Robinhood Form 8949

Robinhood Form 8949 - Web robinhood crypto and form 8949 box b or c? Web use form 8949 to report sales and exchanges of capital assets. Web you'll report crypto gains and losses using form 8949 & schedule d, and additional income from crypto in schedule 1 or schedule c depending on your employment status. Web use form 8949 to report sales and exchanges of capital assets. Turbotax only lets you import the csv file. Whether you received a robinhood tax form or a tax form from another. If you summarize category a or category d, form 8949 is not needed for transactions without adjustments. Web enter your first and last name as they appear on your government id. Web robinhood crypto clients www.robinhood.com at form8949.com, we help you minimize the time and expense of complying with the tax reporting requirements related to your stock. Web you'll use this form to report capital gains and losses on schedule d and form 8949.

Web robinhood securities llc clients www.robinhood.com at form8949.com, we help you minimize the time and expense of complying with the tax reporting requirements related. Web enter your first and last name as they appear on your government id. Web use form 8949 to report sales and exchanges of capital assets. Web information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms and instructions on how to file. Form 8949 is for the sales and dispositions of capital assets,. Robinhood 24 hour market is the only place* you can trade tsla, amzn, aapl and more of your favorite stocks and etfs 24 hours a. Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the. Web you'll report crypto gains and losses using form 8949 & schedule d, and additional income from crypto in schedule 1 or schedule c depending on your employment status. Web robinhood crypto clients www.robinhood.com at form8949.com, we help you minimize the time and expense of complying with the tax reporting requirements related to your stock. If you don't have a.

Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the. Web you'll report crypto gains and losses using form 8949 & schedule d, and additional income from crypto in schedule 1 or schedule c depending on your employment status. Your first 30 days are free, then it’s just $5 a month. Web use form 8949 to report sales and exchanges of capital assets. If you don't have a. Web you'll use this form to report capital gains and losses on schedule d and form 8949. Form 8949 is for the sales and dispositions of capital assets,. Web form 8949 helps you report realized capital gains and losses, ensuring that your taxable gains are recorded correctly and that you’re not taxed more than you should. Web robinhood securities llc clients www.robinhood.com at form8949.com, we help you minimize the time and expense of complying with the tax reporting requirements related. Web capital gains and losses can be reported on form 8949 from the irs, and capital gains and deductible capital losses can be reconciled on form 1040, schedule d.

How To Find Your 1099 Form On Robinhood YouTube

Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the. Form 8949 is for the sales and dispositions of capital assets,. Web form 8949 helps you report realized capital gains and losses, ensuring that your taxable gains are recorded correctly and that you’re not taxed more.

