Oregon Withholding Form

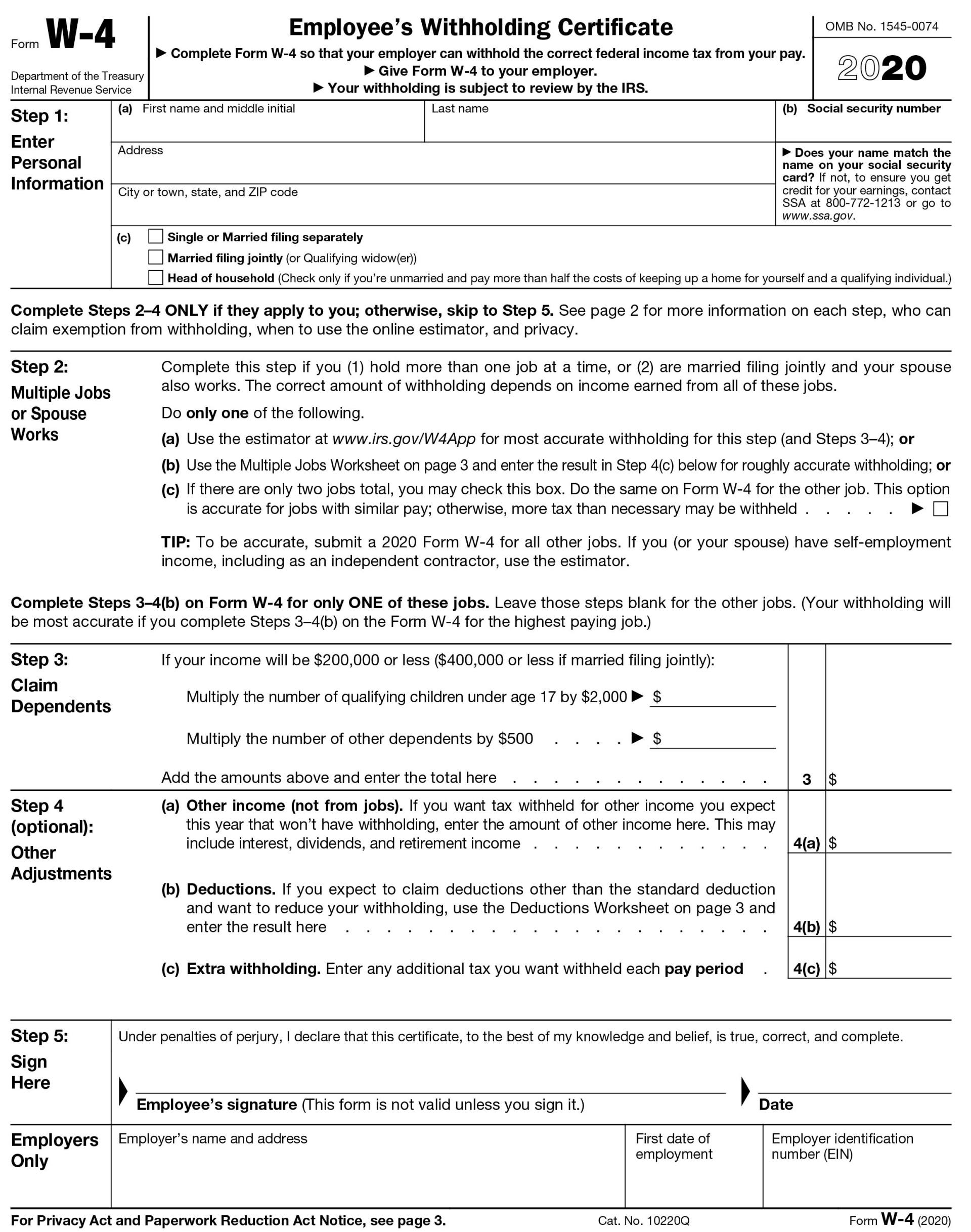

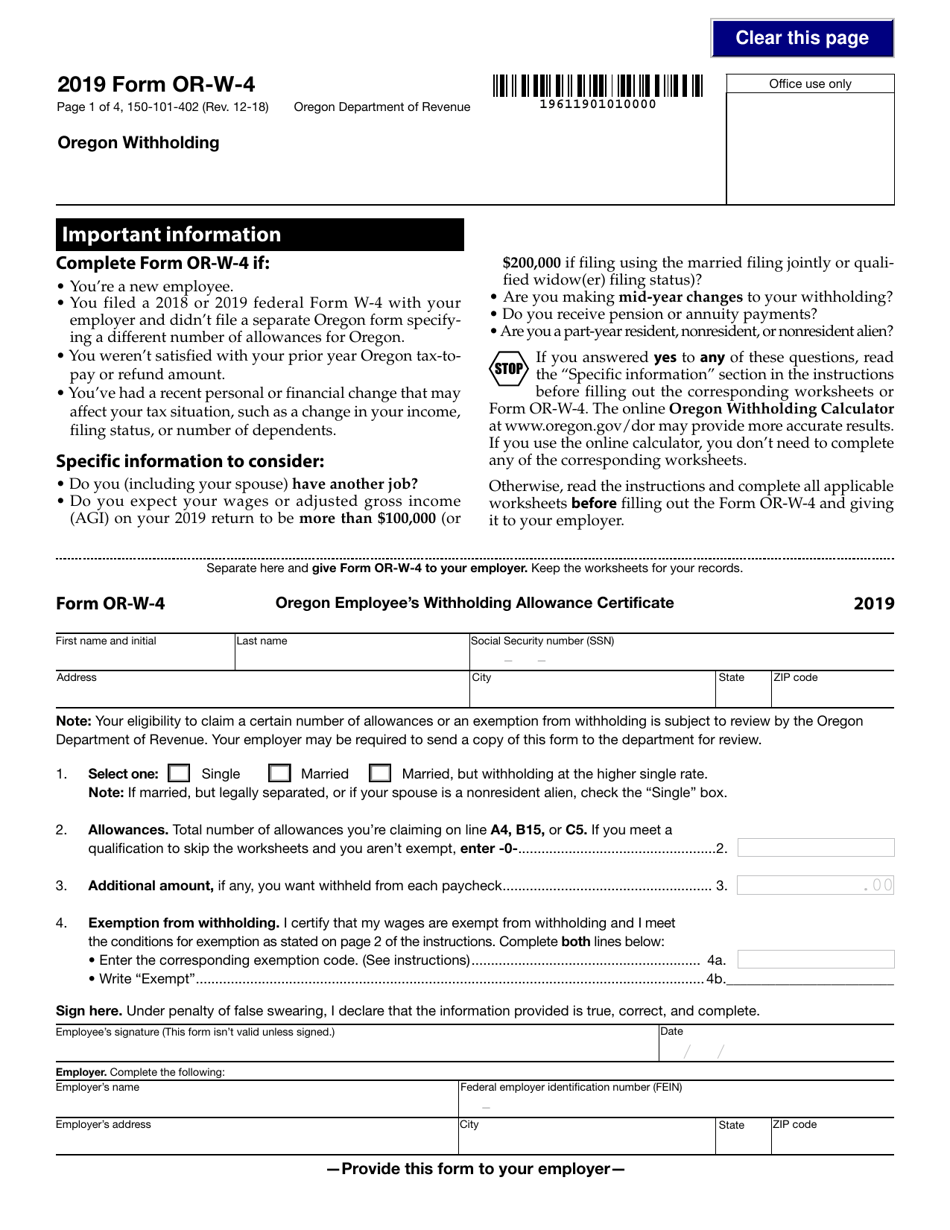

Oregon Withholding Form - Your 2020 tax return may still result in a tax due or refund. Web current forms and publications. View all of the current year's forms and publications by popularity or program area. If too little is withheld, you will generally owe tax when you file your tax return. Web the oregon start a business guide povides a general checklist for the process of starting your r business, along with information on key contacts and business assistance. Web oregon withholding statement and exemption certificate note: See page 2 for more information on each step, who can claim. Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to. Web all oregon employers who have an income tax withholding and statewide transit tax account open with the oregon department of revenue must file form or. Otherwise, skip to step 5.

If too little is withheld, you will generally owe tax when you file your tax return. Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to. Web file your withholding tax returns. The oregon tax tables are found in the. Otherwise, skip to step 5. See page 2 for more information on each step, who can claim. 1511421 ev 11122 2 of 7 223 o 4 o way that federal withholding is done. The completed forms are required for each employee who. Web all oregon employers who have an income tax withholding and statewide transit tax account open with the oregon department of revenue must file form or. Web the wou payroll system utilizes figures listed under the annualized formula to calculate your withholding.

