Philadelphia Local Tax Form

Philadelphia Local Tax Form - Mechanical amusement device tax forms through 2021; Web local withholding tax faqs. Net profits tax (npt) forms; Liquor tax reconciliation forms through 2021; From now on, use the philadelphia tax center to file and pay all taxes. Tax types that are listed under multiple categories below are the same taxes. Web you can choose to file any city tax on the philadelphia tax center, but a few taxes must be filed online. Please note that the following list does not cover all city taxes, since some taxes must be paid through the philadelphia tax center. Use and occupancy (u&o) tax; Local income tax information local withholding tax faqs.

Business income & receipts tax (birt) forms; Please note that the following list does not cover all city taxes, since some taxes must be paid through the philadelphia tax center. Property tax/rent rebate status pennsylvania department of revenue > i'm looking for: Web wage tax (employers) due date. Philadelphia beverage tax (pbt) liquor tax; Our old efile/epay website is no longer available. In fall 2021, philadelphia taxpayers started using a new website to file and pay city taxes electronically: Mechanical amusement device tax forms through 2021; To connect with the governor’s center for local government services (gclgs) by phone, call 888.223.6837. See below to determine your filing frequency.

How do i find local earned income tax (eit) rates and psd codes? Dced local government services act 32: Mechanical amusement device tax forms through 2021; Web make a payment where's my income tax refund? Our old efile/epay website is no longer available. Philadelphia beverage tax (pbt) liquor tax; In fall 2021, philadelphia taxpayers started using a new website to file and pay city taxes electronically: Web wage tax (employers) due date. See below to determine your filing frequency. Net profits tax (npt) forms;

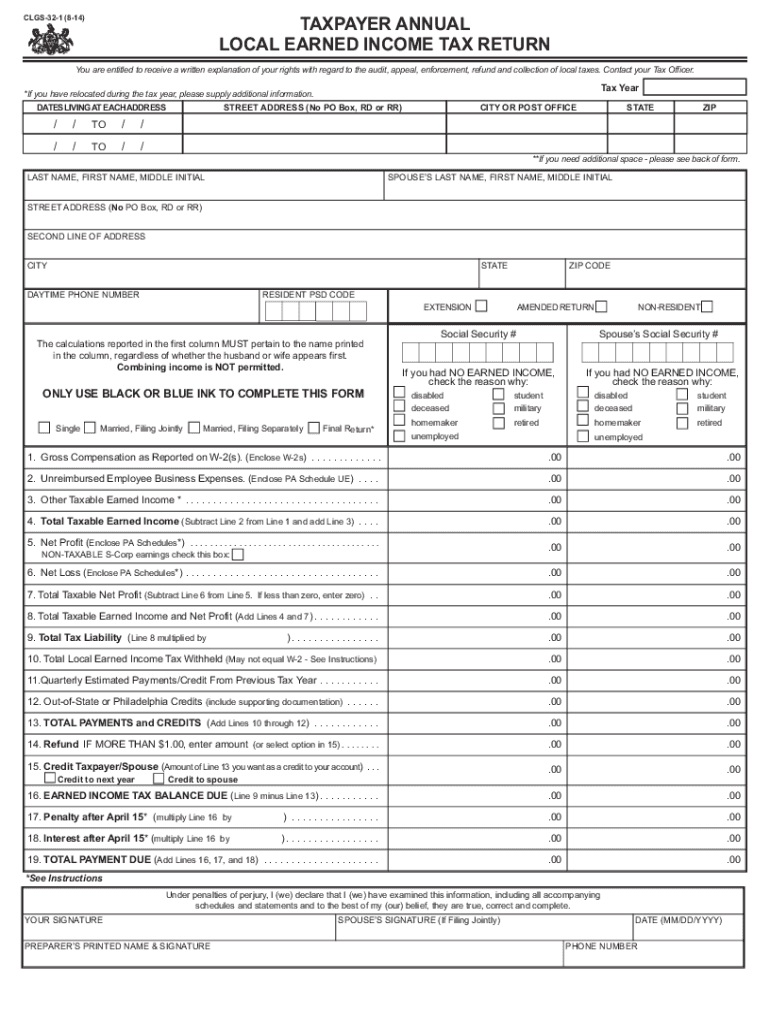

Taxpayer Annual Local Earned Tax Return PA Department Of

You can also use the tax center to pay city fees and apply for all real estate tax assistance programs, including the homestead exemption. Use and occupancy (u&o) tax; Web wage tax (employers) due date. Web local governments may wish to consult with their solicitors on whether and how they might explore alternatives to waive interest and/or penalties for local.

