Ri Tax Form 1040

Ri Tax Form 1040 - Web information about form 1040, u.s. Audit forms business tax forms bank deposits, bank excise, insurance, public service forms corporate tax forms employer tax forms healthcare provider forms Increased federal agi amounts for the social security & the pension and annuity modifications Web to have forms mailed to you, please call 401.574.8970 or email tax.forms@tax.ri.gov click on the appropriate category below to access the forms and instructions you need: Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in rhode island. You can however only prepare a ri state return on efile.com but you would have to mail it to the state from your account; Details on how to only. The amount of your expected refund, rounded to the nearest dollar. Web rhode island income tax forms. We last updated the resident tax return in february 2023, so this is the latest version of form 1040, fully updated for tax year 2022.

Irs use only—do not write or staple in this space. 03 fill out the forms: These where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in rhode island during calendar year 2023. Those under 65 who are not disabled do not qualify for the credit. We last updated the resident tax return in february 2023, so this is the latest version of form 1040, fully updated for tax year 2022. Web rhode island tax forms. Details on how to only. These 2021 forms and more are available: The amount of your expected refund, rounded to the nearest dollar. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding.

It is the basis for preparing your rhode island income tax return. Web ri 1040 h only expected refund: Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability. Form 1040 is used by citizens or residents of the united states to file an annual income tax return. We last updated the resident tax return in february 2023, so this is the latest version of form 1040, fully updated for tax year 2022. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in rhode island. These where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in rhode island during calendar year 2023. For tax year 2021, the property tax relief credit amount increases to $415 from $400. Audit forms business tax forms bank deposits, bank excise, insurance, public service forms corporate tax forms employer tax forms healthcare provider forms Estimated tax payments must be sent to the rhode island department of.

customdesignsbybeth Massachusetts Amended Tax Return Instructions

Individual income tax return, including recent updates, related forms and instructions on how to file. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does.