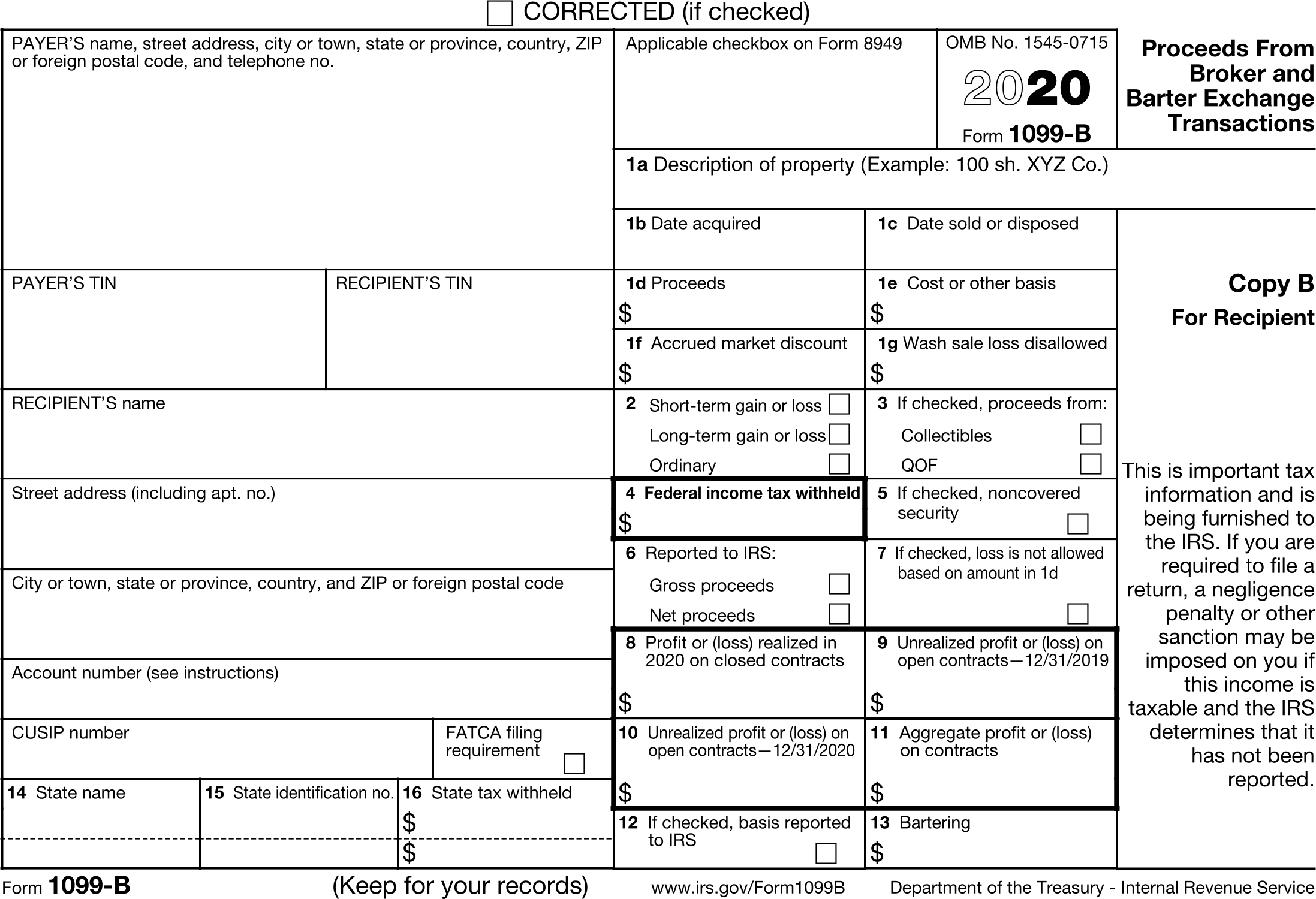

IRS Form 8949 instructions.

Web use form 8949 to report sales and exchanges of capital assets. Web robinhood crypto clients www.robinhood.com at form8949.com, we help you minimize the time and expense of complying with the tax reporting requirements related to your stock. Web robinhood crypto and form 8949 box b or c? If you summarize category a or category d, form 8949 is not.

Coinbase 8949

Whether you received a robinhood tax form or a tax form from another. Web information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms and instructions on how to file. Web enter your first and last name as they appear on your government id. Web use form 8949 to report sales and exchanges of.

Robinhood Tax Loss on Form 8949 YouTube

If you don't have a. Web form 8949 helps you report realized capital gains and losses, ensuring that your taxable gains are recorded correctly and that you’re not taxed more than you should. Your first 30 days are free, then it’s just $5 a month. Web you'll use this form to report capital gains and losses on schedule d and.

