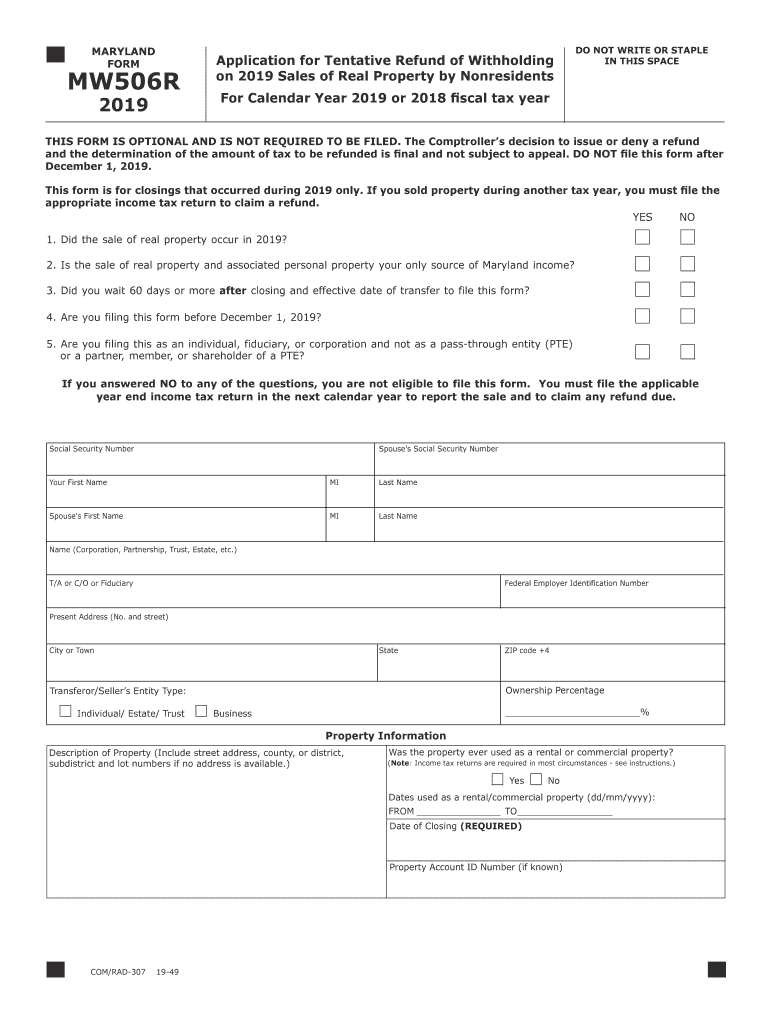

State Of Maryland Tax Extension Form

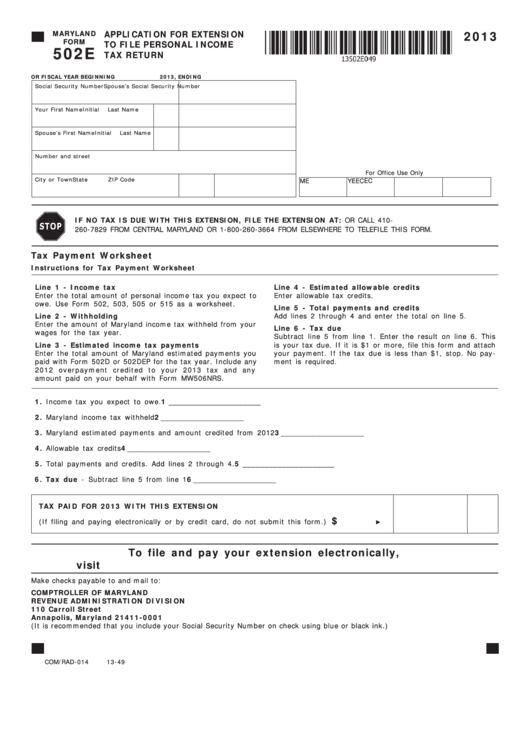

State Of Maryland Tax Extension Form - In order to use the online system you must meet the. For more information about the maryland income tax, see the maryland income tax page. Web the maryland state department of assessments and taxation (sdat) today announced the availability of 2022 annual reports, personal property tax returns, and. Form to be used when claiming dependents. Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. Web application for extension of time to file the maryland estate tax return for decedents dying after december 31, 2019 and before january 1, 2021. Web request an extension of time to file the extension request filing system allows businesses to instantly file for an extension online. Web of estimated tax paid with form 510/511d, mw506nrs, and any overpayment carried forward from the prior year (form 511). Web use form 502e to apply for an extension of time to file your taxes. View history of payments filed via this system.

Web individual taxes 2023 individual income tax forms 2023 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. Web of estimated tax paid with form 510/511d, mw506nrs, and any overpayment carried forward from the prior year (form 511). Web online payment application options. Web application for extension of time to file the maryland estate tax return for decedents dying after december 31, 2019 and before january 1, 2021. Web the maryland state department of assessments and taxation (sdat) today announced the availability of 2022 annual reports, personal property tax returns, and. Web maryland resident income tax