Savers Credit Form 8880

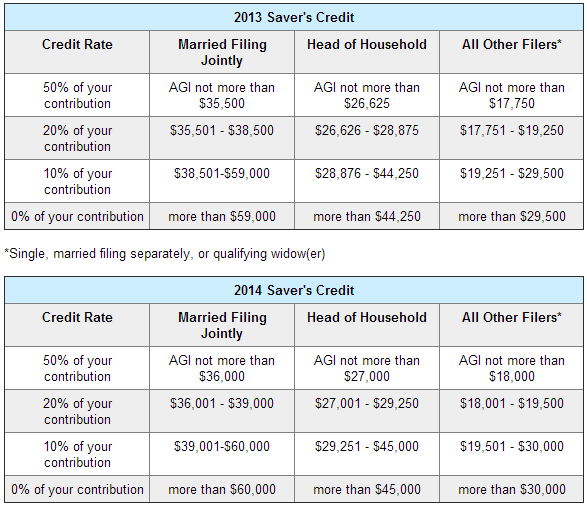

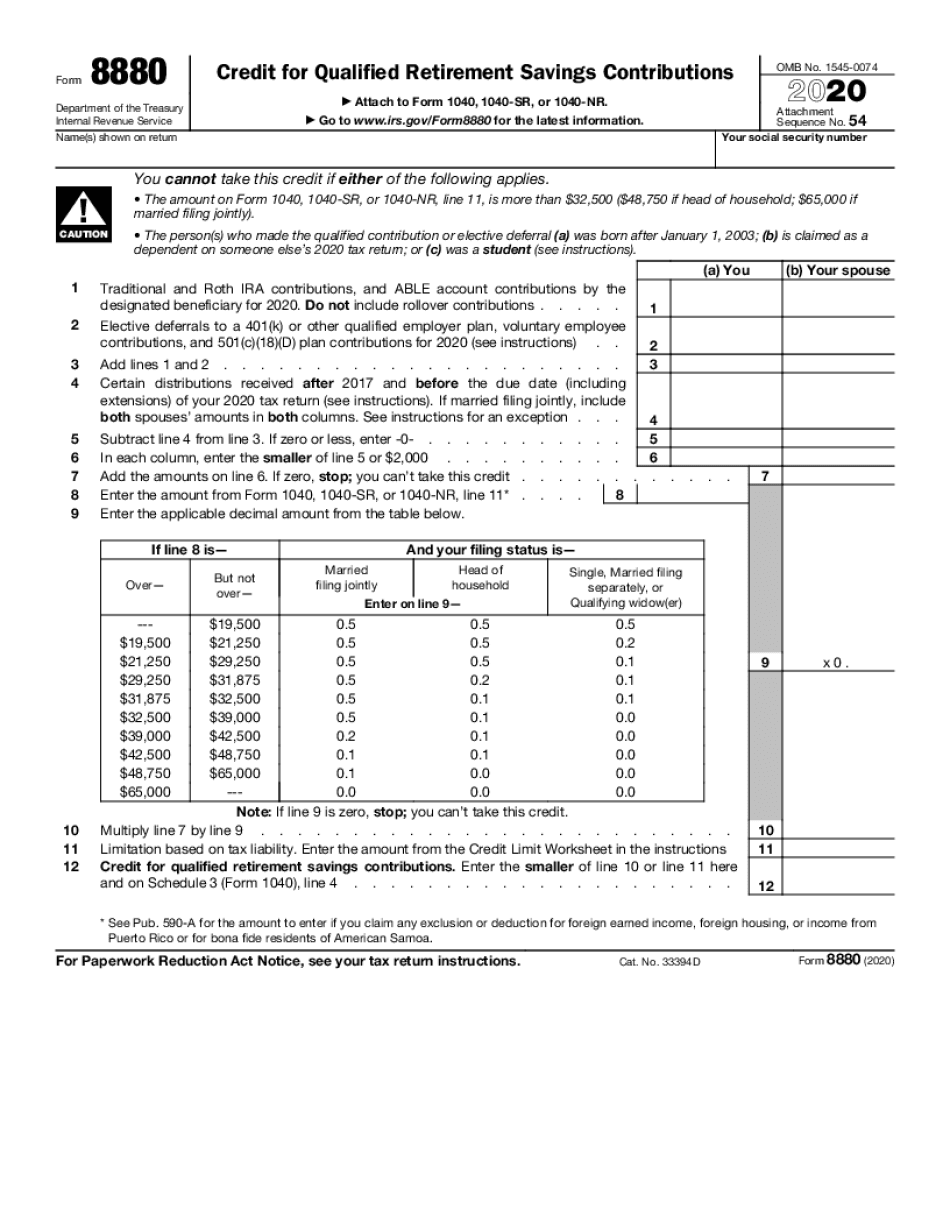

Savers Credit Form 8880 - In tax year 2020, the most recent year for which. Get ready for tax season deadlines by completing any required tax forms today. That specific form deals with 401k contributions and a deduction for the. Web in order to claim the saver’s credit, you’ll need to complete irs form 8880, and attach it to your 1040, 1040a or 1040nr when you file your tax return. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web retirement savings contributions credit (savers credit form 8880) you may be eligible to claim the retirement savings contributions credit, also known as the savers credit,. Web saver's credit fact sheet. Web form 8880 is used to claim the saver's credit, and its instructions have details on figuring the credit correctly. You are age 18 or over; Store opening today at 9 a.m.