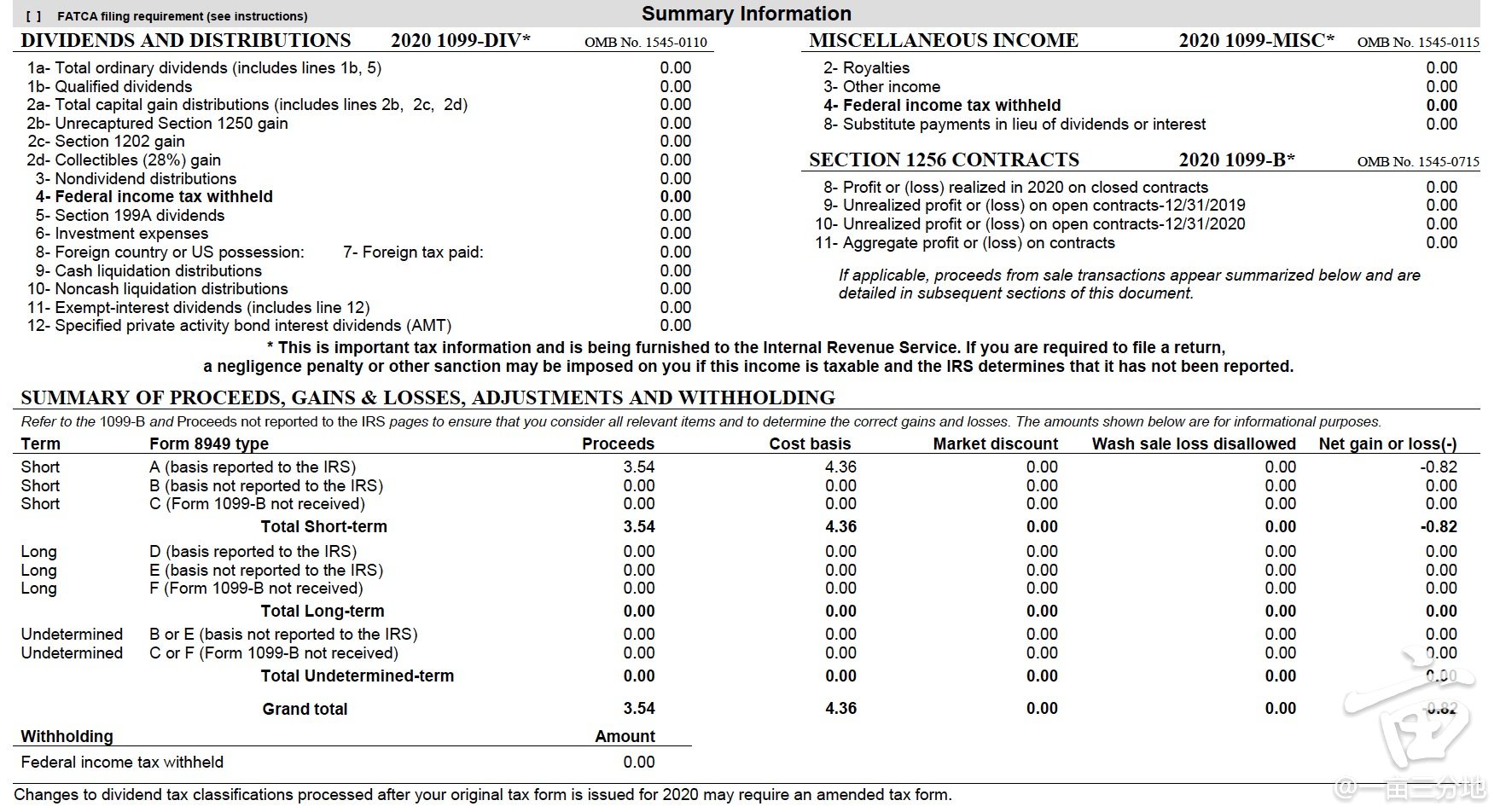

Watch those 1099Bs!!

Robinhood 24 hour market is the only place* you can trade tsla, amzn, aapl and more of your favorite stocks and etfs 24 hours a. Web information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms and instructions on how to file. Web form 8949 helps you report realized capital gains and losses, ensuring.

