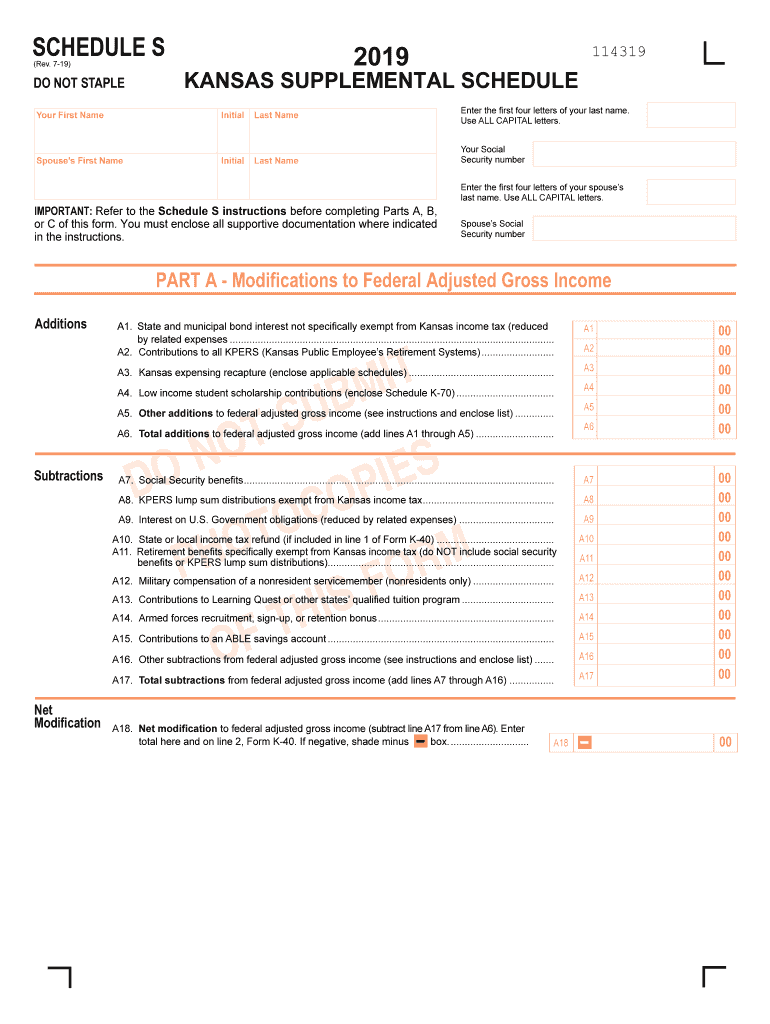

Schedule S Tax Form

Schedule S Tax Form - The first step of filing itr is to collect all the documents related to the process. Income tax return for an s corporation for calendar year 2022 or tax year beginning , 2022, ending , 20 s election effective date name d employer identification number. Web schedule fa was introduced to combat tax evasion and money laundering. The schedule has seven categories of expenses: Government obligations (reduced by related expenses) a18. Medical and dental expenses, taxes,. Web documents needed to file itr; Web if you are an individual filing a california personal income tax return or an estate or trust filing a california fiduciary income tax return, use schedule s to claim a credit against. Web in most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Web if you received social security retirement or disability benefits, enter the amount of conservation reserve program payments included on schedule f, line 4b, or listed on.

Web internal revenue service. (if you checked the box on line 1, see instructions). Medical and dental expenses, taxes,. Attach to form 540, form 540nr, or form 541. (1) the tax is deemed paid in the county in which the. August social security checks are getting disbursed this week for recipients who've. Current revision schedule a (form 1040) pdf. This form is for income earned in tax year 2022, with tax returns. *permanent residents of guam or the virgin islands cannot use form 9465. Estates and trusts, enter on.

State or local income tax. Web documents needed to file itr; *permanent residents of guam or the virgin islands cannot use form 9465. Web if the tax return is being sent to the third party, ensure that lines 5 through 7 are completed before signing. The first step of filing itr is to collect all the documents related to the process. (if you checked the box on line 1, see instructions). Web we last updated california form 540 schedule s in february 2023 from the california franchise tax board. Current revision schedule a (form 1040) pdf. Web in most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. July 29, 2023 5:00 a.m.

California Schedule D 1 carfare.me 20192020

An individual having salary income should collect. Web internal revenue service. Current revision schedule a (form 1040) pdf. (if you checked the box on line 1, see instructions). Estates and trusts, enter on.

Schedule of Rates of Tax on Professions,Trades, Callings and

• if a loss, you. (1) the tax is deemed paid in the county in which the. Web in most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Estates and trusts, enter on. Web documents needed to file itr;

Freelance Taxes Taxes

(if you checked the box on line 1, see instructions). July 29, 2023 5:00 a.m. Web in most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Web if the tax return is being sent to the third party, ensure that lines 5 through 7 are completed before.

Federal Tax Form 1040a Schedule B Universal Network

Kpers lump sum distributions exempt from kansas income tax a17. • if a loss, you. An individual having salary income should collect. Medical and dental expenses, taxes,. State or local income tax.

