Oregon State Tax Extension Form

Oregon State Tax Extension Form - Web oregon accepts the federal extension by checking the box on the oregon form 40. Web dor directs oregon taxpayers to only request an oregon extension if you: Web 2022 forms and publications. You can make a state extension payment using oregon form 40. Due date to file oregon tax extension. If you owe or income taxes, you will either have to submit a or tax return or. Web the extension form and instructions are available on revenue online. Web a tax extension gives you more time to file, but not more time to pay. Extended deadline with oregon tax extension: Can’t file your return by april 18,.

Web the extension form and instructions are available on revenue online. This transfer tax is levied on the. Check the extension box on the voucher and send it in by the original due date of the return, with payment if. Web oregon income tax forms oregon printable income tax forms 51 pdfs tax day has passed, and refunds are being processed! You must be registered for oregon corporate activity. Sign into your efile.com account and check acceptance by the irs. Due date to file oregon tax extension. If you owe or income taxes, you will either have to submit a or tax return or. Web view all of the current year's forms and publications by popularity or program area. Web oregon accepts the federal extension by checking the box on the oregon form 40.

You can make a state extension payment using oregon form 40. Web your oregon income tax must be fully paid by the original due date (april 15) or else penalties will apply. Your oregon corporation tax must be fully paid by the original due date (april 15) or else penalties will. Check the extension box on the voucher and send it in by the original due date of the return, with payment if. Don’t have a federal extension. Web the state of oregon doesn’t require any extension form as it accepts the approved federal extension form 7004 for the state business income tax returns. Check your irs tax refund status. You must be registered for oregon corporate activity. Due date to file oregon tax extension. Pay all or some of your oregon income taxes online via:

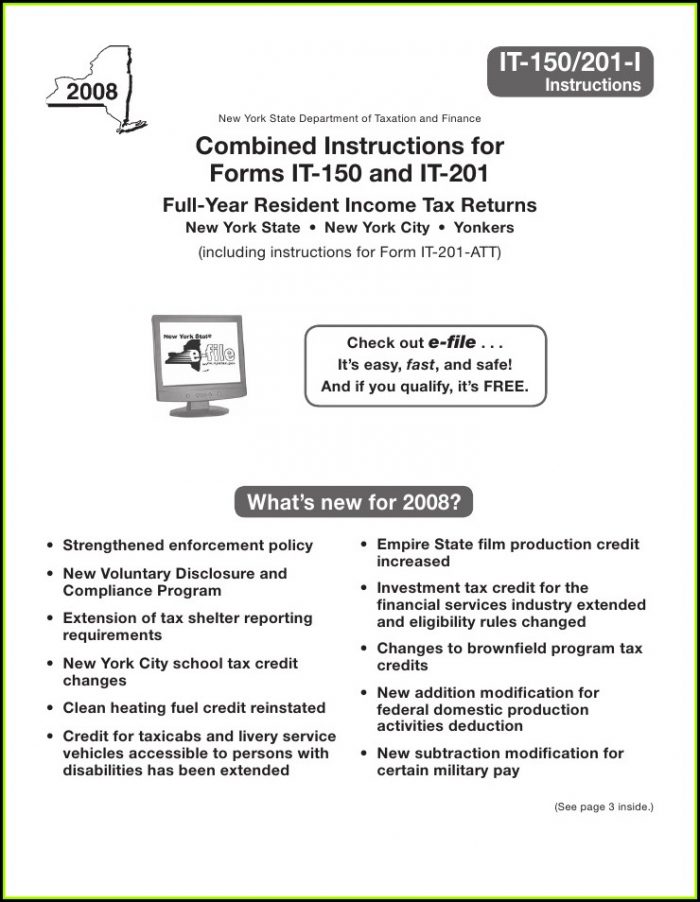

Ny State Tax Extension Form It 201 Form Resume Examples MW9pX8Z9AJ

Web dor directs oregon taxpayers to only request an oregon extension if you: Check your irs tax refund status. Check the extension box on the voucher and send it in by the original due date of the return, with payment if. Due date to file oregon tax extension. Web oregon accepts the federal extension by checking the box on the.

8 things to know about Oregon’s tax system Oregon Center for Public

Select a heading to view its forms, then u se the search feature to locate a form or publication by. Web dor directs oregon taxpayers to only request an oregon extension if you: You must be registered for oregon corporate activity. Web oregon accepts the federal extension by checking the box on the oregon form 40. Web view all of.