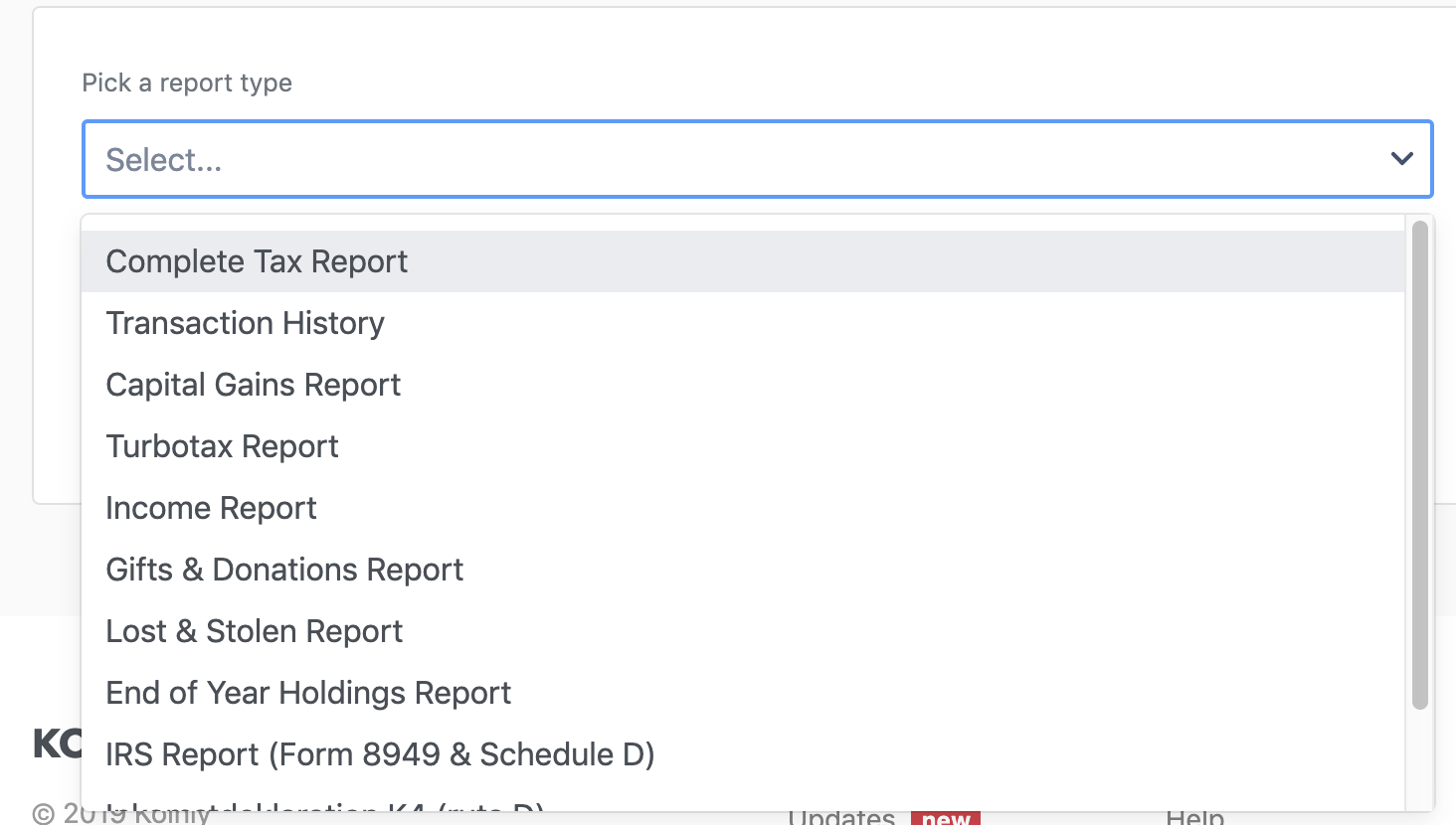

Review Koinly Crypto Tax and Portfolio Tracker

Web you'll report crypto gains and losses using form 8949 & schedule d, and additional income from crypto in schedule 1 or schedule c depending on your employment status. Web robinhood securities llc clients www.robinhood.com at form8949.com, we help you minimize the time and expense of complying with the tax reporting requirements related. Robinhood 24 hour market is the only.

IRS Form 1099B.

Web hop on market movements, day or night. Robinhood 24 hour market is the only place* you can trade tsla, amzn, aapl and more of your favorite stocks and etfs 24 hours a. Web enter your first and last name as they appear on your government id. Web you'll report crypto gains and losses using form 8949 & schedule d,.

How to Report Cryptocurrency On Your Taxes in 5 Steps CoinLedger

Web capital gains and losses can be reported on form 8949 from the irs, and capital gains and deductible capital losses can be reconciled on form 1040, schedule d. Robinhood 24 hour market is the only place* you can trade tsla, amzn, aapl and more of your favorite stocks and etfs 24 hours a. Web use form 8949 to report.

How to read your 1099 Robinhood

Form 8949 is for the sales and dispositions of capital assets,. Whether you received a robinhood tax form or a tax form from another. Web robinhood crypto clients www.robinhood.com at form8949.com, we help you minimize the time and expense of complying with the tax reporting requirements related to your stock. Web use form 8949 to report sales and exchanges of.

Robinhood Tax Form 股票 报税问é¢⃜ 一亩三分地instant / Which

Web use form 8949 to report sales and exchanges of capital assets. Form 8949 is for the sales and dispositions of capital assets,. Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the. Web capital gains and losses can be reported on form 8949 from the.

Web Enter Your First And Last Name As They Appear On Your Government Id.

Web you'll report crypto gains and losses using form 8949 & schedule d, and additional income from crypto in schedule 1 or schedule c depending on your employment status. Web robinhood securities llc clients www.robinhood.com at form8949.com, we help you minimize the time and expense of complying with the tax reporting requirements related. Whether you received a robinhood tax form or a tax form from another. If you summarize category a or category d, form 8949 is not needed for transactions without adjustments.

Web Form 8949 Department Of The Treasury Internal Revenue Service Sales And Other Dispositions Of Capital Assets Go To Www.irs.gov/Form8949 For Instructions And The.

Form 8949 is for the sales and dispositions of capital assets,. If you don't have a. Web capital gains and losses can be reported on form 8949 from the irs, and capital gains and deductible capital losses can be reconciled on form 1040, schedule d. Web robinhood crypto clients www.robinhood.com at form8949.com, we help you minimize the time and expense of complying with the tax reporting requirements related to your stock.

Web Information About Form 8949, Sales And Other Dispositions Of Capital Assets, Including Recent Updates, Related Forms And Instructions On How To File.

Turbotax only lets you import the csv file. Robinhood 24 hour market is the only place* you can trade tsla, amzn, aapl and more of your favorite stocks and etfs 24 hours a. Web use form 8949 to report sales and exchanges of capital assets. Your first 30 days are free, then it’s just $5 a month.

Web Use Form 8949 To Report Sales And Exchanges Of Capital Assets.

Web robinhood crypto and form 8949 box b or c? Web hop on market movements, day or night. Web form 8949 helps you report realized capital gains and losses, ensuring that your taxable gains are recorded correctly and that you’re not taxed more than you should. Web you'll use this form to report capital gains and losses on schedule d and form 8949.