Roth Ira Conversion Form

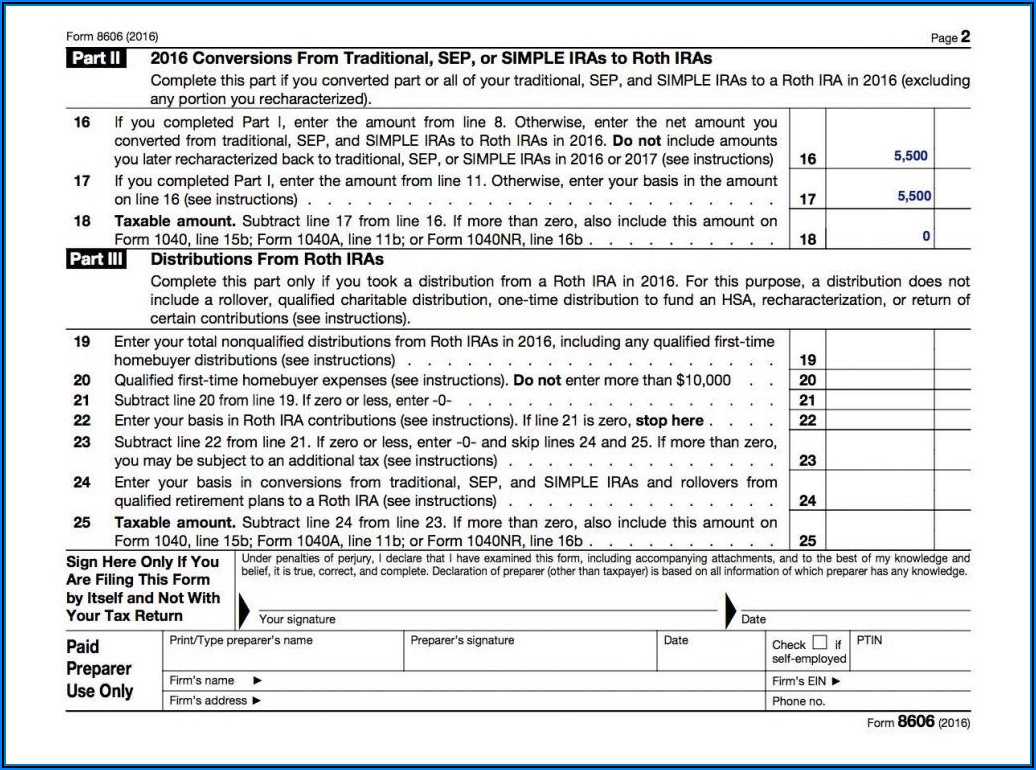

Roth Ira Conversion Form - Web form 8606 (2022) form 8606 (2022) page 2 part ii 2022 conversions from traditional, sep, or simple iras to roth iras complete this part if you converted part or all of your traditional, sep, and simple iras to a roth ira in 2022. A roth ira conversion can be advantageous for individuals. Web the difference between a traditional ira and a roth ira comes down to taxes. Distributions from traditional, sep, or simple iras, if you have ever made nondeductible contributions to traditional iras. Recharacterization is changing a contribution from one type of ira to another type of ira. Irs rules do not allow you to recharacterize a roth ira contribution that was the result of a conversion. This form will be used to initiate the direct conversion of ira funds from a traditional or sep ira to a roth ira. The irs describes three ways to go about it: Web reporting conversions on your return. Web a roth conversion is reported to the irs as a taxable event.

