Self Employment Expense Form

Self Employment Expense Form - Get a free guided quickbooks® setup. The social security administration uses the information from schedule se to figure your. Web earned income includes all the taxable income and wages from working either as an employee or from running or owning a business. You must reduce your deduction for employee wages by the. Publication 225, farmer's tax guide. This readymade template is a. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web download this self employed expense sheet template design in word, google docs, excel, apple pages, apple numbers format. Automatically track all your income and expenses. Form 3800 to claim any of the.

Get a free guided quickbooks® setup. Web updated april 13, 2023 if it's directly related to the work you do, you can deduct it as an expense. You must reduce your deduction for employee wages by the. Web this form is meant to assist clients with properly catagorizing their income and expenses and nothing more. Form 3800 to claim any of the. The social security administration uses the information from schedule se to figure your. This section of the program contains information for part iii of the schedule k. Web earned income includes all the taxable income and wages from working either as an employee or from running or owning a business. To start the blank, use the fill camp; Publication 334, tax guide for small business (for individuals who use.

This readymade template is a. Web updated april 13, 2023 if it's directly related to the work you do, you can deduct it as an expense. Web information about form 2106, employee business expenses, including recent updates, related forms and instructions on how to file. Automatically track all your income and expenses. Web the way to complete the self employment income expense tracking worksheet form online: Form 461 to report an excess business loss. Publication 225, farmer's tax guide. This section of the program contains information for part iii of the schedule k. It also includes certain other. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023)

