Ssa Form 1724

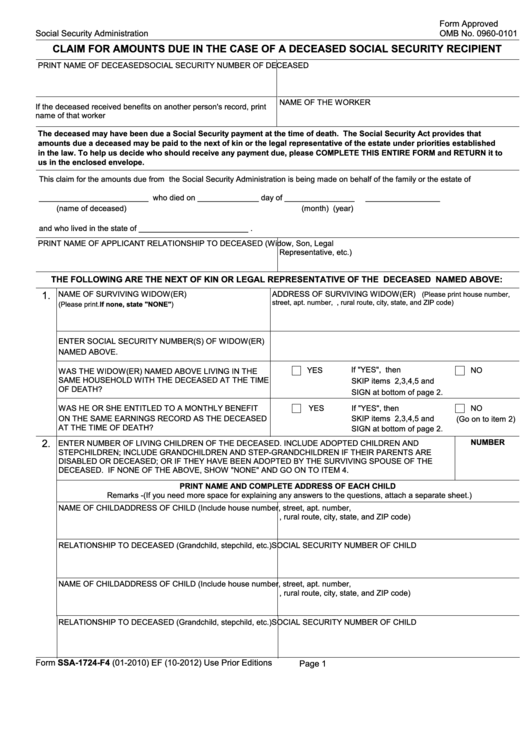

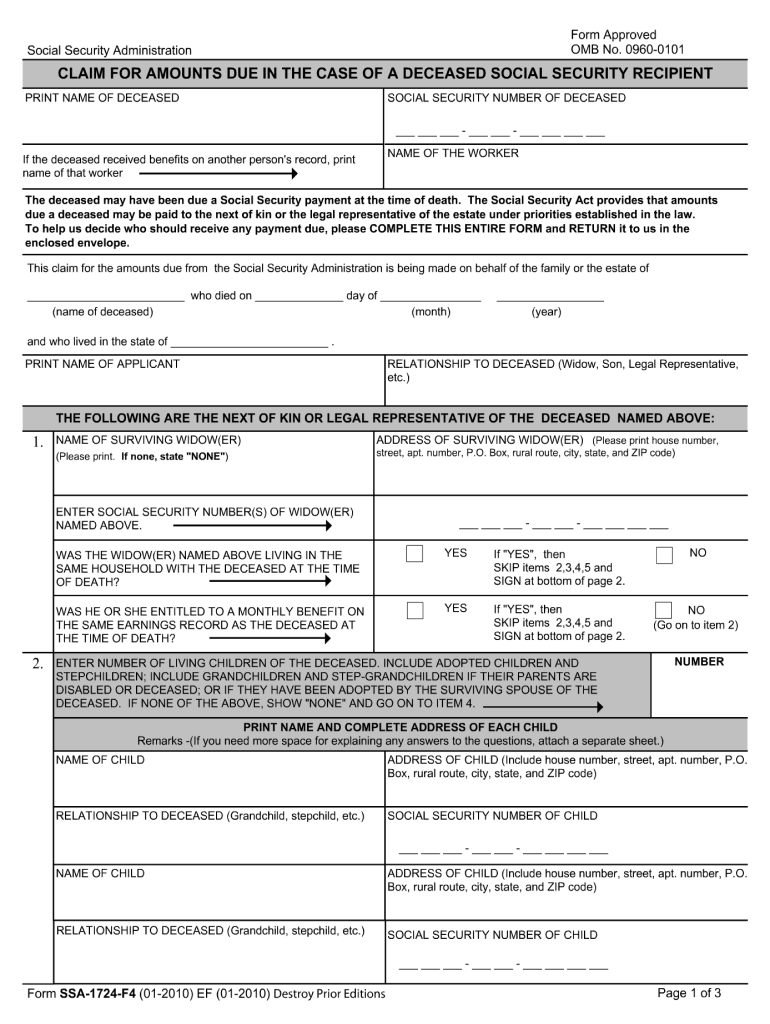

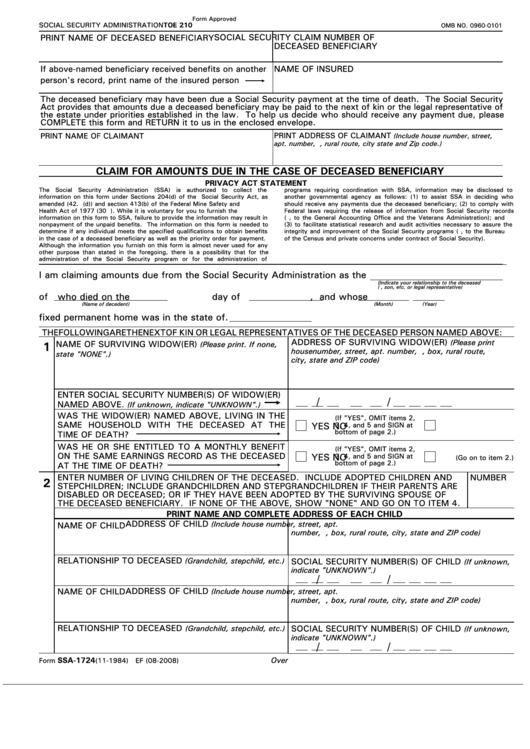

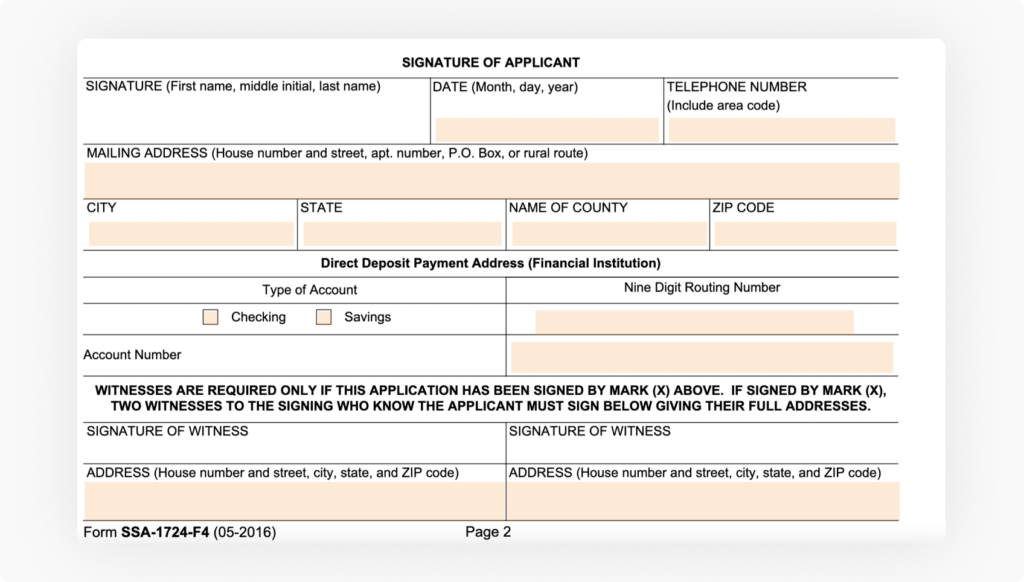

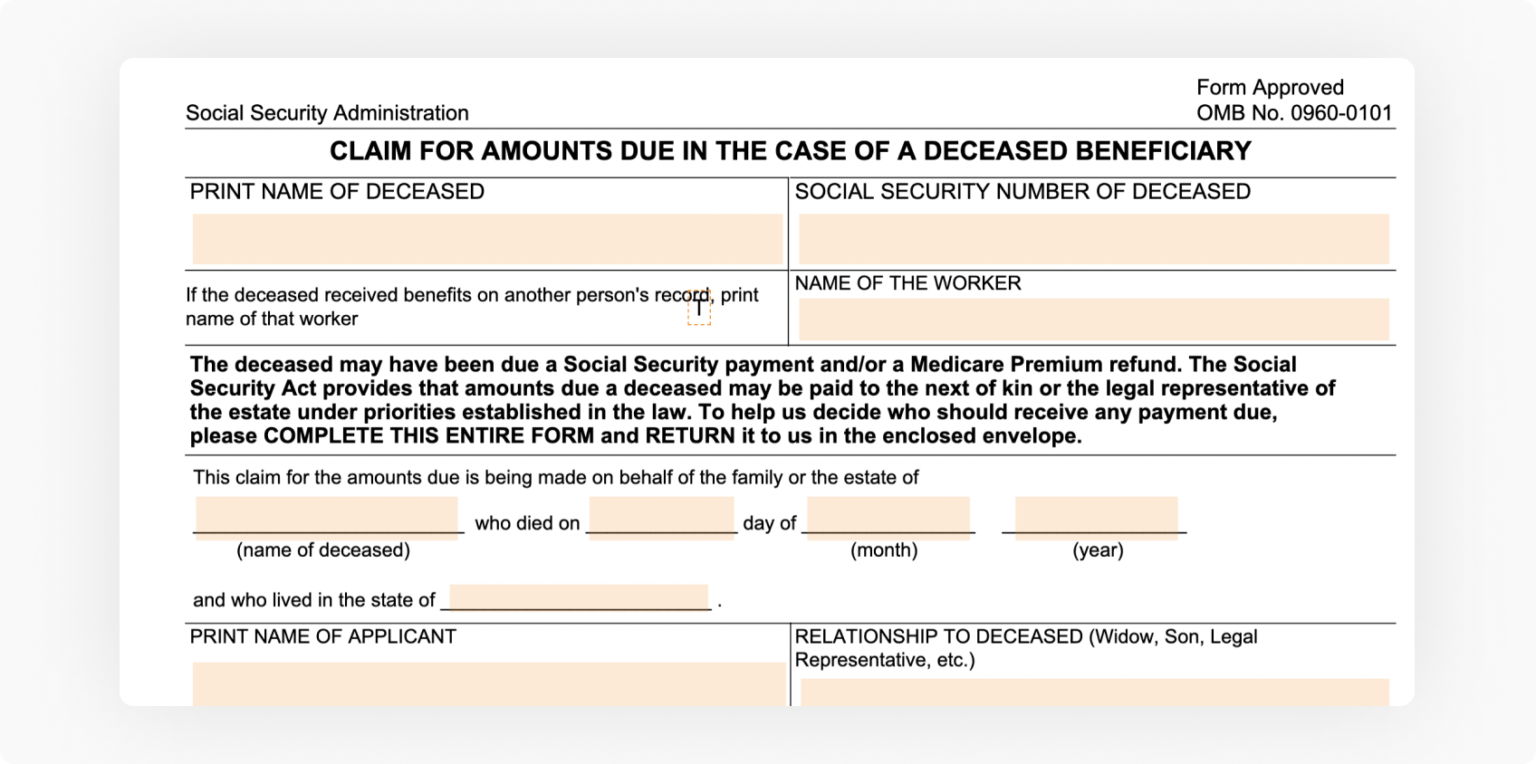

Ssa Form 1724 - Generally, it is the individual's legal next of kin who completes this form. If the deceased received benefits on another person's record, print. We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate. Where to send this form send the completed form to your local social security office. Not all forms are listed. Web all forms are free. If you download, print and complete a paper form, please mail or take it to your local social security. Web a deceased beneficiary may have been due a social security payment at the time of death. Claim for amounts due in the case of a deceased beneficiary. Web form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent before their death.

Print name of deceased social security number of deceased. If you download, print and complete a paper form, please mail or take it to your local social security. Where to send this form send the completed form to your local social security office. We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate. Not all forms are listed. Claim for amounts due in the case of a deceased beneficiary. Claim for amounts due in the case of deceased beneficiary. Web all forms are free. Keep in mind social security payments are for the previous month's benefit and are paid only if the recipient is alive for the full month. Generally, it is the individual's legal next of kin who completes this form.

If the deceased received benefits on another person's record, print. Claim for amounts due in the case of deceased beneficiary. We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate. Keep in mind social security payments are for the previous month's benefit and are paid only if the recipient is alive for the full month. Web a deceased beneficiary may have been due a social security payment at the time of death. Generally, it is the individual's legal next of kin who completes this form. Claim for amounts due in the case of a deceased beneficiary. Web form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent before their death. Web all forms are free. Print name of deceased social security number of deceased.

Fillable Form Ssa1724F4 Claim For Amounts Due In The Case Of A

Web all forms are free. If the deceased received benefits on another person's record, print. If you download, print and complete a paper form, please mail or take it to your local social security. Web a deceased beneficiary may have been due a social security payment at the time of death. Keep in mind social security payments are for the.