Web 2 days agobut first, the easy answer: Web your ira could decrease $2,138 with a roth conversion. Conversions from traditional, sep, or. If you do not have an existing roth ira plan, a navy federal roth ira application (nfcu form 602a) must be provided with this application. If you are required to take a required minimum distribution (rmd) in the year you convert, you must do so before converting to a roth ira. Web but first, the easy answer: Web a conversion of a traditional ira to a roth ira, and a rollover from any other eligible retirement plan to a roth ira, made in tax years beginning after december 31, 2017, cannot be recharacterized as having been made to a traditional ira. 16 if you completed part i, enter the amount from line 8. This form will be used to initiate the direct conversion of ira funds from a traditional or sep ira to a roth ira. Web use form 8606 to report:

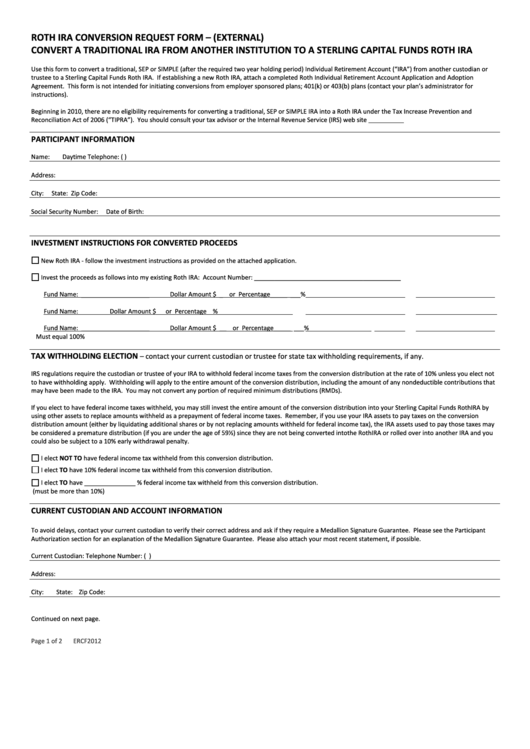

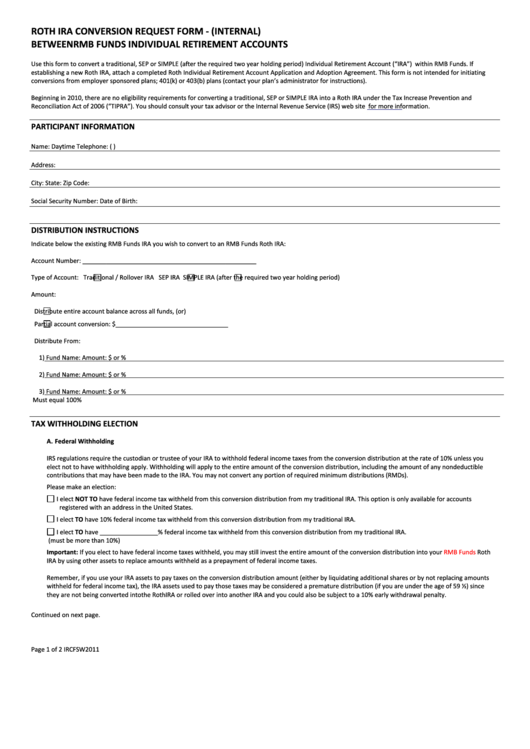

Therefore, this request cannot be reversed once it is completed. You would report the taxable amount of your conversion on this form, then transfer it to your tax return. Log in and go to client services > message center to attach the file regular mail: Web a conversion of a traditional ira to a roth ira, and a rollover from any other eligible retirement plan to a roth ira, made in tax years beginning after december 31, 2017, cannot be recharacterized as having been made to a traditional ira. Web roth conversion form roth conversion form questions? Distributions from traditional, sep, or simple iras, if you have ever made nondeductible contributions to traditional iras. Web a roth conversion is reported to the irs as a taxable event. Conversions from traditional, sep, or. Web under certain conditions, you can move assets from a traditional ira or from a designated roth account to a roth ira. With a traditional ira or.

Roth Ira Form Pdf Universal Network

For more information about these transfers, see converting from any traditional ira into a roth ira, later in this chapter, and can you move amounts into a roth ira? Web a conversion of a traditional ira to a roth ira, and a rollover from any other eligible retirement plan to a roth ira, made in tax years beginning after december.