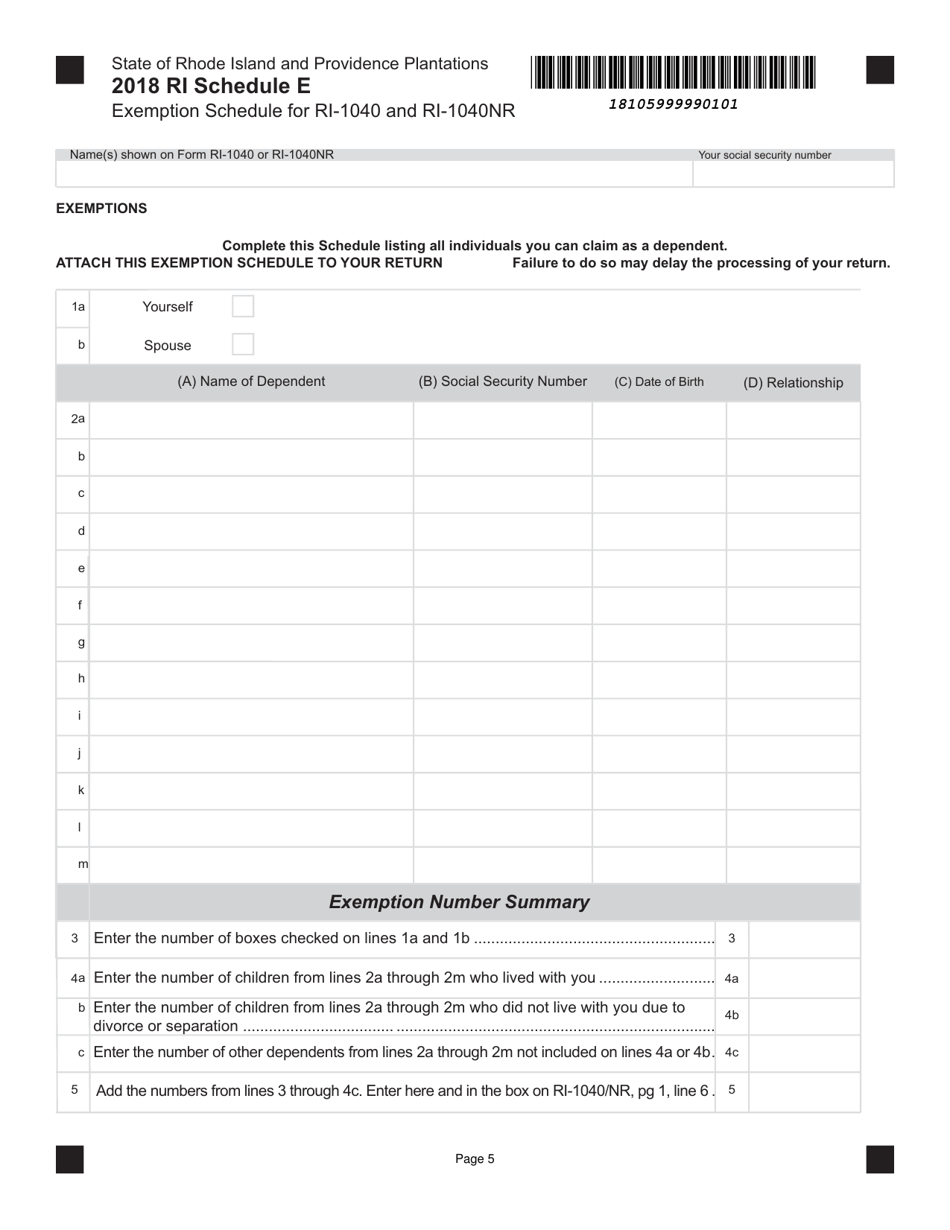

Schedule E Download Fillable PDF or Fill Online Exemption Schedule for

Irs use only—do not write or staple in this space. Individual income tax return, including recent updates, related forms and instructions on how to file. Form 1040 is used by citizens or residents of the united states to file an annual income tax return. Web to have forms mailed to you, please call 401.574.8970 or email tax.forms@tax.ri.gov click on the.

