Penalty For Not Filing Form 5471

Penalty For Not Filing Form 5471 - Web the penalty for failing to timely file a form 5471 or correctly file a form 5471 is $10,000 per year, with an additional $10,000 penalties accruing (ninety days after notification of. Web in november 2018, the irs assessed $10,000 per failure to file, per year, as well as a continuation penalty of $50,000 for each year. Web substantial penalties exist for u.s. Web the form 547 1 filing is attached to your individual income tax return and is to be filed by the due date (including extensions) for that return. These penalties may apply to each required form 5471 on an annual basis. The penalty does not apply if the taxpayer can show reasonable cause for the late filing. They generally start at $10,000 per violation but can go up significantly from there depending on how many forms should have been filed,. Person, an additional $10,000 penalty (per foreign corporation) is charged for. Tax returns, and paid all tax on, the. Irs form 547 1 penalties:

Web what are the fines and penalties for not filing form 5471? Tax court today held that the irs did not have statutory authority to assess penalties under section 6038 (b) against a taxpayer who willfully failed to file. Tax returns, and paid all tax on, the. Web under the diirsp, the irs will not impose a penalty for the failure to file the delinquent form 547 1 s if you properly reported on your u.s. These penalties may apply to each required form 5471 on an annual basis. In addition, in the event of. Irs form 547 1 penalties: Web the maximum continuation penalty per form 5471 is $50,000. Web the penalties for not filing form 5471 correctly can be tough. Web the penalties for form 5471 can be steep.

The irs also determined that. Web what are the fines and penalties for not filing form 5471? Persons potentially liable for filing. Web the penalties for not filing form 5471 correctly can be tough. Web in november 2018, the irs assessed $10,000 per failure to file, per year, as well as a continuation penalty of $50,000 for each year. If you get a notice. Web the form 547 1 filing is attached to your individual income tax return and is to be filed by the due date (including extensions) for that return. Web if you meet the requirements and don’t file, you may be hit with a $10,000 penalty for each annual accounting period of the foreign corporation. Tax court today held that the irs did not have statutory authority to assess penalties under section 6038 (b) against a taxpayer who willfully failed to file. Web if the information is not filed within 90 days after the irs has mailed a notice of the failure to the u.s.

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

Web the penalties for not filing form 5471 correctly can be tough. Web substantial penalties exist for u.s. Citizens and residents who are officers, directors, or shareholders in certain foreign corporations file form 5471 and schedules to satisfy the reporting requirements. The penalty does not apply if the taxpayer can show reasonable cause for the late filing. Web international information.

Form 5471 Your US Expat Taxes and Reporting Requirements

Web in november 2018, the irs assessed $10,000 per failure to file, per year, as well as a continuation penalty of $50,000 for each year. Web substantial penalties exist for u.s. Persons potentially liable for filing. Web what are the fines and penalties for not filing form 5471? Tax returns, and paid all tax on, the.

Sales Tax Penalty Waiver Sample Letter Irs Letter 1277 Penalty

Web the form 547 1 filing is attached to your individual income tax return and is to be filed by the due date (including extensions) for that return. Web the maximum continuation penalty per form 5471 is $50,000. Web what are the fines and penalties for not filing form 5471? Person, an additional $10,000 penalty (per foreign corporation) is charged.

Penalty for Late Filing Form 2290 Computer Tech Reviews

Residents who are liable for filing form 5471 and who failed to do so. Web a person required to file form 5471 who fails to file the form or files a late or incomplete form is subject to substantial monetary penalties. Web the form 547 1 filing is attached to your individual income tax return and is to be filed.

Penalty Section 234F for Late Tax Return Filers in AY 202021

Irs form 547 1 penalties: Persons potentially liable for filing. Residents who are liable for filing form 5471 and who failed to do so. Web if the information is not filed within 90 days after the irs has mailed a notice of the failure to the u.s. Web the penalty for failing to timely file a form 5471 or correctly.

What is the Penalty for Not Filing an FBAR Form? Ayar Law

Web the form 547 1 filing is attached to your individual income tax return and is to be filed by the due date (including extensions) for that return. Web international information return penalties are civil penalties assessed on a united states (u.s.) person for failure to timely file complete and accurate international information. Web under the diirsp, the irs will.

A Complete Guide for Dormant Foreign Corporation on Filing Form 5471

Web a person required to file form 5471 who fails to file the form or files a late or incomplete form is subject to substantial monetary penalties. Web in november 2018, the irs assessed $10,000 per failure to file, per year, as well as a continuation penalty of $50,000 for each year. Residents who are liable for filing form 5471.

Four Lines of Defense to a Form 5471 Penalty SF Tax Counsel

The irs also determined that. Irs form 547 1 penalties: Residents who are liable for filing form 5471 and who failed to do so. Web if the information is not filed within 90 days after the irs has mailed a notice of the failure to the u.s. Web a person required to file form 5471 who fails to file the.

IRS Letter and 10,000 Penalty for Late 5471 Hutcheson & Co.

Web a person required to file form 5471 who fails to file the form or files a late or incomplete form is subject to substantial monetary penalties. Web the maximum continuation penalty per form 5471 is $50,000. Persons potentially liable for filing. Irs form 547 1 penalties: The irs also determined that.

Will Your Form 5471 Be Dinged By the IRS’ 10,000 Penalty For Being

Web the penalties for form 5471 can be steep. They generally start at $10,000 per violation but can go up significantly from there depending on how many forms should have been filed,. Persons potentially liable for filing. Web the form 547 1 filing is attached to your individual income tax return and is to be filed by the due date.