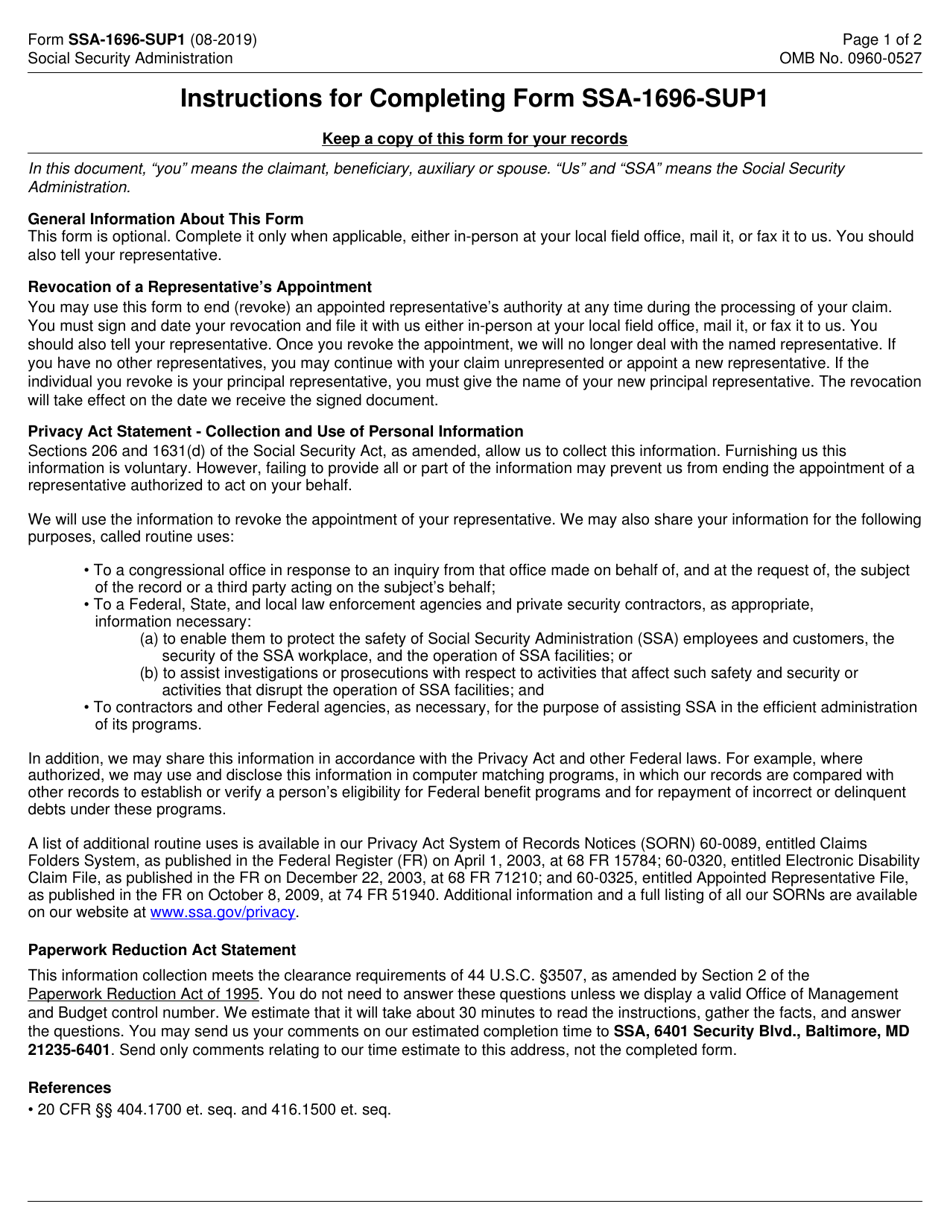

Form SSA1696 Supplement 1 Download Fillable PDF or Fill Online

Not all forms are listed. Web a deceased beneficiary may have been due a social security payment at the time of death. If the deceased received benefits on another person's record, print. Claim for amounts due in the case of deceased beneficiary. Generally, it is the individual's legal next of kin who completes this form.