return: Web request an extension of time to file the extension request filing system allows businesses to instantly file for an extension online. For more information about the maryland income tax, see the maryland income tax page. Web use form 502e to apply for an extension of time to file your taxes. Form to be used when claiming dependents.

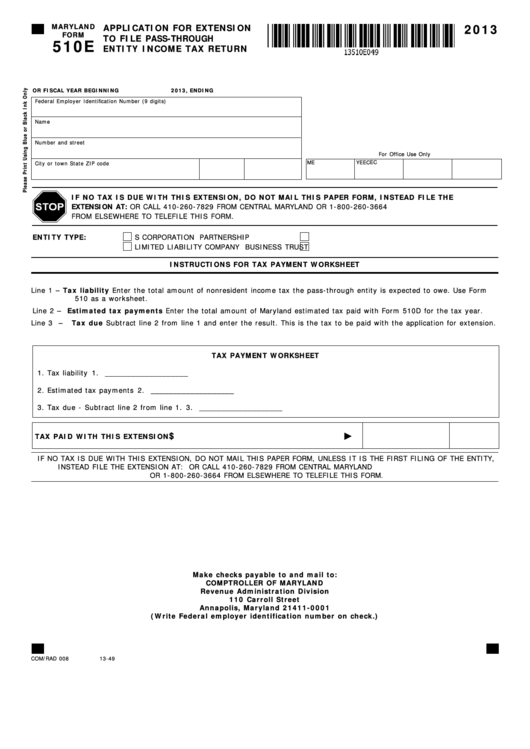

Web $34.95 now only $29.95 file your personal tax extension now! Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. Web individual taxes 2023 individual income tax forms 2023 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. Web the maryland state department of assessments and taxation (sdat) today announced the availability of 2022 annual reports, personal property tax returns, and. Form 402e is also used to pay the tax balance due for your maryland. Businesses can file the 500e or 510e. Maryland personal income tax returns are due by the 15th day of the 4th month following the close of the. Web application for extension of time to file the maryland estate tax return for decedents dying after december 31, 2019 and before january 1, 2021. Web of estimated tax paid with form 510/511d, mw506nrs, and any overpayment carried forward from the prior year (form 511). In order to use the online system you must meet the.

Down to the Wire Should You File For a Tax Extension?

Web an official website of the state of maryland. Web of estimated tax paid with form 510/511d, mw506nrs, and any overpayment carried forward from the prior year (form 511). Form 402e is also used to pay the tax balance due for your maryland. Web maryland resident income tax return: Web use form 502e to apply for an extension of time.

