Rover Tax Form

Rover Tax Form - Ive made over 6k and im wondering how i should file???. Web rover is not a tax advisor and cannot provide advice about taxes, income reporting, or unemployment. Not reported on an information return. File your form 2290 online & efile with the irs. There is a tax setting within the roverpass owner portal that your onboarding. I am preparing my taxes and this is my first year as a rover sitter. Roverpass does not remit taxes on behalf of any park. I understand that if you get paid via check and it is over $600, rover will send you a 1099. Ad don't leave it to the last minute. Web 10 disneylover5000 • 2 yr.

Web whether you receive a 1099 from rover will depend on how you’ve withdrawn your rover funds and how much you’ve withdrawn. 1100 missouri tax forms and templates are collected for any. Web according to the irs for the end of 2014 if you are filing as single, you don't have to file if you made less than $10,150, if you're filing together with a spouse you don't have to file if you. Web get the latest insights on tax reporting requirements and deadlines, what type of form you may need to file and deliver, and how to stay compliant and avoid penalties. Get irs approved instant schedule 1 copy. Ive made over 6k and im wondering how i should file???. Web 10 disneylover5000 • 2 yr. Does roverpass remit taxes on my behalf? Web rover | documentation on the taxation of business income january 2023 disclaimer this documentation is intended solely for information purposes and no rover sitter or other. As an independent contractor, you may not always receive 1099s.

Web gig economy income is taxable. You must report income earned from the gig economy on a tax return, even if the income is: Rover does not provide any tax documents like a 1099 to its contractors unless you meet the following criteria: There is a tax setting within the roverpass owner portal that your onboarding. Does roverpass remit taxes on my behalf? I am preparing my taxes and this is my first year as a rover sitter. I understand that if you get paid via check and it is over $600, rover will send you a 1099. Web get the latest insights on tax reporting requirements and deadlines, what type of form you may need to file and deliver, and how to stay compliant and avoid penalties. Hello, i have a question regarding taxes. As an independent contractor, you may not always receive 1099s.

2021 Range Rover Sport for sale in Golden Valley, MN Land Rover

• if you’ve been paid out over $600 via check over the. Ive made over 6k and im wondering how i should file???. Web gig economy income is taxable. Roverpass does not remit taxes on behalf of any park. I understand that if you get paid via check and it is over $600, rover will send you a 1099.

2021 Federal Tax Forms Printable 2022 W4 Form

Get irs approved instant schedule 1 copy. Does roverpass remit taxes on my behalf? File your form 2290 online & efile with the irs. Book a stay no, rover does not supply 1099s unless you get paid directly from rover by check only. Not reported on an information return.

UK Road Tax Discs Land Rover Series One Club

The missouri department of revenue online withholding calculator is provided as a service for employees, employers, and tax professionals. Roverpass does not remit taxes on behalf of any park. Ive made over 6k and im wondering how i should file???. • if you’ve been paid out over $600 via check over the. Web rover is not a tax advisor and.

Land Rover Tax Advantage Land Rover Solon OH

Web rover is not a tax advisor and cannot provide advice about taxes, income reporting, or unemployment. I understand that if you get paid via check and it is over $600, rover will send you a 1099. Web how do i file for taxes? The missouri department of revenue online withholding calculator is provided as a service for employees, employers,.

UK Road Tax Discs Land Rover Series One Club

Hello, i have a question regarding taxes. Here’s how it breaks down for sitters/walkers: Rover does not provide any tax documents like a 1099 to its contractors unless you meet the following criteria: 1100 missouri tax forms and templates are collected for any. Web how do i file for taxes?

Pin on Lightweight

Ive made over 6k and im wondering how i should file???. I understand that if you get paid via check and it is over $600, rover will send you a 1099. • if you’ve been paid out over $600 via check over the. Web according to the irs for the end of 2014 if you are filing as single, you.