Web oregon withholding statement and exemption certificate first name address initial last name city social security number (ssn) redeterimination state zip code note: The completed forms are required for each employee who. Your 2020 tax return may still result in a tax due or refund. Web a withholding statement includes: Web all oregon employers who have an income tax withholding and statewide transit tax account open with the oregon department of revenue must file form or. Web payroll withholding requirements metro shs personal income tax for calendar year 2021, payroll withholding is not required. Otherwise, skip to step 5. However, an employer must offer in writing to. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. 1511421 ev 11122 2 of 7 223 o 4 o way that federal withholding is done.

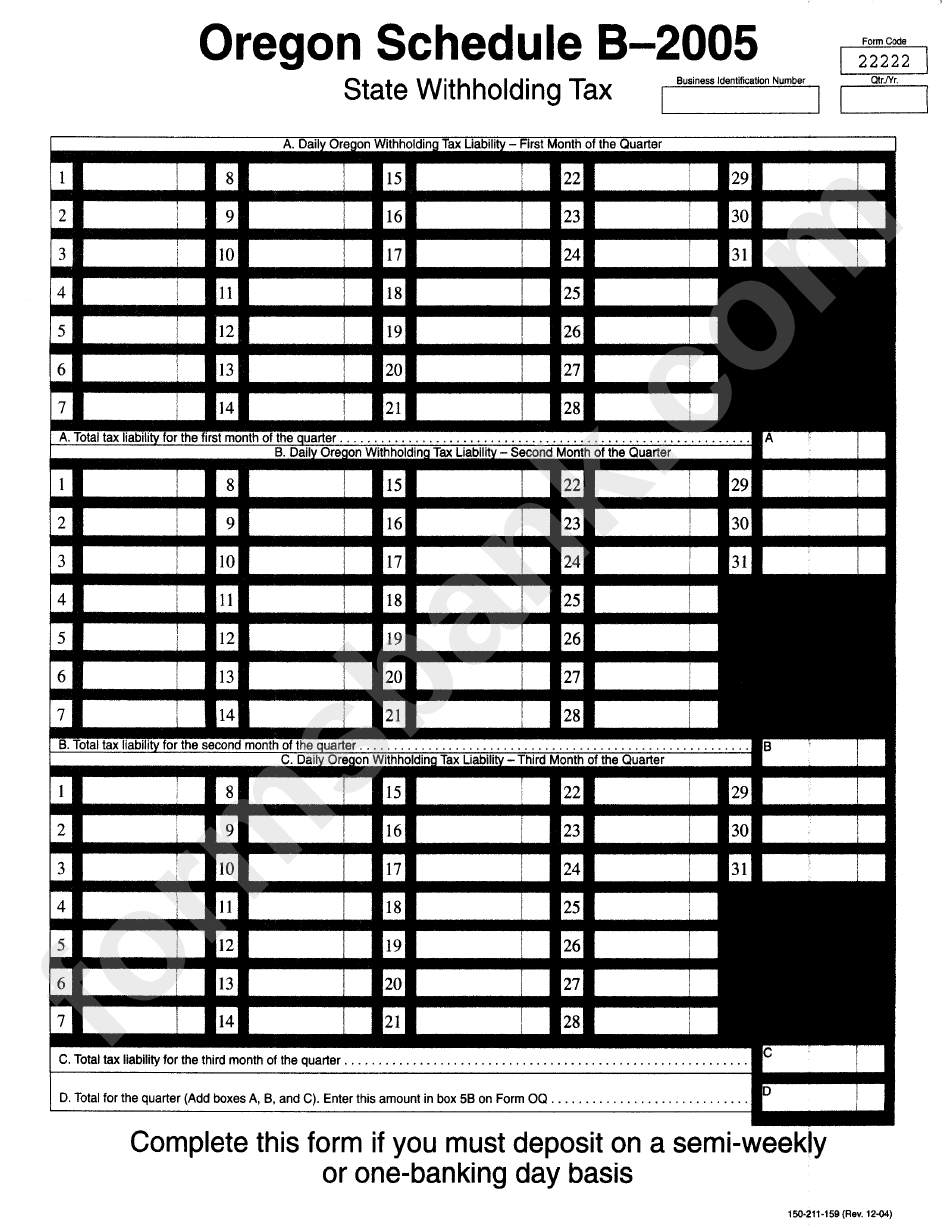

Form 22222 Oregon Schedule B State Withholding Tax Form Oregon

Select a heading to view its forms, then u se the search. Web a withholding statement includes: Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to. Web oregon withholding statement and exemption certificate first name address initial last name city social security number (ssn) redeterimination state zip code note: See page.