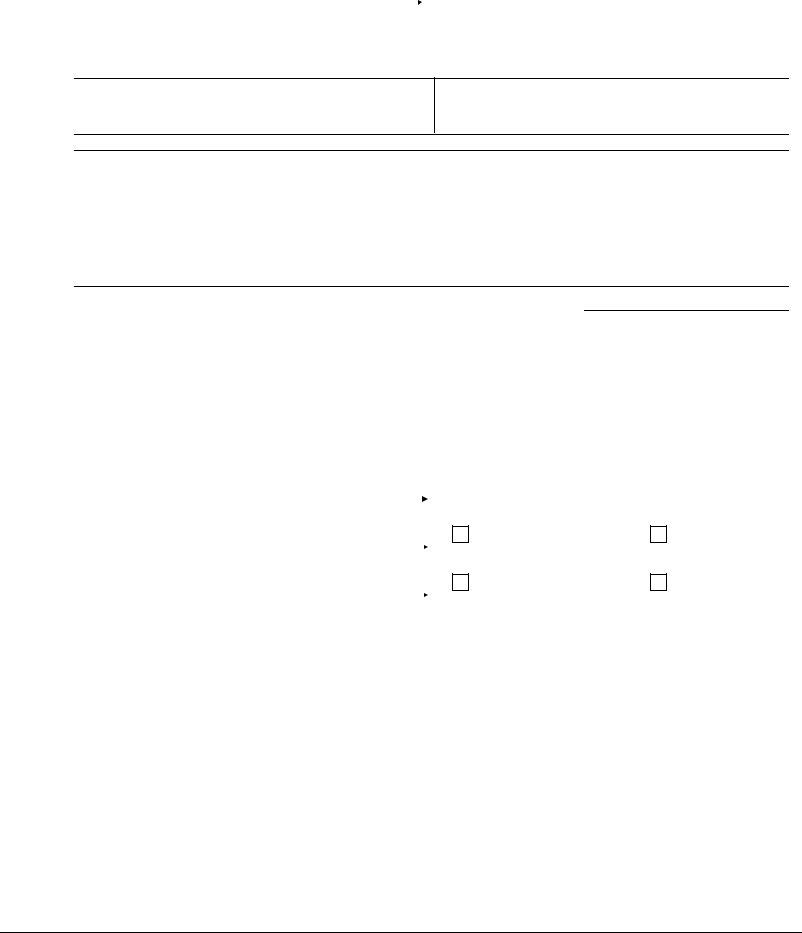

Form Ssa 1724 ≡ Fill Out Printable PDF Forms Online

Claim for amounts due in the case of deceased beneficiary. Where to send this form send the completed form to your local social security office. If you download, print and complete a paper form, please mail or take it to your local social security. Generally, it is the individual's legal next of kin who completes this form. Web form ssa.

Ssa 1724 Form ≡ Fill Out Printable PDF Forms Online

We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate. Print name of deceased social security number of deceased. Claim for amounts due in the case of deceased beneficiary. Web a deceased beneficiary may have been due a social security payment at the time of death. Keep in mind social security payments.