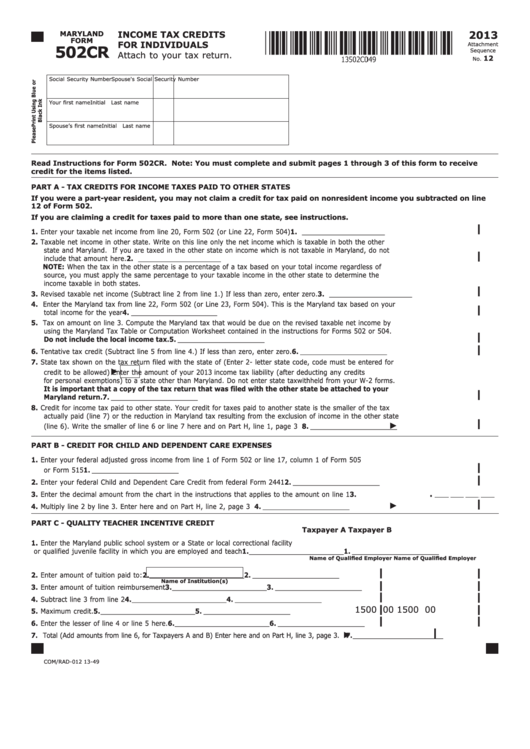

Fillable Maryland Form 502cr Tax Credits For Individuals

Marylanders now have until july 15, 2022, to file and pay 2021 state individual income taxes, comptroller peter franchot announced. Web of estimated tax paid with form 510/511d, mw506nrs, and any overpayment carried forward from the prior year (form 511). Web maryland department of assessments and taxation extension request application () we are sorry, the extension request application is closed.

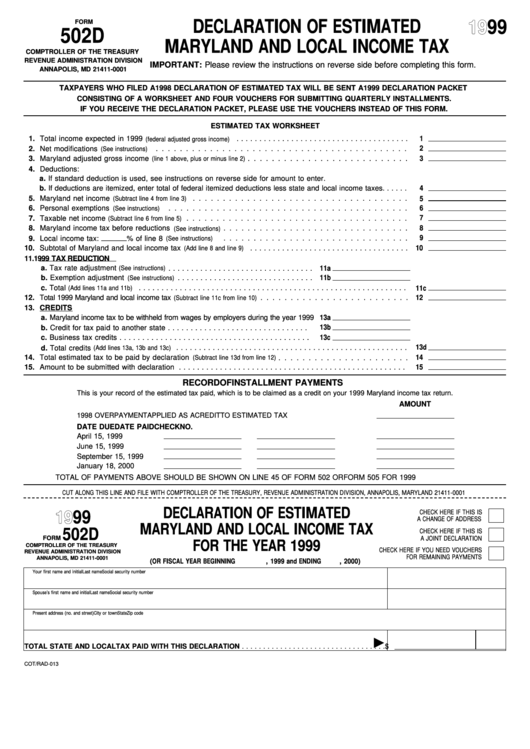

Fillable Form 502 D Declaration Of Estimated Maryland And Local

Web application for extension of time to file the maryland estate tax return for decedents dying after december 31, 2019 and before january 1, 2021. Web use form 502e to apply for an extension of time to file your taxes. Web maryland department of assessments and taxation extension request application () we are sorry, the extension request application is closed.