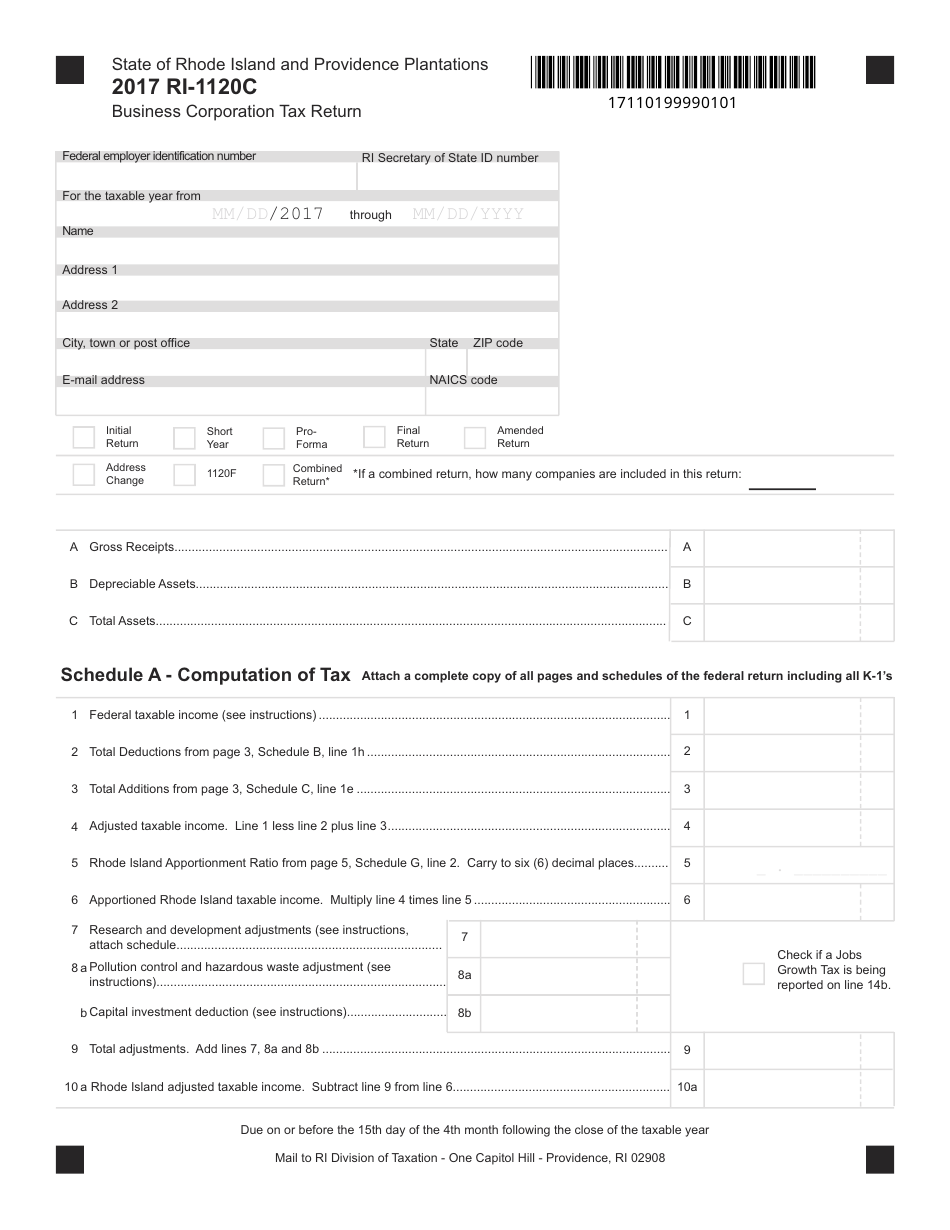

Form RI1120C Download Fillable PDF or Fill Online Business Corporation

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability. Those under 65 who are not disabled do not.