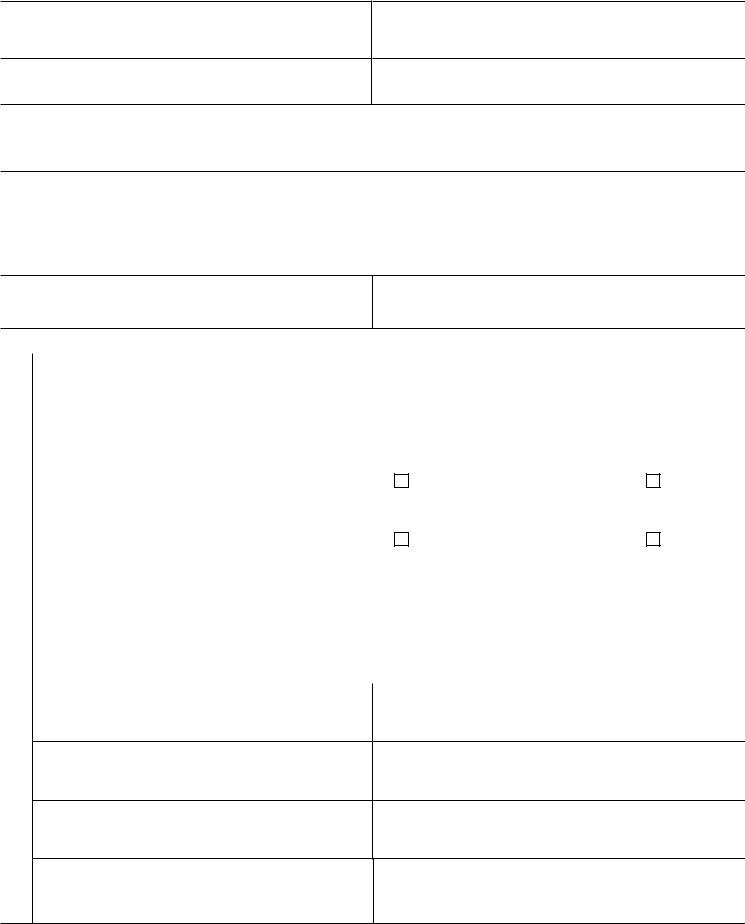

SSA1724F4 Claim for Amounts due in case of a Deceased Beneficiary

Keep in mind social security payments are for the previous month's benefit and are paid only if the recipient is alive for the full month. Web all forms are free. Web form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the.

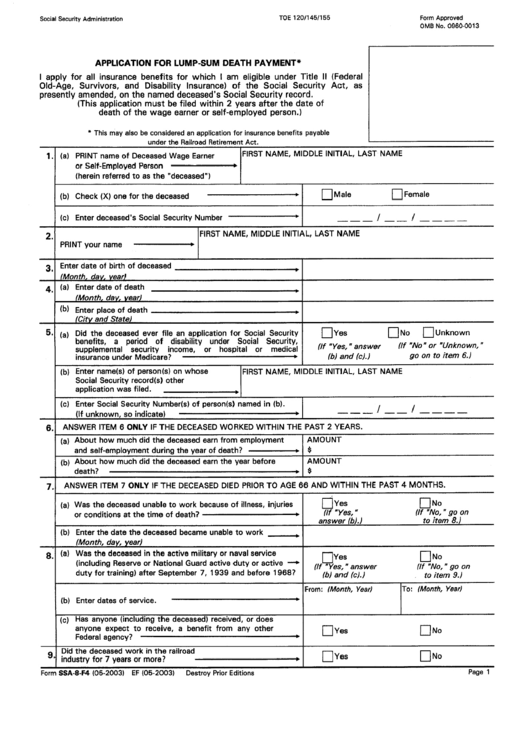

Form Ssa8F4 Application For LumpSum Death Payment printable pdf

Claim for amounts due in the case of deceased beneficiary. Claim for amounts due in the case of a deceased beneficiary. Web a deceased beneficiary may have been due a social security payment at the time of death. Print name of deceased social security number of deceased. Where to send this form send the completed form to your local social.

how do i complete form ssa 1724 2010 Fill out & sign online DocHub

Claim for amounts due in the case of a deceased beneficiary. Web all forms are free. Web form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent before their death. We may pay amounts due a deceased beneficiary to a.

Form Ssa1724 Claim For Amounts Due In The Case Of Deceased

Web a deceased beneficiary may have been due a social security payment at the time of death. Where to send this form send the completed form to your local social security office. If you download, print and complete a paper form, please mail or take it to your local social security. If the deceased received benefits on another person's record,.

Form SSA1724F4 Instructions to Follow pdfFiller Blog

Web a deceased beneficiary may have been due a social security payment at the time of death. Not all forms are listed. If you download, print and complete a paper form, please mail or take it to your local social security. Where to send this form send the completed form to your local social security office. Web form ssa 1724,.

Form SSA1724F4 Instructions to Follow pdfFiller Blog

Where to send this form send the completed form to your local social security office. Not all forms are listed. Print name of deceased social security number of deceased. Web all forms are free. We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate.

If The Deceased Received Benefits On Another Person's Record, Print.

Claim for amounts due in the case of deceased beneficiary. Where to send this form send the completed form to your local social security office. Web all forms are free. Keep in mind social security payments are for the previous month's benefit and are paid only if the recipient is alive for the full month.

Claim For Amounts Due In The Case Of A Deceased Beneficiary.

Web form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent before their death. We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate. If you download, print and complete a paper form, please mail or take it to your local social security. Not all forms are listed.

Print Name Of Deceased Social Security Number Of Deceased.

Web a deceased beneficiary may have been due a social security payment at the time of death. Generally, it is the individual's legal next of kin who completes this form.