Complete, edit or print tax forms instantly. Web per the instructions for form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). In tax year 2020, the most recent year for which. Store opening today at 9 a.m. You are age 18 or over; Web in order to claim the saver’s credit, you’ll need to complete irs form 8880, and attach it to your 1040, 1040a or 1040nr when you file your tax return. Web form 8880 is used to claim the saver's credit, and its instructions have details on figuring the credit correctly. Web with over 300 thrift stores in the u.s., canada and australia you're sure to find great deals on clothing, accessories, hard goods, electronics, books, home goods, and more. This credit can be claimed in addition to any ira.

Web the irs is fairly explicit on how retirement savers can claim the saver's credit. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web in order to claim the saver’s credit, you’ll need to complete irs form 8880, and attach it to your 1040, 1040a or 1040nr when you file your tax return. Web 5441 w 95th st. In tax year 2020, the most recent year for which. Download infographic pdf learn more about the saver's credit. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). For tax years prior to 2018, you can only claim the savers. Tip this credit can be claimed in addition to any ira.

What is the Saver’s Credit? The TurboTax Blog

Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Ad access irs tax forms. Web 4 rows irs form 8880 reports contributions made to qualified retirement savings accounts. Web you may be eligible to claim the retirement savings contributions credit, also known as the savers credit,.

Credit Limit Worksheet Form 8880

Here's the rundown—follow it, and if you're eligible, you should get your tax. Complete, edit or print tax forms instantly. Web saver's credit fact sheet. Web you may be eligible to claim the retirement savings contributions credit, also known as the savers credit, if all of the following apply: Web use form 8880 to figure the amount, if any, of.

savers credit irs form Fill Online, Printable, Fillable Blank form

Web saver's credit to encourage people with lower incomes to contribute to their retirement savings accounts, the internal revenue service offers a tax credit for. Web with over 300 thrift stores in the u.s., canada and australia you're sure to find great deals on clothing, accessories, hard goods, electronics, books, home goods, and more. Download infographic pdf learn more about.

9+ Easy Tips How To Remove Late Payments From Credit Report Sample

Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Here's the rundown—follow it, and if you're eligible, you should get your tax. Ad access irs tax forms. Web retirement savings contributions credit (savers credit form 8880) you may be eligible to claim the retirement savings contributions credit,.

Form 8880 Credit for Qualified Retirement Savings Contributions

Web 4 rows irs form 8880 reports contributions made to qualified retirement savings accounts. Ad access irs tax forms. Tip this credit can be claimed in addition to any ira. Get ready for tax season deadlines by completing any required tax forms today. Web the irs is fairly explicit on how retirement savers can claim the saver's credit.

Get to Know The Savers Tax Credit

Web saver's credit fact sheet. Web with over 300 thrift stores in the u.s., canada and australia you're sure to find great deals on clothing, accessories, hard goods, electronics, books, home goods, and more. Complete, edit or print tax forms instantly. For tax years prior to 2018, you can only claim the savers. Web you can then calculate and claim.

Credits and Deductions Getting more from your pay check Saverocity

Web saver's credit to encourage people with lower incomes to contribute to their retirement savings accounts, the internal revenue service offers a tax credit for. Web retirement savings contributions credit (savers credit form 8880) you may be eligible to claim the retirement savings contributions credit, also known as the savers credit,. For tax years prior to 2018, you can only.

Saver's Credit Fact Sheet English

Tip this credit can be claimed in addition to any ira. You are not a full. Ad access irs tax forms. Here's the rundown—follow it, and if you're eligible, you should get your tax. Get ready for tax season deadlines by completing any required tax forms today.

What Is the Savers Credit? TurboTax Tax Tips & Videos

Web with over 300 thrift stores in the u.s., canada and australia you're sure to find great deals on clothing, accessories, hard goods, electronics, books, home goods, and more. Store opening today at 9 a.m. Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement.

How States Can Utilize the Saver’s Tax Credit to Boost Retirement

Ad access irs tax forms. Web saver's credit fact sheet. Tip this credit can be claimed in addition to any ira. Web per the instructions for form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. This credit can be claimed in addition to any ira.

Web Per The Instructions For Form 8880, The Credit Percentage Is 50%, 20%, Or 10% Of The Eligible Contributions, Depending On Your Adjusted Gross Income.

Complete, edit or print tax forms instantly. Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement savings contributions, when. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web the irs is fairly explicit on how retirement savers can claim the saver's credit.

Web With Over 300 Thrift Stores In The U.s., Canada And Australia You're Sure To Find Great Deals On Clothing, Accessories, Hard Goods, Electronics, Books, Home Goods, And More.

Web saver's credit fact sheet. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Download infographic pdf learn more about the saver's credit. Web form 8880 is used to claim the saver's credit, and its instructions have details on figuring the credit correctly.

Here's The Rundown—Follow It, And If You're Eligible, You Should Get Your Tax.

Uslegalforms allows users to edit, sign, fill & share all type of documents online. You are age 18 or over; Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web my specific complaint deals with how their system treats the 8880 filing in their filing program.

Tip This Credit Can Be Claimed In Addition To Any Ira.

Get ready for tax season deadlines by completing any required tax forms today. Web 4 rows irs form 8880 reports contributions made to qualified retirement savings accounts. Web 5441 w 95th st. Web retirement savings contributions credit (savers credit form 8880) you may be eligible to claim the retirement savings contributions credit, also known as the savers credit,.

:max_bytes(150000):strip_icc()/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)