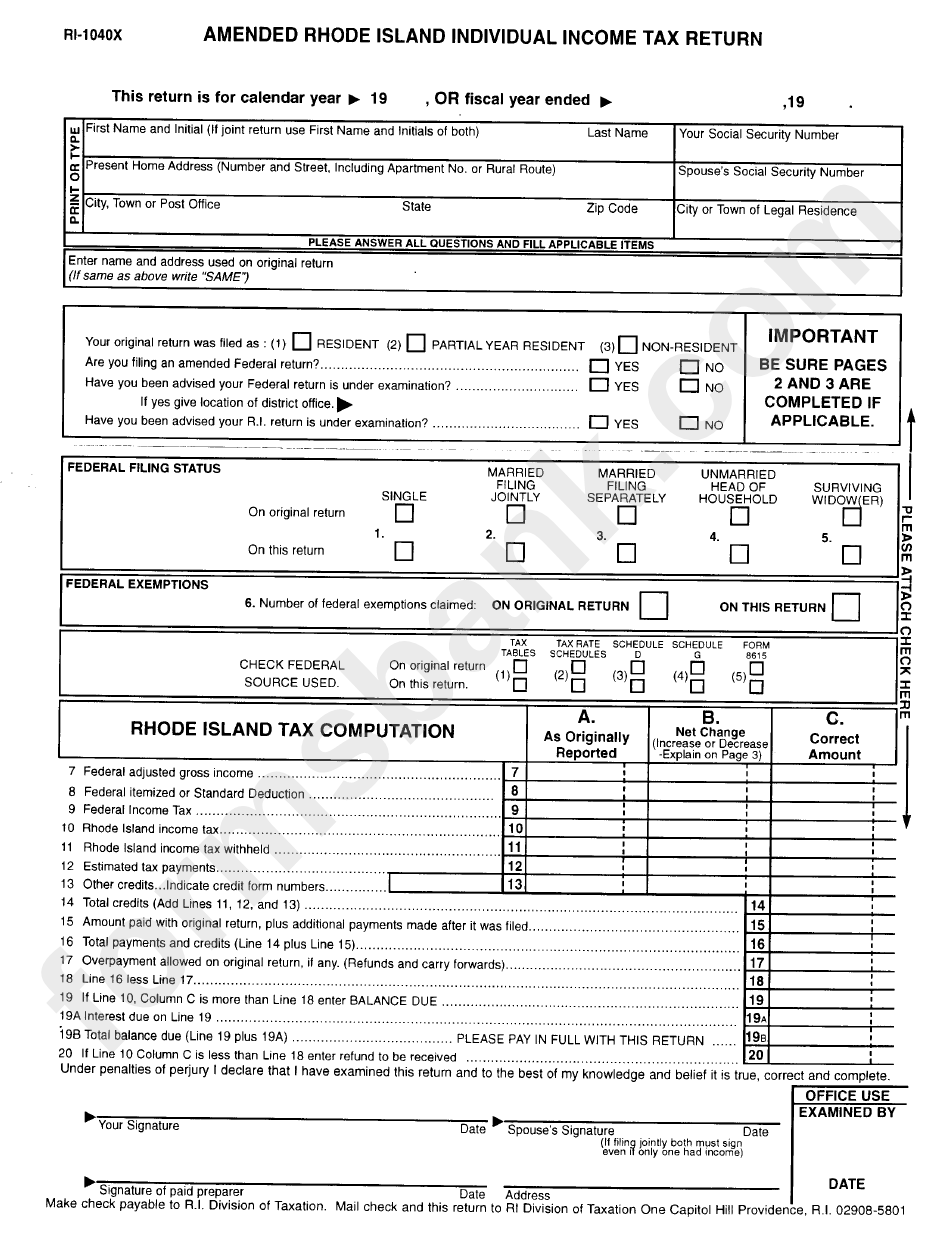

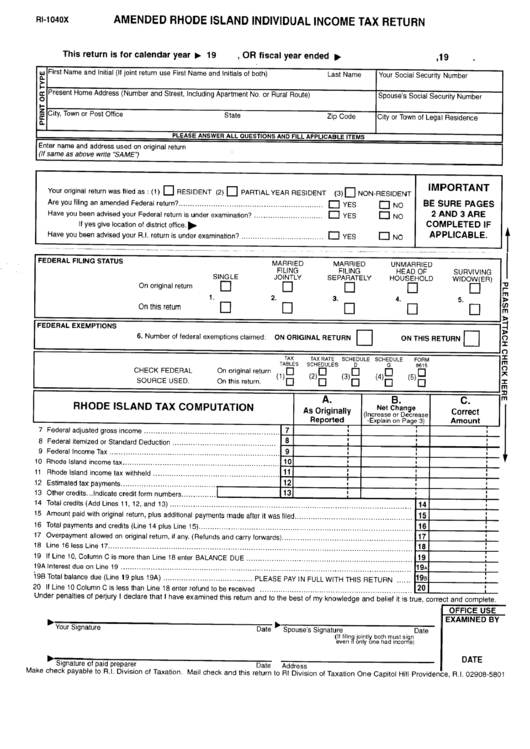

Fillable Form Ri1040x Amended Rhode Island Individual Tax

This form is for income earned in. Web ri 1040 h only expected refund: Web if you are a legal resident of rhode island that lives in a household or rents property that is subject to tax in the state and are up to date on all tax payments or rent on the property, and your household income is $30,000.