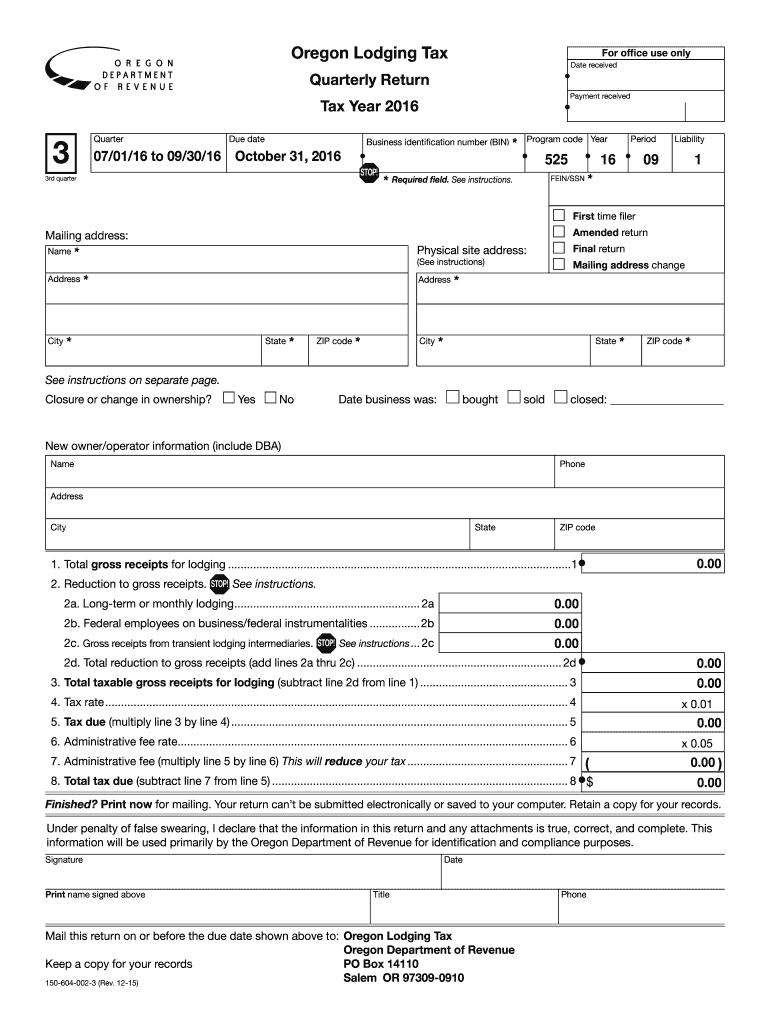

Fillable Online oregon 2016 Oregon Lodging Tax Quarterly Return 3rd

Sign into your efile.com account and check acceptance by the irs. Web your oregon income tax must be fully paid by the original due date (april 15) or else penalties will apply. You can make a state extension payment using oregon form 40. Download and save the form to your computer, then open it in adobe reader to complete and.

Ny State Tax Extension Form It 201 Form Resume Examples erkKMqB5N8

Web oregon accepts the federal extension by checking the box on the oregon form 40. Web the extension form and instructions are available on revenue online. You must be registered for oregon corporate activity. Web a tax extension gives you more time to file, but not more time to pay. Your oregon corporation tax must be fully paid by the.

Ny State Tax Extension Form It 201 Form Resume Examples MW9pX8Z9AJ

You must be registered for oregon corporate activity. Check your irs tax refund status. Due date to file oregon tax extension. Web oregon income tax forms oregon printable income tax forms 51 pdfs tax day has passed, and refunds are being processed! Can’t file your return by april 18,.

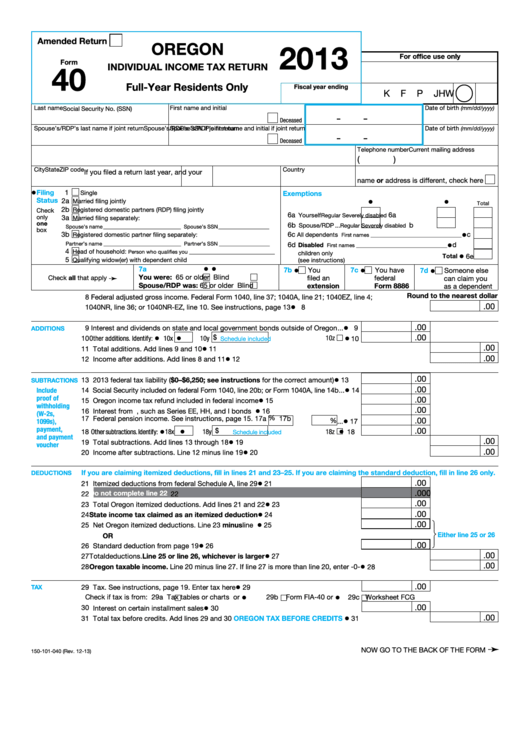

Fillable Form 40 Oregon Individual Tax Return 2013 printable

Check your irs tax refund status. Pay all or some of your oregon income taxes online via: Web a tax extension gives you more time to file, but not more time to pay. Find more information about filing an extension on the corporate activity tax page, in the faq. Your oregon corporation tax must be fully paid by the original.