Local Tax Form Editable Forms

Web wage tax (employers) due date. Dates living at each address street address (no po box, rd or rr) city or post office state zip / / to. You can also use the tax center to pay city fees and apply for all real estate tax assistance programs, including the homestead exemption. Dced local government services act 32: From now.

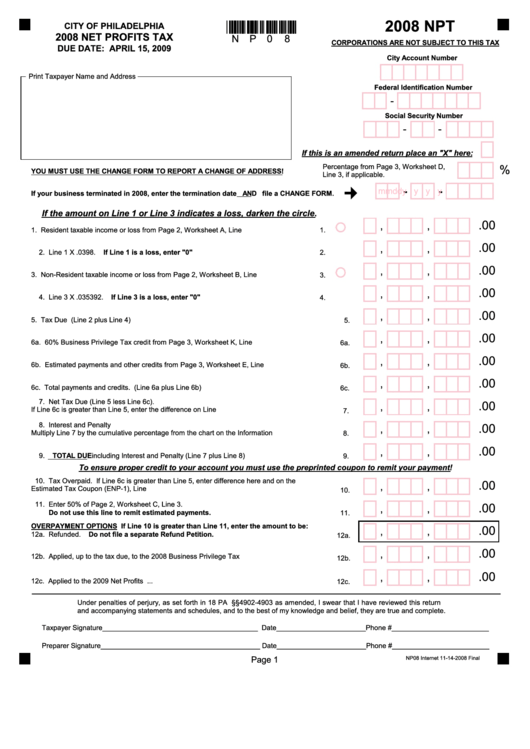

Form Npt Net Profits Tax City Of Philadelphia 2008 printable pdf

Web local governments may wish to consult with their solicitors on whether and how they might explore alternatives to waive interest and/or penalties for local tax filings and payments that are made on or before may 17, 2021, which is the extension for filing federal and state taxes. Dates living at each address street address (no po box, rd or.