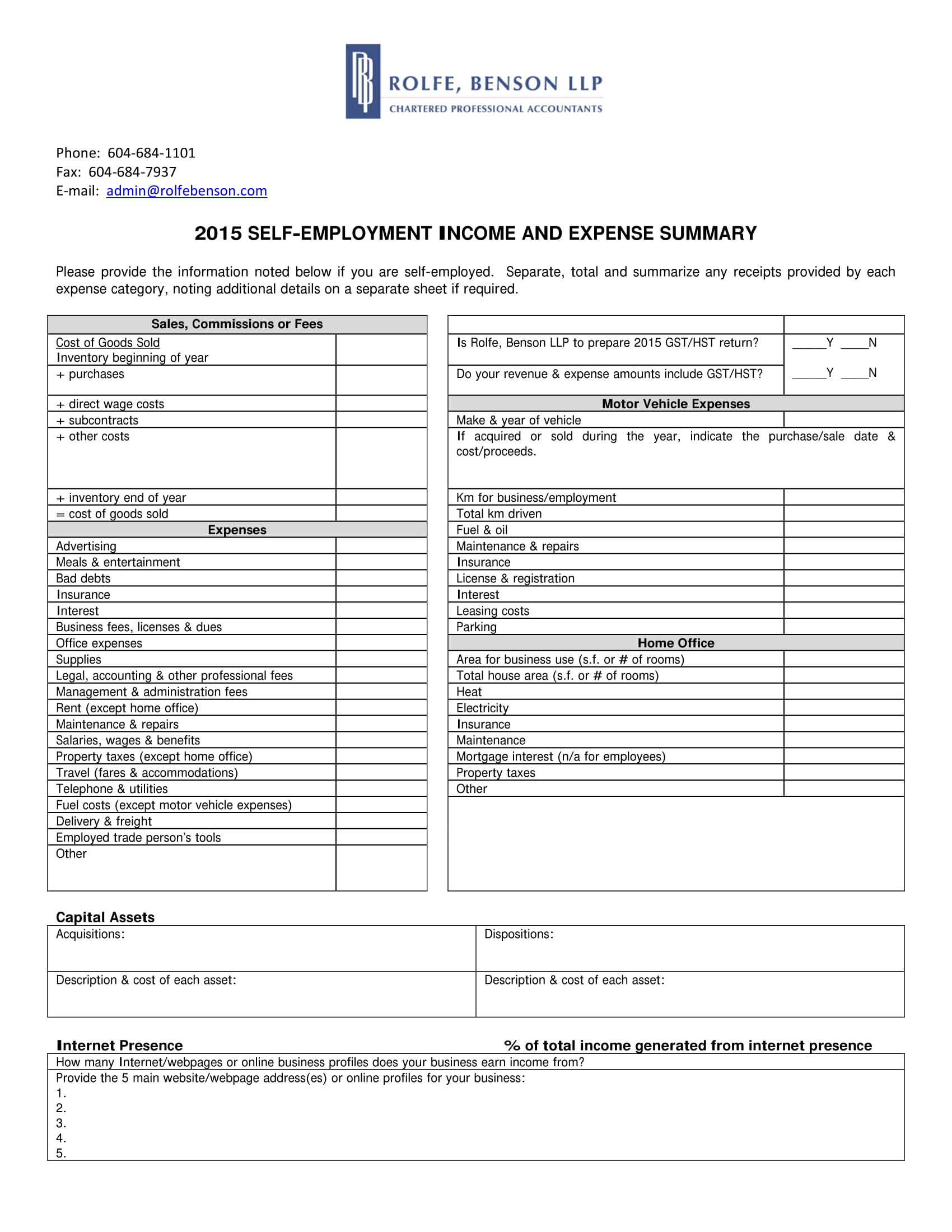

9+ Expense Summary Templates PDF

This section of the program contains information for part iii of the schedule k. Web this form is meant to assist clients with properly catagorizing their income and expenses and nothing more. Publication 225, farmer's tax guide. Web updated april 13, 2023 if it's directly related to the work you do, you can deduct it as an expense. This readymade.

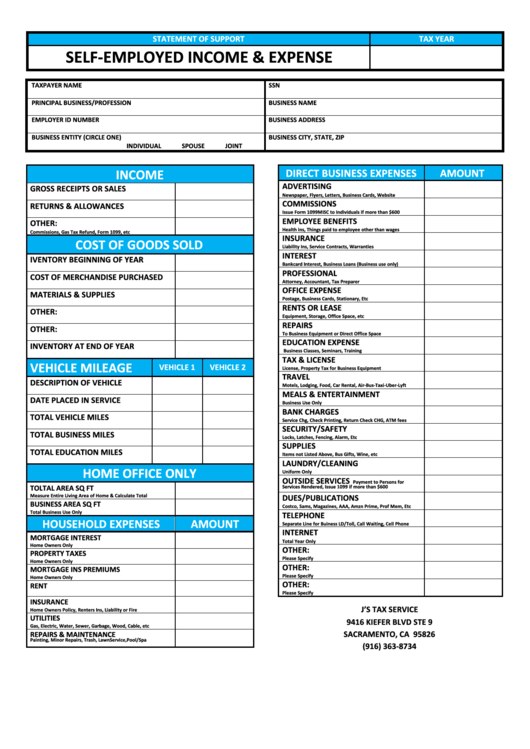

SelfEmployed & Expense printable pdf download

Web updated april 13, 2023 if it's directly related to the work you do, you can deduct it as an expense. Get a free guided quickbooks® setup. Web earned income includes all the taxable income and wages from working either as an employee or from running or owning a business. Publication 225, farmer's tax guide. Web download this self employed.

Self Employed Excel Spreadsheet Google Spreadshee self employed excel

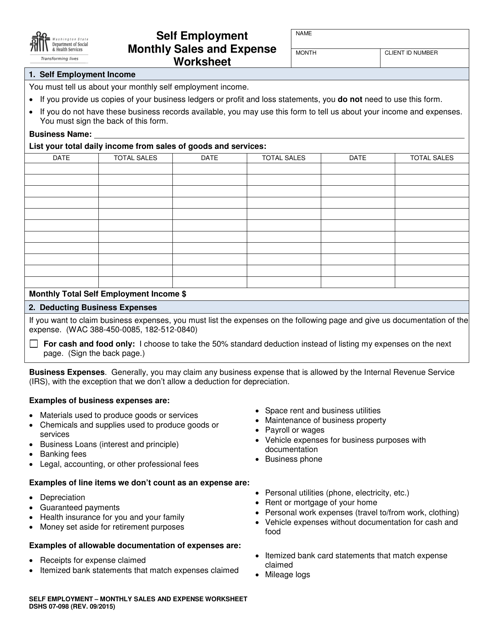

This section of the program contains information for part iii of the schedule k. List on back purchases of: Automatically track all your income and expenses. Form 461 to report an excess business loss. Web information about form 2106, employee business expenses, including recent updates, related forms and instructions on how to file.