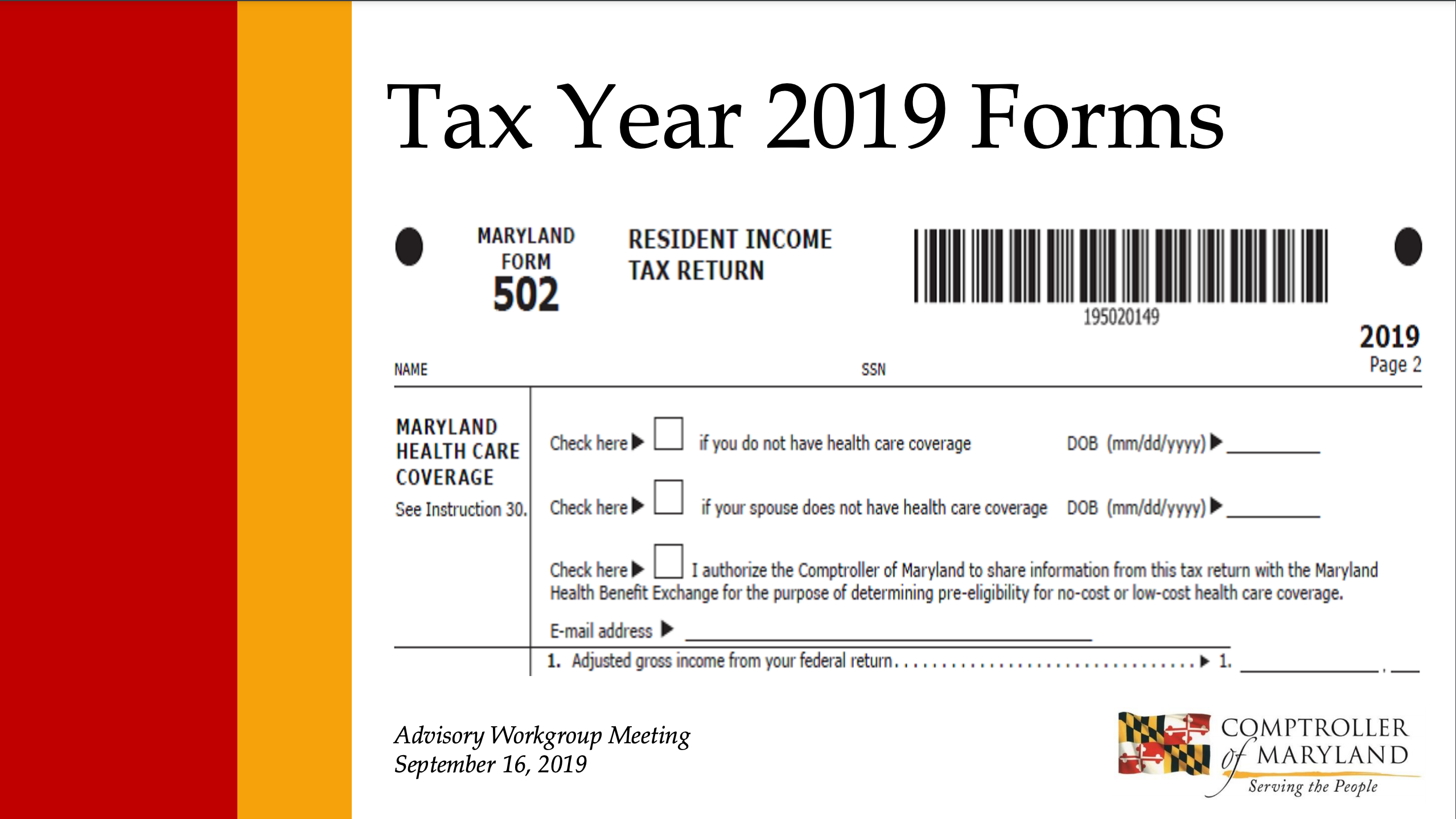

A Closer Look at Easy Enrollment GetInsured

Businesses can file the 500e or 510e. Web an official website of the state of maryland. Web the maryland state department of assessments and taxation (sdat) today announced the availability of 2022 annual reports, personal property tax returns, and. For more information about the maryland income tax, see the maryland income tax page. Web $34.95 now only $29.95 file your.

2012 Form MD 502D Fill Online, Printable, Fillable, Blank pdfFiller

Web maryland resident income tax return: Marylanders now have until july 15, 2022, to file and pay 2021 state individual income taxes, comptroller peter franchot announced. In order to use the online system you must meet the. Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. For more information about.