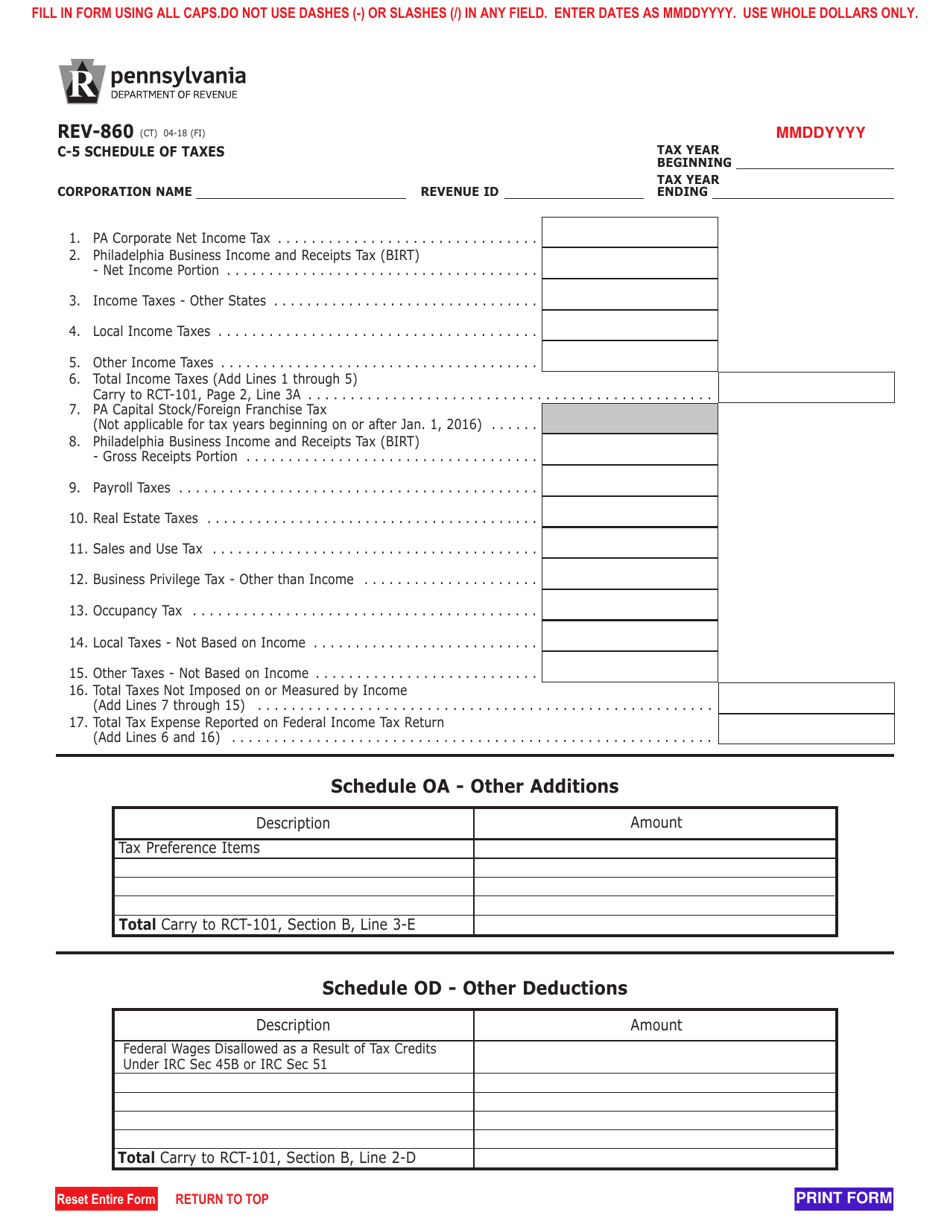

Form REV860 Download Fillable PDF or Fill Online C5 Schedule of Taxes

From now on, use the philadelphia tax center to file and pay all taxes. Web wage tax (employers) due date. If you need to update your address, close a tax account, or request payment coupons, you can use the department. Web 2022 tax forms. Tax types that are listed under multiple categories below are the same taxes.

