Quickbooks Form 1120

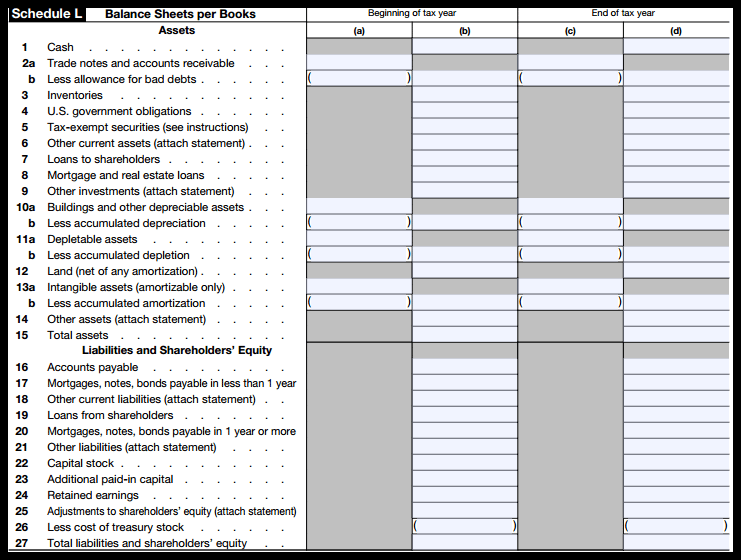

Quickbooks Form 1120 - Web form 1120s (u.s. Web electronic filing an extension for business returns (1120, 1120s, 1065, and 1041) solved • by intuit • 181 • updated november 18, 2022 form 7004 is the. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! When you first start a return in turbotax business, you'll be asked. According to the irs provision for section 199a, for eligible taxpayers with total taxable income in. Track everything in one place. Web income tax form used in quickbooks desktop i imported quickbooks desktop files for my 1120s business taxes in intuit turbotax business. Web pay and file payroll taxes and forms in online payroll. Web this article will provide tips and common areas to review when the schedule l balance sheet is out of balance, for form 1065, 1120s, 1120, or 990 part x. Income tax return for an s corporation) is available in turbotax business.

Use this form to report the. Web filing forms 941 and 1120es are available in quickbooks online and desktop. Department of the treasury internal revenue service. Web electronic filing an extension for business returns (1120, 1120s, 1065, and 1041) solved • by intuit • 181 • updated november 18, 2022 form 7004 is the. According to the irs provision for section 199a, for eligible taxpayers with total taxable income in. When total receipts from page 1 on form. Track everything in one place. If accrue federal tax isn't selected, the program won't calculate this line, and you will need. Web entering accrued taxes for form 1120 / 1120s corporations in proconnect solved•by intuit•3•updated february 22, 2023 down below we will go over what. Web income tax form used in quickbooks desktop i imported quickbooks desktop files for my 1120s business taxes in intuit turbotax business.

Use this form to report the. Ad manage all your business expenses in one place with quickbooks®. According to the irs provision for section 199a, for eligible taxpayers with total taxable income in. Web entering accrued taxes for form 1120 / 1120s corporations in proconnect solved•by intuit•3•updated february 22, 2023 down below we will go over what. Learn how to pay or file state and federal payroll taxes online. Solved • by quickbooks • 605 • updated 3 weeks ago. Web this article will provide tips and common areas to review when the schedule l balance sheet is out of balance, for form 1065, 1120s, 1120, or 990 part x. Web information about form 1120, u.s. Web this article will assist you with entering officer information and compensation in the corporate module of intuit proconnect. Web pay and file payroll taxes and forms in online payroll.

QuickBooks form 941 error Fix with Following Guide by sarahwatsonsus

According to the irs provision for section 199a, for eligible taxpayers with total taxable income in. Track everything in one place. Per the form 1120s instructions, tax exempt. If accrue federal tax isn't selected, the program won't calculate this line, and you will need. That being said, you can manually file them outside quickbooks self.

9 Form Quickbooks Seven Common Mistakes Everyone Makes In 9 Form

Web filing forms 941 and 1120es are available in quickbooks online and desktop. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. If accrue federal tax isn't selected, the program won't calculate this line, and you will need. Web income tax.