Sample Expense Form Classles Democracy

Web this form is meant to assist clients with properly catagorizing their income and expenses and nothing more. Publication 334, tax guide for small business (for individuals who use. List on back purchases of: Form 461 to report an excess business loss. Web the way to complete the self employment income expense tracking worksheet form online:

Top 5 Frequently Asked Questions on SelfEmployed Expenses

Automatically track all your income and expenses. Web you may be able to claim employment credits, such as the credits listed below, if you meet certain requirements. Web updated april 13, 2023 if it's directly related to the work you do, you can deduct it as an expense. You must reduce your deduction for employee wages by the. It also.

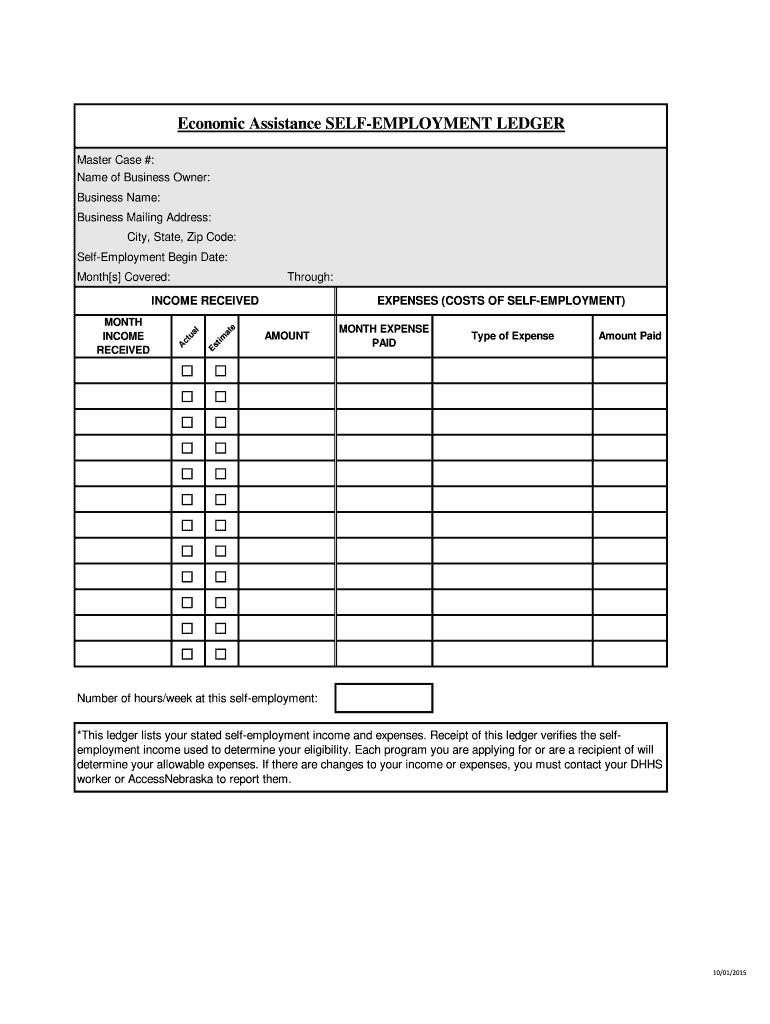

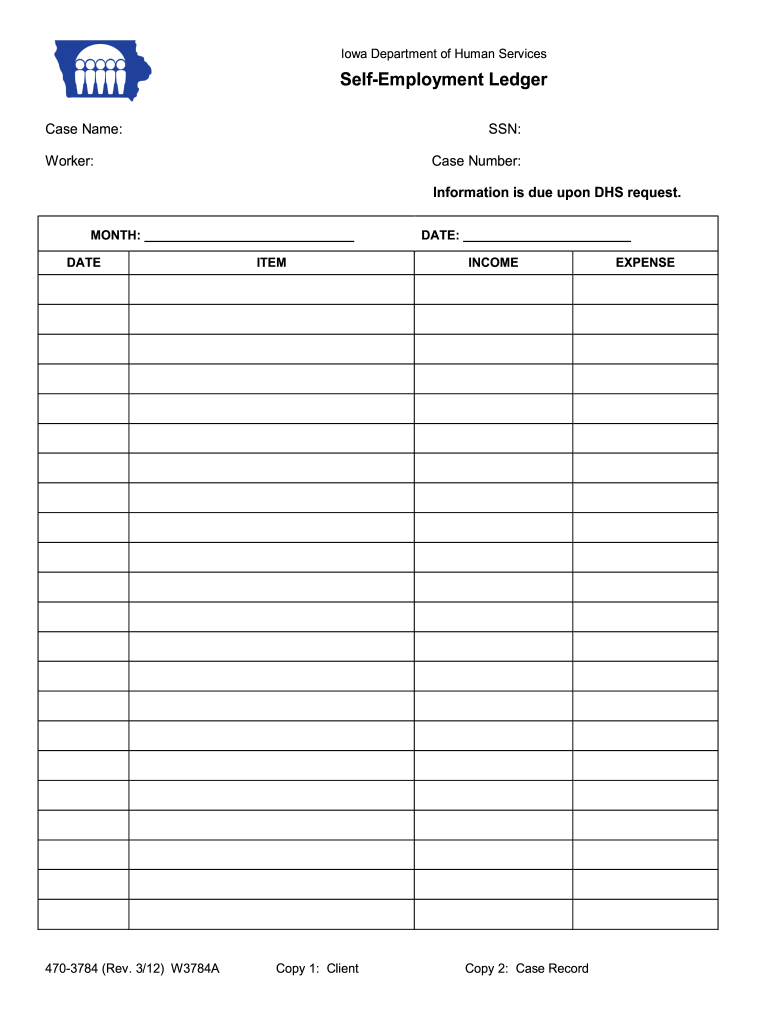

SelfEmployment Ledger 2010 Fill and Sign Printable Template Online

Web earned income includes all the taxable income and wages from working either as an employee or from running or owning a business. Publication 225, farmer's tax guide. Form 3800 to claim any of the. Web you may be able to claim employment credits, such as the credits listed below, if you meet certain requirements. This section of the program.

Elc Self Employment Business Expense Form Employment Form

Web earned income includes all the taxable income and wages from working either as an employee or from running or owning a business. You must reduce your deduction for employee wages by the. To start the blank, use the fill camp; Web this form is meant to assist clients with properly catagorizing their income and expenses and nothing more. Web.

Printable Expense And Ledger With Balance 50 Excel and

This section of the program contains information for part iii of the schedule k. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Get a free guided quickbooks® setup. Form 461 to report an excess business loss. It also includes certain other.

Self Employment Ledger Template Fill Out and Sign Printable PDF

