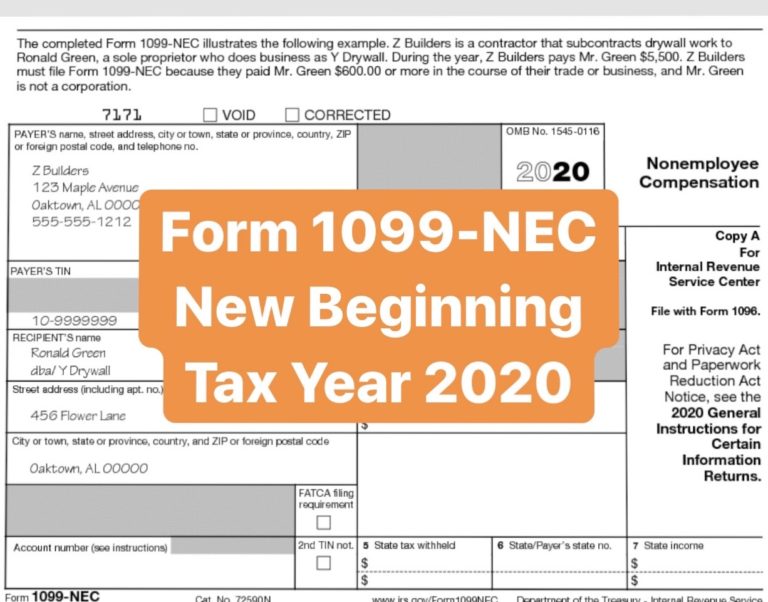

The New 1099NEC Tax Form for All NonEmployee Compensation

What counts as being paid,. Get ready for tax season deadlines by completing any required tax forms today. Web watch on understanding onlyfans 1099 form online what is onlyfans 1099 form? The form is typically sent out in late january or early february. Web onlyfans content creators can expect to receive one or more 1099 forms at the end of.

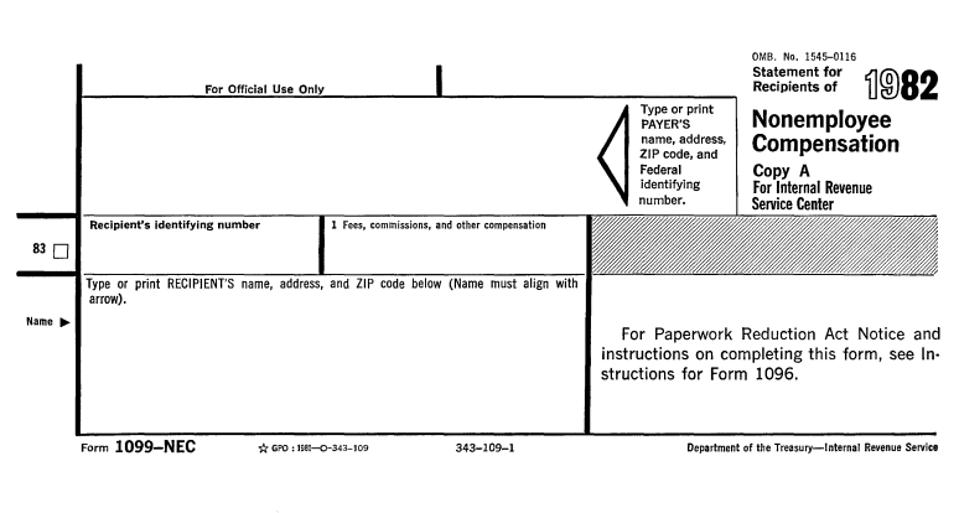

Move Over, 1099MISC IRS Throwback Season Continues With Form 1099NEC

What counts as being paid,. Web watch on understanding onlyfans 1099 form online what is onlyfans 1099 form? Web onlyfans will not send you any sort of income document so you just use your own records of how much you made. This article will simplify the process of filing taxes for onlyfans by providing five. Do not miss the deadline.

Web Does Onlyfans Send You A 1099?

Do not miss the deadline. This article will simplify the process of filing taxes for onlyfans by providing five. Web onlyfans will not send you any sort of income document so you just use your own records of how much you made. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms.

The Form Is Typically Sent Out In Late January Or Early February.

Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. You are an independent contractor to the irs. Web onlyfans is required to send you (and the irs) a 1099 when you make over $600, but they can send you one even if you are under that amount. This form is used to report.

The Form Is Crucial For Content.

Web watch on understanding onlyfans 1099 form online what is onlyfans 1099 form? Get ready for tax season deadlines by completing any required tax forms today. The most common form creators will receive if they earn more. What counts as being paid,.

By Filing Online, You Can.

We’ll go over some of the most typical 1099 forms as a self. You should also receive a copy by mail, or you. The onlyfans 1099 form is a tax document that is issued to content. Web when earnings exceed $600, the platform issues a 1099 form to account for taxes.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://static.wixstatic.com/media/9fe6e6_c02527d741474d7e88dbd9fa3595b59f~mv2.png/v1/fit/w_1000%2Ch_853%2Cal_c%2Cq_80/file.jpg)

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/1553021637842-T52O55S3Z3ILYDIS44PS/ke17ZwdGBToddI8pDm48kCpGfv303rFPf_R2MmpjQDgUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYxCRW4BPu10St3TBAUQYVKcmomqGy8QKumd8_Xi9pibUHb-95JWteCRKkaNKL5Nmf61lF01BYr72PFdZDEdDuE_/what+is+a+1099-k)