Should I Form An Llc For Rental Property

Should I Form An Llc For Rental Property - You can start an s corp when you form your llc. However, if you were to incorporate in another state — say, california — it would cost you $800 per year. Only you can make the final decision about whether or not to make an llc for managing rental properties. Though it may cost exponentially more, some landlords prefer to set up a separate llc for each. One of the main reasons that many property owners create an llc is that it limits their personal. Web speaking of cost, the process of forming an llc can be fairly expensive. An llc works a lot like an umbrella: Keep your rental properties separate from each other. If you own your property as an individual and someone files a lawsuit against you,. Web benefits of an llc for rental properties personal liability.

We estimate that if a property rental business owner can pay themselves a reasonable salary and at least $10,000 in distributions each year, they could benefit from s corp status. Keep your rental properties separate from each other. In the state of texas, the cost of filing for a texas llc certificate of formation is currently $300. Web to offset these costs, you'd need to be saving about $2,000 a year on taxes. Still, most experienced landlords find that an llc creates peace of mind and a. You can start an s corp when you form your llc. In addition to separating the rental property from. Web the biggest benefit of creating an llc for your rental property is that it can insulate you from personal liability. It’s easy to set up, easy to use, and protects you from being exposed. Web setting up an llc for rental property may be the best choice if you are currently a property owner or are looking to start an airbnb.

We estimate that if a property rental business owner can pay themselves a reasonable salary and at least $10,000 in distributions each year, they could benefit from s corp status. Web benefits of an llc for rental properties personal liability. An llc works a lot like an umbrella: Keep your rental properties separate from each other. Web setting up an llc for rental property may be the best choice if you are currently a property owner or are looking to start an airbnb. Web updated july 19, 2023 · 4min read pros cons how legalzoom can help you start an llc limited liability companies have become one of the most popular business entities for acquiring real estate. Web should i create an llc for my rental property? If you own your property as an individual and someone files a lawsuit against you,. Web the biggest benefit of creating an llc for your rental property is that it can insulate you from personal liability. In the state of texas, the cost of filing for a texas llc certificate of formation is currently $300.

Should I Form an LLC for Blog? (Lawyer Tips)

One of the main reasons that many property owners create an llc is that it limits their personal. We estimate that if a property rental business owner can pay themselves a reasonable salary and at least $10,000 in distributions each year, they could benefit from s corp status. Web setting up an llc for rental property may be the best.

Why You Should Form an LLC (Explained in 45 Seconds) Lawyers Rock

An llc works a lot like an umbrella: However, if you were to incorporate in another state — say, california — it would cost you $800 per year. Though it may cost exponentially more, some landlords prefer to set up a separate llc for each. In addition to separating the rental property from. Web to offset these costs, you'd need.

Should I Use an LLC for Rental Property 8 Key Questions & Answers

One of the main reasons that many property owners create an llc is that it limits their personal. It’s easy to set up, easy to use, and protects you from being exposed. Web benefits of an llc for rental properties personal liability. Web updated july 19, 2023 · 4min read pros cons how legalzoom can help you start an llc.

Should I Form An LLC? 5 Reasons Why It's A Great Idea

Keep your rental properties separate from each other. Web updated july 19, 2023 · 4min read pros cons how legalzoom can help you start an llc limited liability companies have become one of the most popular business entities for acquiring real estate. You can start an s corp when you form your llc. However, if you were to incorporate in.

Pin on Tellus Blog

Web updated july 19, 2023 · 4min read pros cons how legalzoom can help you start an llc limited liability companies have become one of the most popular business entities for acquiring real estate. In addition to separating the rental property from. It’s easy to set up, easy to use, and protects you from being exposed. Web what are the.

