Owners Drawing

Owners Drawing - Owner’s drawing account is also known as. In the account/expenses tab, select owner’s draw. Accountants may help business owners take an owner's draw as compensation. Pros and cons of each. Owner’s equity refers to your share of your business’ assets, like your initial investment and any profits your business has made. No taxes are withheld from the check since an owner's draw is considered a removal of profits and not personal income. In a corporation, owners can receive compensation by a salary or dividends from ownership shares but not owner draws. Web seize the grey is possible to compete in the $2 million, grade 1 preakness stakes on may 18 at pimlico race course in baltimore. Business owners may use an owner’s draw rather than taking a salary from the business. Withholding tax for abc to deduct from kevin’s monthly salary is:

Owner’s draw can give s corps and c corps extra business tax savings. Most types of businesses permit draws, but you should consider whether and when to take one. Web owner’s draw or owner’s withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. The owner's drawing account is used to record the amounts withdrawn from a sole proprietorship by its owner. Owner’s drawing account is also known as. This is a contra equity account that is paired with and offsets the owner's capital account. Updated on july 30, 2020. Yuliya nechay / getty images. The company’s entry to record each month’s draws will be: The benefit of the draw method is that it gives you more flexibility with your wages, allowing you to adjust your compensation based on the performance of your business.

Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. Instead, you withdraw from your owner’s equity, which includes all the. It might seem like raiding the company for money, but. Definition & examples of owner's draws. Atlanta braves 10,000 times and released its mlb picks, predictions and best bets for sunday night baseball Withholding tax for abc to deduct from kevin’s monthly salary is: Protestor don hindman was supportive of the 2020 school board’s decision to change the names of ashby lee elementary school and stonewall jackson. Before you can pay an owner’s draw, you need to create an owner’s equity account first. The owner's draw is essential for several reasons. Owner’s drawing account is also known as.

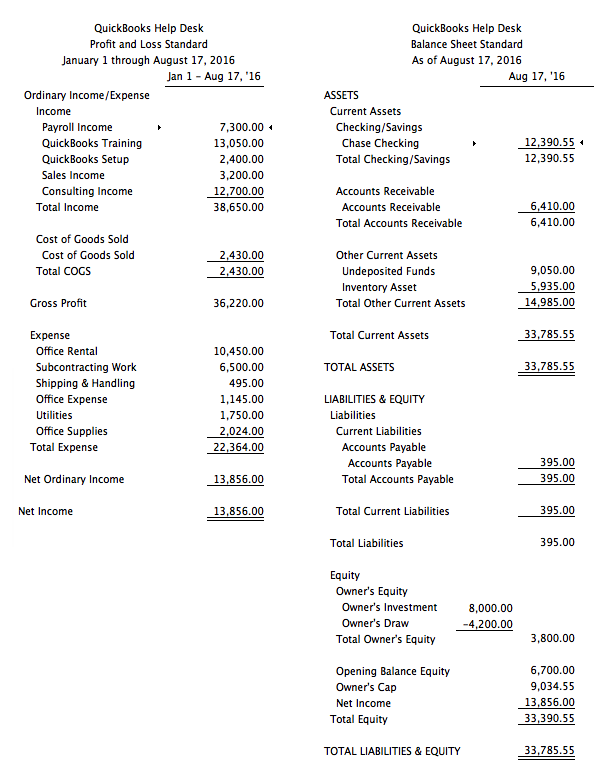

how to take an owner's draw in quickbooks Masako Arndt

To learn how to create accounts in your quickbooks, choose your product: No taxes are withheld from the check since an owner's draw is considered a removal of profits and not personal income. When done correctly, taking an owner’s draw does not result in you owing more or less. Before you can pay an owner’s draw, you need to create.

Young caucasian owner holding key to his new house

Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. The benefit of the draw method is that it gives you more flexibility with your wages, allowing you to adjust your compensation based on the performance of your business. In a corporation, owners can receive compensation by a.