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Ad manage all your business expenses in one place with quickbooks®. Web information about form 2106, employee business expenses, including recent updates, related forms and instructions on how to file. Publication 225, farmer's tax guide. Employees file this form to.

Monthly+Business+Expense+Worksheet+Template Business budget template

Web this form is meant to assist clients with properly catagorizing their income and expenses and nothing more. Publication 334, tax guide for small business (for individuals who use. Get a free guided quickbooks® setup. The social security administration uses the information from schedule se to figure your. This section of the program contains information for part iii of the.

Web The Way To Complete The Self Employment Income Expense Tracking Worksheet Form Online:

You must reduce your deduction for employee wages by the. Sign online button or tick the preview image. Web earned income includes all the taxable income and wages from working either as an employee or from running or owning a business. To start the blank, use the fill camp;

Ad Manage All Your Business Expenses In One Place With Quickbooks®.

Web this form is meant to assist clients with properly catagorizing their income and expenses and nothing more. Owning your own business, babysitting, day care, home party sales, odd jobs, ohio. Form 3800 to claim any of the. Web updated april 13, 2023 if it's directly related to the work you do, you can deduct it as an expense.

List On Back Purchases Of:

Form 461 to report an excess business loss. Web information about form 2106, employee business expenses, including recent updates, related forms and instructions on how to file. The social security administration uses the information from schedule se to figure your. Automatically track all your income and expenses.

This Section Of The Program Contains Information For Part Iii Of The Schedule K.

Get a free guided quickbooks® setup. Employees file this form to. This readymade template is a. Web you may be able to claim employment credits, such as the credits listed below, if you meet certain requirements.