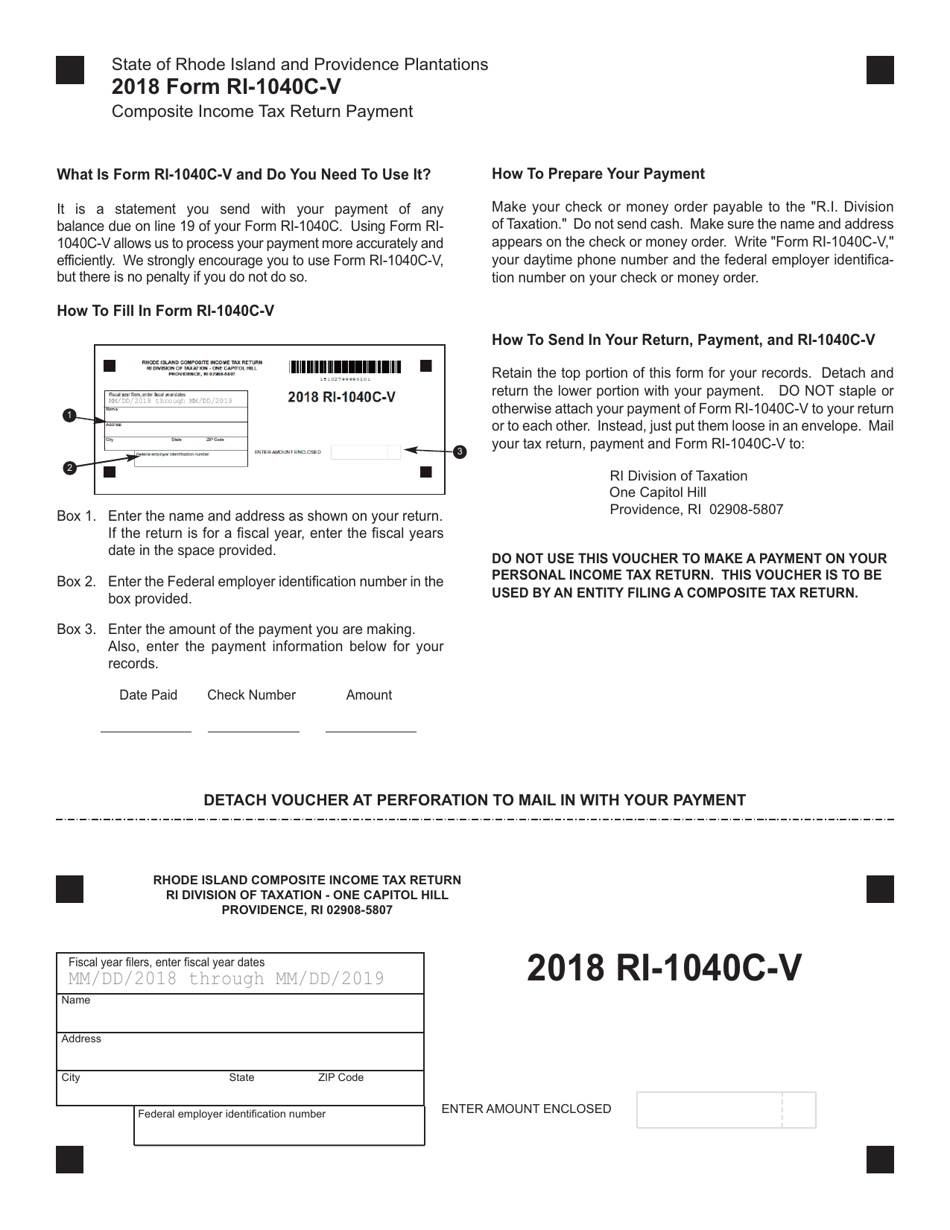

Form RI1040CV Download Printable PDF or Fill Online Composite

Individual income tax return, including recent updates, related forms and instructions on how to file. You can however only prepare a ri state return on efile.com but you would have to mail it to the state from your account; For tax year 2021, the property tax relief credit amount increases to $415 from $400. We last updated the amended rhode.