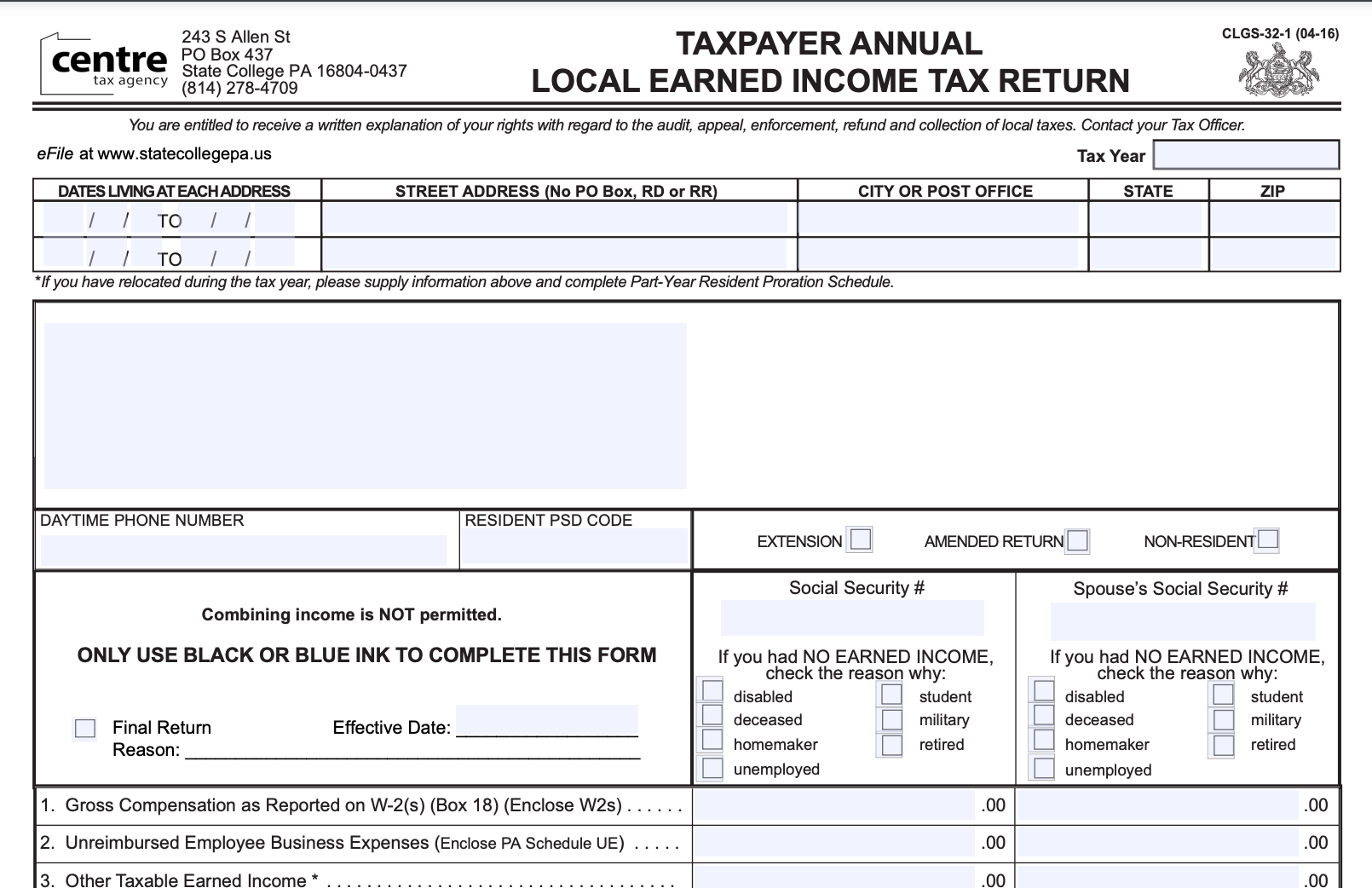

Late Filing Penalties on Local Tax Returns in Centre County Waived

Please note that the following list does not cover all city taxes, since some taxes must be paid through the philadelphia tax center. Web local governments may wish to consult with their solicitors on whether and how they might explore alternatives to waive interest and/or penalties for local tax filings and payments that are made on or before may 17,.

