Short Calendar Spread

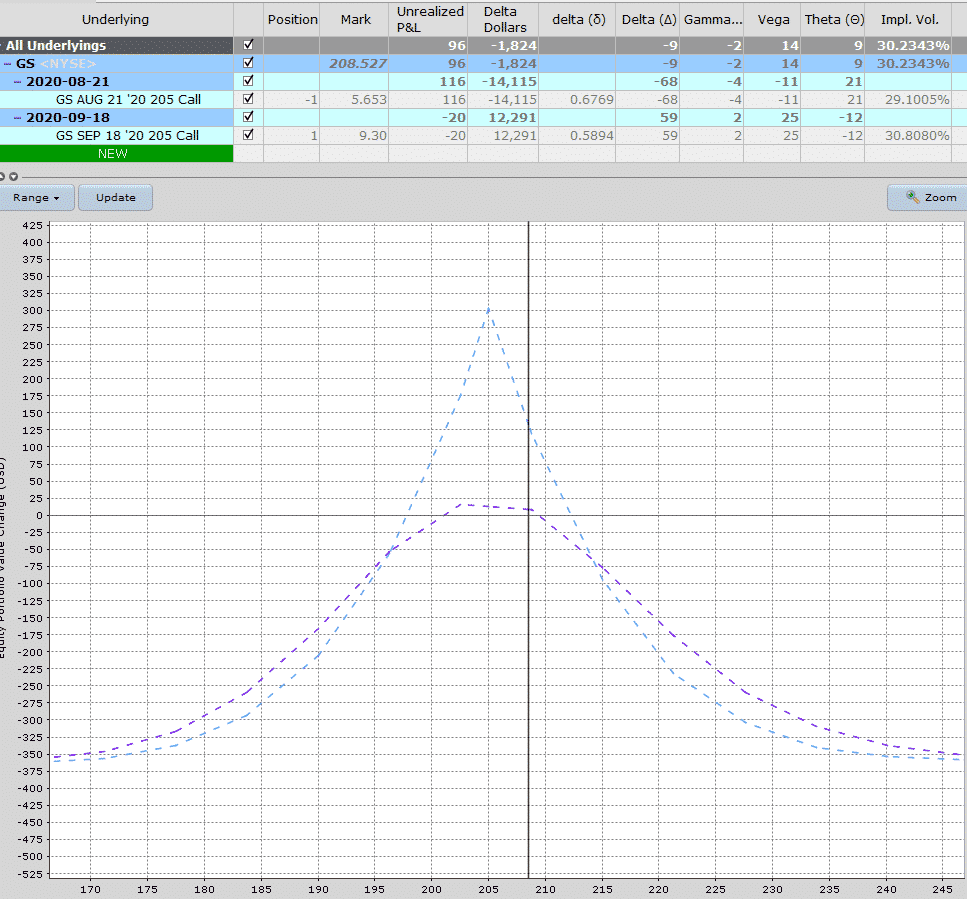

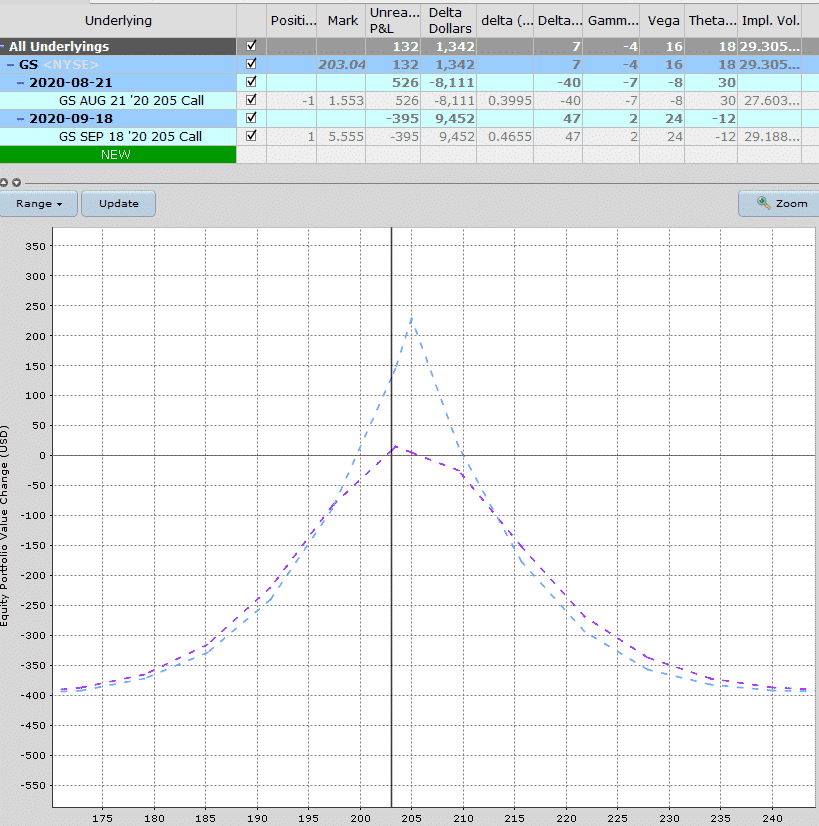

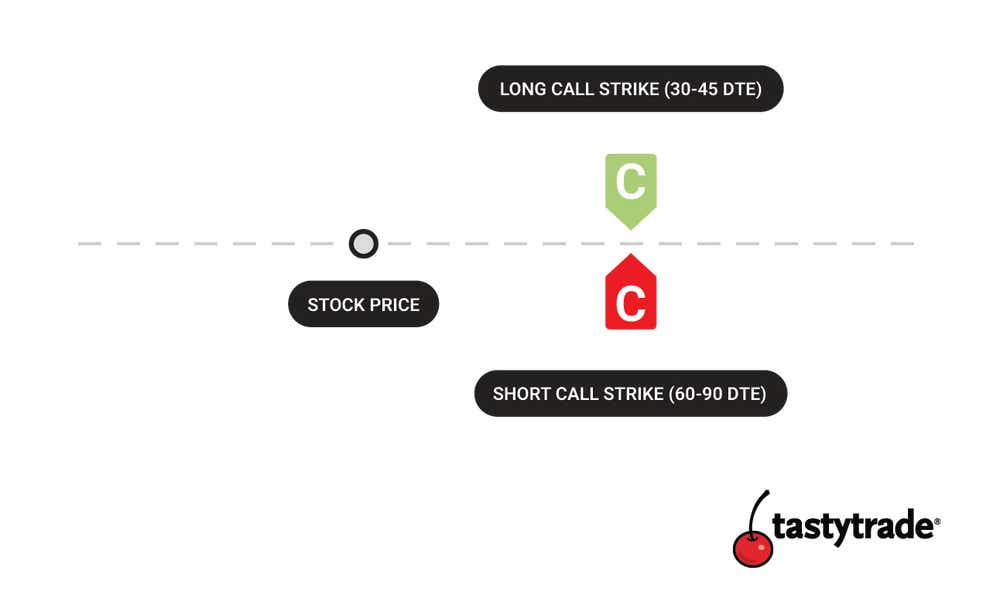

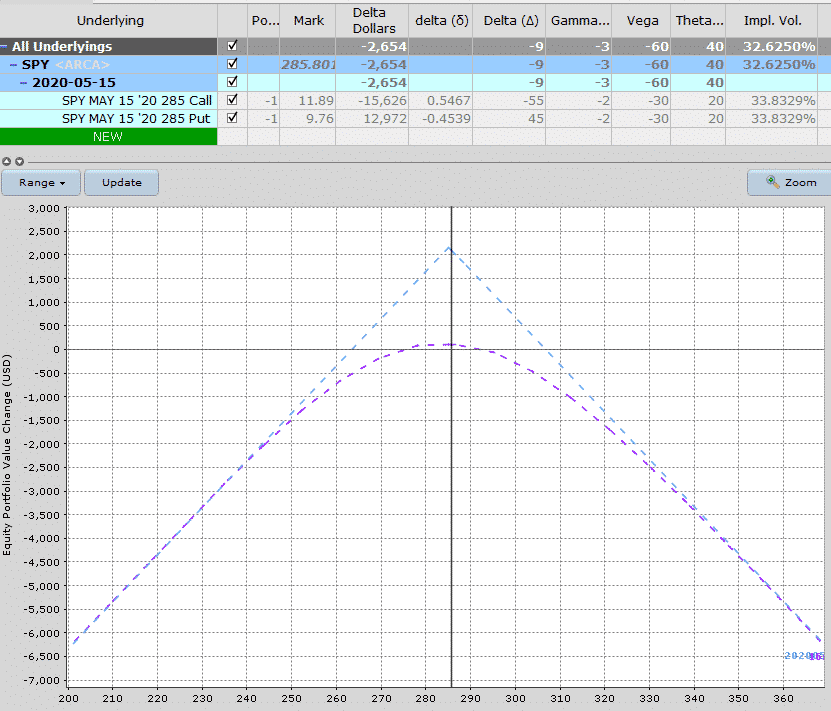

Short Calendar Spread - Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously. Web the calendar spread. Web september 25, 2024 advanced. Web calendar spread definition. Web die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. Web how to set up a put calendar spread. Web learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Short selling involves the sale of borrowed shares in the hope of profiting from a decline in the stock price. This strategy can profit from a stock move or a volatility change,.

Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long put. Web die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. You make money when the stock. Web september 25, 2024 advanced. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously. Web learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Web calendar spread definition. Web a calendar spread is a strategy used in options and futures trading: Web in diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich gewinnbringend einsetzen können. Web the calendar spread.

Short selling involves the sale of borrowed shares in the hope of profiting from a decline in the stock price. Web september 25, 2024 advanced. Calculate the fair value of current month contract. You make money when the stock. Web learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long put. It's risky, but it also adds to market. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously. In addition to selling a call with strike a, you’re buying the cheaper call with strike b to limit your risk if the stock goes up. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call.

Calendar Spreads 101 Everything You Need To Know

Web the calendar spread. Web a calendar spread is a strategy used in options and futures trading: Short selling involves the sale of borrowed shares in the hope of profiting from a decline in the stock price. Web calendar spread definition. Calculate the fair value of current month contract.

Short Put Calendar Spread Printable Calendars AT A GLANCE

Short selling involves the sale of borrowed shares in the hope of profiting from a decline in the stock price. Web learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Entering into a calendar spread simply involves buying a call or put option for.

Short Calendar Spread

This strategy can profit from a stock move or a volatility change,. Web in diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich gewinnbringend einsetzen können. Web ein short calendar spread ist eine optionsstrategie, bei der du optionen mit unterschiedlichen verfallsterminen handelst. The ideal forecast, therefore, is for a “big stock price change.

How to Trade Options Calendar Spreads (Visuals and Examples)

It's risky, but it also adds to market. Web die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. Short selling involves the sale of borrowed shares in the hope of profiting from a decline in the stock price. Web a calendar spread allows option traders to take advantage of.

Calendar Spreads 101 Everything You Need To Know

Short selling involves the sale of borrowed shares in the hope of profiting from a decline in the stock price. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Web in diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich.

Calendar Spread What is a Calendar Spread Option? tastytrade

Web how to set up a put calendar spread. It's risky, but it also adds to market. Das verfallsdatum der verkauften put. Web september 25, 2024 advanced. Web learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

Calendar Spreads 101 Everything You Need To Know

Web die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. Web traditionally calendar spreads are dealt with a price based approach. Short selling involves the sale of borrowed shares in the hope of profiting from a decline in the stock price. Web ein short calendar spread ist eine optionsstrategie,.

How to Profit with a Short Calendar Spread Options Cafe

Web a calendar spread is a strategy used in options and futures trading: Web the calendar spread. Web a short call spread is an alternative to the short call. Web in diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich gewinnbringend einsetzen können. Web september 25, 2024 advanced.

Calendar Spread Options Strategy Steady Options

Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long put. You make money when the stock. Calculate the fair value of current month contract. Web calendar spread definition. Web ein short calendar spread ist eine optionsstrategie, bei.

Calendar Spreads in Futures and Options Trading Explained

You make money when the stock. Web a calendar spread is a strategy used in options and futures trading: Web calendar spread definition. The ideal forecast, therefore, is for a “big stock price change when the direction of the change could be. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short.

Web A Calendar Spread Is A Strategy Used In Options And Futures Trading:

You make money when the stock. Short selling involves the sale of borrowed shares in the hope of profiting from a decline in the stock price. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. Das verfallsdatum der verkauften put.

Entering Into A Calendar Spread Simply Involves Buying A Call Or Put Option For An Expiration Month That's Further Out While Simultaneously.

Web september 25, 2024 advanced. This strategy can profit from a stock move or a volatility change,. Web the calendar spread. Calculate the fair value of current month contract.

Web A Short Call Spread Is An Alternative To The Short Call.

It's risky, but it also adds to market. Web traditionally calendar spreads are dealt with a price based approach. Web calendar spread definition. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call.

Web Learn How To Use A Short Calendar Call Spread To Profit From A Volatile Market When You Are Unsure Of The Direction Of Price Movement.

Web in diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich gewinnbringend einsetzen können. Web die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. The ideal forecast, therefore, is for a “big stock price change when the direction of the change could be. This strategy involves buying and.

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)