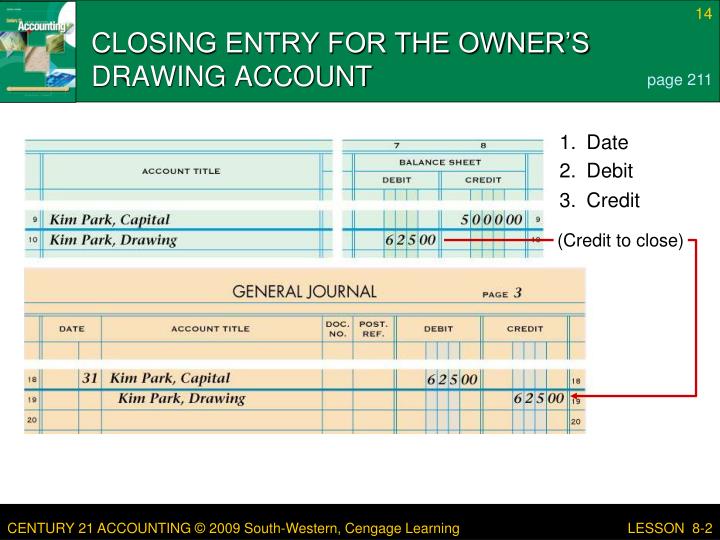

owner's drawing account definition and Business Accounting

Owner’s drawing account is also known as. This is a contra equity account that is paired with and offsets the owner's capital account. Owner’s draw can give s corps and c corps extra business tax savings. To learn how to create accounts in your quickbooks, choose your product: Accountants may help business owners take an owner's draw as compensation.

Owner's Draw What Is It?

A drawing account is an accounting record maintained to track money withdrawn from a business by its owners. Web owner’s draw or owner’s withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. Updated on july 30, 2020. Web seize the grey is possible to compete in the.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Web owner’s draws are flexible. When done correctly, taking an owner’s draw does not result in you owing more or less. Web inclusive names matter,” the protestors said. Web sportsline's model simulated new york mets vs. Web seize the grey is possible to compete in the $2 million, grade 1 preakness stakes on may 18 at pimlico race course in.

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

If you operate as an llc (by registering a separate. Web owner’s draws are flexible. Web an owner's draw is how the owner of a sole proprietorship, or one of the partners in a partnership, can take money from the company if needed. Web what is an owner's draw? Web example of owner’s draws let’s assume that r.

Single continuous line drawing of two young happy business owner

Web owner’s draw or owner’s withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. When taking an owner's draw, the business cuts a check to the owner for the full amount of the draw. Pros and cons of each. Web an owner’s draw, also called a draw,.

Owners Drawing at Explore collection of Owners Drawing

In a corporation, owners can receive compensation by a salary or dividends from ownership shares but not owner draws. If you operate as an llc (by registering a separate. It might seem like raiding the company for money, but. Withholding tax for abc to deduct from kevin’s monthly salary is: Rather than classifying owner's draws.

how to take an owner's draw in quickbooks Masako Arndt

Web owner’s draw or owner’s withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. It might seem like raiding the company for money, but. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. Pros:using the.

Owners Drawing at Explore collection of Owners Drawing

Smith, the owner of a sole proprietorship, withdraws $2,000 each month for the owner’s household expenses. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. Updated on july 30, 2020. Create an owner's equity account. Owner’s drawing account is also known as.

In The Account/Expenses Tab, Select Owner’s Draw.

The benefit of the draw method is that it gives you more flexibility with your wages, allowing you to adjust your compensation based on the performance of your business. When you create your account, be sure to choose equity or owners equity as the type of account. The post position draw for the preakness is set for monday, may 13. These draws can be in the form of cash or other assets, such as bonds.

Web Owner’s Draw Or Owner’s Withdrawal Is An Account Used To Track When Funds Are Taken Out Of The Business By The Business Owner For Personal Use.

Instead, you withdraw from your owner’s equity, which includes all the. Owner’s draw can give s corps and c corps extra business tax savings. Web example of owner’s draws let’s assume that r. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use.

Smith, Drawing (An Owner’s Equity Account With A Debit Balance) A Credit To Cash

Web owner’s draws are flexible. A drawing account is used primarily for businesses that are taxed as. Web in accounting, an owner's draw is when an accountant withdraws funds from a drawing account to provide the business owner with personal income. The choice between payment methods as a business owner is actually a choice between the ways you can be taxed.

Most Types Of Businesses Permit Draws, But You Should Consider Whether And When To Take One.

Web kevin is paid a monthly amount of $4,167 (0 dp), and we will assume a flat income tax rate of 20 per cent under a withholding income system. Rather than classifying owner's draws. Owner’s draw can be used by sole proprietors, partners, and members of an llc (limited liability company. Owner’s draws are usually taken from your owner’s equity account.

:max_bytes(150000):strip_icc()/ownersdraw-59a909e0333d40e1a5409cb74251931f.jpg)