Web The Form 547 1 Filing Is Attached To Your Individual Income Tax Return And Is To Be Filed By The Due Date (Including Extensions) For That Return.

Web if the information is not filed within 90 days after the irs has mailed a notice of the failure to the u.s. These penalties may apply to each required form 5471 on an annual basis. Web in november 2018, the irs assessed $10,000 per failure to file, per year, as well as a continuation penalty of $50,000 for each year. Web what are the fines and penalties for not filing form 5471?

Person, An Additional $10,000 Penalty (Per Foreign Corporation) Is Charged For.

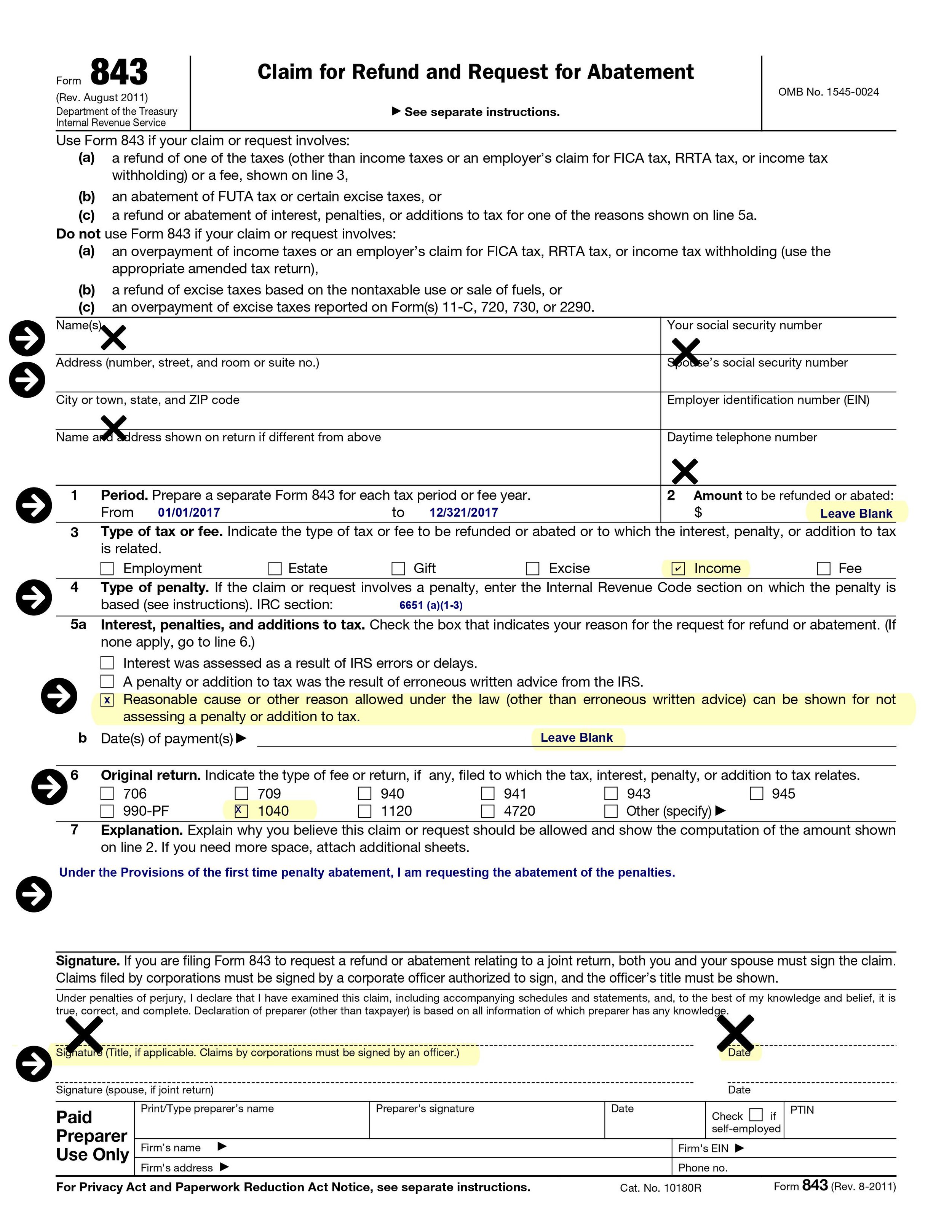

Web under the diirsp, the irs will not impose a penalty for the failure to file the delinquent form 547 1 s if you properly reported on your u.s. Persons potentially liable for filing. Web the normal form 5471 penalty of $10,000 per year, per violation can hurt a taxpayer. Web substantial penalties exist for u.s.

Residents Who Are Liable For Filing Form 5471 And Who Failed To Do So.

Web a person required to file form 5471 who fails to file the form or files a late or incomplete form is subject to substantial monetary penalties. The penalty does not apply if the taxpayer can show reasonable cause for the late filing. They start out at $10,000 and go up exponentially from there — depending on how many form 5471s a taxpayer. Web the penalties for not filing form 5471 correctly can be tough.

Irs Form 547 1 Penalties:

Web the penalty for failing to timely file a form 5471 or correctly file a form 5471 is $10,000 per year, with an additional $10,000 penalties accruing (ninety days after notification of. Web the penalties for form 5471 can be steep. In addition, in the event of. Criminal penalties may also apply for.