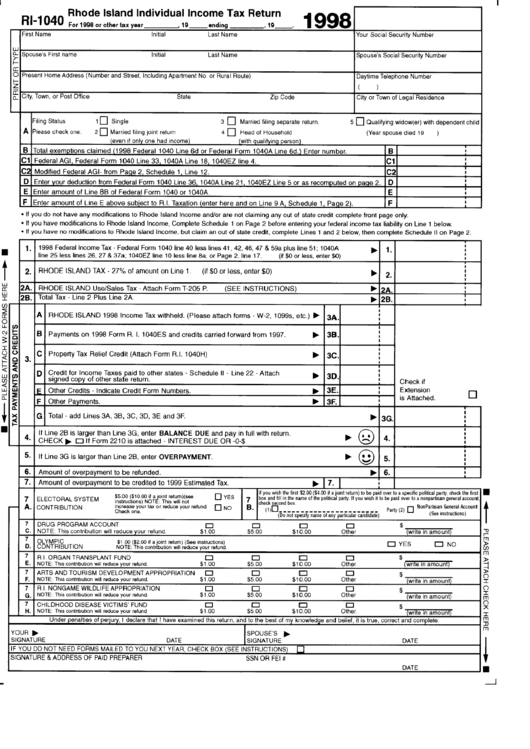

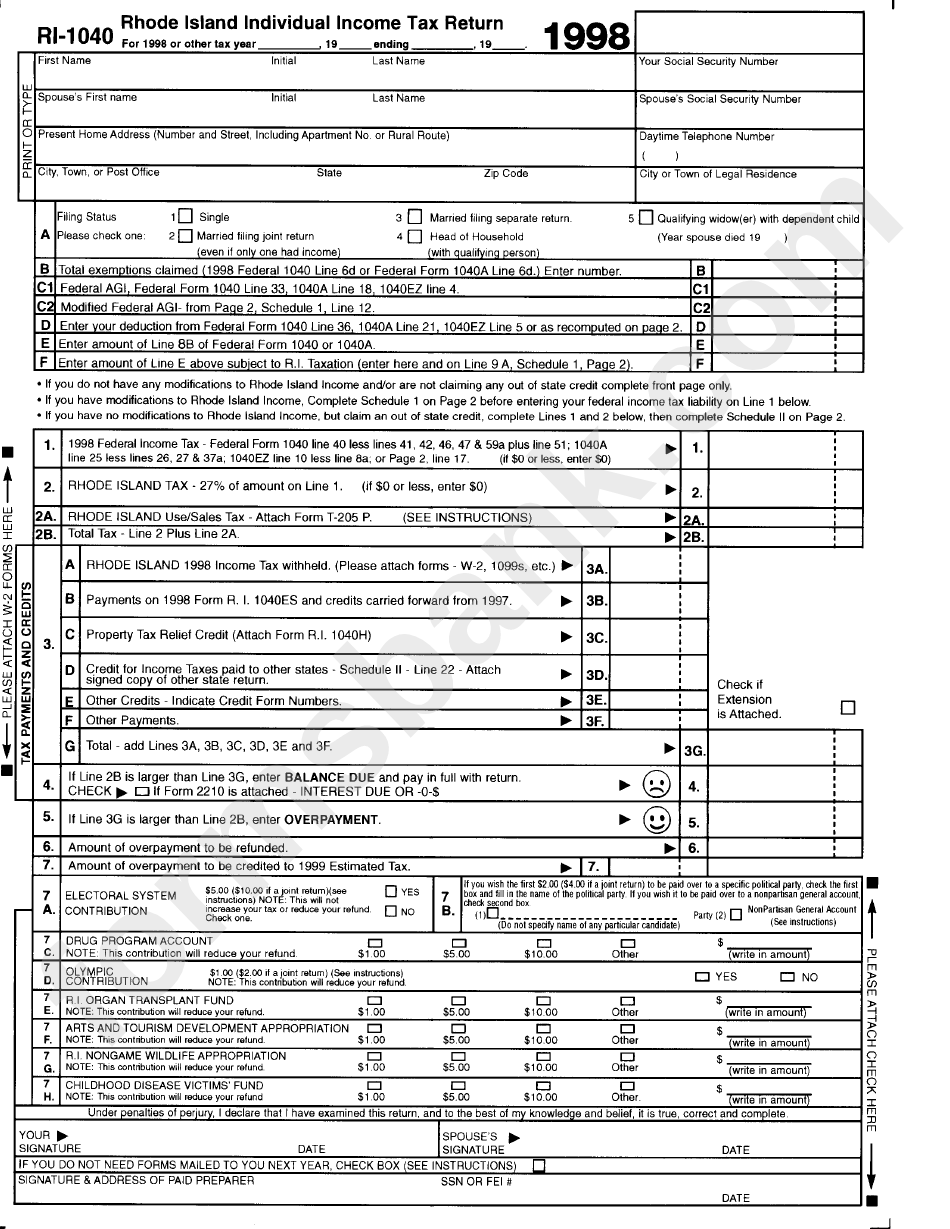

Fillable Form Ri1040 Rhode Island Individual Tax Return

For example, if your expected refund is between $151.50 and $151.99 enter $152. Increased federal agi amounts for the social security & the pension and annuity modifications Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax refund.

