Owner Draws Quickbooks

Owner Draws Quickbooks - Web before deciding which method is best for you, you must first understand the basics. Important offers, pricing details & disclaimers. A user guide to help advisors get started with quickbooks online advanced. An owner’s draw is when an owner takes money out of the business. How does owner's draw work? Owner draw is an equity type account used when you take funds from the business. Web sales tax may be applied where applicable. Owner’s draw refers to the process of withdrawing money from a business for personal use by the owner. You can customize the report for the owner's draw you have set up in quickbooks online (qbo). Draws can happen at regular intervals or when needed.

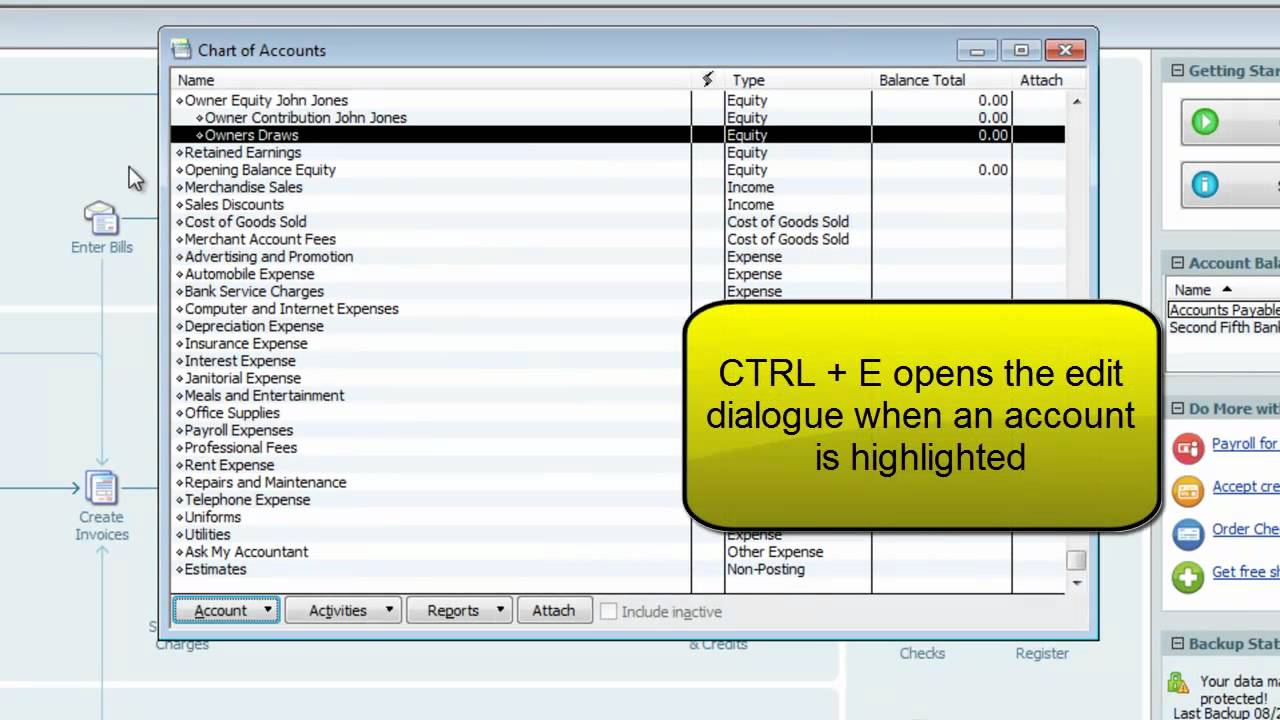

Select the equity account option. Web type the name of the owner's draw account in the search box. So your chart of accounts could look like this. Web owner’s draw in quickbooks refers to the distribution of funds or assets from a business to its owners for personal use or investments. Web a sole proprietor, partner, or an llc owner can legally draw as much as he wants for the owner’s equity. Draws can happen at regular intervals or when needed. Click chart of accounts and click add. 3. Download the quickbooks online advanced user guide. Guide to set up owner’s draw in quickbooks desktop. How does owner's draw work?