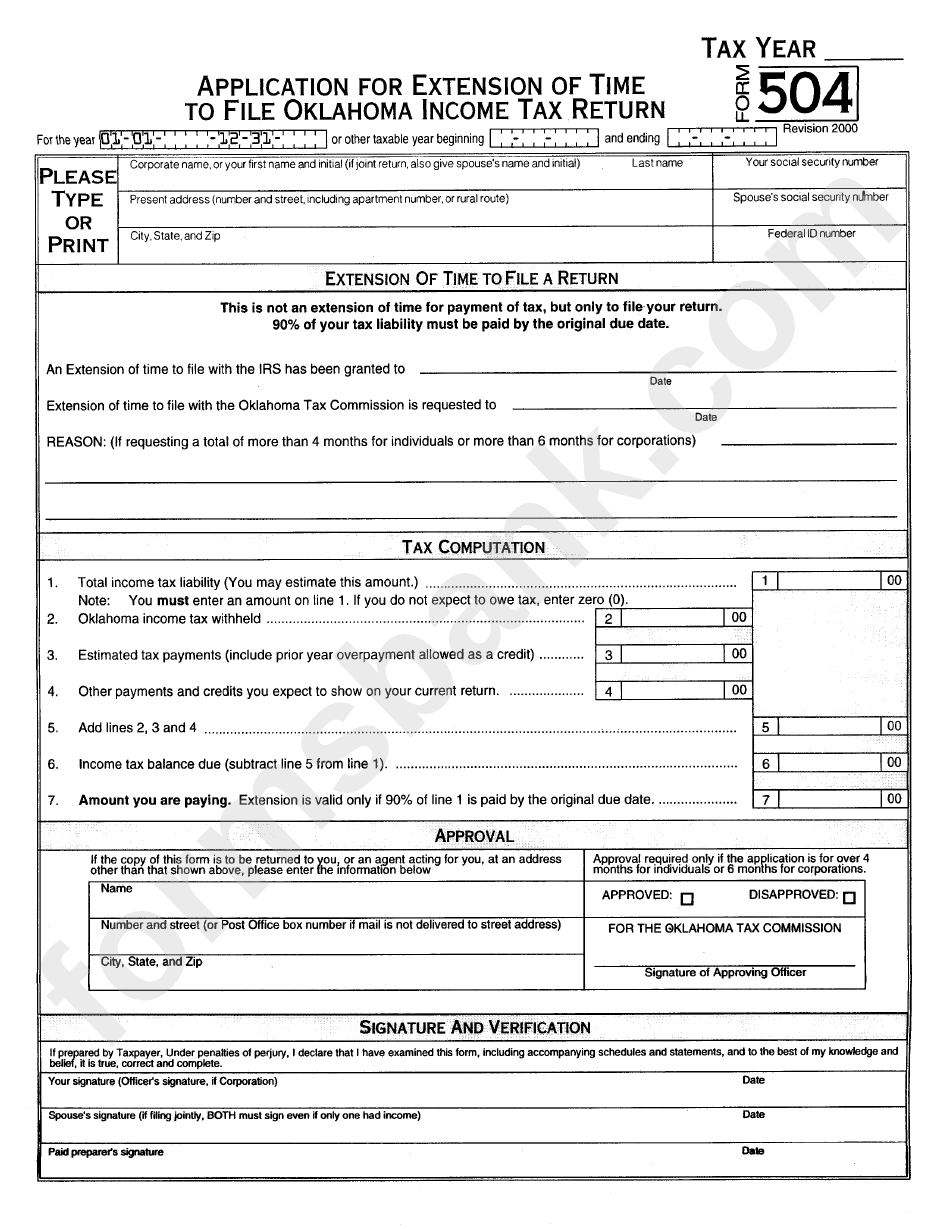

Form 504 Application For Extension Of Time To File Oklahoma

Web individual taxes 2023 individual income tax forms 2023 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. View history of payments filed via this system. Web application for extension of time to file the maryland estate tax return for decedents dying after december 31, 2019 and before january 1, 2021. In order.

