Sample 4868 Form

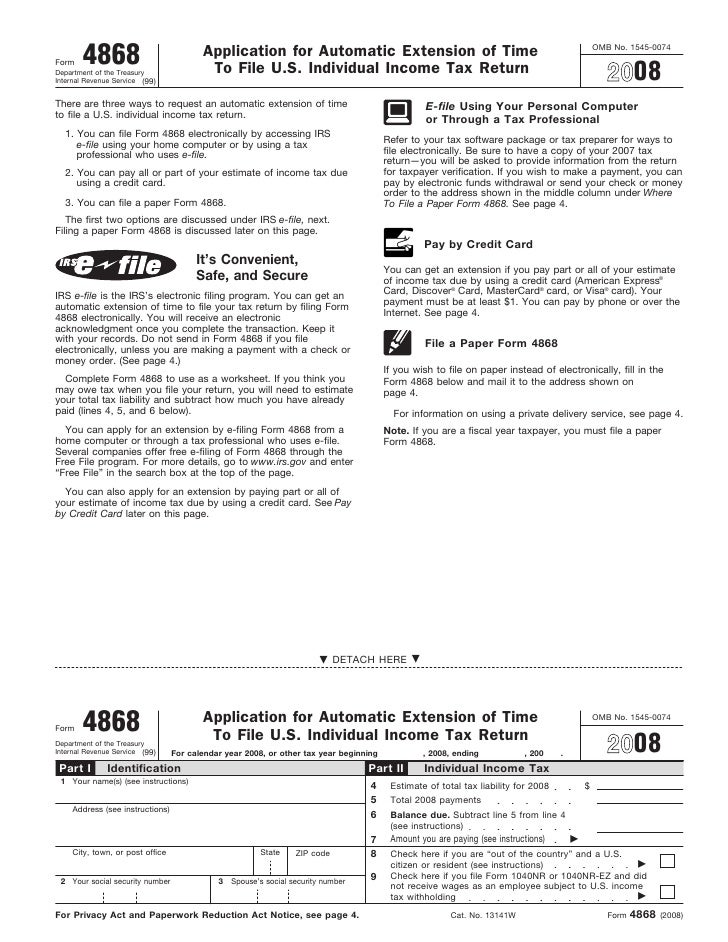

Sample 4868 Form - You can get anautomatic extension of time to file your tax return by filing form4868 electronically. Web form 4868 is known as the application for automatic extension of time to file u.s. Web in this material, we will discuss the structure of the sample, the rules for filling it in, and provide an example of a correctly completed extension form 4868 in 2023. Web use form 4868 to apply for 6 more months (4 if “out of the country” (defined later under taxpayers who are out of the country) and a u.s. The 4868 template structure form 4868 consists of nine boxes and fields that must be completed. Click print, then click the pdf link. If you’re a fiscal year taxpayer, you must file a paper form 4868. Individual income tax return in december 2022, so this is the latest version of form 4868, fully updated for tax year 2022. If you think you may owe tax when you file your return, you will need to estimate your total tax liability and subtract how much you have already paid (lines 4, 5, and 6 below). Web paper form 4868 (see page 4).

If you see a message indicating you have not paid your. You should include your tax payment in the same envelope and mail it to the address outlined in the form instructions. If you’re a fiscal year taxpayer, you must file a paper form 4868. Web this video assists in understanding how to file a tax extension in 2020 and how to fill out a form 4868. Enter your name(s) and address. The new template is available for download in blank, printable, and pdf files on our or the irs website. Web windows pc version 2023 screenshots > 4868 tax form: Web form 4868, also known as an “application for automatic extension of time to file u.s. All about time extension application sophia morris it’s a document used by taxpayers in the united states to apply for an automatic extension of time to file their federal income returns. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government.

If you wish to file on paper instead of electronically, fill in the form 4868 below and mail it to the address shown on page 4. Citizen or resident files this form to request an automatic extension of time to file a u.s. Individual income tax return,” is a form that taxpayers can file with the irs if they need more time to. If you think you may owe tax when you file your return, you will need to estimate your total tax liability and subtract how much you have already paid (lines 4, 5, and 6 below). Web irs form 4868, application for automatic extension of time to file. Click the printer icon or the save icon (available when you hover your mouse over the pdf form) to print or save the pdf copy. Web we last updated the application for automatic extension of time to file u.s. The new template is available for download in blank, printable, and pdf files on our or the irs website. Individual income tax return,’ is the irs form that individual taxpayers use to request an automatic six month tax extension for their federal tax return (form 1040). Individual income tax return in december 2022, so this is the latest version of form 4868, fully updated for tax year 2022.