A user guide to help advisors get started with quickbooks online advanced. This can be achieved through various methods such as creating a journal entry or using the owner’s equity account. Procedure to set up owner’s draw in quickbooks online. 10k views 2 years ago. Download the quickbooks online advanced user guide. Business owners often use the company’s bank and credit card accounts to pay personal bills and expenses, or simply. Trusted by 3 million students with our good fit guarantee. I’ll try to explain it in a way that makes sense to people who use quickbooks. Web 16k views 2 years ago. Click the list option on the menu bar at the top of the window.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

A clip from mastering quick. An owner's draw account is an equity account used by quickbooks online to track withdrawals of the company's assets to pay an owner. Offer only available for a limited time and to new quickbooks customers. Click chart of accounts and click add. 3. Web when you outsource online bookkeeping with steph’s bookkeeping service, our skilled.

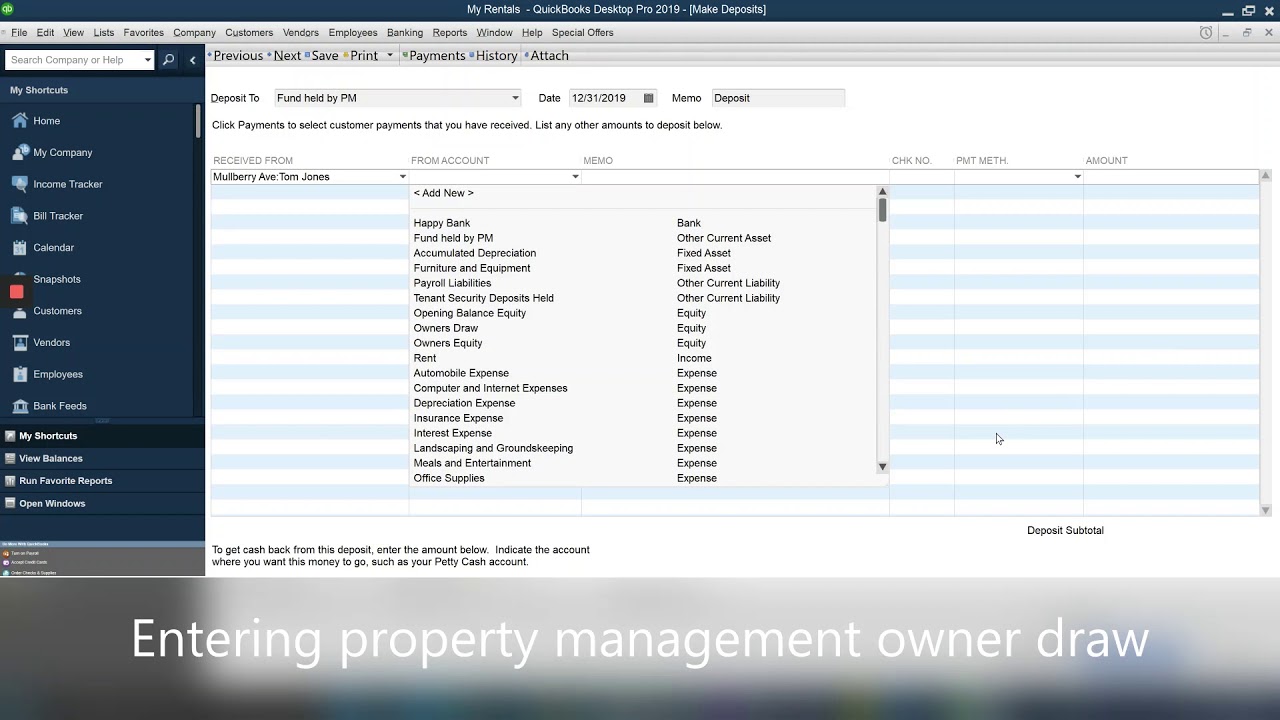

How to enter the property management owner draw to QuickBooks YouTube

Web when recording an owner's draw in quickbooks online, you'll need to create an equity account. Web before deciding which method is best for you, you must first understand the basics. This offer can’t be combined with any other quickbooks offers. Web type the name of the owner's draw account in the search box. Web what is owner's draw in.

