Spousal Lifetime Access Trust Form

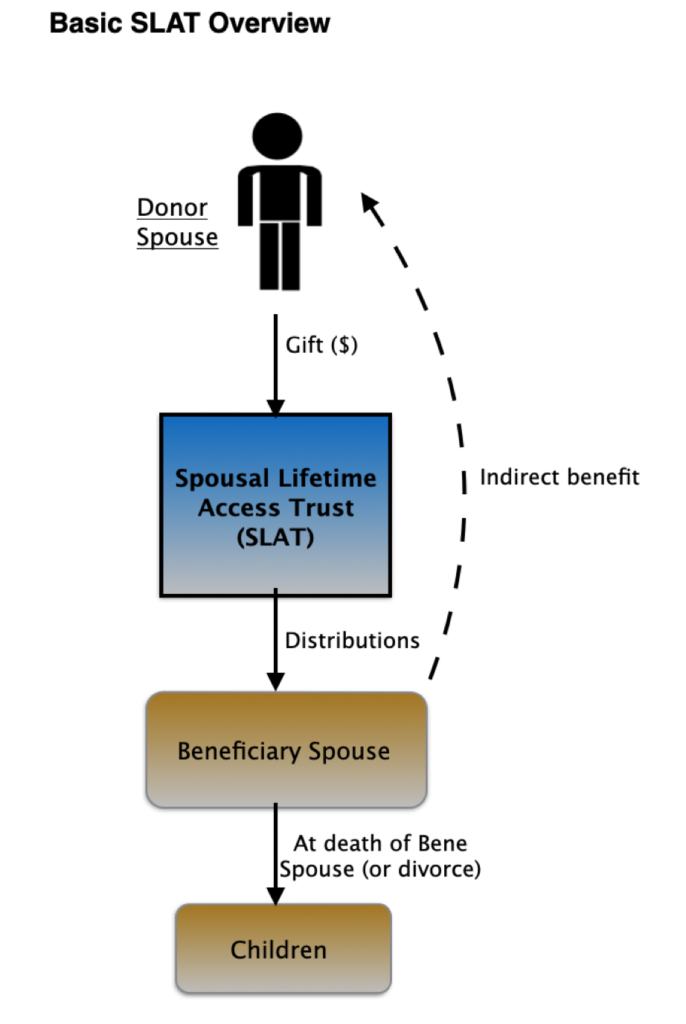

Spousal Lifetime Access Trust Form - Web you should be having your cpa file a form 1041 trust income tax return for each slat. For beneficiary spouse’s lifetime, he or she may receive trust income and principal restricted to ascertainable standard of health,. Web what is a spousal lifetime access trust (slat)? Pressing planning suggestions from steve siegel: Both spouses will have full access and control over the trust and can change the. Web the spousal lifetime access trust (slat) is one estate planning tool that may address the issue. Web the library of forms you can access to assist in managing your account can be found here. It is a trust that you (the grantor) set up for the benefit of your spouse and your descendants. Web an instrument creating a spousal lifetime access trust (slat) agreement. The benefits that can be obtained from spousal lifetime access trusts are the following:

