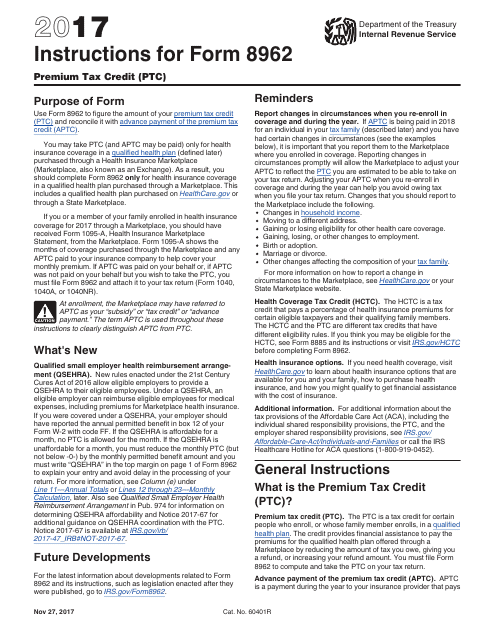

Pdf Form 8962

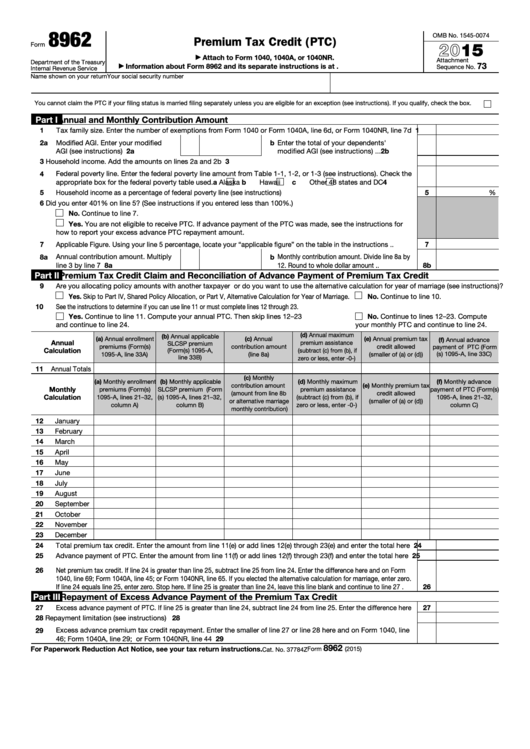

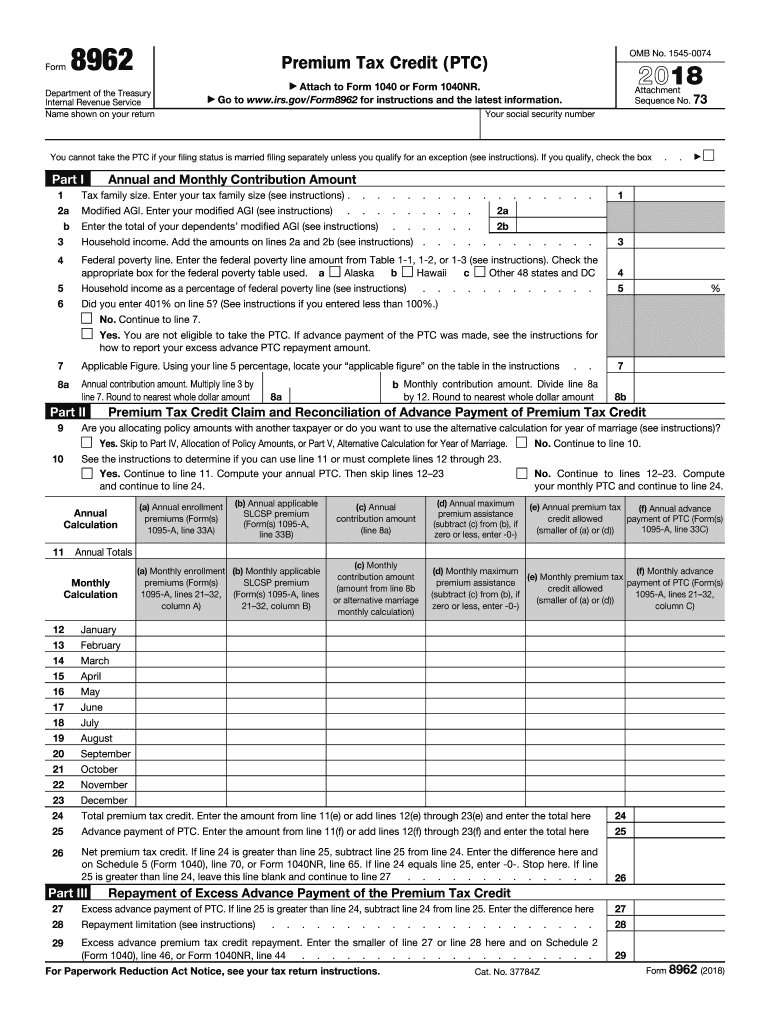

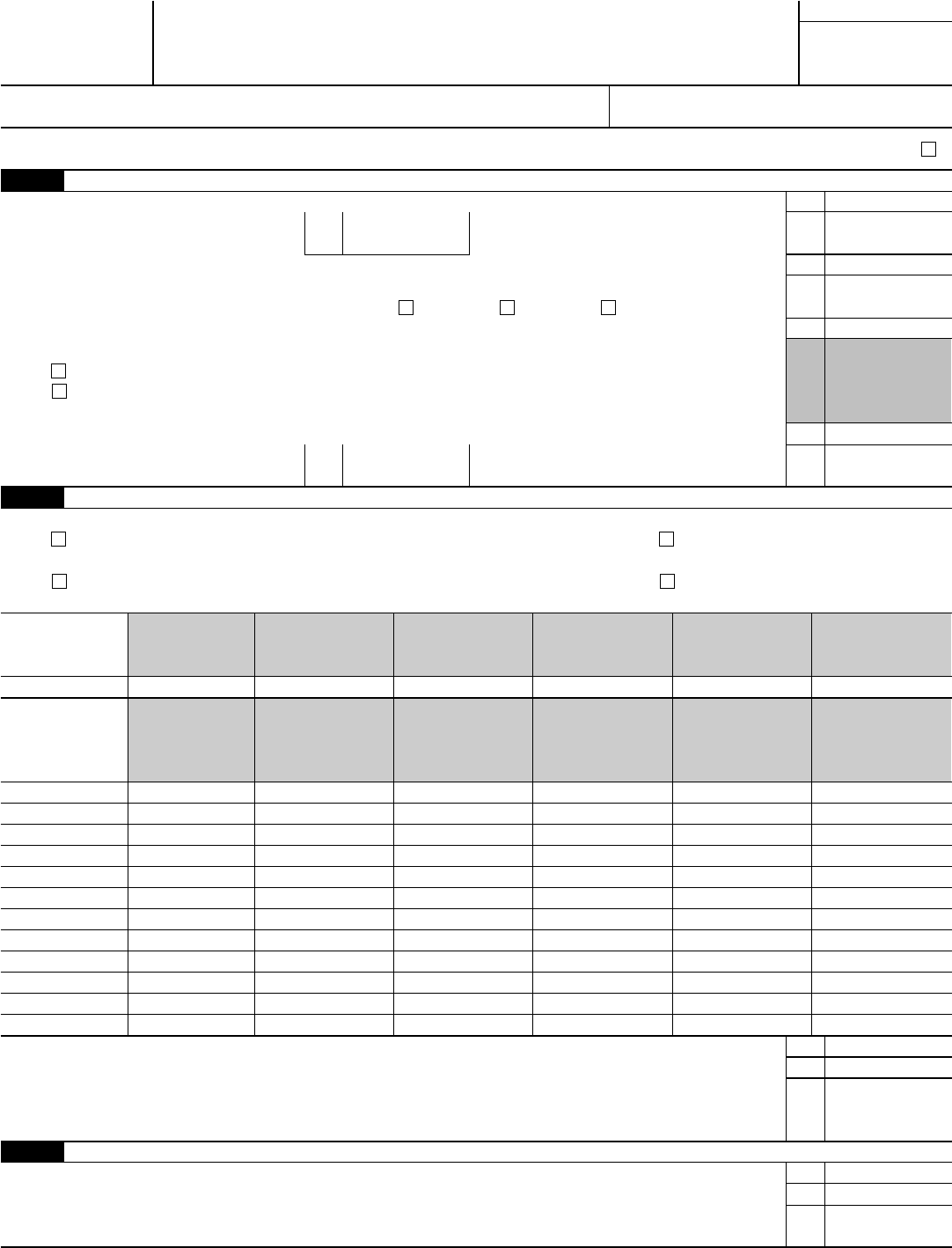

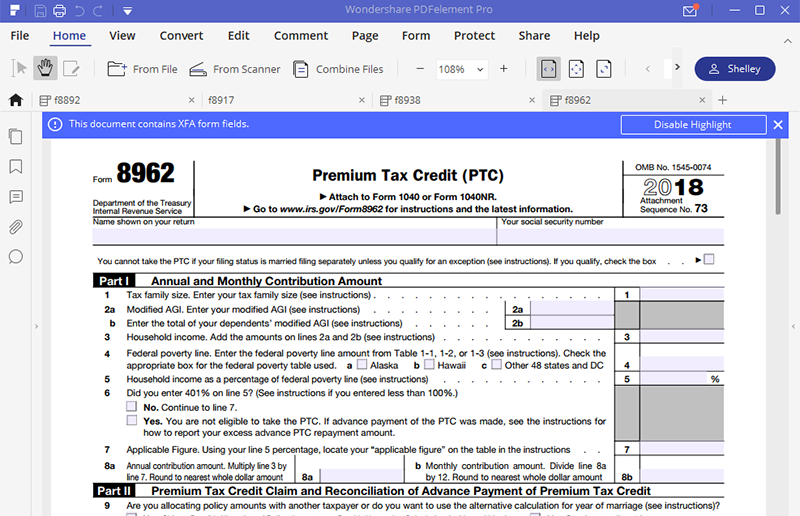

Pdf Form 8962 - Get ready for this year's tax season quickly and safely with pdffiller! Web while preparing your taxes, you might need to fill out irs form 8962. Even if you estimated your income perfectly, you must complete form 8962 and submit it with. More about the federal form 8962 we last updated. With jotform smart pdf forms, you can easily upload the pdf of. Web you must use form 8962 to reconcile your estimated and actual income for the year. Complete, edit or print tax forms instantly. Additional information to help you determine if your health care coverage is minimum. Enter the number of exemptions from form 1040 or form 1040a, line 6d, or form 1040nr, line 7d 1 2 a modified agi. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise.