Owner Draw Report Quickbooks

Offer only available for a limited time and to new quickbooks customers. Web 16k views 2 years ago. Click chart of accounts and click add. 3. Owner’s draw refers to the process of withdrawing money from a business for personal use by the owner. Click the list option on the menu bar at the top of the window.

Quickbooks Owner Draws & Contributions YouTube

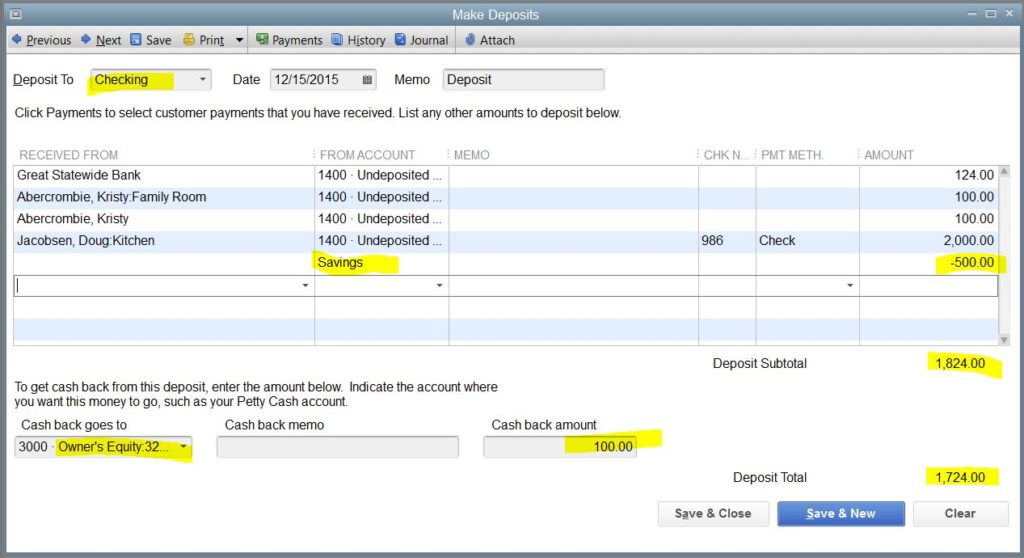

Web sales tax may be applied where applicable. However, the amount withdrawn must be reasonable and should consider all aspects of business finance. Web how to complete an owner's draw in quickbooks online | qbo tutorial | home bookkeeper thanks for watching. When you put money in the business you also use an equity account. Trusted by 3 million students.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Web owner’s draw in quickbooks: This can be achieved through various methods such as creating a journal entry or using the owner’s equity account. Web when recording an owner's draw in quickbooks online, you'll need to create an equity account. At the federal level, you need your employer id number (ein) and an account in the electronic federal tax payment.

how to take an owner's draw in quickbooks Masako Arndt

Web what is owner's draw in quickbooks? Web this quickbooks tutorial video shows you how to record an owner’s draw in quickbooks 2023. Learn about recording an owner’s. Web what is the owner’s draw in quickbooks? The business owner takes funds out of the business for personal use.

Owners Draw Quickbooks Desktop DRAWING IDEAS

Set up your business as an employer. Web this quickbooks tutorial video shows you how to record an owner’s draw in quickbooks 2023. This transaction impacts the owner’s equity and is essential for accurate financial management within. Important offers, pricing details & disclaimers. Learn about recording an owner’s.

How to record personal expenses and owner draws in QuickBooks Online

Owner draw is an equity type account used when you take funds from the business. Important offers, pricing details & disclaimers. Each employee is an additional $6/month for core, $8/month for premium, and $10/month for elite. An owner’s draw is when an owner takes money out of the business. Business owners often use the company’s bank and credit card accounts.

how to take an owner's draw in quickbooks Masako Arndt

Web recording the owner’s draw transaction in quickbooks involves accurately documenting the withdrawal amount and linking it to the designated equity account for comprehensive financial tracking. A user guide to help advisors get started with quickbooks online advanced. December 10, 2018 05:56 pm. How does owner's draw work? Web this quickbooks tutorial video shows you how to record an owner’s.

