Printable 2290 Form

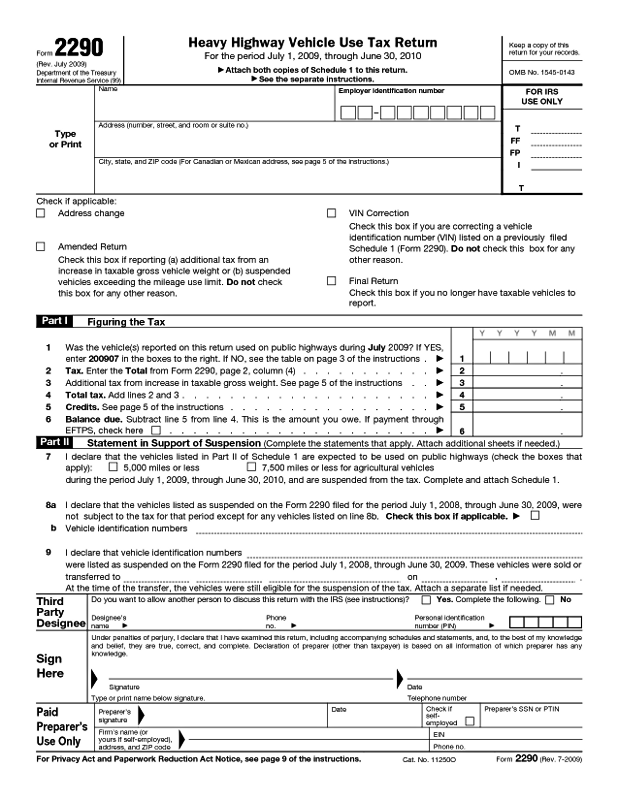

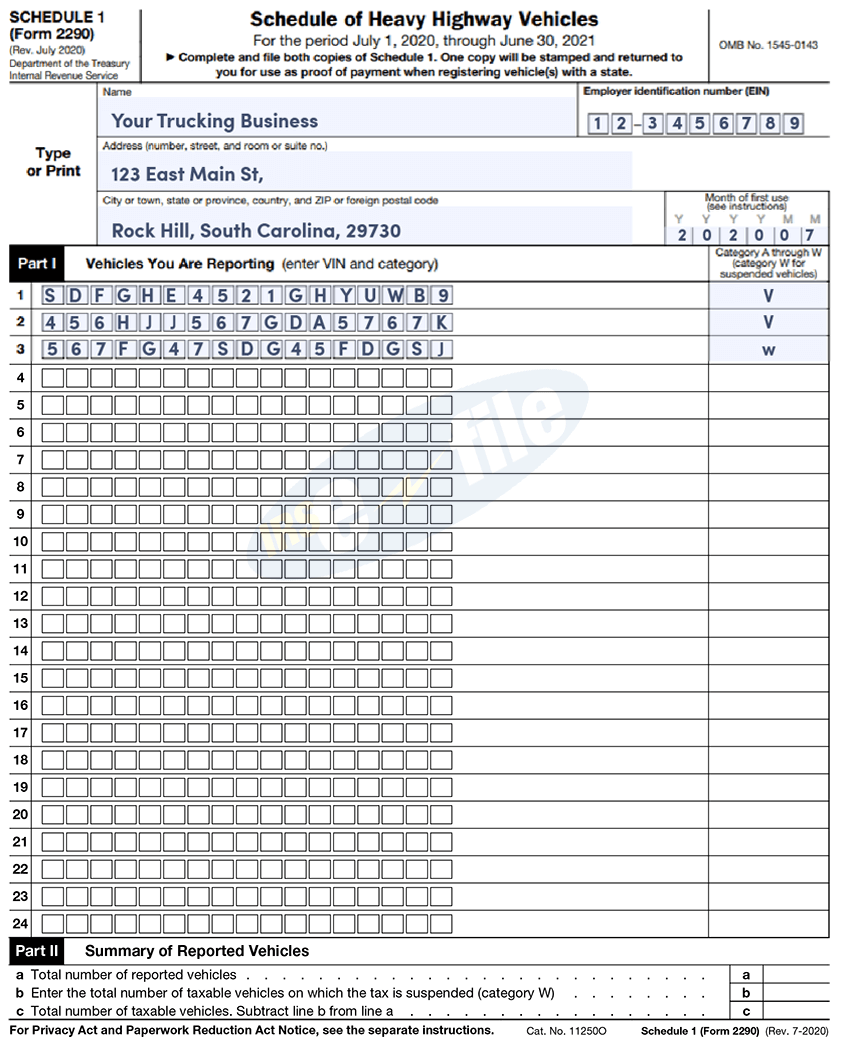

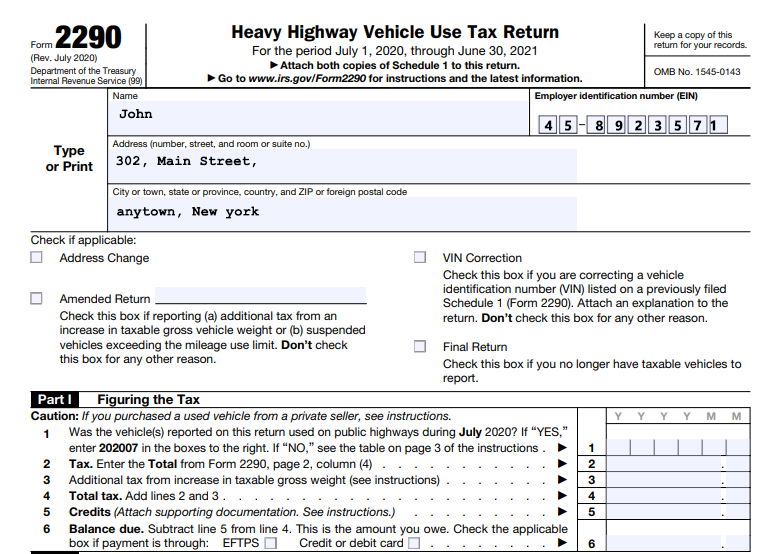

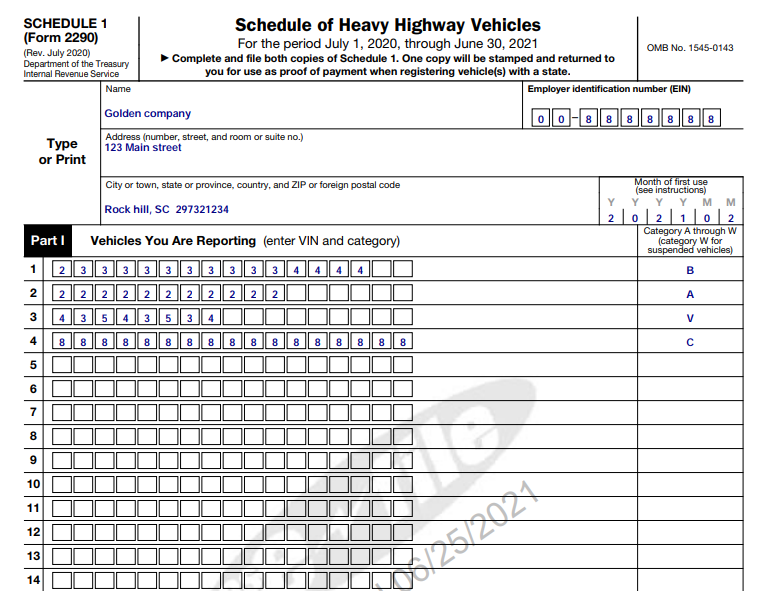

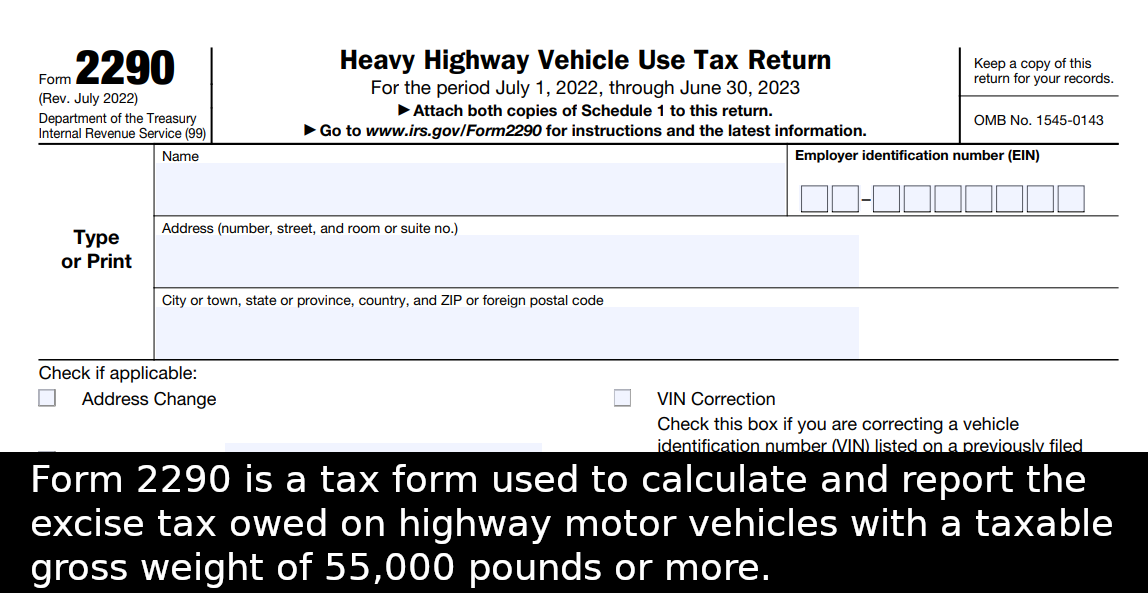

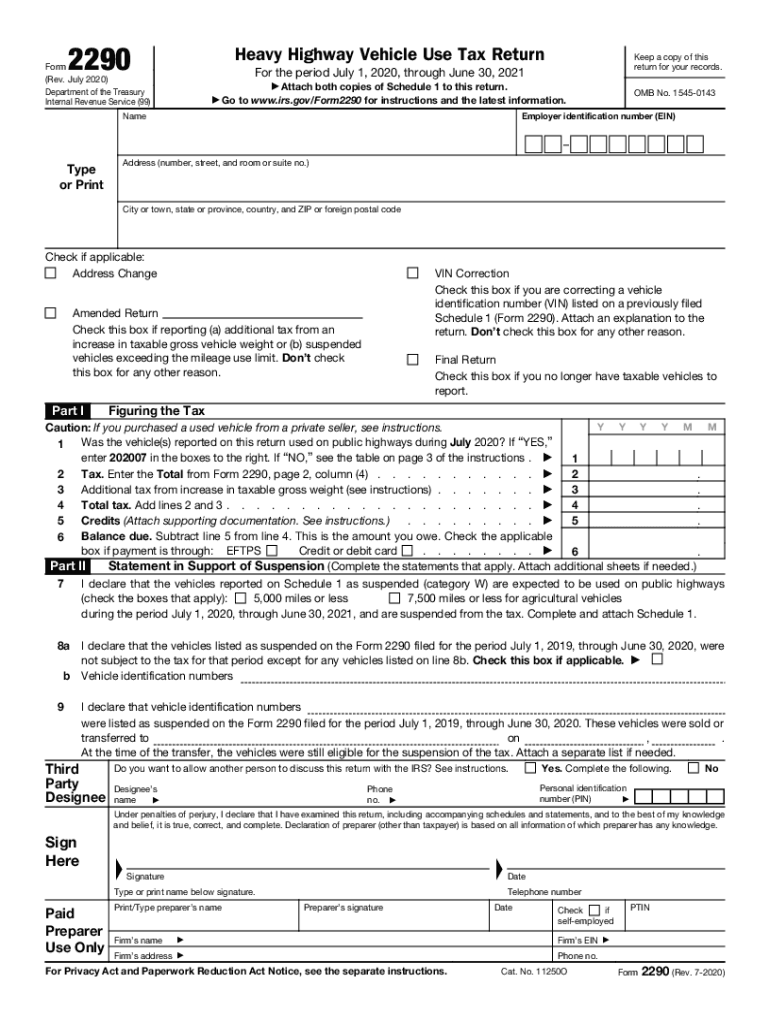

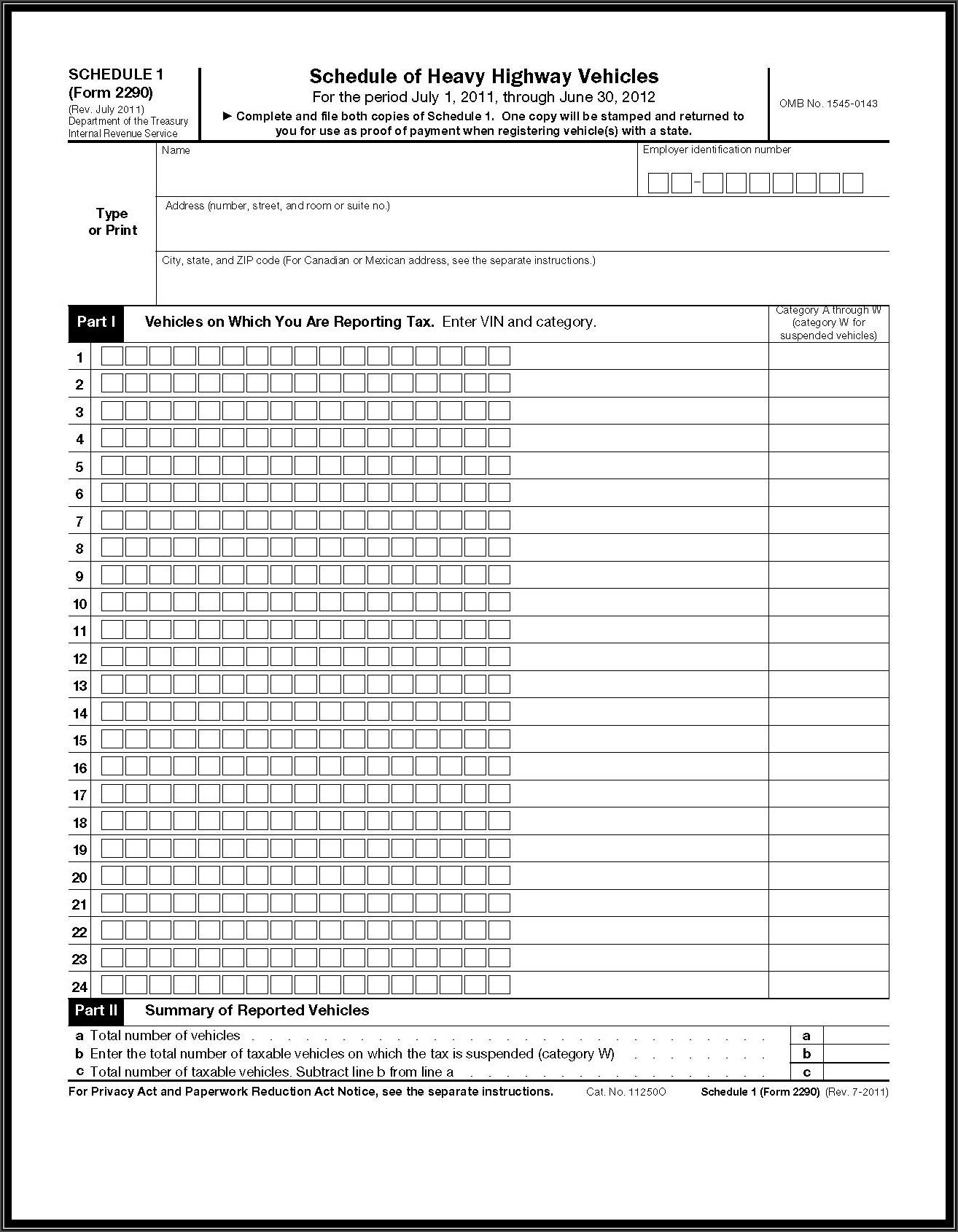

Printable 2290 Form - It is an excise tax that apply for the taxable gross weight of 55,000 pounds and over vehicles that operate on public highways. Fill out the form in our online filing application. Web download form 2290 for current and previous years. Web a trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more must complete and file form 2290 to figure out and pay hvut with the irs every tax year. Web irs form 2290 is used by truck drivers as part of their federal tax return. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is registered, or Web schedule 1 (form 2290) (rev. July 2020) departrnent of the treasury internal revenue service name schedule of heavy highway vehicles for the period july 1, 2020, through june 30, 2021 complete and file both copies of schedule 1. Web form 2290 is the irs form used for reporting and paying the heavy highway vehicle use tax (hvut) for vehicles with a gross weight of 55,000 pounds or more. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles.

Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable highway motor vehicle (defined later) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the tax period. It is an excise tax that apply for the taxable gross weight of 55,000 pounds and over vehicles that operate on public highways. This revision if you need to file a return for a tax period that began on or before june 30, 2019. Get schedule 1 in minutes. It is also known as a heavy highway vehicle use tax return. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable highway motor vehicle (defined below) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the. Actual and valid for filing 2023 taxes; Keep a copy of this return for your records. Web download form 2290 for current and previous years. Web you must file this form 2290 (rev.