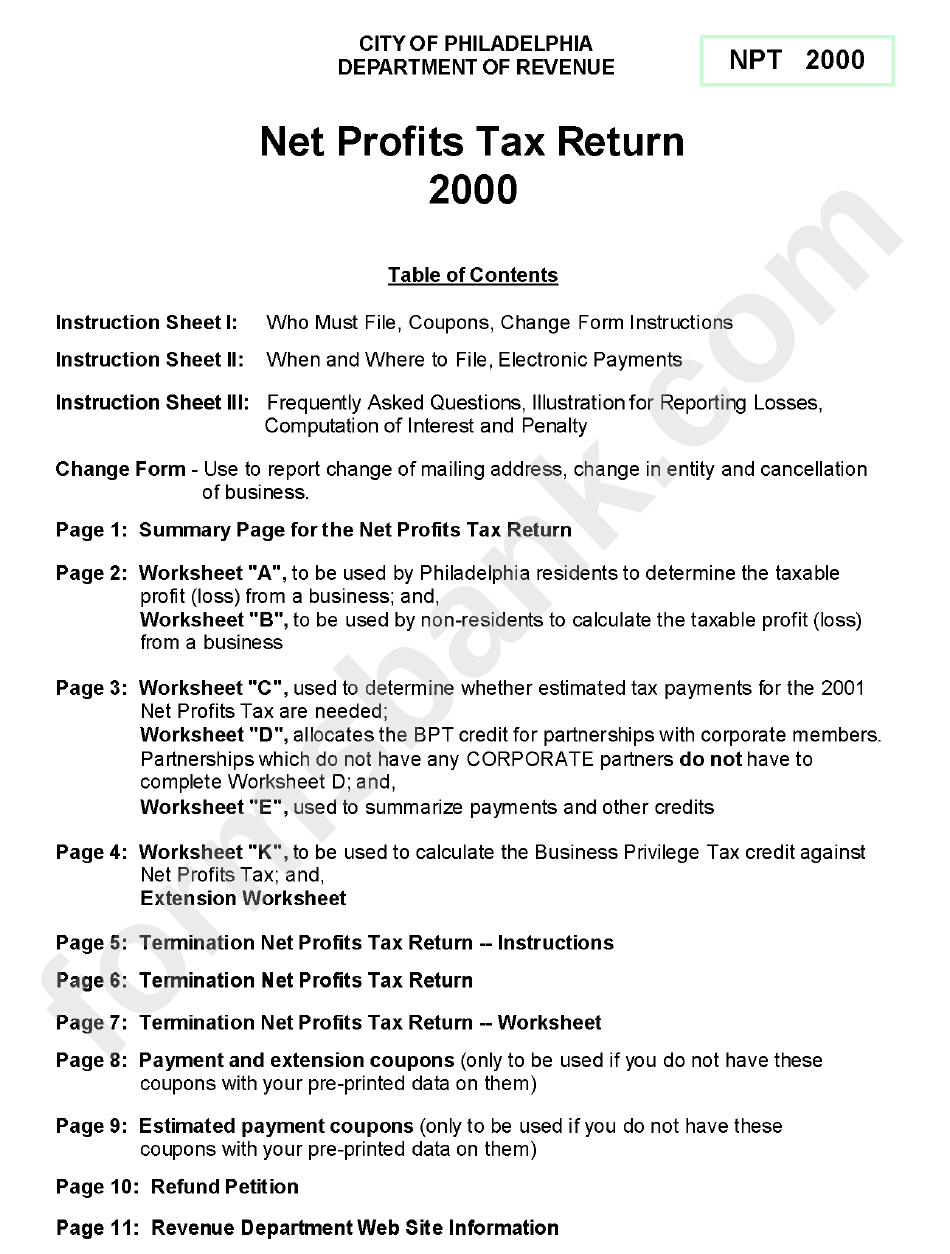

Net Profits Tax Return Worksheets (Form Npt) City Of Philadelphia

Dates living at each address street address (no po box, rd or rr) city or post office state zip / / to. In fall 2021, philadelphia taxpayers started using a new website to file and pay city taxes electronically: Mechanical amusement device tax forms through 2021; Web 2022 tax forms. How do i find local earned income tax (eit) rates.

Prepare the Annual Reconciliation of Employer Wage

See below to determine your filing frequency. Use and occupancy (u&o) tax; Web you can choose to file any city tax on the philadelphia tax center, but a few taxes must be filed online. Web local withholding tax faqs. How do i find local earned income tax (eit) rates and psd codes?

Tax Refund Philadelphia Fill Online, Printable, Fillable, Blank

Property tax/rent rebate status pennsylvania department of revenue > i'm looking for: In fall 2021, philadelphia taxpayers started using a new website to file and pay city taxes electronically: If you need to update your address, close a tax account, or request payment coupons, you can use the department. Liquor tax reconciliation forms through 2021; See below to determine your.