how to take an owner's draw in quickbooks Masako Arndt

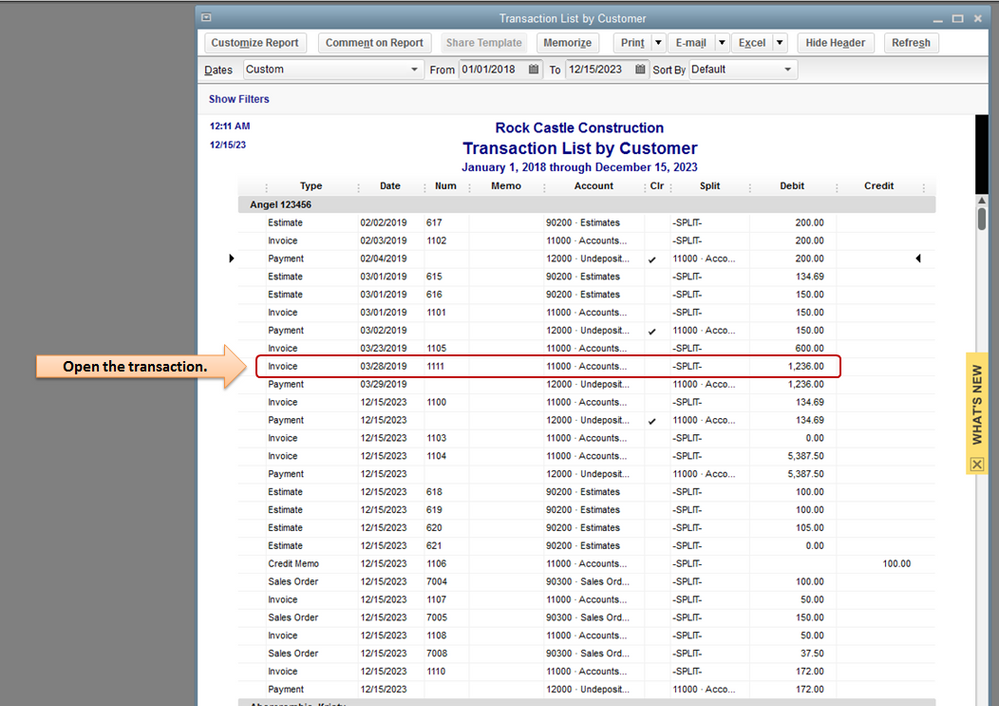

Web how to complete an owner's draw in quickbooks online | qbo tutorial | home bookkeeper thanks for watching. Web this quickbooks tutorial video shows you how to record an owner’s draw in quickbooks 2023. How does owner's draw work? You can customize the report for the owner's draw you have set up in quickbooks online (qbo). Select the date.

Web What Is Owner's Draw In Quickbooks?

Procedure to set up owner’s draw in quickbooks online. December 10, 2018 05:56 pm. A clip from mastering quick. Learn about recording an owner’s.

Web When You Outsource Online Bookkeeping With Steph’s Bookkeeping Service, Our Skilled Team Of Certified Quickbooks Proadvisors Will Help You Analyze, Organize, And Maintain Your Company’s Financial Processes And Expenses To Prepare You For Tax Season.

Set up your business as an employer. Owner’s draw refers to the process of withdrawing money from a business for personal use by the owner. If you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll. Web how to complete an owner's draw in quickbooks online | qbo tutorial | home bookkeeper thanks for watching.

Web 16K Views 2 Years Ago.

Important offers, pricing details & disclaimers. Owner equity (parent account) owner draws (sub account of owner equity) 10k views 2 years ago. I’ll try to explain it in a way that makes sense to people who use quickbooks.

Web A Sole Proprietor, Partner, Or An Llc Owner Can Legally Draw As Much As He Wants For The Owner’s Equity.

When you put money in the business you also use an equity account. Web when recording an owner's draw in quickbooks online, you'll need to create an equity account. Each employee is an additional $6/month for core, $8/month for premium, and $10/month for elite. A user guide to help advisors get started with quickbooks online advanced.