Roth Ira Conversion Form Universal Network

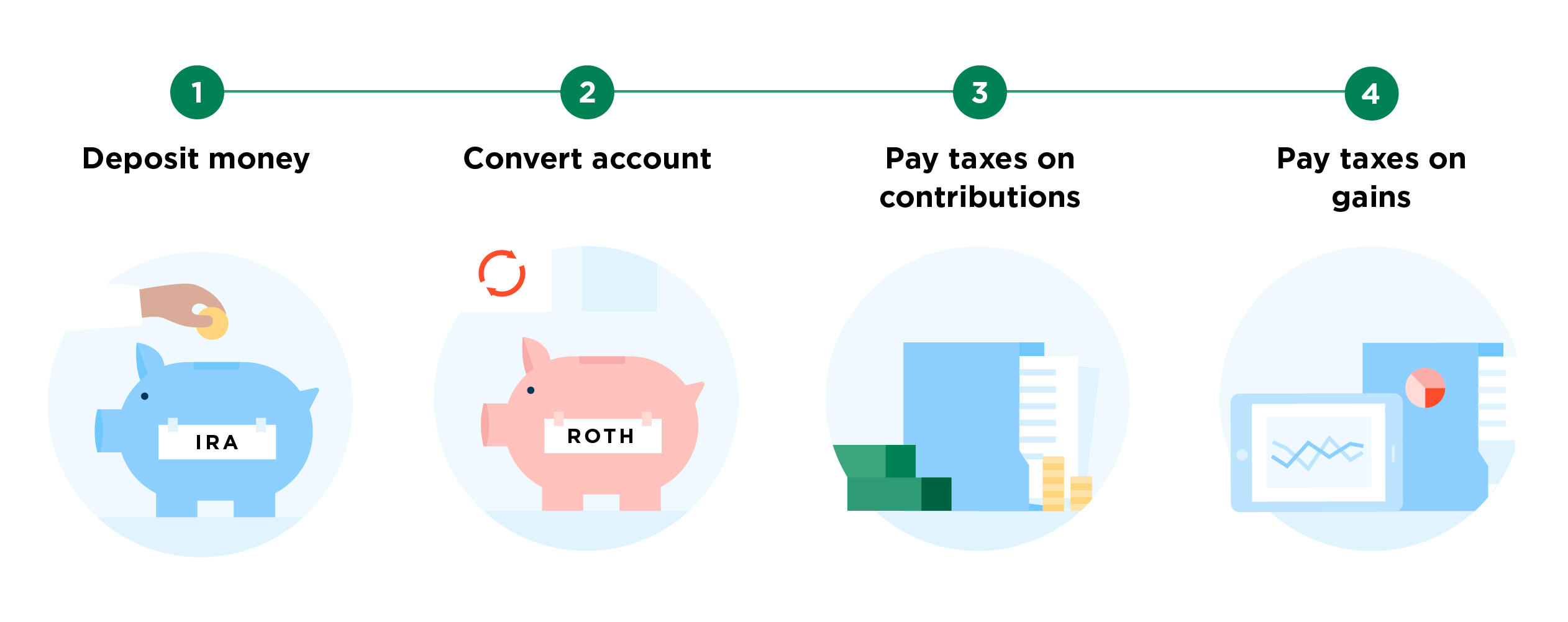

Converting it to a roth. Web the difference between a traditional ira and a roth ira comes down to taxes. Web but first, the easy answer: Follow these simple steps to convert your traditional ira or old 401 (k) to a roth ira. This form will be sent to your currentcustodian to request the assets be movedto blackrock.

How Does Roth IRA Compound Interest?

Web but first, the easy answer: A rollover, in which you take a distribution from. Web this is currently the case for roth iras, and it will be for roth 401 (k)s starting in 2024. And distributions (withdrawals) from your roth ira. Setting up your roth ira;

Roth Ira Conversion Request Form (External) Convert A Traditional Ira

For many individuals, converting to a. And distributions (withdrawals) from your roth ira. A roth ira conversion can be advantageous for individuals. This form will be used to initiate the direct conversion of ira funds from a traditional or sep ira to a roth ira. Web under certain conditions, you can move assets from a traditional ira or from a.