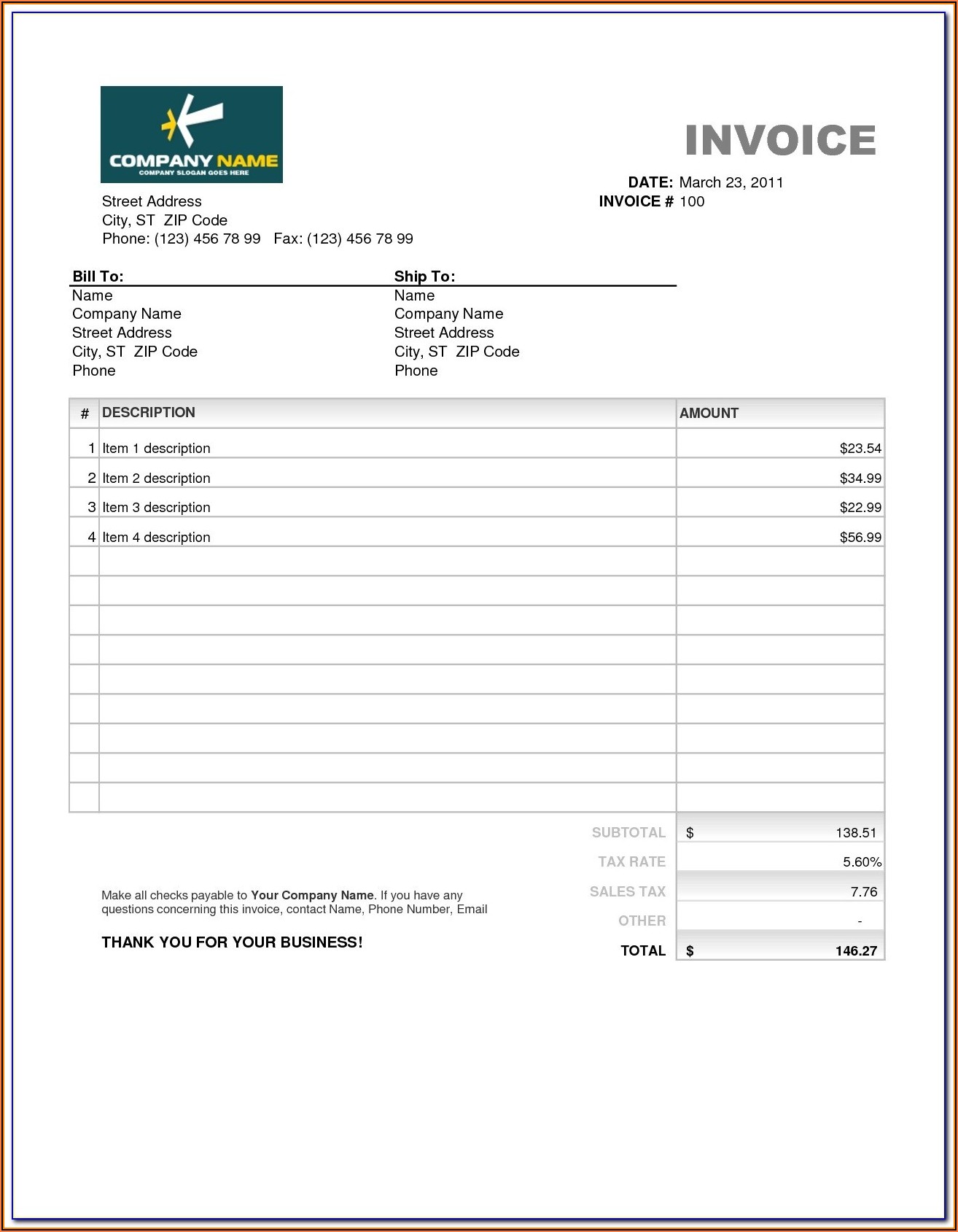

Quickbooks Invoice Forms Form Resume Examples qeYzOnMV8X

Web pay and file payroll taxes and forms in online payroll. When you use a schedule c with form 1040, or file form 1120 for a corporation, you usually need to file your return by the april 15 deadline. When total receipts from page 1 on form. Income tax return for an s corporation form 966, corporate dissolution or liquidation.

Customize QuickBooks' Forms Williams CPA & Associates

When total receipts from page 1 on form. If accrue federal tax isn't selected, the program won't calculate this line, and you will need. Ad manage all your business expenses in one place with quickbooks®. Explore the #1 accounting software for small businesses. Web filing forms 941 and 1120es are available in quickbooks online and desktop.

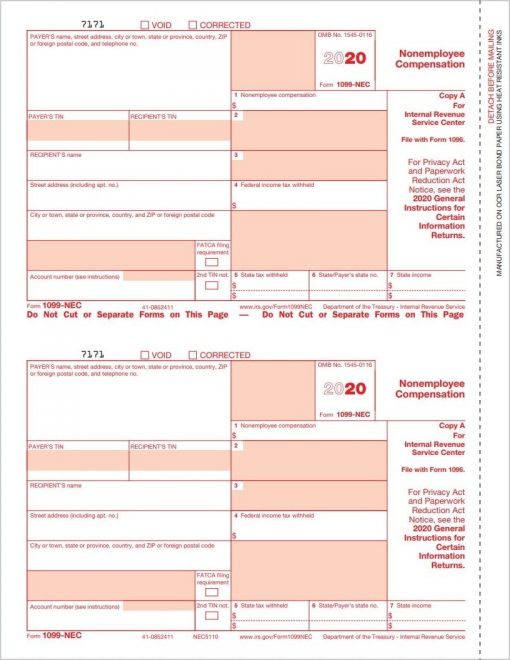

QuickBooks 1099NEC Form Copy A Federal Discount Tax Forms

For calendar year 2022 or tax year beginning, 2022, ending. Corporation income tax return, including recent updates, related forms and instructions on how to file. That being said, you can manually file them outside quickbooks self. Explore the #1 accounting software for small businesses. Web information about form 1120, u.s.