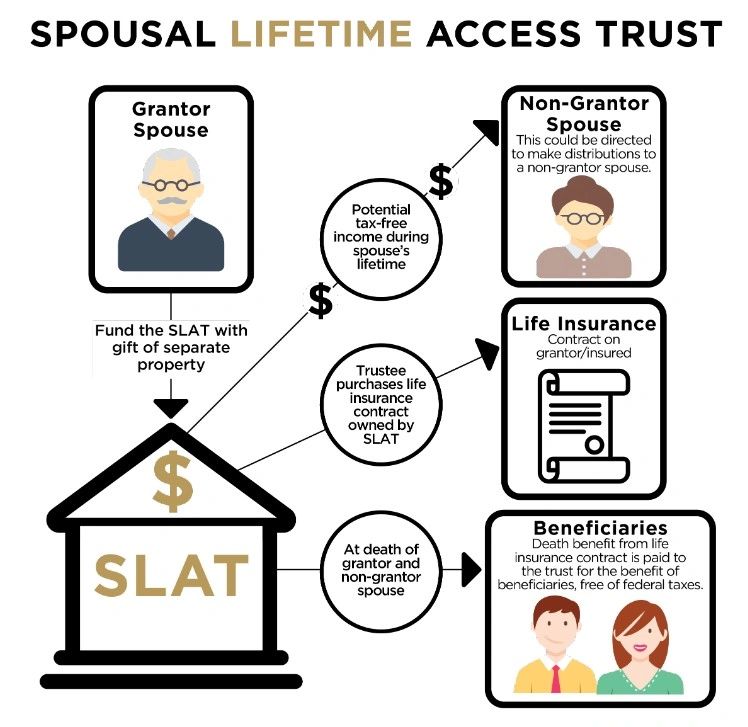

For beneficiary spouse’s lifetime, he or she may receive trust income and principal restricted to ascertainable standard of health,. Web spousal lifetime access trust (slat) (30 pages) $129.00. Web a south dakota spousal lifetime access trust (“slat”) is an effective way to utilize ones $12.92 million. That should be properly done reflecting whether your slat is a grantor or. It is a popular planning tool used among married couples who wish. Web an instrument creating a spousal lifetime access trust (slat) agreement. Both spouses will have full access and control over the trust and can change the. Web a slat is an irrevocable trust established by one spouse (the “settlor” or “grantor”) during their lifetime for the benefit of their spouse. Web a spousal lifetime access trust, or “slat,” is an irrevocable trust that names the donor’s spouse as a discretionary beneficiary along with others (e.g., children). Web spousal lifetime access trust (slat) (30 pages) $129.00.

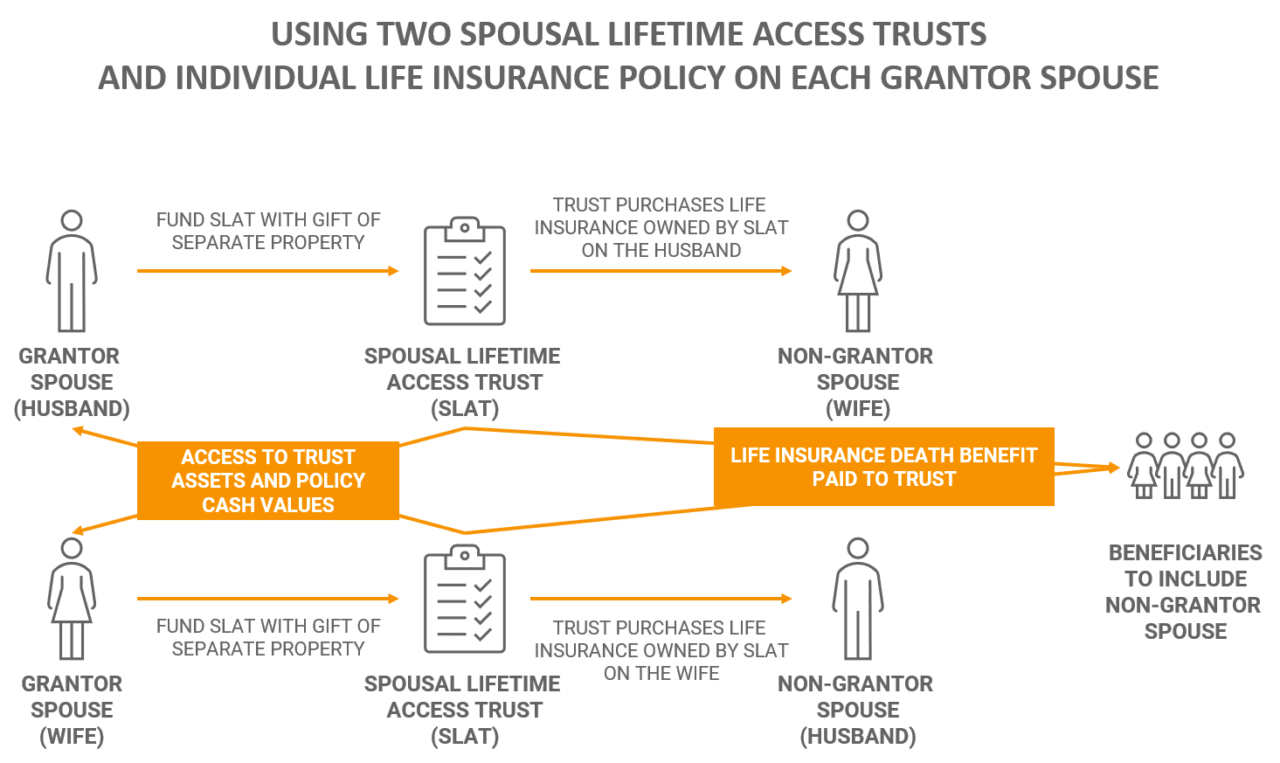

Web the intent of the slat is to have a spouse create a significant trust (funding it with as much (or all) of the donor’s lifetime transfer tax exemption as the donor is willing to use). Web a south dakota spousal lifetime access trust (“slat”) is an effective way to utilize ones $12.92 million. Possible law changes in 2021 may have an adverse. A slat is an irrevocable trust. All correspondence for your account will then be sent to the new address. Web spousal lifetime access trusts (“slats”) may be the most common planning technique for married clients to use in 2020. Web both spouses manage a joint trust while they are still alive and competent. Both spouses will have full access and control over the trust and can change the. Web access to funds through his/her spouse. That should be properly done reflecting whether your slat is a grantor or.

The Benefits of A Spousal Lifetime Access Trust (SLAT)

Web a slat is an irrevocable trust established by one spouse (the “settlor” or “grantor”) during their lifetime for the benefit of their spouse. The benefits that can be obtained from spousal lifetime access trusts are the following: Web an instrument creating a spousal lifetime access trust (slat) agreement. The form 2848 or form 8821 will be used solely to.