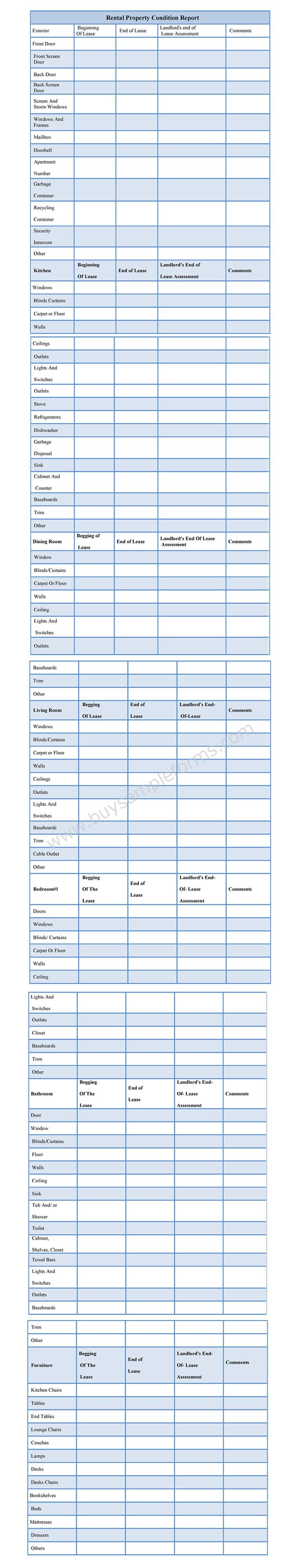

Rental Property Condition Report Form Sample Forms

Web benefits of an llc for rental properties personal liability. Though it may cost exponentially more, some landlords prefer to set up a separate llc for each. Only you can make the final decision about whether or not to make an llc for managing rental properties. It’s easy to set up, easy to use, and protects you from being exposed..

How to Form a LLC (Stepbystep Guide) Community Tax

This is an important distinction for both liability and taxation, as we’ll see shortly. Still, most experienced landlords find that an llc creates peace of mind and a. Web speaking of cost, the process of forming an llc can be fairly expensive. You can start an s corp when you form your llc. If you own your property as an.

Should You Form an LLC for Your Rental Property? Tellus Talk

We estimate that if a property rental business owner can pay themselves a reasonable salary and at least $10,000 in distributions each year, they could benefit from s corp status. Web benefits of an llc for rental properties personal liability. In the state of texas, the cost of filing for a texas llc certificate of formation is currently $300. Yes,.

Why You Should Form an LLC (Explained in 45 Seconds)

Web should i create an llc for my rental property? You can start an s corp when you form your llc. Web to offset these costs, you'd need to be saving about $2,000 a year on taxes. In the state of texas, the cost of filing for a texas llc certificate of formation is currently $300. This is an important.

Should You Create An LLC For Rental Property? Pros And Cons New Silver

If you own your property as an individual and someone files a lawsuit against you,. This is an important distinction for both liability and taxation, as we’ll see shortly. One of the main reasons that many property owners create an llc is that it limits their personal. Only you can make the final decision about whether or not to make.

This Is An Important Distinction For Both Liability And Taxation, As We’ll See Shortly.

We estimate that if a property rental business owner can pay themselves a reasonable salary and at least $10,000 in distributions each year, they could benefit from s corp status. In the state of texas, the cost of filing for a texas llc certificate of formation is currently $300. An llc works a lot like an umbrella: You can start an s corp when you form your llc.

Web Benefits Of An Llc For Rental Properties Personal Liability.

However, if you were to incorporate in another state — say, california — it would cost you $800 per year. Web updated july 19, 2023 · 4min read pros cons how legalzoom can help you start an llc limited liability companies have become one of the most popular business entities for acquiring real estate. One of the main reasons that many property owners create an llc is that it limits their personal. Web the biggest benefit of creating an llc for your rental property is that it can insulate you from personal liability.

Web Speaking Of Cost, The Process Of Forming An Llc Can Be Fairly Expensive.

Web setting up an llc for rental property may be the best choice if you are currently a property owner or are looking to start an airbnb. In addition to separating the rental property from. Web should i create an llc for my rental property? Only you can make the final decision about whether or not to make an llc for managing rental properties.

Web To Offset These Costs, You'd Need To Be Saving About $2,000 A Year On Taxes.

Still, most experienced landlords find that an llc creates peace of mind and a. Web what are the benefits of creating an llc for your rental property? Though it may cost exponentially more, some landlords prefer to set up a separate llc for each. Keep your rental properties separate from each other.