Sba Offer In Compromise Form 770

Sba Offer In Compromise Form 770 - Complete these tabs in order for the sba to process your request for approval of an offer in compromise for 7 (a) and 504 loans. Web preparation of sba form 770—financial statement of debtor; Preparation of sba form 1150—offer in compromise; Offer in compromise on the sba loan,. Web how do i submit an offer in compromise? Web offer in compromise (oic) tabs. Sba consent to verify form; Web completing the compromise. The sba commercial loan service center east located at 2120 riverfront drive, suite 100, little rock, ar 72202, fax: Web filling out sba form 770:

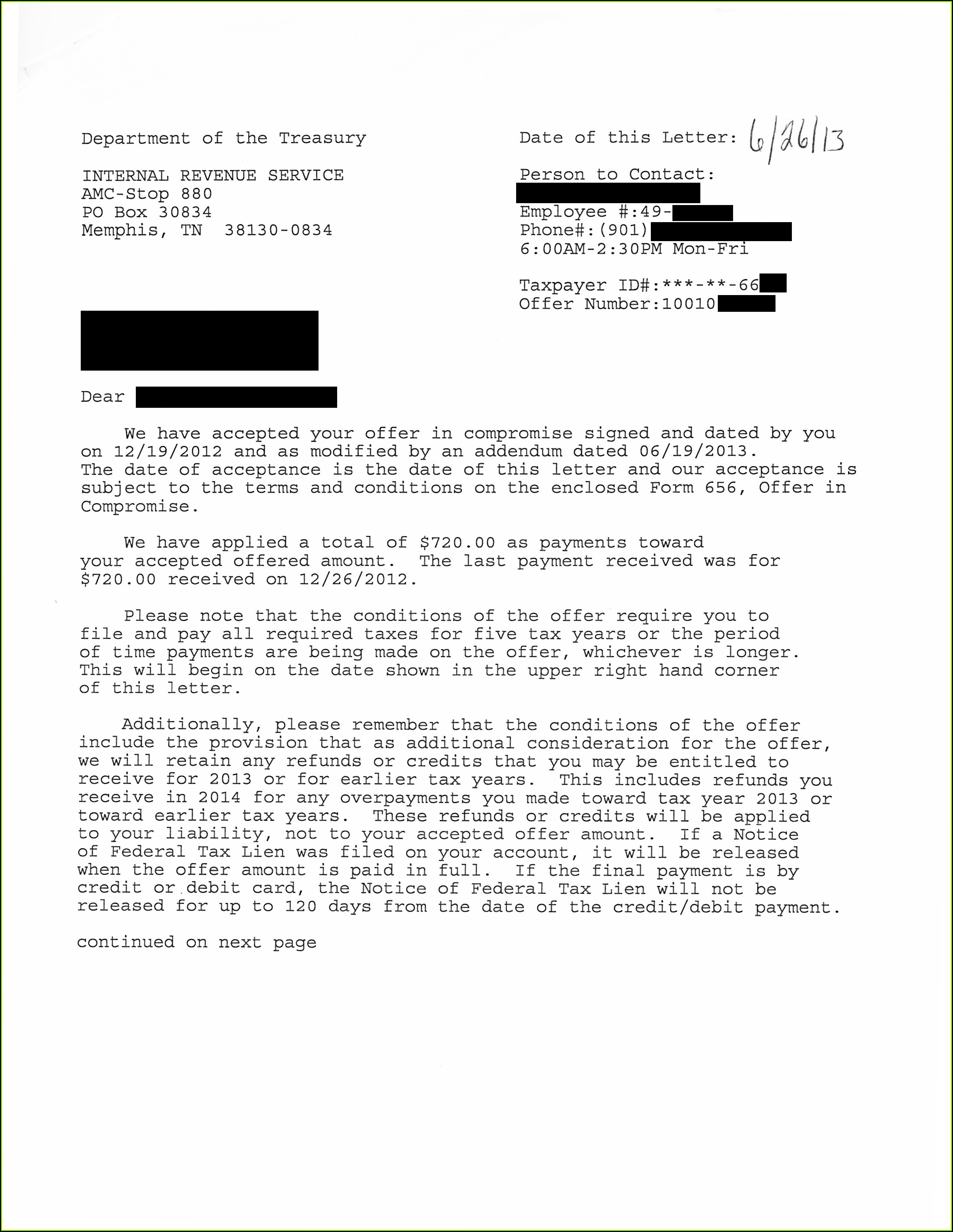

Web an offer in compromise is an offer by the borrower to pay a portion of what is owed on the sba loan, in exchange for the sba to consider the debt settled or satisfied. Prepare and file the offer in compromise with the. The sba commercial loan service center east located at 2120 riverfront drive, suite 100, little rock, ar 72202, fax: Unveiling the mystery of the sba’s interest in your spouse’s finances. The more complete you are in what you provide,. Covid eidls are not able. Web offer in compromise. 2 years of personal tax returns; 7a commercial loans packages should be forwarded to:€ loanresolution@sba.gov. Proof of income for at least two years;