Form 4868 IRS Tax Extension Fill Out Online PDF FormSwift

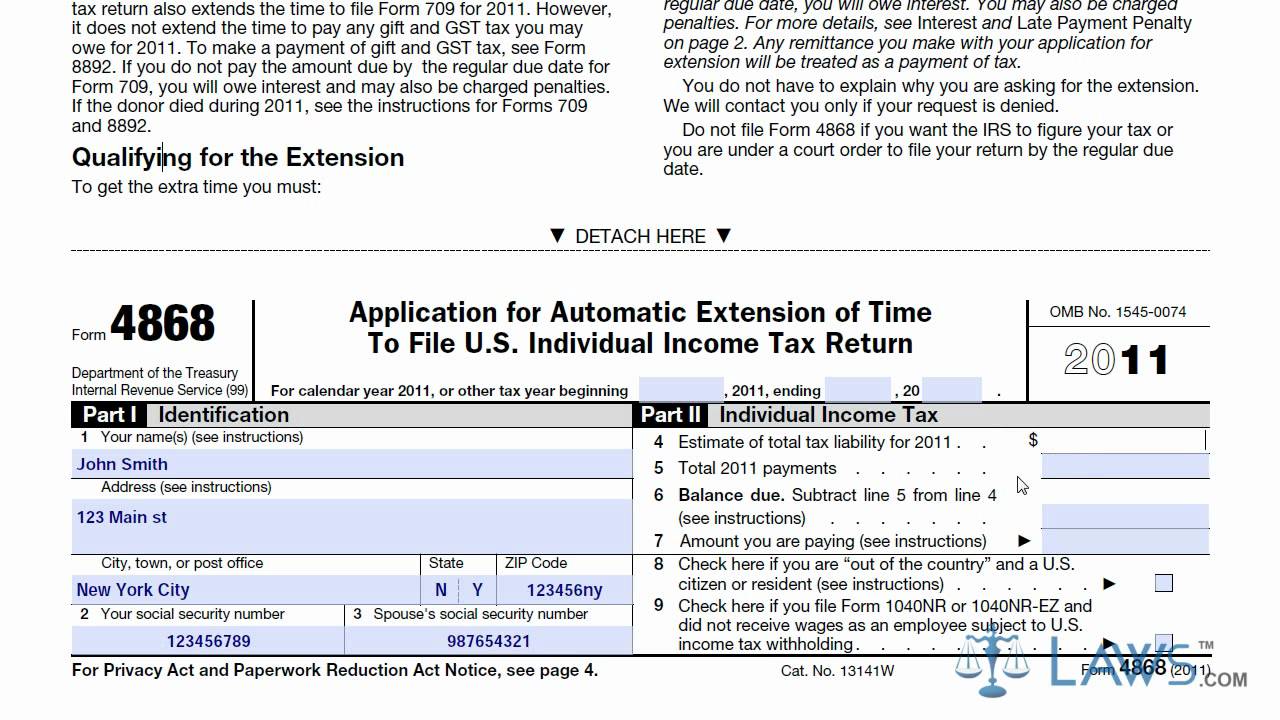

Enter your name(s) and address. Web this video assists in understanding how to file a tax extension in 2020 and how to fill out a form 4868. The 4868 template structure form 4868 consists of nine boxes and fields that must be completed. All about time extension application sophia morris it’s a document used by taxpayers in the united states.

Irs Gov Form 4868 E File Universal Network

This form is for income earned in tax year 2022, with tax returns due in april 2023. If all of the tax jargon is still too confusing, remember that you can always take the easy route and efile tax form 4868 online in just minutes. If you wish to file on paper instead of electronically, fill in the form 4868.

Form IRS 4868 for 2016 How to apply, Irs, Instruction

Citizen or resident files this form to request an automatic extension of time to file a u.s. Web form 4868 is known as the application for automatic extension of time to file u.s. Web complete form 4868 to use as a worksheet. Individual income tax return,” is a form that taxpayers can file with the irs if they need more.

Form 4868 Application for Automatic Extension of Time to File U.S

Web form 4868, ‘application for automatic extension of time to file u.s. Filing a tax extension is important to avoid penalties and interest for failure to file a. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web general instructions purpose of form use.

IRS Form 4868 Fill it Right to File Tax Form

You can get anautomatic extension of time to file your tax return by filing form4868 electronically. You may have to scroll down in the forms and schedules section to locate the item. For information on using a private delivery service, see page 4. Web complete form 4868 to use as a worksheet. Web we last updated federal form 4868 in.

IRS Form 4868 Fill it Right In Case You Failed to File Tax Form

If all of the tax jargon is still too confusing, remember that you can always take the easy route and efile tax form 4868 online in just minutes. It is important to estimate tax. The 4868 template structure form 4868 consists of nine boxes and fields that must be completed. If you wish to file on paper instead of electronically,.

SimpleTax Form 4868 YouTube

Individual income tax return in december 2022, so this is the latest version of form 4868, fully updated for tax year 2022. If you’re a fiscal year taxpayer, you must file a paper form 4868. It is important to estimate tax. You can get anautomatic extension of time to file your tax return by filing form4868 electronically. Web form 4868.

Learn How to Fill the Form 4868 Application for Extension of Time To

You can get anautomatic extension of time to file your tax return by filing form4868 electronically. You have two options to submit your irs form 4868. Web form 4868 is known as the application for automatic extension of time to file u.s. Citizen or resident files this form to request an automatic extension of time to file a u.s. If.