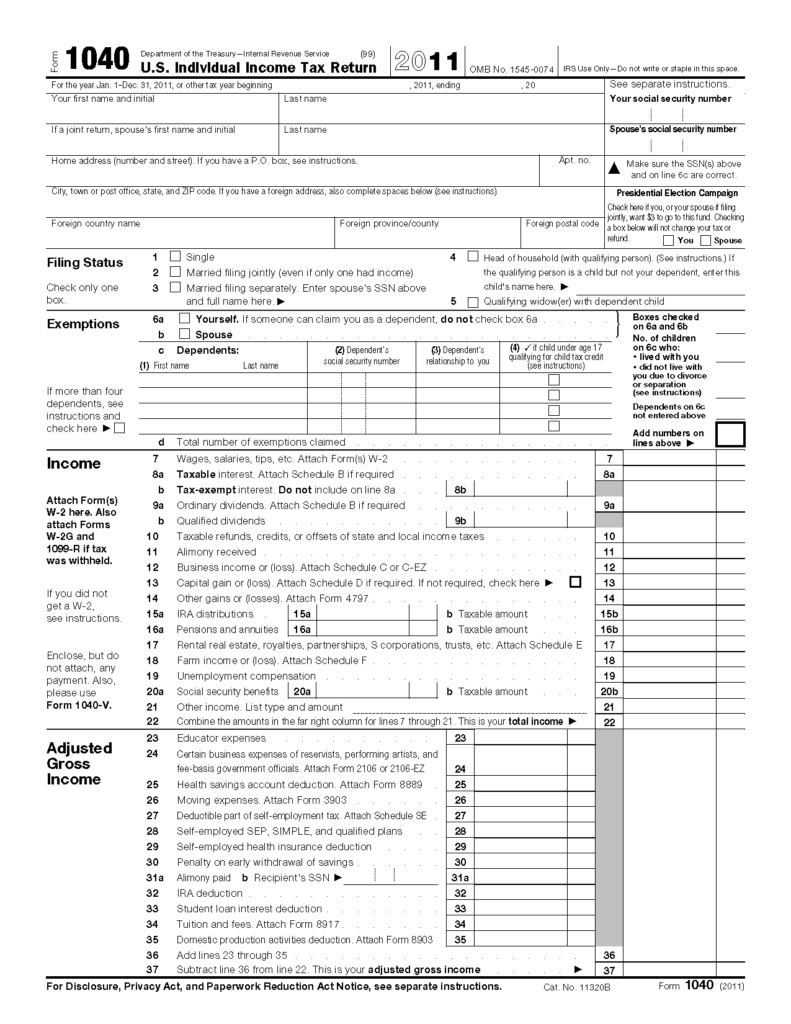

Form 1040 U S Individual Tax Return 2021 Tax Forms 1040 Printable

Attach to form 540, form 540nr, or form 541. Web we last updated california form 540 schedule s in february 2023 from the california franchise tax board. Current revision schedule a (form 1040) pdf. Medical and dental expenses, taxes,. Web internal revenue service.

Kansas Schedule S Fill Out and Sign Printable PDF Template signNow

An individual having salary income should collect. This form is for income earned in tax year 2022, with tax returns. Medical and dental expenses, taxes,. *permanent residents of guam or the virgin islands cannot use form 9465. Use this address if you are not enclosing a payment use this.

Eric's Postulations after great Cogitation Cruz’s Tax Form is Nuts!

Estates and trusts, enter on. Web schedule a is required in any year you choose to itemize your deductions. Web schedule fa was introduced to combat tax evasion and money laundering. Attach to form 540, form 540nr, or form 541. (1) the tax is deemed paid in the county in which the.