File the offer in compromise with the lender or the sba;. The more complete you are in what you provide,. Web offer in compromise in order for the small business administration (sba) to consider your request for. Web this form must be signed by each party seeking settlement with the sba. Web the information on the sba form 770 is used by sba loan officers in their review of loans and associated obligors. Web offer in compromise (oic) tabs. This offer form may be submitted only after liquidation of all collateral pursuant to agency guidelines. Sba consent to verify form; Complete these tabs in order for the sba to process your request for approval of an offer in compromise for 7 (a) and 504 loans. A letter requesting that sba consider your request for an offer in compromise, signed and dated by all sba borrowers and guarantors.

What to do When a Borrower Submits an Offer in Compromise on an SBA Loan

File the offer in compromise with the lender or the sba;. 2 years of personal tax returns; Web the information on the sba form 770 is used by sba loan officers in their review of loans and associated obligors. Web an offer in compromise is an offer by the borrower to pay a portion of what is owed on the.

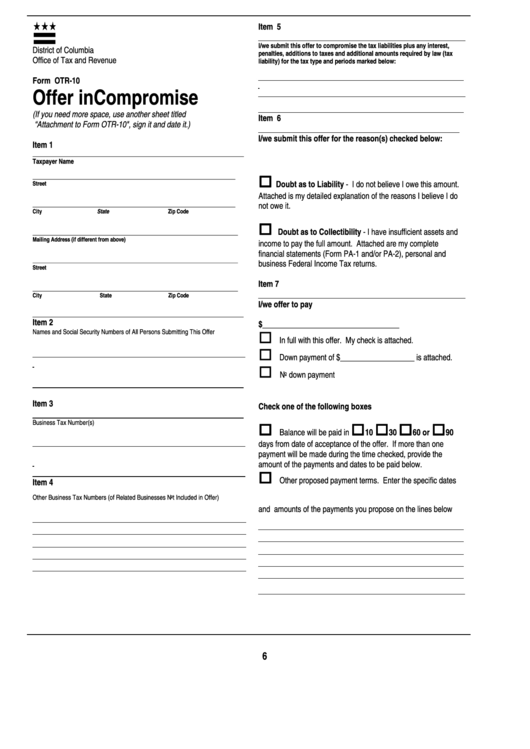

Form Otr10 Offer In Compromise printable pdf download

In order for sba to process your. Web how do i submit an offer in compromise? Complete these tabs in order for the sba to process your request for approval of an offer in compromise for 7 (a) and 504 loans. Once the sba approves the offer in compromise, the lender/cdc should take the following actions: Sba consent to verify.

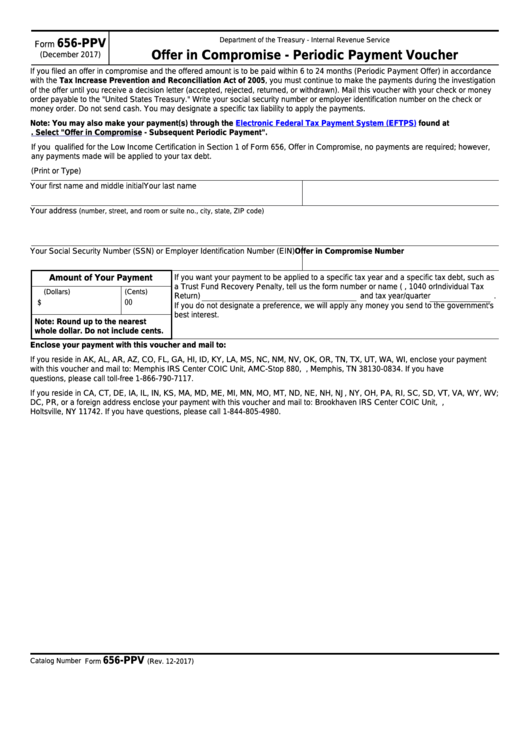

Fillable Form 656Ppv Offer In Compromise Periodic Payment Voucher

The more complete you are in what you provide,. Web offer in compromise. Web how do i submit an offer in compromise? Once the sba approves the offer in compromise, the lender/cdc should take the following actions: Complete these tabs in order for the sba to process your request for approval of an offer in compromise for 7 (a) and.

