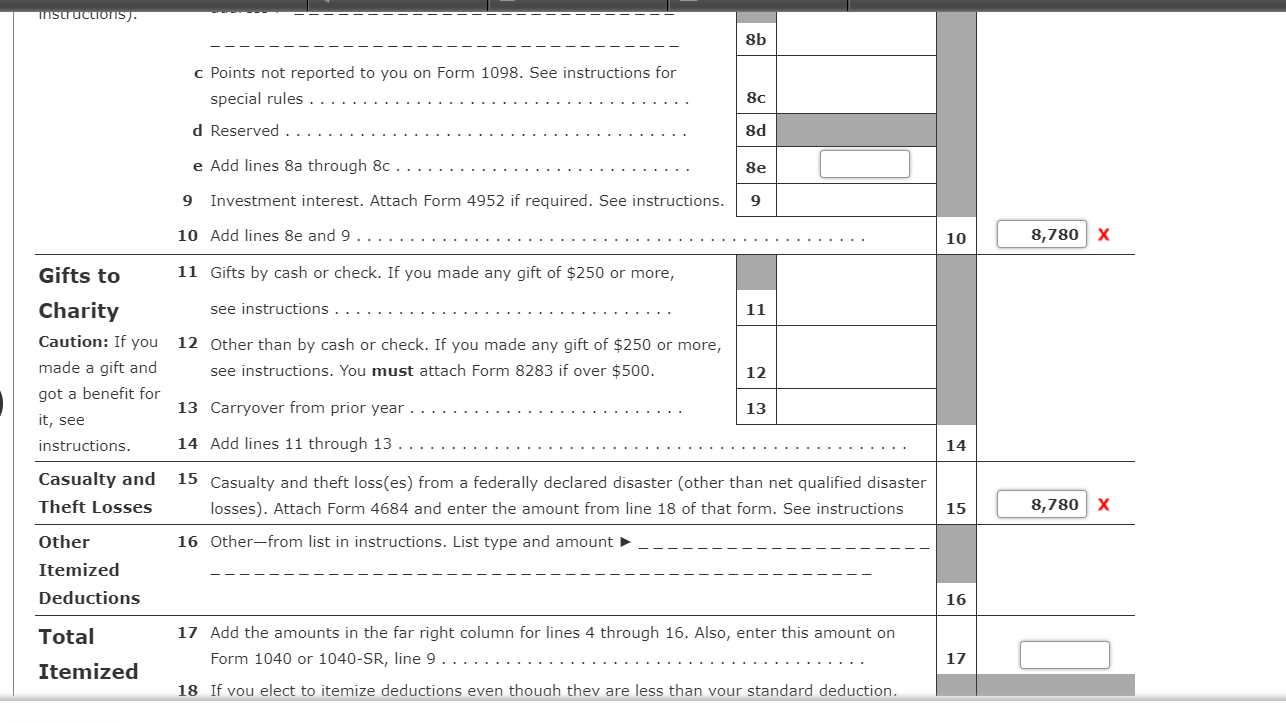

Points Not Reported To You On Form 1098

Points Not Reported To You On Form 1098 - Web if the amount you borrow to buy your home exceeds $750,000 million ($1m for mortgages originated before december 15, 2017), you are generally limited on the. Web any deductible points not included on form 1098 (usually not included on the form when refinancing) should be entered on schedule a (form 1040), itemized. Web the form 1098 and property tax statement only have my name and social security number. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Not in the lending business. Web to enter points not reported to you on form 1098 to determine if they are fully deductible in the current year or if you must deduct them over the life of the loan: Web not all points are reportable to you. Web person (including a financial institution, a governmental unit, and a cooperative housing corporation) who is engaged in a trade or business and, in the course of such trade or. How do we split these payments of interest and taxes on schedule a so we can both.

Web to enter points not reported to you: Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web not all points are reportable to you. Box 6 shows points you or the seller paid this year for the purchase of your principal residence that are required to be reported to you. Web to enter points not reported to you on form 1098 to determine if they are fully deductible in the current year or if you must deduct them over the life of the loan: On smaller devices, click in the upper. You obtain that information from your closing statement. Web person (including a financial institution, a governmental unit, and a cooperative housing corporation) who is engaged in a trade or business and, in the course of such trade or. Points paid only to borrow money are deductible over the life. Not in the lending business.

Not all points are reportable to you. Web to enter points not reported to you: You are not required to file form 1098. Web not all points are reportable to you. You obtain that information from your closing statement. Box 6 shows points you or the seller paid this year for the purchase of your principal residence that are required to be reported to you. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web mortgage points are located in box 6 points paid on purchase of principal residence on the 1098 form. For information about who must file to report points, see who must report points, later.

Solved Bea Jones (birthdate March 27, 1984) moved from Texas

Web to enter points not reported to you: Not in the lending business. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. On smaller devices, click in the upper. Points paid only to borrow money are deductible over.