Additional information to help you determine if your health care coverage is minimum. Who must file form 8962. You may take ptc (and aptc may. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Get ready for tax season deadlines by completing any required tax forms today. Send the following to the irs address or fax number given in your irs letter: Even if you estimated your income perfectly, you must complete form 8962 and submit it with. Market leader with over 700k customers. Web you must use form 8962 to reconcile your estimated and actual income for the year. Web 1 tax family size.

Create a blank & editable 8962 form,. Web you’ll need it to complete form 8962, premium tax credit. Web follow these guidelines to quickly and accurately submit irs 8962. Get ready for tax season deadlines by completing any required tax forms today. Who must file form 8962. Ad get ready for tax season deadlines by completing any required tax forms today. Web open the downloaded pdf and navigate to your form 8962 to print it. Enter your modified agi (see instructions). Market leader with over 700k customers. With jotform smart pdf forms, you can easily upload the pdf of.

2016 Form IRS Instructions 8962 Fill Online, Printable, Fillable, Blank

Web you must use form 8962 to reconcile your estimated and actual income for the year. It is used to figure the amount of your premium tax credit and reconcile it with advanced. Even if you estimated your income perfectly, you must complete form 8962 and submit it with. Web to confirm the aptc was not paid, you should attach.

Form 8962 Premium Tax Credit (PTC) for Shared Policy Allocation DocHub

Ad access irs tax forms. Web irs 8962 is the form that was made for taxpayers who want to find out the premium tax credit amount and to reconcile this figure with advance payment of the premium tax. Web 1 tax family size. Click on the button get form to open it and start editing. With jotform smart pdf forms,.

Irs Printable Form 8962 Master of Documents

The american rescue plan, signed into law on march 11, 2021, includes a provision that eliminates the requirement. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Web to confirm the aptc was not paid, you should attach to your return a pdf.

Fillable Form 8962 Premium Tax Credit (Ptc) 2015 printable pdf download

Ad get ready for tax season deadlines by completing any required tax forms today. Convenient toolkit for editing pdfs. Enter your modified agi (see instructions). Who must file form 8962. You may take ptc (and aptc may.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Web follow these guidelines to quickly and accurately submit irs 8962. With jotform smart pdf forms, you can easily upload the pdf of. Web you must use form 8962 to reconcile your estimated and actual income for the year. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

2014 federal form 8962 instructions

Who can take the ptc. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Web you’ll need it to complete form 8962, premium tax credit. Web irs 8962 is the form that was made for taxpayers who want to find out the premium.

Form 8962 Edit, Fill, Sign Online Handypdf

Web you must use form 8962 to reconcile your estimated and actual income for the year. Form 8962 is used either (1) to reconcile a premium tax. Who must file form 8962. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly.

IRS Form 8962 Instruction for How to Fill it Right

The american rescue plan, signed into law on march 11, 2021, includes a provision that eliminates the requirement. Who can take the ptc. Web irs 8962 is the form that was made for taxpayers who want to find out the premium tax credit amount and to reconcile this figure with advance payment of the premium tax. Enter your modified agi.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Web open the downloaded pdf and navigate to your form 8962 to print it. Ad get ready for tax season deadlines by completing any required tax forms today. Ad get ready for tax season.

IRS Form 8962 2016 Irs forms, Number forms, Irs

Additional information to help you determine if your health care coverage is minimum. With jotform smart pdf forms, you can easily upload the pdf of. The american rescue plan, signed into law on march 11, 2021, includes a provision that eliminates the requirement. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how.

You May Take Ptc (And Aptc May.

With jotform smart pdf forms, you can easily upload the pdf of. Get ready for this year's tax season quickly and safely with pdffiller! Complete, edit or print tax forms instantly. Convenient toolkit for editing pdfs.

Who Must File Form 8962.

Web you’ll need it to complete form 8962, premium tax credit. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Who can take the ptc. Web open the downloaded pdf and navigate to your form 8962 to print it.

The American Rescue Plan, Signed Into Law On March 11, 2021, Includes A Provision That Eliminates The Requirement.

Web to confirm the aptc was not paid, you should attach to your return a pdf attachment titled aca explanation with a written explanation of the reason why you. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Market leader with over 700k customers. Web you must use form 8962 to reconcile your estimated and actual income for the year.

Send The Following To The Irs Address Or Fax Number Given In Your Irs Letter:

Web while preparing your taxes, you might need to fill out irs form 8962. Click on the button get form to open it and start editing. Even if you estimated your income perfectly, you must complete form 8962 and submit it with. Enter your modified agi (see instructions).