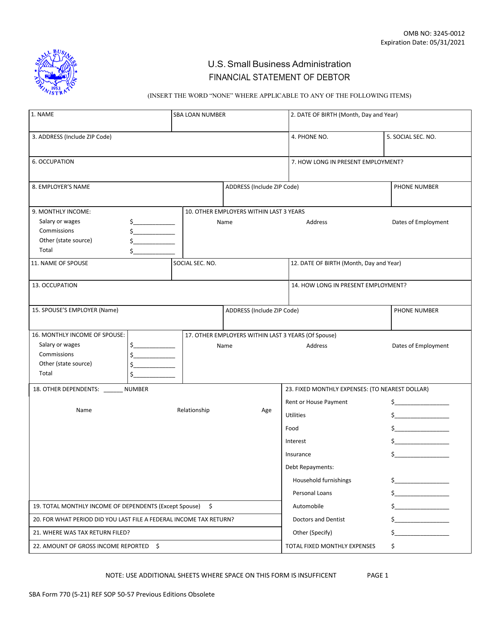

SBA Form 770 Download Fillable PDF or Fill Online Financial Statement

Web offer in compromise in order for the small business administration (sba) to consider your request for. Proof of income for at least two years; Web an offer in compromise is an offer by the borrower to pay a portion of what is owed on the sba loan, in exchange for the sba to consider the debt settled or satisfied..

SBA Offer In Compromise 101 YouTube

The sba commercial loan service center east located at 2120 riverfront drive, suite 100, little rock, ar 72202, fax: Web an offer in compromise is an offer by the borrower to pay a portion of what is owed on the sba loan, in exchange for the sba to consider the debt settled or satisfied. 7a commercial loans packages should be.

SBA Form 1150 Download Fillable PDF or Fill Online Offer in Compromise

Web in order for the small business administration to process a request for an offer in compromise on the sba loan, please provide the following required information as. Sba consent to verify form; 7a commercial loans packages should be forwarded to:€ loanresolution@sba.gov. Web an offer in compromise is an offer by the borrower to pay a portion of what is.

SBA Standard Operating Procedures and the Offer in Compromise YouTube

Preparation of sba form 1150—offer in compromise; This offer form may be submitted only after liquidation of all collateral pursuant to agency guidelines. Once the sba approves the offer in compromise, the lender/cdc should take the following actions: Each party to the oic must also complete and sign an sba form 770 financial. Web prepare sba form 770 (financial statement.

Irs Offer In Compromise Form 656 L Form Resume Examples goVLD7ZVva

(sba form 770) for all. Web filling out sba form 770: Web offer in compromise (oic) tabs. Each party to the oic must also complete and sign an sba form 770 financial. 7a commercial loans packages should be forwarded to:€ loanresolution@sba.gov.

SBA Offer in Compromise vs Bankruptcy YouTube

Web filling out sba form 770: This offer form may be submitted only after liquidation of all collateral pursuant to agency guidelines. Web offer in compromise (oic) tabs. Web prepare sba form 770 (financial statement of debtor) review all financial data and suggest settlement terms. In order for sba to process your.

What to do When a Borrower Submits an Offer in Compromise on an SBA Loan

Web offer in compromise in order for the small business administration (sba) to consider your request for. Unveiling the mystery of the sba’s interest in your spouse’s finances. 7a commercial loans packages should be forwarded to:€ loanresolution@sba.gov. Web filling out sba form 770: Web offer in compromise (oic) tabs.

Web Offer In Compromise (Oic) Tabs.

Web prepare sba form 770 (financial statement of debtor) review all financial data and suggest settlement terms. Proof of income for at least two years; Web filling out sba form 770: Each party to the oic must also complete and sign an sba form 770 financial.

Web Offer In Compromise In Order For The Small Business Administration (Sba) To Consider Your Request For.

Offer in compromise on the sba loan,. Prepare and file the offer in compromise with the. The more complete you are in what you provide,. Once the sba approves the offer in compromise, the lender/cdc should take the following actions:

Web How Do I Submit An Offer In Compromise?

Web offer in compromise (oic) tabs. In order for sba to process your. 7a commercial loans packages should be forwarded to:€ loanresolution@sba.gov. Web the sba will only ask for two standard forms, the sba form 770 and 1150 and your tax filings for two years, but there are many more documents you should supply.

This Offer Form May Be Submitted Only After Liquidation Of All Collateral Pursuant To Agency Guidelines.

The information is a prerequisite to a compromise settlement. Web completing the compromise. A letter requesting that sba consider your request for an offer in compromise, signed and dated by all sba borrowers and guarantors. Unveiling the mystery of the sba’s interest in your spouse’s finances.