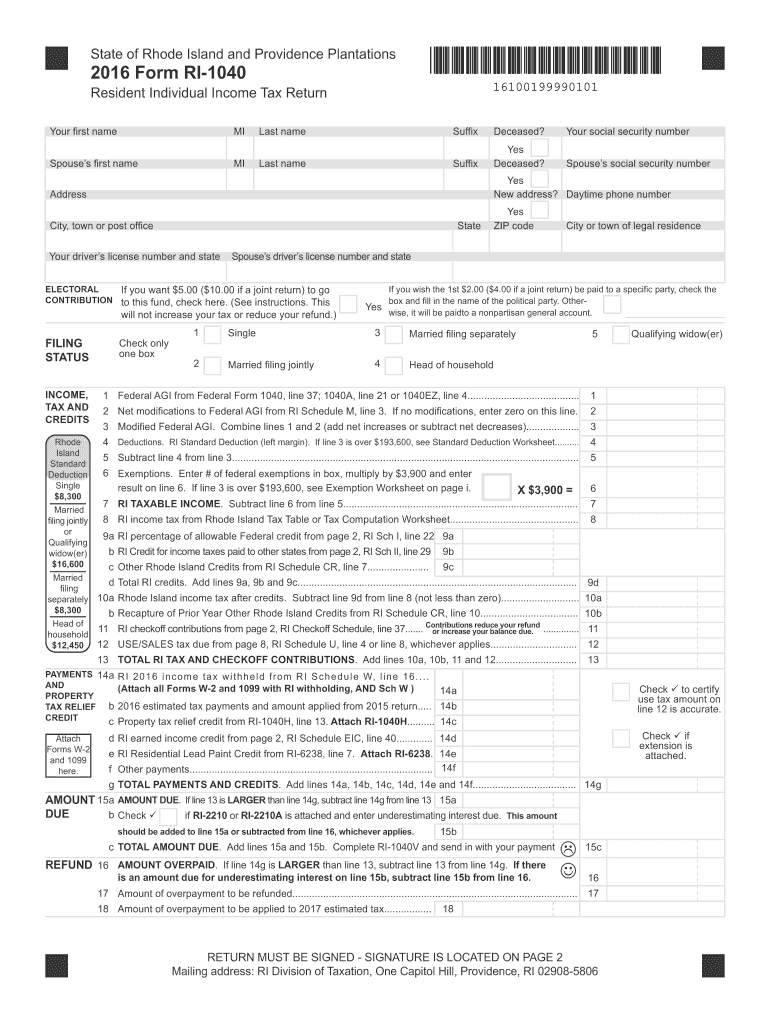

RI DoT RI1040 2016 Fill out Tax Template Online US Legal Forms

Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in rhode island. 03 fill out the forms: Individual income tax return, including recent updates, related forms and instructions on how to file. It is the basis for preparing your rhode island income tax return. The amount of your expected refund, rounded.