Maryland Tax Forms 2021 2022 W4 Form

Web request an extension of time to file the extension request filing system allows businesses to instantly file for an extension online. Web $34.95 now only $29.95 file your personal tax extension now! Web application for extension of time to file the maryland estate tax return for decedents dying after december 31, 2019 and before january 1, 2021. Form to.

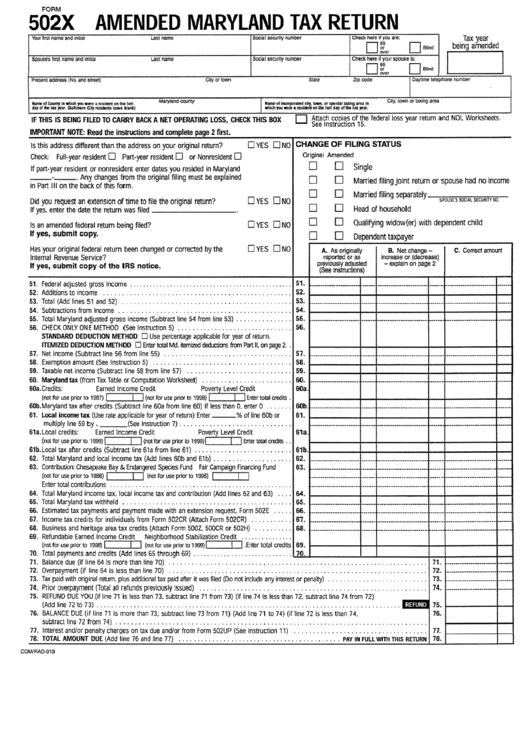

Form 502x Amended Maryland Tax Return printable pdf download

Web $34.95 now only $29.95 file your personal tax extension now! Web use form 502e to apply for an extension of time to file your taxes. Web an official website of the state of maryland. Web request an extension of time to file the extension request filing system allows businesses to instantly file for an extension online. Maryland personal income.

Fillable Maryland Form 502e Application For Extension To File

Marylanders now have until july 15, 2022, to file and pay 2021 state individual income taxes, comptroller peter franchot announced. View history of payments filed via this system. Web $34.95 now only $29.95 file your personal tax extension now! Web maryland resident income tax return: Web of estimated tax paid with form 510/511d, mw506nrs, and any overpayment carried forward from.

Fillable Maryland Form 510e Application For Extension To File Pass

Web online payment application options. Web an official website of the state of maryland. Web individual taxes 2023 individual income tax forms 2023 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. View history of payments filed via this system. Web application for extension of time to file the maryland estate tax return.

Web Maryland Department Of Assessments And Taxation Extension Request Application () We Are Sorry, The Extension Request Application Is Closed For Season.

Web online payment application options. Web the maryland state department of assessments and taxation (sdat) today announced the availability of 2022 annual reports, personal property tax returns, and. Web individual taxes 2023 individual income tax forms 2023 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. Web of estimated tax paid with form 510/511d, mw506nrs, and any overpayment carried forward from the prior year (form 511).

Maryland Personal Income Tax Returns Are Due By The 15Th Day Of The 4Th Month Following The Close Of The.

Web request an extension of time to file the extension request filing system allows businesses to instantly file for an extension online. Marylanders now have until july 15, 2022, to file and pay 2021 state individual income taxes, comptroller peter franchot announced. Form 402e is also used to pay the tax balance due for your maryland. Web an official website of the state of maryland.

In Order To Use The Online System You Must Meet The.

Web fy 2024 strategic goals. Web $34.95 now only $29.95 file your personal tax extension now! Web maryland resident income tax return: Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e.

Web Application For Extension Of Time To File The Maryland Estate Tax Return For Decedents Dying After December 31, 2019 And Before January 1, 2021.

Businesses can file the 500e or 510e. For more information about the maryland income tax, see the maryland income tax page. Form to be used when claiming dependents. View history of payments filed via this system.