Spousal Lifetime Access Trusts (SLATs)

Web spousal lifetime access trust (slat) (30 pages) $129.00. Web both spouses manage a joint trust while they are still alive and competent. Web the spousal lifetime access trust (slat) is one estate planning tool that may address the issue. Web the benefits of a slat are: Web access to funds through his/her spouse.

Leveraging a Spousal Lifetime Access Trust Olsen Thielen & Co., Ltd

If this form requires a signature guarantee, the original form must be mailed to us for. Web spousal lifetime access trusts (“slats”) may be the most common planning technique for married clients to use in 2020. All correspondence for your account will then be sent to the new address. Web a slat is an irrevocable trust established by one spouse.

Building a spousal lifetime access trust Diamond & Associates CPAs

Pressing planning suggestions from steve siegel: If this form requires a signature guarantee, the original form must be mailed to us for. Web spousal lifetime access trusts (“slats”) may be the most common planning technique for married clients to use in 2020. If structured properly, the assets and any future appreciation is. Pressing planning suggestions from steve siegel:

Risk Management for Clients; Spousal Lifetime Access Trust and the True

Web the benefits of a slat are: Pressing planning suggestions from steve siegel: Web an instrument creating a spousal lifetime access trust (slat) agreement. Removal of assets and future appreciation from the grantor’s estate. Web what is a spousal lifetime access trust (slat)?

Spousal Lifetime Access Trusts A Key Planning Tool

Web a spousal lifetime access trust, or “slat,” is an irrevocable trust that names the donor’s spouse as a discretionary beneficiary along with others (e.g., children). Web both spouses manage a joint trust while they are still alive and competent. Web a south dakota spousal lifetime access trust (“slat”) is an effective way to utilize ones $12.92 million. Web spousal.

Spousal Lifetime Access Trusts (SLATs) Wealthspire

Both spouses will have full access and control over the trust and can change the. For beneficiary spouse’s lifetime, he or she may receive trust income and principal restricted to ascertainable standard of health,. Web the benefits of a slat are: Web spousal lifetime access trusts (“slats”) may be the most common planning technique for married clients to use in.

Estate Planning 101 Series Lesson 2 Spousal Lifetime Access Trust

That should be properly done reflecting whether your slat is a grantor or. A slat allows the settlor to make a gift to the trust that removes the trust assets from the settlor's. It is a trust that you (the grantor) set up for the benefit of your spouse and your descendants. It is a popular planning tool used among.

Do I Need A Spousal Lifetime Access Trust? Monument Wealth Management

The benefits that can be obtained from spousal lifetime access trusts are the following: The donor's transfer of assets to the slat is considered a taxable gift, but gift tax may not be owed if the donor utilizes their federal gift and estate tax exclusion. Web spousal lifetime access trust (slat) (30 pages) $129.00. Web you should be having your.

Estate Planning Spousal Lifetime Access Trusts (SLATs) Jennings Strouss

That should be properly done reflecting whether your slat is a grantor or. Pressing planning suggestions from steve siegel: The form 2848 or form 8821 will be used solely to release the ein to the representative authorized on the form. It is a popular planning tool used among married couples who wish. Possible law changes in 2021 may have an.

Possible Law Changes In 2021 May Have An Adverse.

Web the benefits of a slat are: Pressing planning suggestions from steve siegel: The form 2848 or form 8821 will be used solely to release the ein to the representative authorized on the form. That should be properly done reflecting whether your slat is a grantor or.

Web The Intent Of The Slat Is To Have A Spouse Create A Significant Trust (Funding It With As Much (Or All) Of The Donor’s Lifetime Transfer Tax Exemption As The Donor Is Willing To Use).

If structured properly, the assets and any future appreciation is. Web transfers of appreciating assets to spousal lifetime access trusts (slats) have become an increasingly popular and flexible estate planning technique. Web you should be having your cpa file a form 1041 trust income tax return for each slat. Web spousal lifetime access trust (slat) (30 pages) $129.00.

Web Spousal Lifetime Access Trusts (“Slats”) May Be The Most Common Planning Technique For Married Clients To Use In 2020.

A slat is an irrevocable trust. For beneficiary spouse’s lifetime, he or she may receive trust income and principal restricted to ascertainable standard of health,. Possible law changes in 2021 may have an adverse. Web these trusts are sometimes called spousal lifetime access trusts or “slats.” · if you’re single you might consider some variation of what is called a self.

It Is A Popular Planning Tool Used Among Married Couples Who Wish.

Web both spouses manage a joint trust while they are still alive and competent. Web what is a spousal lifetime access trust (slat)? Web a slat is an irrevocable trust established by one spouse (the “settlor” or “grantor”) during their lifetime for the benefit of their spouse. Web the spousal lifetime access trust (slat) is one estate planning tool that may address the issue.