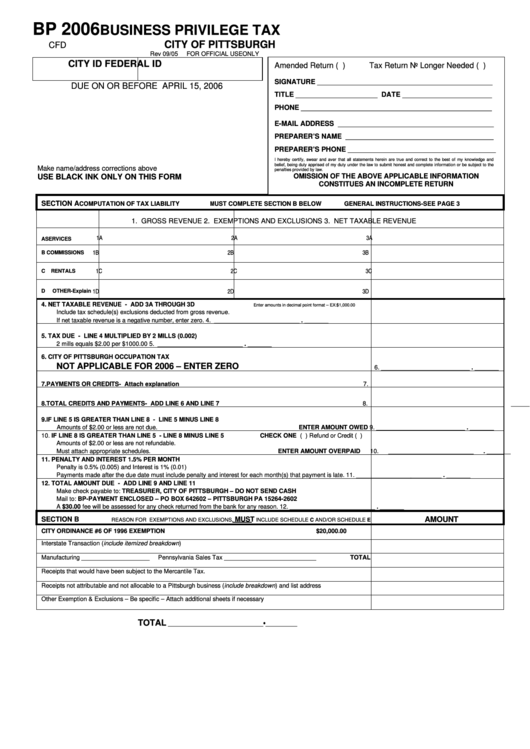

Form Bp Business Privilege Tax City Of Pittsburgh 2006 printable

Net profits tax (npt) forms; Dates living at each address street address (no po box, rd or rr) city or post office state zip / / to. Web you can choose to file any city tax on the philadelphia tax center, but a few taxes must be filed online. Local income tax information local withholding tax faqs. Philadelphia beverage tax.

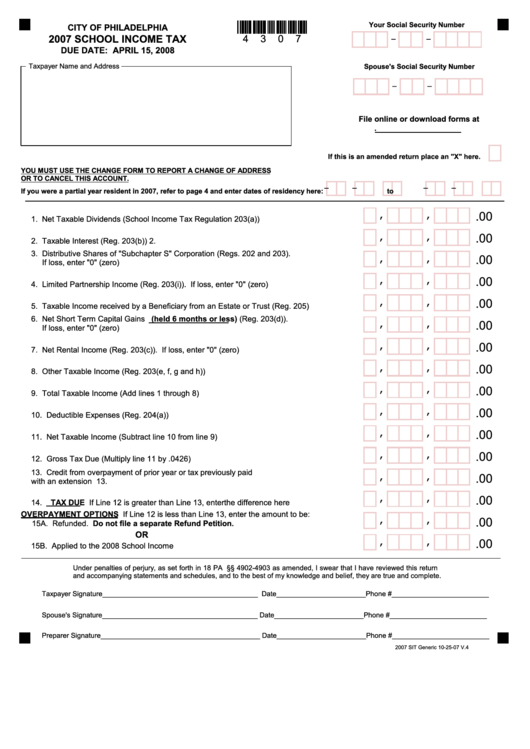

School Tax Form City Of Philadelphia 2007 printable pdf download

You can also use the tax center to pay city fees and apply for all real estate tax assistance programs, including the homestead exemption. Dates living at each address street address (no po box, rd or rr) city or post office state zip / / to. Net profits tax (npt) forms; Please note that the following list does not cover.

Mechanical Amusement Device Tax Forms Through 2021;

> tax forms and information tax forms and information tax credits and incentives forms and publications tax rates due dates [pdf] tax types tax law Property tax/rent rebate status pennsylvania department of revenue > i'm looking for: Please note that the following list does not cover all city taxes, since some taxes must be paid through the philadelphia tax center. Web wage tax (employers) due date.

See Below To Determine Your Filing Frequency.

The wage tax must be filed quarterly and paid on a schedule that corresponds with how much money is withheld from employees’ paychecks. Web some taxes are listed as both income taxes and business taxes. Web local governments may wish to consult with their solicitors on whether and how they might explore alternatives to waive interest and/or penalties for local tax filings and payments that are made on or before may 17, 2021, which is the extension for filing federal and state taxes. Dced local government services act 32:

Web Local Withholding Tax Faqs.

Use and occupancy (u&o) tax; Web you can choose to file any city tax on the philadelphia tax center, but a few taxes must be filed online. Tax types that are listed under multiple categories below are the same taxes. Philadelphia beverage tax (pbt) liquor tax;

You Can Also Use The Tax Center To Pay City Fees And Apply For All Real Estate Tax Assistance Programs, Including The Homestead Exemption.

Our old efile/epay website is no longer available. How do i find local earned income tax (eit) rates and psd codes? To connect with the governor’s center for local government services (gclgs) by phone, call 888.223.6837. Web make a payment where's my income tax refund?