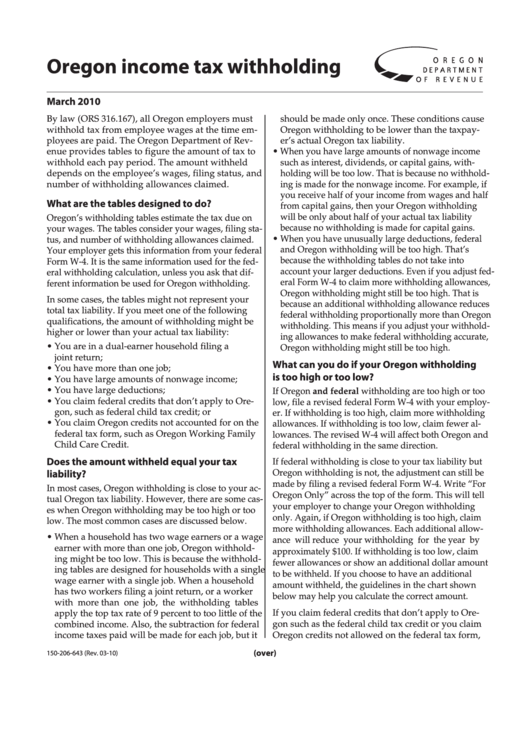

Oregon Tax Withholding Form Department Of Revenue 2010

See page 2 for more information on each step, who can claim. Web oregon withholding statement and exemption certificate note: Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web oregon withholding statement and exemption certificate first.

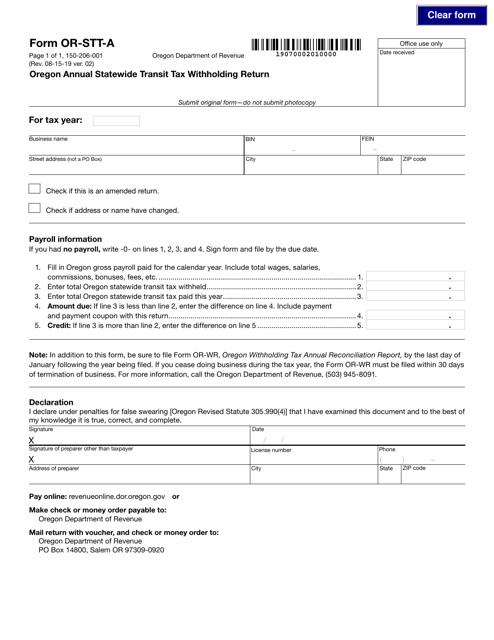

Form ORSTTA (150206001) Download Fillable PDF or Fill Online Oregon

View all of the current year's forms and publications by popularity or program area. However, an employer must offer in writing to. The oregon tax tables are found in the. Web oregon withholding statement and exemption certificate note: The completed forms are required for each employee who.

Care oregon Prior Authorization form Best Of 3 21 111 Chapter Three

Web current forms and publications. Web the oregon start a business guide povides a general checklist for the process of starting your r business, along with information on key contacts and business assistance. Web all oregon employers who have an income tax withholding and statewide transit tax account open with the oregon department of revenue must file form or. Web.