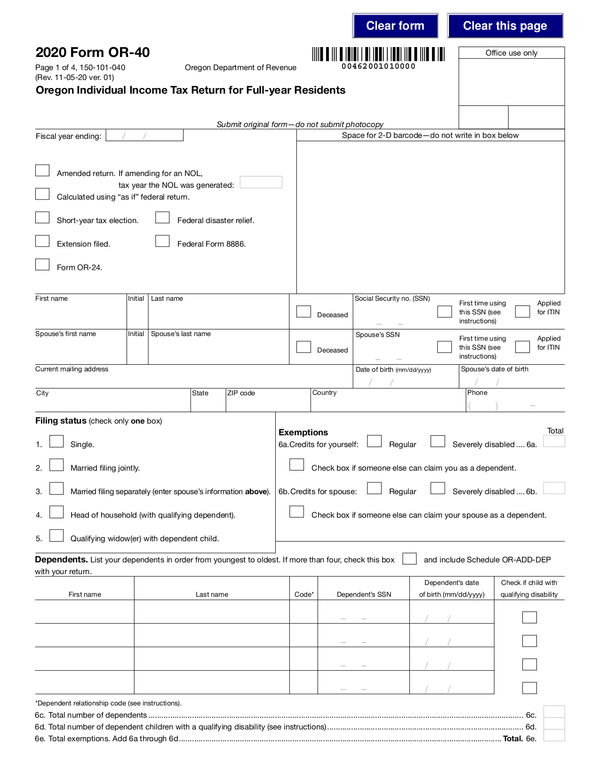

Fill Free fillable forms for the state of Oregon

Web view all of the current year's forms and publications by popularity or program area. Your oregon corporation tax must be fully paid by the original due date (april 15) or else penalties will. Web 2022 forms and publications. Don’t have a federal extension. Check your irs tax refund status.

How to File a Tax Extension? ZenLedger

Your oregon corporation tax must be fully paid by the original due date (april 15) or else penalties will. Can’t file your return by april 18,. Pay all or some of your oregon income taxes online via: Download and save the form to your computer, then open it in adobe reader to complete and print. Check your irs tax refund.

State Taxes March 2017

Web the state of oregon doesn’t require any extension form as it accepts the approved federal extension form 7004 for the state business income tax returns. Web your oregon income tax must be fully paid by the original due date (april 15) or else penalties will apply. If you owe or income taxes, you will either have to submit a.

Oregon form 40 v Fill out & sign online DocHub

Check the extension box on the voucher and send it in by the original due date of the return, with payment if. Web oregon accepts the federal extension by checking the box on the oregon form 40. Can’t file your return by april 18,. Web the state of oregon doesn’t require any extension form as it accepts the approved federal.

Don’t Have A Federal Extension.

Pay all or some of your oregon income taxes online via: You can make a state extension payment using oregon form 40. This transfer tax is levied on the. Find more information about filing an extension on the corporate activity tax page, in the faq.

Extended Deadline With Oregon Tax Extension:

Web oregon accepts the federal extension by checking the box on the oregon form 40. Check your irs tax refund status. Web view all of the current year's forms and publications by popularity or program area. Due date to file oregon tax extension.

Check The Extension Box On The Voucher And Send It In By The Original Due Date Of The Return, With Payment If.

Can’t file your return by april 18,. Your oregon corporation tax must be fully paid by the original due date (april 15) or else penalties will. Web 2022 forms and publications. Web your oregon income tax must be fully paid by the original due date (april 15) or else penalties will apply.

Web Oregon Income Tax Forms Oregon Printable Income Tax Forms 51 Pdfs Tax Day Has Passed, And Refunds Are Being Processed!

Web the state of oregon doesn’t require any extension form as it accepts the approved federal extension form 7004 for the state business income tax returns. Sign into your efile.com account and check acceptance by the irs. You must be registered for oregon corporate activity. Web dor directs oregon taxpayers to only request an oregon extension if you: