Pa 529 Tax Form

Pa 529 Tax Form - Web tax benefits & features of a pa 529 plan. Web pennsylvania department of revenue > forms and publications > forms for individuals forms for individuals note: Distributions from an irc section 529 college career and savings program. Web pennsylvania will follow the federal tax legislation signed into law on december 22, 2017, which includes several new provisions related specifically to 529. 529 plans are savings and investment accounts offered by states or colleges that are established in accordance with. If you withdrew money from. Ad start saving for your child’s higher education in just 10 minutes with most 529. Web how do i report my 529 plan information for pennsylvania? Web learn pa 529 plan benefits pa 529 plan benefits saving for education now will benefit your child in the future. Web for contributions to irc section 529a pennsylvania able savings account programs, pennsylvania allows a maximum yearly deduction equal to the annual federal gift tax.

Web learn pa 529 plan benefits pa 529 plan benefits saving for education now will benefit your child in the future. Web pennsylvania personal income tax law follows the federal income tax treatment of not taxing 529 plan (college career and savings program account). If you withdrew money from. Web how do i report my 529 plan information for pennsylvania? Pa 529 accounts can be used to pay for tuition, mandatory fees, supplies and equipment, and some room and board at schools. Web pennsylvania state treasurer, stacy garrity. Ad start saving for your child’s higher education in just 10 minutes with most 529. Web where do i enter my pa 529 plan contributions contributions to a qualified college savings plan are not deductible on your federal return, but may be deductible on. Web pennsylvania 529 plan, 529 college and career savings program, pa tuition account program, pa 529 guaranteed savings plan, pa 529 investment plan, 529 tax benefits,. Web pennsylvania department of revenue > forms and publications > forms for individuals forms for individuals note:

Distributions from an irc section 529 college career and savings program. 529 plans are savings and investment accounts offered by states or colleges that are established in accordance with. Web pennsylvania state treasurer, stacy garrity. Web 12,351 clicked to enroll pennsylvania's 529 investment plan is available to residents of any state, and offers 26 vanguard investment options, including a socially responsible equity. Web learn pa 529 plan benefits pa 529 plan benefits saving for education now will benefit your child in the future. If you withdrew money from. Web where do i enter my pa 529 plan contributions contributions to a qualified college savings plan are not deductible on your federal return, but may be deductible on. Web for contributions to irc section 529a pennsylvania able savings account programs, pennsylvania allows a maximum yearly deduction equal to the annual federal gift tax. Web pennsylvania 529 plan, 529 college and career savings program, pa tuition account program, pa 529 guaranteed savings plan, pa 529 investment plan, 529 tax benefits,. Pa 529 accounts can be used to pay for tuition, mandatory fees, supplies and equipment, and some room and board at schools.

where do i enter my PA 529 plan contributions TurboTax Support

If you withdrew money from. Web pennsylvania will follow the federal tax legislation signed into law on december 22, 2017, which includes several new provisions related specifically to 529. Web 12,351 clicked to enroll pennsylvania's 529 investment plan is available to residents of any state, and offers 26 vanguard investment options, including a socially responsible equity. Ad start saving for.

Capturing a 529 tax break in just 24 hours The College Solution

If you withdrew money from. If you contributed to the 529 plan, you will be able to claim a subtraction from income. Web pennsylvania will follow the federal tax legislation signed into law on december 22, 2017, which includes several new provisions related specifically to 529. Web learn pa 529 plan benefits pa 529 plan benefits saving for education now.

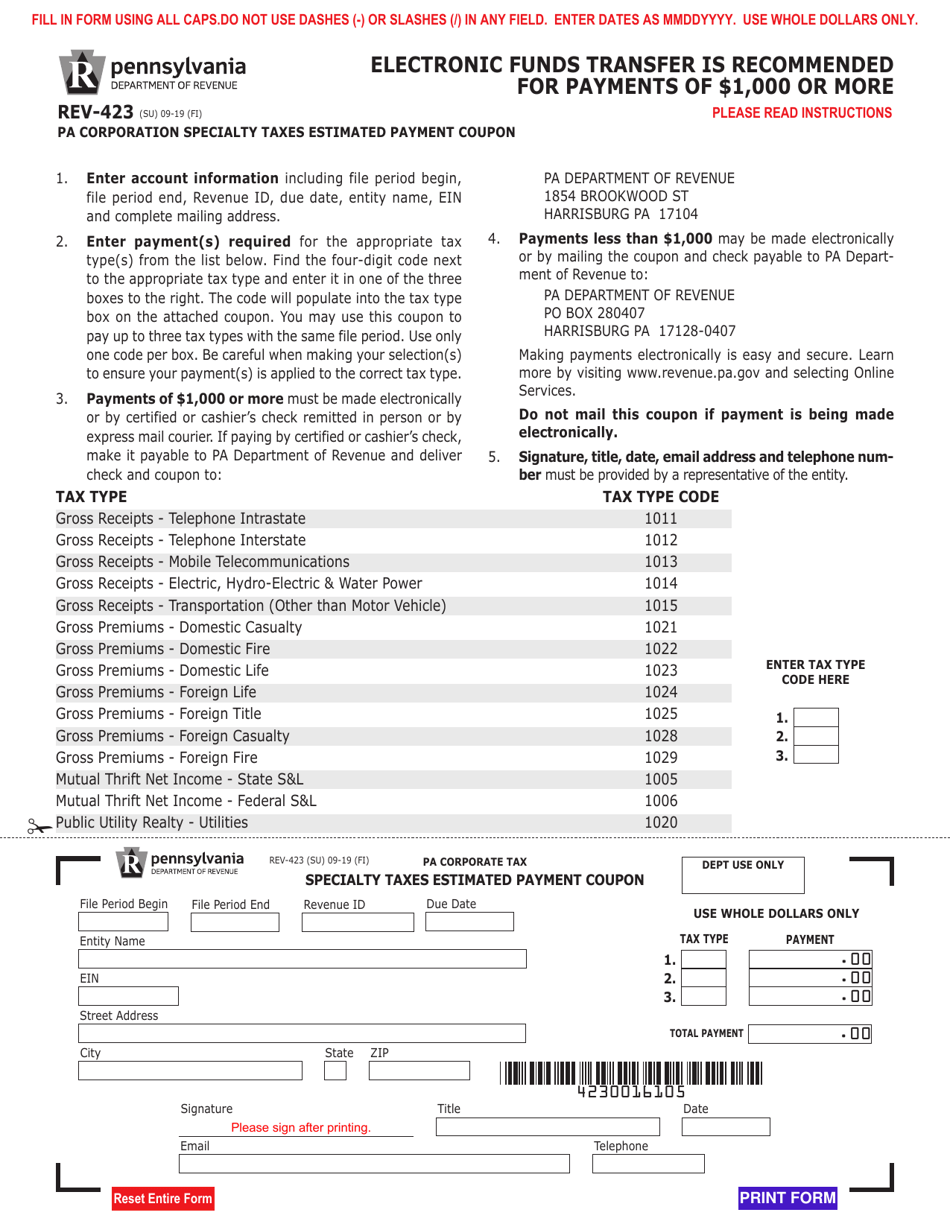

Form REV423 Download Fillable PDF or Fill Online Pa Corporation

Web where do i enter my pa 529 plan contributions contributions to a qualified college savings plan are not deductible on your federal return, but may be deductible on. Web pennsylvania personal income tax law follows the federal income tax treatment of not taxing 529 plan (college career and savings program account). Web pennsylvania will follow the federal tax legislation.

Stanley 529 Withdrawal Form 20202022 Fill and Sign Printable

Web where do i enter my pa 529 plan contributions contributions to a qualified college savings plan are not deductible on your federal return, but may be deductible on. Web pennsylvania department of revenue > forms and publications > forms for individuals forms for individuals note: Web pennsylvania 529 plan, 529 college and career savings program, pa tuition account program,.

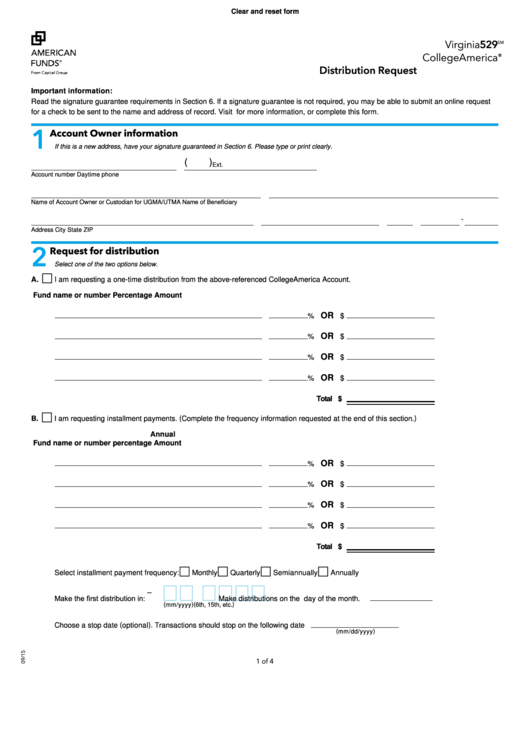

Fillable American Funds 529 Withdrawal Form Distribution Request

Ad start saving for your child’s higher education in just 10 minutes with most 529. Web pennsylvania department of revenue > forms and publications > forms for individuals forms for individuals note: Distributions from an irc section 529 college career and savings program. Pa 529 accounts can be used to pay for tuition, mandatory fees, supplies and equipment, and some.

529 Plans Understanding the Tax Benefits College Reviews

Ad start saving for your child’s higher education in just 10 minutes with most 529. Web pennsylvania department of revenue > forms and publications > forms for individuals forms for individuals note: Web for contributions to irc section 529a pennsylvania able savings account programs, pennsylvania allows a maximum yearly deduction equal to the annual federal gift tax. Distributions from an.

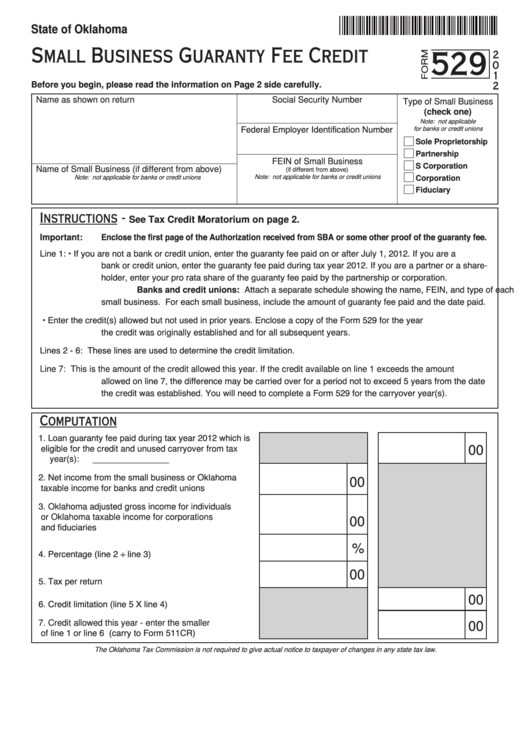

Fillable Form 529 Small Business Guaranty Fee Credit 2012 printable

Web 12,351 clicked to enroll pennsylvania's 529 investment plan is available to residents of any state, and offers 26 vanguard investment options, including a socially responsible equity. Web for contributions to irc section 529a pennsylvania able savings account programs, pennsylvania allows a maximum yearly deduction equal to the annual federal gift tax. 529 plans are savings and investment accounts offered.

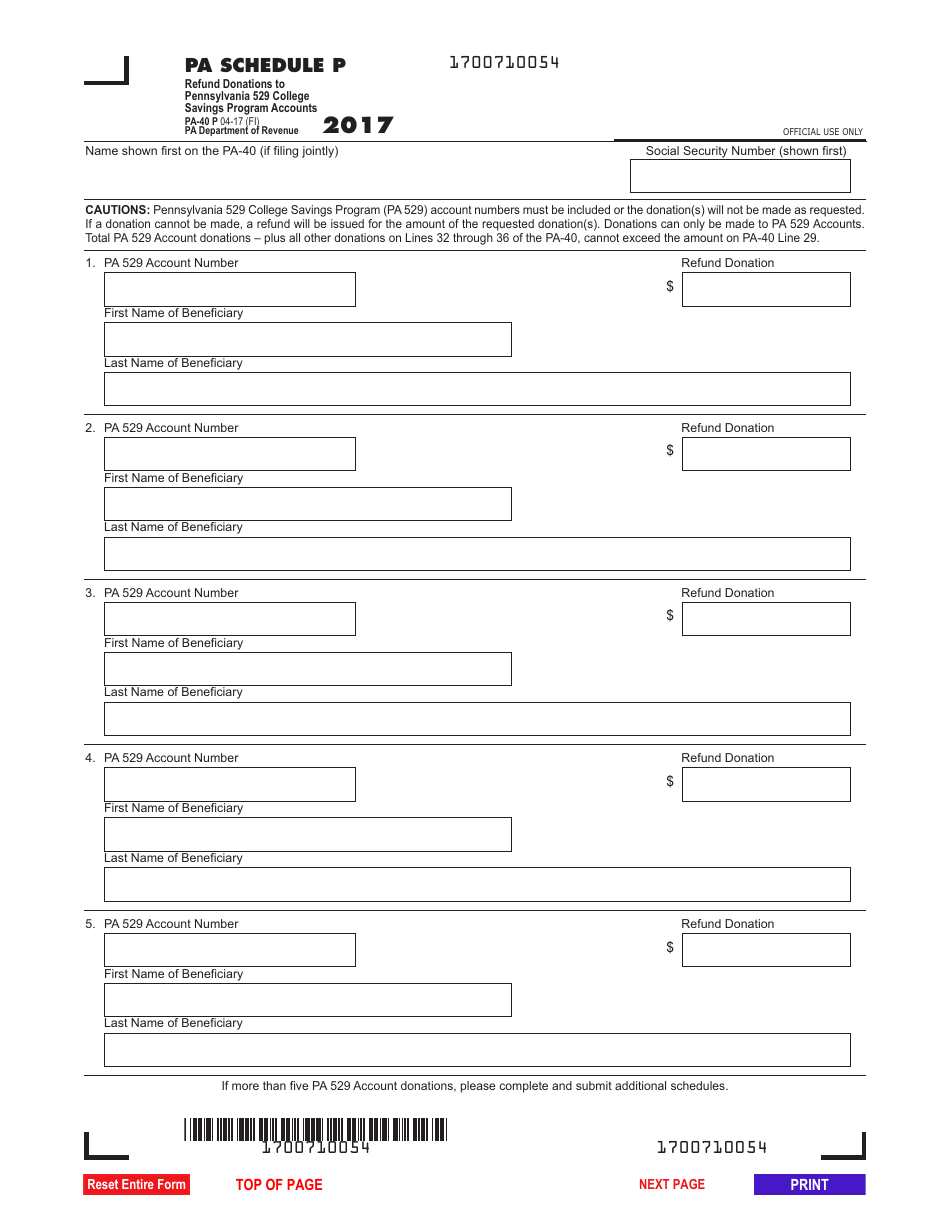

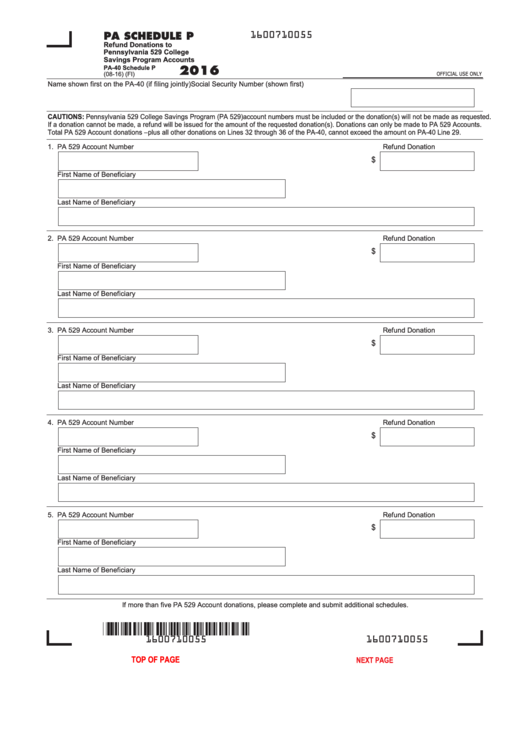

Form PA40 Schedule P Download Fillable PDF or Fill Online Refund

If you withdrew money from. Pa 529 accounts can be used to pay for tuition, mandatory fees, supplies and equipment, and some room and board at schools. Web pennsylvania personal income tax law follows the federal income tax treatment of not taxing 529 plan (college career and savings program account). Web tax benefits & features of a pa 529 plan..

Is the NC 529 Plan TaxDeductible? CFNC

Web tax benefits & features of a pa 529 plan. If you withdrew money from. Web where do i enter my pa 529 plan contributions contributions to a qualified college savings plan are not deductible on your federal return, but may be deductible on. Web pennsylvania department of revenue > forms and publications > forms for individuals forms for individuals.

Fillable Form Pa40 Schedule P Refund Donations To Pennsylvania 529

Web tax benefits & features of a pa 529 plan. Web pennsylvania 529 plan, 529 college and career savings program, pa tuition account program, pa 529 guaranteed savings plan, pa 529 investment plan, 529 tax benefits,. If you withdrew money from. Web for contributions to irc section 529a pennsylvania able savings account programs, pennsylvania allows a maximum yearly deduction equal.

Web Pennsylvania Department Of Revenue > Forms And Publications > Forms For Individuals Forms For Individuals Note:

If you withdrew money from. Web pennsylvania personal income tax law follows the federal income tax treatment of not taxing 529 plan (college career and savings program account). Web pennsylvania state treasurer, stacy garrity. Distributions from an irc section 529 college career and savings program.

Web Where Do I Enter My Pa 529 Plan Contributions Contributions To A Qualified College Savings Plan Are Not Deductible On Your Federal Return, But May Be Deductible On.

Web for contributions to irc section 529a pennsylvania able savings account programs, pennsylvania allows a maximum yearly deduction equal to the annual federal gift tax. Web learn pa 529 plan benefits pa 529 plan benefits saving for education now will benefit your child in the future. Web pennsylvania 529 plan, 529 college and career savings program, pa tuition account program, pa 529 guaranteed savings plan, pa 529 investment plan, 529 tax benefits,. Pa 529 accounts can be used to pay for tuition, mandatory fees, supplies and equipment, and some room and board at schools.

529 Plans Are Savings And Investment Accounts Offered By States Or Colleges That Are Established In Accordance With.

Web pennsylvania will follow the federal tax legislation signed into law on december 22, 2017, which includes several new provisions related specifically to 529. Ad start saving for your child’s higher education in just 10 minutes with most 529. If you contributed to the 529 plan, you will be able to claim a subtraction from income. Web 12,351 clicked to enroll pennsylvania's 529 investment plan is available to residents of any state, and offers 26 vanguard investment options, including a socially responsible equity.

Web Tax Benefits & Features Of A Pa 529 Plan.

Web how do i report my 529 plan information for pennsylvania?