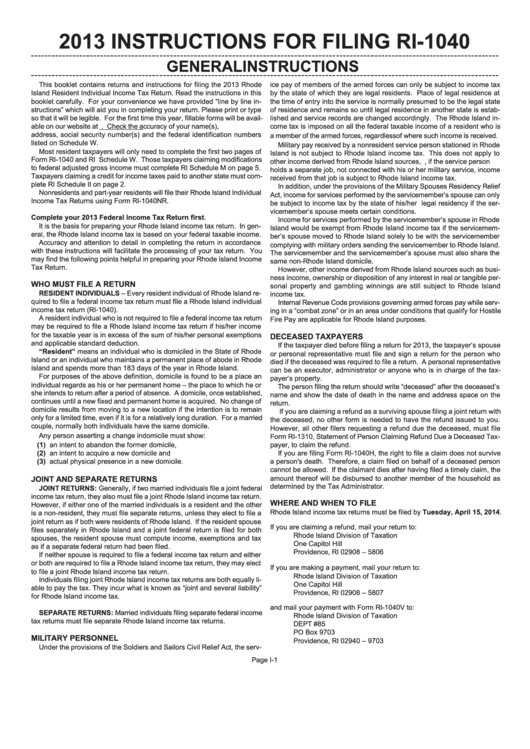

Form Ri1040 Rhode Island Tax Computation Worksheet 2013 printable

The amount of your expected refund, rounded to the nearest dollar. Irs use only—do not write or staple in this space. Audit forms business tax forms bank deposits, bank excise, insurance, public service forms corporate tax forms employer tax forms healthcare provider forms Web ri 1040 h only expected refund: Complete your 2021 federal income tax return first.

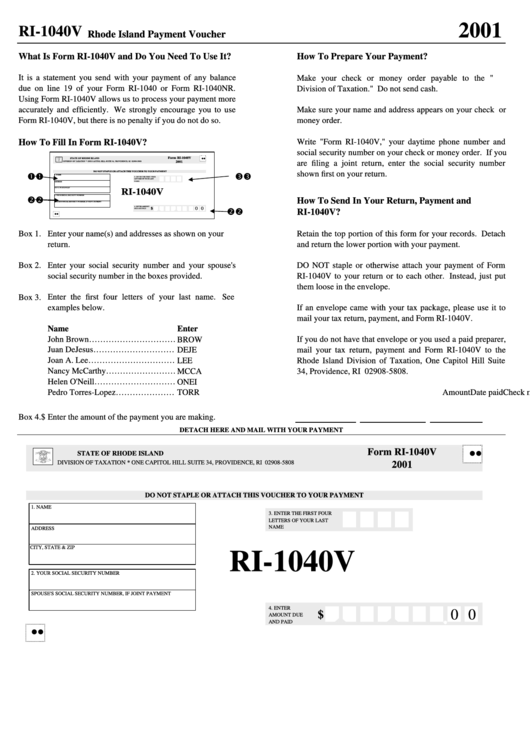

Form Ri1040v Rhode Island Payment Voucher printable pdf download

Estimated tax payments must be sent to the rhode island department of. For tax year 2021, the property tax relief credit amount increases to $415 from $400. 03 fill out the forms: Web information about form 1040, u.s. Department of the treasury—internal revenue service.

Fillable Form Ri1040 Rhode Island Individual Tax Return

Web ri 1040 h only expected refund: Increased federal agi amounts for the social security & the pension and annuity modifications Department of the treasury—internal revenue service. Information last updated july 27, 2023 Individual income tax return, including recent updates, related forms and instructions on how to file.

Web To Have Forms Mailed To You, Please Call 401.574.8970 Or Email Tax.forms@Tax.ri.gov Click On The Appropriate Category Below To Access The Forms And Instructions You Need:

Web rhode island tax forms. These 2021 forms and more are available: Web information about form 1040, u.s. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability.

You Can However Only Prepare A Ri State Return On Efile.com But You Would Have To Mail It To The State From Your Account;

Details on how to only. The amount of your expected refund, rounded to the nearest dollar. Irs use only—do not write or staple in this space. You will have to fill out the forms with the information from your financial documents.

We Last Updated The Amended Rhode Island Resident Return (Discontinued) In April 2021, And The Latest Form We.

Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in rhode island. Form 1040 is used by citizens or residents of the united states to file an annual income tax return. Web form 1040h is a rhode island individual income tax form. Increased federal agi amounts for the social security & the pension and annuity modifications

Some Common Tax Credits Apply To Many Taxpayers, While Others Only Apply To Extremely Specific Situations.

Web ri 1040 h only expected refund: 03 fill out the forms: It is the basis for preparing your rhode island income tax return. Information last updated july 27, 2023