Roth Ira Withdrawal Form Universal Network

Web reporting conversions on your return. Web roth ira conversion: If you do not have an existing roth ira plan, a navy federal roth ira application (nfcu form 602a) must be provided with this application. Web this is currently the case for roth iras, and it will be for roth 401 (k)s starting in 2024. Log in and go to.

form 8606 for roth conversion Fill Online, Printable, Fillable Blank

Conversions from traditional, sep, or. Web use this form to request a conversion of all or any part of your fidelity traditional, rollover, sep, or simple ira (“ira”) to a fidelity roth ira. Web reporting conversions on your return. Web roth ira conversion calculator is converting to a roth ira the right move for you? Important ira to roth conversion.

When to Consider a Roth IRA Conversion Mariner Wealth Advisors

Web this is currently the case for roth iras, and it will be for roth 401 (k)s starting in 2024. Web a conversion of a traditional ira to a roth ira, and a rollover from any other eligible retirement plan to a roth ira, made in tax years beginning after december 31, 2017, cannot be recharacterized as having been made.

Should I Make a Roth IRA Conversion? Financial Symmetry, Inc.

If you do not have an existing roth ira plan, a navy federal roth ira application (nfcu form 602a) must be provided with this application. Web your ira could decrease $2,138 with a roth conversion. Web roth ira conversion: For many individuals, converting to a. Setting up your roth ira;

401k Conversion To Roth Ira Tax Form Form Resume Examples dP9l71Dq2R

Web roth ira conversion: Web if you prefer, you can download and mail in a fidelity roth ira conversion form (pdf); Web if you withdraw another $40k for conversion, that will be taxed at 22%. Not having to worry about rmds gives you added flexibility with your money. Web under certain conditions, you can move assets from a traditional ira.

Roth Ira Conversion Request Form (Internal) Between Rmb Funds

Web but first, the easy answer: Web a conversion of a traditional ira to a roth ira, and a rollover from any other eligible retirement plan to a roth ira, made in tax years beginning after december 31, 2017, cannot be recharacterized as having been made to a traditional ira. This form will be used to initiate the direct conversion.

Web Reporting Conversions On Your Return.

Web converting to a roth ira requires filing form 8606, “nondeductible iras ,” with your form 1040 tax return. Web under certain conditions, you can move assets from a traditional ira or from a designated roth account to a roth ira. Anyone can convert their eligible ira assets to a roth ira regardless of income or marital status. You would report the taxable amount of your conversion on this form, then transfer it to your tax return.

Web Form 8606 (2022) Form 8606 (2022) Page 2 Part Ii 2022 Conversions From Traditional, Sep, Or Simple Iras To Roth Iras Complete This Part If You Converted Part Or All Of Your Traditional, Sep, And Simple Iras To A Roth Ira In 2022.

Web if you prefer, you can download and mail in a fidelity roth ira conversion form (pdf); Web converting all or part of a traditional ira to a roth ira is a fairly straightforward process. Web if you withdraw another $40k for conversion, that will be taxed at 22%. And distributions (withdrawals) from your roth ira.

Web A Traditional Ira Or Traditional 401 (K) That Has Been Converted To A Roth Ira Will Be Taxed And Penalized If Withdrawals Are Taken Within Five Years Of The Conversion Or Before Age 59 1/2.

A reportable movement of assets from a traditional, sep or simple ira to a roth ira , which can be subject to taxes. Converting it to a roth. Web roth conversion form roth conversion form questions? With a traditional ira or.

Web Use This Form To Request A Conversion Of All Or Any Part Of Your Fidelity Traditional, Rollover, Sep, Or Simple Ira (“Ira”) To A Fidelity Roth Ira.

The irs describes three ways to go about it: Not having to worry about rmds gives you added flexibility with your money. Web a conversion of a traditional ira to a roth ira, and a rollover from any other eligible retirement plan to a roth ira, made in tax years beginning after december 31, 2017, cannot be recharacterized as having been made to a traditional ira. Please note that roth conversions are taxable events, and.