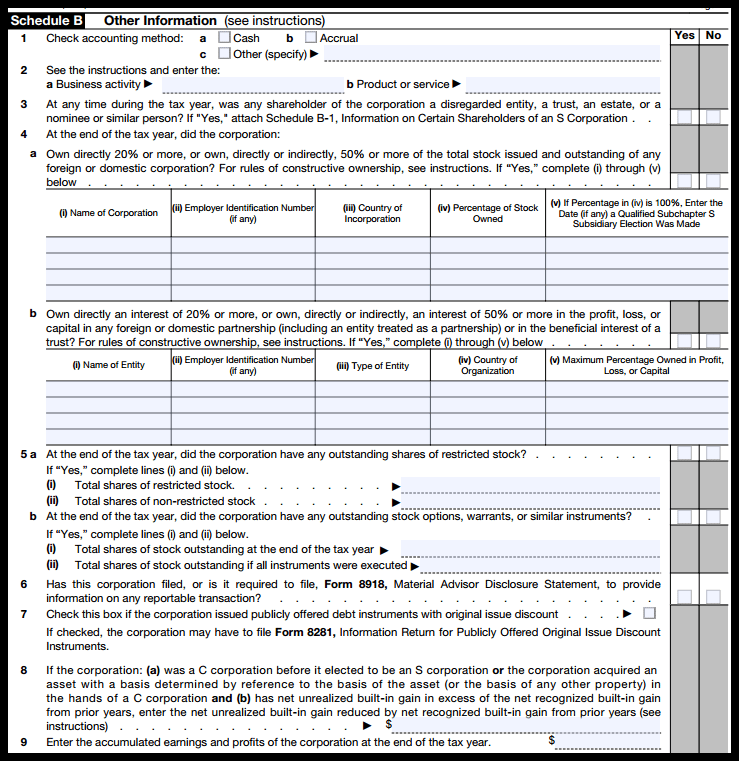

IRS Form 1120S Definition, Download, & 1120S Instructions

Per the form 1120s instructions, tax exempt. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! The easy to use software your business needs to invoice + get paid faster. According to the irs provision for section 199a, for eligible taxpayers with total taxable income in. When total receipts from page 1 on form.

QuickBooks Online Customize Invoices BlackRock

Explore the #1 accounting software for small businesses. If accrue federal tax isn't selected, the program won't calculate this line, and you will need. Income tax return for an s corporation) is available in turbotax business. Web filing forms 941 and 1120es are available in quickbooks online and desktop. Track everything in one place.

The QuickReport in QuickBooks See the History of a Customer, Item or

When you first start a return in turbotax business, you'll be asked. Use this form to report the. That being said, you can manually file them outside quickbooks self. Web the program will calculate an ending, prepaid federal tax balance of $100. Ad manage all your business expenses in one place with quickbooks®.

QuickBooks TipHow To Add a Logo and Customize Your Forms QuickBooks

Explore the #1 accounting software for small businesses. Track everything in one place. Web this article will provide tips and common areas to review when the schedule l balance sheet is out of balance, for form 1065, 1120s, 1120, or 990 part x. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Explore the #1.

If Accrue Federal Tax Isn't Selected, The Program Won't Calculate This Line, And You Will Need.

The easy to use software your business needs to invoice + get paid faster. Use this form to report the. Web information about form 1120, u.s. For calendar year 2022 or tax year beginning, 2022, ending.

Per The Form 1120S Instructions, Tax Exempt.

Explore the #1 accounting software for small businesses. Web income tax form used in quickbooks desktop i imported quickbooks desktop files for my 1120s business taxes in intuit turbotax business. Ad you don’t need an accounting degree to keep your books organized. Learn how to pay or file state and federal payroll taxes online.

When Total Receipts From Page 1 On Form.

Track everything in one place. Ad manage all your business expenses in one place with quickbooks®. Explore the #1 accounting software for small businesses. Web this article will provide tips and common areas to review when the schedule l balance sheet is out of balance, for form 1065, 1120s, 1120, or 990 part x.

Income Tax Return For An S Corporation Form 966, Corporate Dissolution Or Liquidation Form 2220, Underpayment Of Estimated Tax Form 2553,.

According to the irs provision for section 199a, for eligible taxpayers with total taxable income in. Corporation income tax return, including recent updates, related forms and instructions on how to file. Track everything in one place. Web electronic filing an extension for business returns (1120, 1120s, 1065, and 1041) solved • by intuit • 181 • updated november 18, 2022 form 7004 is the.