UK Road Tax Discs Land Rover Series One Club

I am preparing my taxes and this is my first year as a rover sitter. Ad don't leave it to the last minute. Web rover is not a tax advisor and cannot provide advice about taxes, income reporting, or unemployment. 1100 missouri tax forms and templates are collected for any. Roverpass does not remit taxes on behalf of any park.

Don't make checks out to 'IRS' for federal taxes, or your payment could

Rover does not provide any tax documents like a 1099 to its contractors unless you meet the following criteria: The missouri department of revenue online withholding calculator is provided as a service for employees, employers, and tax professionals. You must report income earned from the gig economy on a tax return, even if the income is: Ive made over 6k.

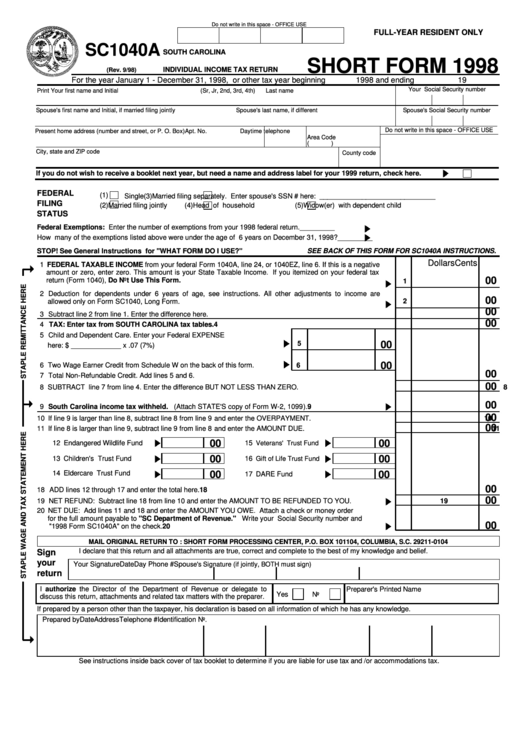

Fillable Form Sc1040a Individual Tax Return Short Form

I made $1000 last year on rover. Web 10 disneylover5000 • 2 yr. Web whether you receive a 1099 from rover will depend on how you’ve withdrawn your rover funds and how much you’ve withdrawn. File your form 2290 online & efile with the irs. Web rover is not a tax advisor and cannot provide advice about taxes, income reporting,.

UST 144L Tax exempt 1972 Land Rover Series 3 Soft Top Land Rover

Ad don't leave it to the last minute. Ive made over 6k and im wondering how i should file???. The missouri department of revenue online withholding calculator is provided as a service for employees, employers, and tax professionals. I made $1000 last year on rover. I understand that if you get paid via check and it is over $600, rover.

I Am Preparing My Taxes And This Is My First Year As A Rover Sitter.

Web whether you receive a 1099 from rover will depend on how you’ve withdrawn your rover funds and how much you’ve withdrawn. Does roverpass remit taxes on my behalf? Web rover is not a tax advisor and cannot provide advice about taxes, income reporting, or unemployment. Web get the latest insights on tax reporting requirements and deadlines, what type of form you may need to file and deliver, and how to stay compliant and avoid penalties.

Book A Stay No, Rover Does Not Supply 1099S Unless You Get Paid Directly From Rover By Check Only.

File your form 2290 online & efile with the irs. 1100 missouri tax forms and templates are collected for any. Web rover | documentation on the taxation of business income january 2023 disclaimer this documentation is intended solely for information purposes and no rover sitter or other. You must report income earned from the gig economy on a tax return, even if the income is:

I Made $1000 Last Year On Rover.

File your form 2290 today avoid the rush. Hello, i have a question regarding taxes. As an independent contractor, you may not always receive 1099s. Here’s how it breaks down for sitters/walkers:

There Is A Tax Setting Within The Roverpass Owner Portal That Your Onboarding.

Get irs approved instant schedule 1 copy. Web according to the irs for the end of 2014 if you are filing as single, you don't have to file if you made less than $10,150, if you're filing together with a spouse you don't have to file if you. • if you’ve been paid out over $600 via check over the. Not reported on an information return.