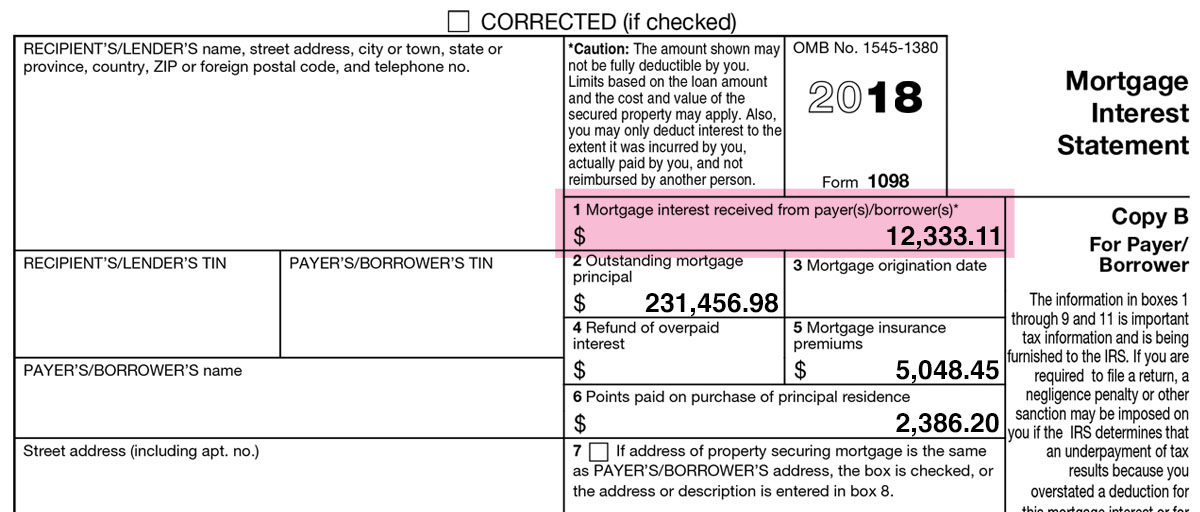

Form 1098 Mortgage Interest Statement, Payer Copy B

Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the. Web mortgage points are located in box 6 points paid on purchase of principal residence on the 1098 form. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later).

Form 1098 1999 Fill Out and Sign Printable PDF Template signNow

Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. How do we split these payments of interest and taxes on schedule a so we can both. Web person (including a financial institution, a governmental unit, and a cooperative.