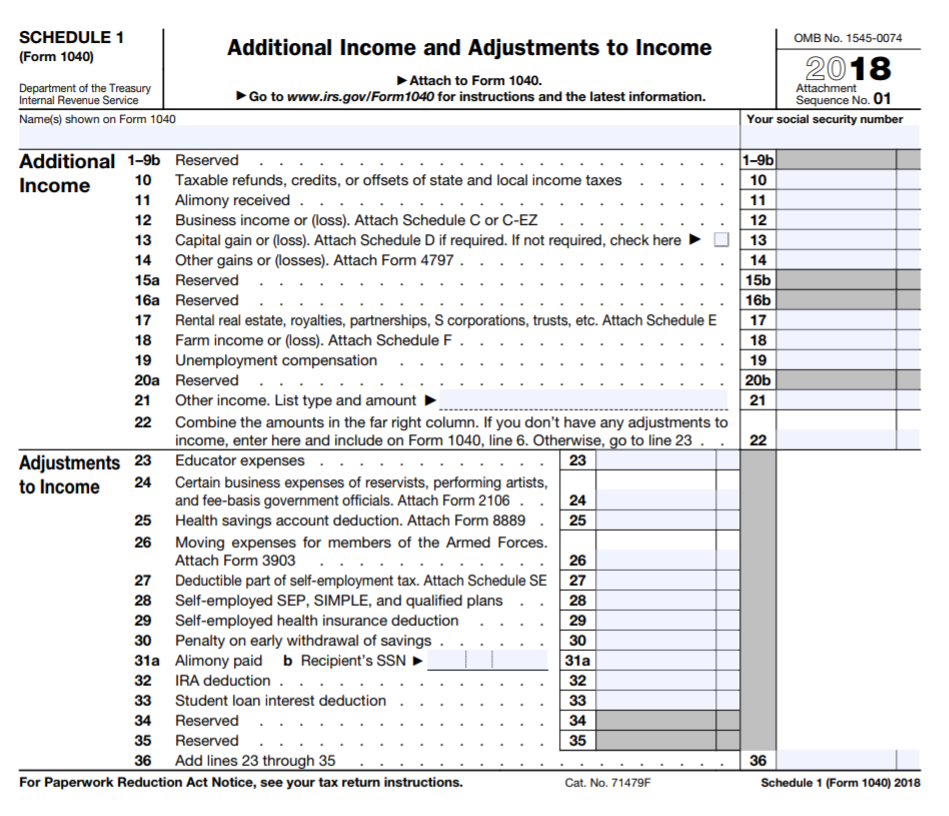

Understanding the New Tax Forms for Filing 2018 Taxes OTAcademy

This form is for income earned in tax year 2022, with tax returns. Web documents needed to file itr; August social security checks are getting disbursed this week for recipients who've. July 29, 2023 5:00 a.m. Web schedule 1 (form 1040), line 3, and on.

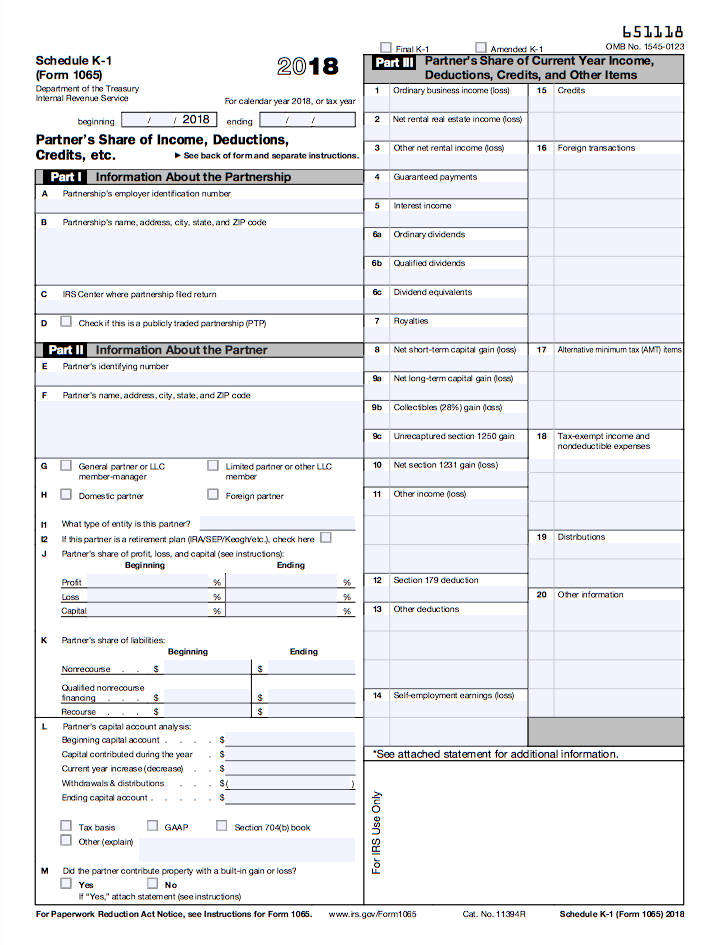

Barbara Johnson Blog Schedule K1 Tax Form What Is It and Who Needs

Form 1040, 1120, 941, etc. • if a loss, you. Attach to form 540, form 540nr, or form 541. Web schedule fa was introduced to combat tax evasion and money laundering. An individual having salary income should collect.

August Social Security Checks Are Getting Disbursed This Week For Recipients Who've.

Medical and dental expenses, taxes,. The schedule has seven categories of expenses: Attach to form 540, form 540nr, or form 541. Web documents needed to file itr;

Web Schedule A Is Required In Any Year You Choose To Itemize Your Deductions.

An individual having salary income should collect. Kpers lump sum distributions exempt from kansas income tax a17. • if a loss, you. Web if you received social security retirement or disability benefits, enter the amount of conservation reserve program payments included on schedule f, line 4b, or listed on.

Web Schedule Fa Was Introduced To Combat Tax Evasion And Money Laundering.

Estates and trusts, enter on. Web internal revenue service. (if you checked the box on line 1, see instructions). Web we last updated california form 540 schedule s in february 2023 from the california franchise tax board.

Web In Most Cases, Your Federal Income Tax Will Be Less If You Take The Larger Of Your Itemized Deductions Or Your Standard Deduction.

(1) the tax is deemed paid in the county in which the. *permanent residents of guam or the virgin islands cannot use form 9465. Use this address if you are not enclosing a payment use this. Current revision schedule a (form 1040) pdf.