Form 4868 Application for Automatic Extension of Time to File U.S

Individual income tax return in december 2022, so this is the latest version of form 4868, fully updated for tax year 2022. Web how to complete a form 4868 (step by step) to complete a form 4868, you will need to provide the following information: Here are some helpful instructions that will make the process easier. Individual income tax return,’.

Form 4868Application for Automatic Extension of Time

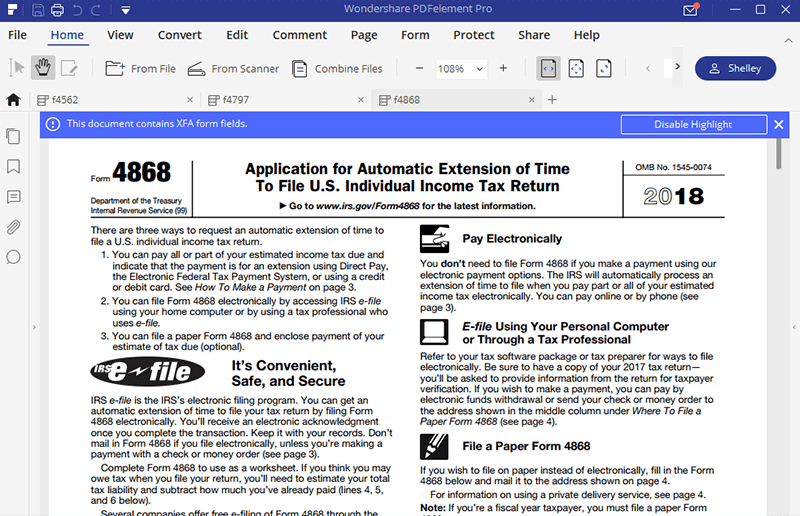

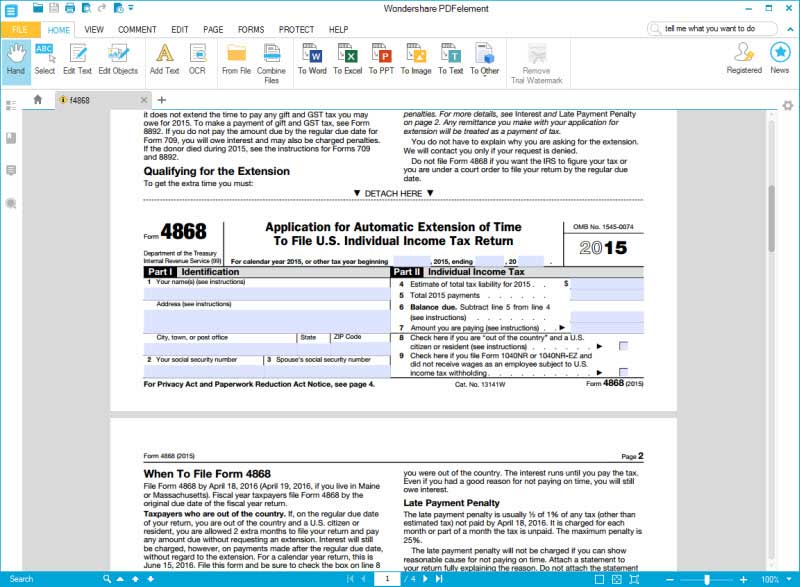

Web windows pc version 2023 screenshots > 4868 tax form: Individual income tax return,’ is the irs form that individual taxpayers use to request an automatic six month tax extension for their federal tax return (form 1040). The new template is available for download in blank, printable, and pdf files on our or the irs website. Web the 4868 tax.

If You See A Message Indicating You Have Not Paid Your.

If you’re a fiscal year taxpayer, you must file a paper form 4868. Web windows pc version 2023 screenshots > 4868 tax form: Enter your name(s) and address. Citizen or resident files this form to request an automatic extension of time to file a u.s.

Mail In The Paper Irs Form 4868.

All about time extension application sophia morris it’s a document used by taxpayers in the united states to apply for an automatic extension of time to file their federal income returns. Click print, then click the pdf link. Individual income tax return in december 2022, so this is the latest version of form 4868, fully updated for tax year 2022. Individual income tax return,’ is the irs form that individual taxpayers use to request an automatic six month tax extension for their federal tax return (form 1040).

Web Struggling To Fill Out Irs Form 4868?

Here are some helpful instructions that will make the process easier. Do not send in form 4868 if you fileelectronically. Individual income tax return,” is a form that taxpayers can file with the irs if they need more time to. You should include your tax payment in the same envelope and mail it to the address outlined in the form instructions.

Web We Last Updated Federal Form 4868 In December 2022 From The Federal Internal Revenue Service.

An extension for federal income tax returns due on april 15 would give you until october 15 to. File a paper form 4868. Click the printer icon or the save icon (available when you hover your mouse over the pdf form) to print or save the pdf copy. Anyone needing more time to file their federal tax returns must complete the 4868 form.