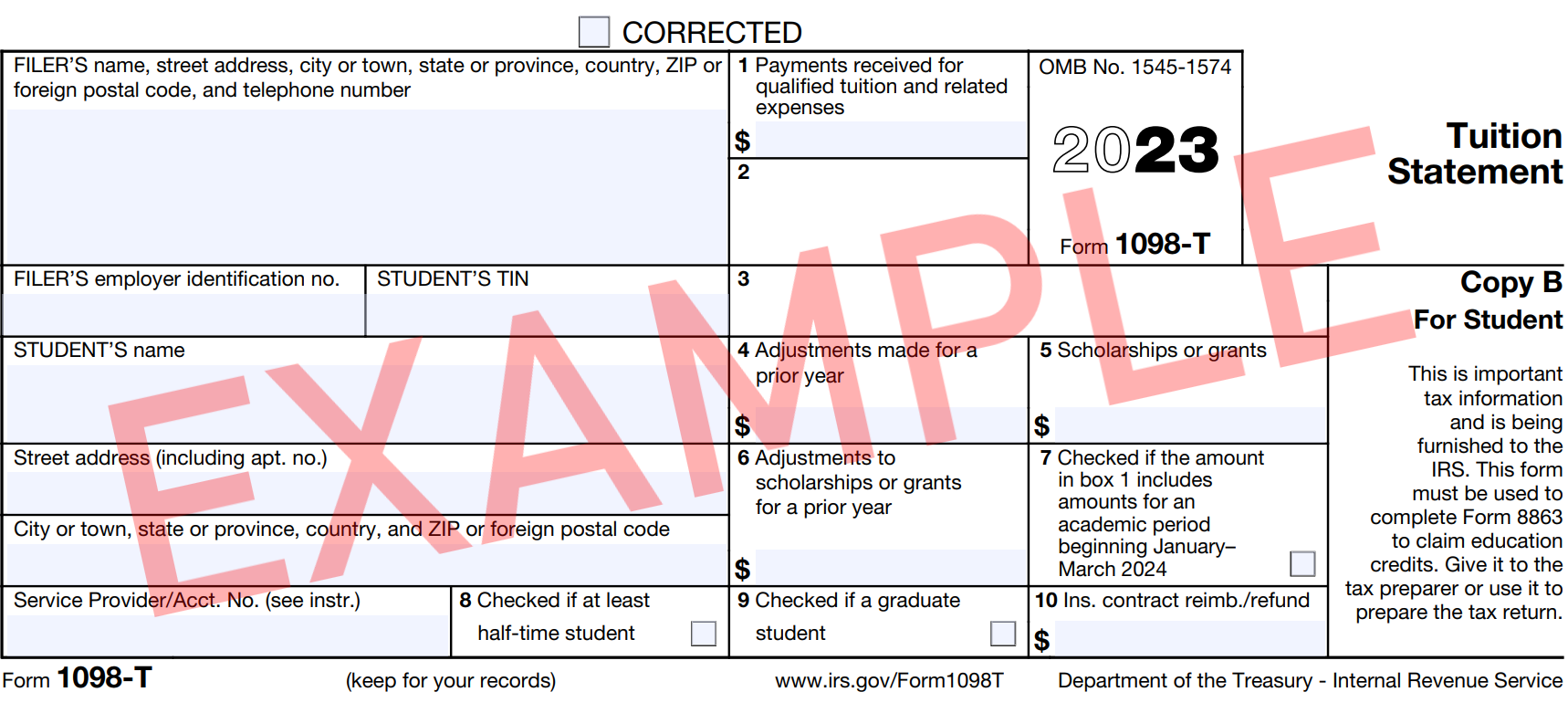

Form 1098T Information Student Portal

Web not all points are reportable to you. Web mortgage points are located in box 6 points paid on purchase of principal residence on the 1098 form. On smaller devices, click in the upper. You are not required to file form 1098. Box 6 shows points you or the seller paid this year for the purchase of your principal residence.

Irs Form 1098 T Explanation Universal Network

For information about who must file to report points, see who must report points, later. How do we split these payments of interest and taxes on schedule a so we can both. Web points not reported to you on form 1098 means they were not reported on form 1098. Web use form 1098, mortgage interest statement, to report mortgage interest.

Form 1098T Information Student Portal

You are not required to file form 1098. Web to enter points not reported to you: Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web if the amount you borrow to buy your home exceeds $750,000 million ($1m for mortgages originated before december 15, 2017), you are generally limited on.

Form 1098 Mortgage Interest Statement Definition

Not all points are reportable to you. Box 6 shows points you or the seller paid this year for the purchase of your principal residence that are required to be reported to you. Web not all points are reportable to you. Web if the amount you borrow to buy your home exceeds $750,000 million ($1m for mortgages originated before december.

Form 1098 and Your Mortgage Interest Statement

How do we split these payments of interest and taxes on schedule a so we can both. You obtain that information from your closing statement. From within your taxact return ( online or desktop), click federal. Web mortgage points are located in box 6 points paid on purchase of principal residence on the 1098 form. Web person (including a financial.

Learn How to Fill the Form 1098 Mortgage Interest Statement YouTube

On smaller devices, click in the upper. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you.

Form 1098T Community Tax

Web person (including a financial institution, a governmental unit, and a cooperative housing corporation) who is engaged in a trade or business and, in the course of such trade or. From within your taxact return ( online or desktop), click federal. Web any deductible points not included on form 1098 (usually not included on the form when refinancing) should be.

Web The Form 1098 And Property Tax Statement Only Have My Name And Social Security Number.

Points paid only to borrow money are deductible over the life. Web to enter points not reported to you on form 1098 to determine if they are fully deductible in the current year or if you must deduct them over the life of the loan: On smaller devices, click in the upper. Web mortgage points are located in box 6 points paid on purchase of principal residence on the 1098 form.

How Do We Split These Payments Of Interest And Taxes On Schedule A So We Can Both.

Web to enter points not reported to you: Box 6 shows points you or the seller paid this year for the purchase of your principal residence that are required to be reported to you. Web if you cannot get a 1098 form from the issuer, your points paid are usually listed on your settlement statement. Web points not reported to you on form 1098 means they were not reported on form 1098.

Web Beyond The $725 Million Settlement, The Company Paid A Record $5 Billion Settlement To The Federal Trade Commission, Alongside A Further $100 Million To The.

For information about who must file to report points, see who must report points, later. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. You are not required to file form 1098. Not in the lending business.

Web Use Form 1098, Mortgage Interest Statement, To Report Mortgage Interest (Including Points, Defined Later) Of $600 Or More You Received During The Year In The Course Of Your Trade Or.

Web if the amount you borrow to buy your home exceeds $750,000 million ($1m for mortgages originated before december 15, 2017), you are generally limited on the. Web person (including a financial institution, a governmental unit, and a cooperative housing corporation) who is engaged in a trade or business and, in the course of such trade or. Web not all points are reportable to you. Web any deductible points not included on form 1098 (usually not included on the form when refinancing) should be entered on schedule a (form 1040), itemized.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png)