Web download form 2290 for current and previous years. The purpose of the tax is to help fund the construction and maintenance of the nation's public highway system. Web a trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more must complete and file form 2290 to figure out and pay hvut with the irs every tax year. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is registered, or This will however be alleviated with this tax as the. July 2020) departrnent of the treasury internal revenue service name schedule of heavy highway vehicles for the period july 1, 2020, through june 30, 2021 complete and file both copies of schedule 1. Fill out the form in our online filing application. Web the easiest way to get a copy of your paid 2290 if you have misplaced the stamped schedule 1 that was sent via email, is to log into your account. Web simple & secure service for form 2290 online filing. Web tax form 2290 is used by applicants for the heavy vehicle use tax to report the paying of taxes along the road known as the internal revenue service form 2290.

Irs 2290 Form 2021 Printable Customize and Print

Web tax form 2290 is used by applicants for the heavy vehicle use tax to report the paying of taxes along the road known as the internal revenue service form 2290. Every year, millions of trucking companies file their 2290 forms. Web simple & secure service for form 2290 online filing. July 2019) department of the treasury internal revenue service.

2290 Form Printable

Web report used vehicles that you purchased and also claim credits for vehicles that were sold, destroyed, and stolen. The purpose of the tax is to help fund the construction and maintenance of the nation's public highway system. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file..

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

Get schedule 1 in minutes. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. The purpose of the tax is to help fund the construction and maintenance of the nation's.

File IRS 2290 Form Online for 20232024 Tax Period

This will however be alleviated with this tax as the. Filing online is simple, fast & secure. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable highway motor vehicle (defined below) is registered, or required to be registered, in your name under state,.

Irs Forms 2290 Printable For 2023 To 2024

The form, instructions, or publication you are looking for begins after this coversheet. Keep a copy of this return for your records. July 2019) for the tax period beginning on july 1, 2019, and ending on june 30, 2020. Go to www.irs.gov/form2290 for instructions and the latest information. Filing online is simple, fast & secure.

Irs 2290 Form 2021 Printable Customize and Print

This will however be alleviated with this tax as the. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable highway motor vehicle (defined later) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican.

Irs 2290 Form 2021 Printable Customize and Print

Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable highway motor vehicle (defined later) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the.

Form 2290 2023 Printable Forms Free Online

Web tax form 2290 is used by applicants for the heavy vehicle use tax to report the paying of taxes along the road known as the internal revenue service form 2290. Every year, millions of trucking companies file their 2290 forms. Actual and valid for filing 2023 taxes; Get schedule 1 in minutes. You must file form 2290 and schedule.

Irs Form 2290 Printable 2023 To 2024

Web irs form 2290 is used by truck drivers as part of their federal tax return. The form, instructions, or publication you are looking for begins after this coversheet. Get schedule 1 in minutes. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable.

Irs Form 2290 Printable 2023 To 2024

This will however be alleviated with this tax as the. Web the easiest way to get a copy of your paid 2290 if you have misplaced the stamped schedule 1 that was sent via email, is to log into your account. Web you must file this form 2290 (rev. Web tax form 2290 is used by applicants for the heavy.

Web Report Used Vehicles That You Purchased And Also Claim Credits For Vehicles That Were Sold, Destroyed, And Stolen.

This revision if you need to file a return for a tax period that began on or before june 30, 2019. Every year, millions of trucking companies file their 2290 forms. Web download form 2290 for current and previous years. July 2019) department of the treasury internal revenue service (99) heavy highway vehicle use tax return for the period july 1, 2019, through june 30, 2020 attach both copies of schedule 1 to this return.

Actual And Valid For Filing 2023 Taxes;

Web tax form 2290 is used by applicants for the heavy vehicle use tax to report the paying of taxes along the road known as the internal revenue service form 2290. Please review the information below. Web a trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more must complete and file form 2290 to figure out and pay hvut with the irs every tax year. July 2020) departrnent of the treasury internal revenue service name schedule of heavy highway vehicles for the period july 1, 2020, through june 30, 2021 complete and file both copies of schedule 1.

This July 2021 Revision Is For The Tax Period Beginning On July 1, 2021, And Ending On June 30, 2022.

Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is registered, or Web simple & secure service for form 2290 online filing. July 2019) for the tax period beginning on july 1, 2019, and ending on june 30, 2020. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles.

You Must File Form 2290 And Schedule 1 For The Tax Period Beginning On July 1, 2024, And Ending On June 30, 2025, If A Taxable Highway Motor Vehicle (Defined Below) Is Registered, Or Required To Be Registered, In Your Name Under State, District Of Columbia, Canadian, Or Mexican Law At The.

The purpose of the tax is to help fund the construction and maintenance of the nation's public highway system. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable highway motor vehicle (defined later) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the tax period. Fill out the form in our online filing application. Web irs form 2290 is used by truck drivers as part of their federal tax return.