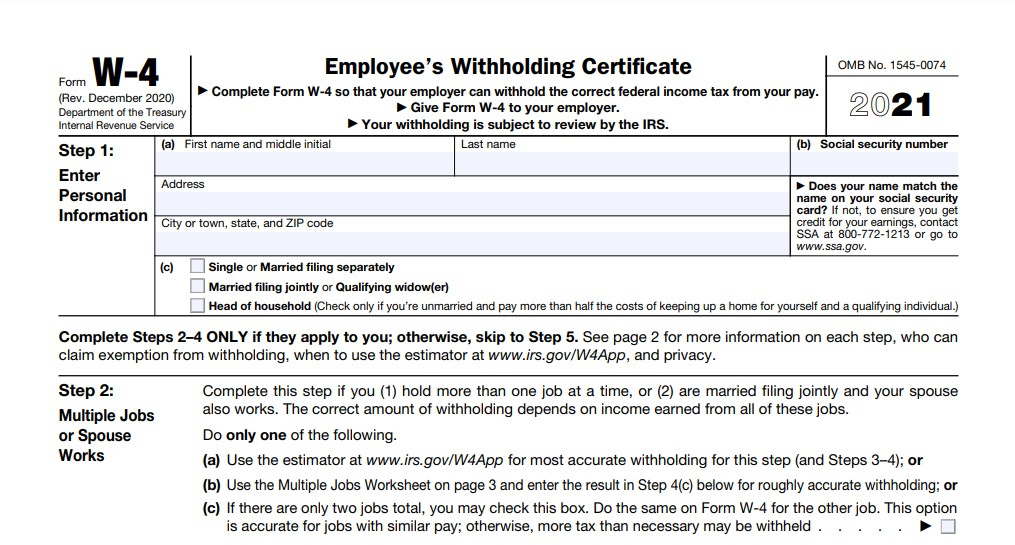

Oregon W4 2021 Form Printable 2022 W4 Form

Employers and payroll service providers must file quarterly returns and annual reconciliation returns for the metro supporting housing. Select a heading to view its forms, then u se the search. Web oregon withholding statement and exemption certificate first name address initial last name city social security number (ssn) redeterimination state zip code note: Web payroll withholding requirements metro shs personal.

Forms & Worksheets Storms & Alpaugh PLLC Victoria MN

However, an employer must offer in writing to. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Your 2020 tax return may still result in a tax due or refund. Your eligibility to claim a certain number.

Fill Free fillable forms for the state of Oregon

Web oregon withholding statement and exemption certificate first name address initial last name city social security number (ssn) redeterimination state zip code note: Web payroll withholding requirements metro shs personal income tax for calendar year 2021, payroll withholding is not required. Select a heading to view its forms, then u se the search. If too little is withheld, you will.

Form 150101402 (ORW4) Download Fillable PDF or Fill Online Oregon

Otherwise, skip to step 5. Your 2020 tax return may still result in a tax due or refund. Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to. Web the oregon start a business guide povides a general checklist for the process of starting your r business, along with information on key.

Oregon Annual Withholding Tax Reconciliation Report 2019 20202022

The completed forms are required for each employee who. Your 2020 tax return may still result in a tax due or refund. Select a heading to view its forms, then u se the search. The oregon tax tables are found in the. If too little is withheld, you will generally owe tax when you file your tax return.

Oregon Schedule B State Withholding Tax Form 2011 printable pdf download

Web payroll withholding requirements metro shs personal income tax for calendar year 2021, payroll withholding is not required. However, an employer must offer in writing to. Web oregon withholding statement and exemption certificate note: Web the oregon start a business guide povides a general checklist for the process of starting your r business, along with information on key contacts and.

Web Oregon Withholding Statement And Exemption Certificate First Name Address Initial Last Name City Social Security Number (Ssn) Redeterimination State Zip Code Note:

The oregon tax tables are found in the. Web oregon withholding statement and exemption certificate note: If too little is withheld, you will generally owe tax when you file your tax return. Web all oregon employers who have an income tax withholding and statewide transit tax account open with the oregon department of revenue must file form or.

View All Of The Current Year's Forms And Publications By Popularity Or Program Area.

See page 2 for more information on each step, who can claim. Otherwise, skip to step 5. The completed forms are required for each employee who. Web current forms and publications.

However, An Employer Must Offer In Writing To.

Web the oregon start a business guide povides a general checklist for the process of starting your r business, along with information on key contacts and business assistance. Select a heading to view its forms, then u se the search. Web a withholding statement includes: Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to.

Web File Your Withholding Tax Returns.

Web the wou payroll system utilizes figures listed under the annualized formula to calculate your withholding. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web payroll withholding requirements metro shs personal income tax for calendar year 2021, payroll withholding is not required. Employers and payroll service providers must file quarterly returns and annual reconciliation returns for the metro supporting housing.