State Tax Form Louisiana

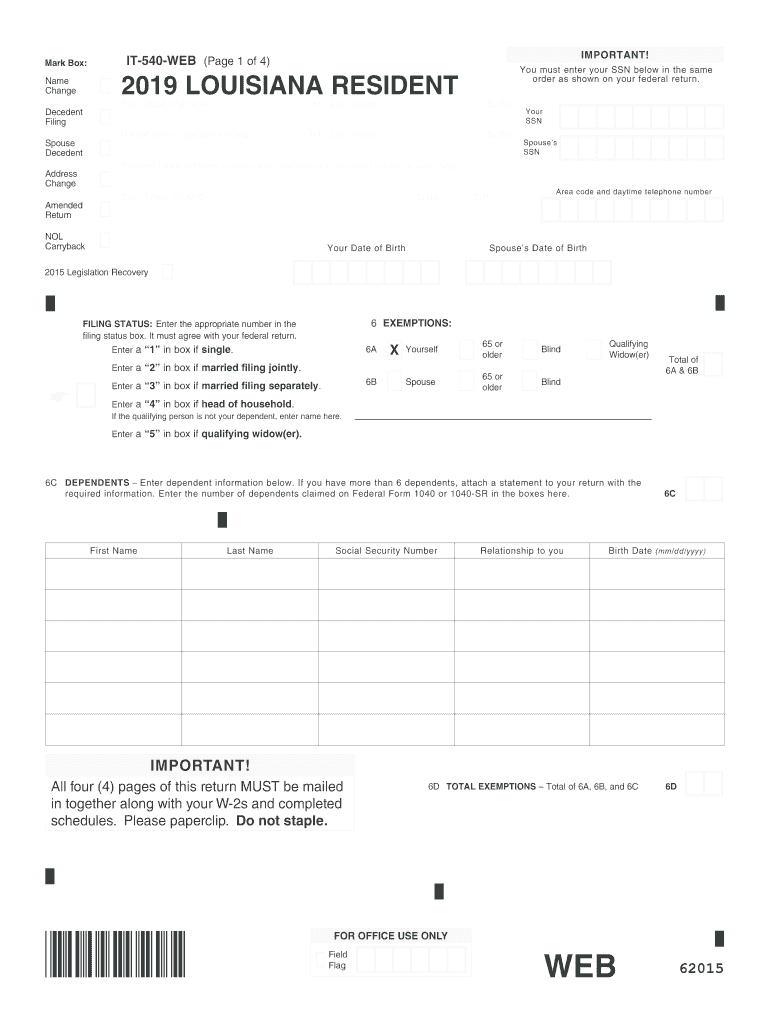

State Tax Form Louisiana - Web what’s new for louisiana 2022 individual income tax. Web your louisiana tax table income subtract lines 8c and 9 from line 7. We last updated louisiana form it540i from the department of revenue in january 2023. If you file this paper return, it will take up to 14 weeks to get your refund check. Web louisiana usually releases forms for the current tax year between january and april. Web when a corporation does business within and without louisiana, the louisiana franchise tax is imposed only on that part of the total taxable capital that is employed in louisiana. Web using louisiana file online and direct deposit, you can receive your refund within 30 days. New users for online filing in order to use the online tax filing application, you must have already filed a. Web where's my refund. Web louisiana has a state income tax that ranges between 2% and 6% , which is administered by the louisiana department of revenue.

Revenue.louisiana.gov/fileonline are you due a refund? Web where's my refund. Web the louisiana tax forms are listed by tax year below and all la back taxes for previous years would have to be mailed in. Request an individual income tax return. If you file this paper return, it will take up to 14 weeks to get your refund check. Web louisiana usually releases forms for the current tax year between january and april. Act 15 of the first extraordinary. (all fields are required unless otherwise indicated) first name:. Web louisiana has a state income tax that ranges between 2% and 6% , which is administered by the louisiana department of revenue. We last updated louisiana form it540i from the department of revenue in january 2023.

Web louisiana usually releases forms for the current tax year between january and april. Ad discover 2290 form due dates for heavy use vehicles placed into service. We last updated louisiana form it540i from the department of revenue in january 2023. If you file this paper return, it will take up to 14 weeks to get your refund check. Act 15 of the first extraordinary. Our goals are to provide the general public with a centralized place to. Revenue.louisiana.gov/fileonline are you due a refund? Web using louisiana file online and direct deposit, you can receive your refund within 30 days. Web booklets request a tax return please provide your name and address to where we will send your booklet (s). Request an individual income tax return.

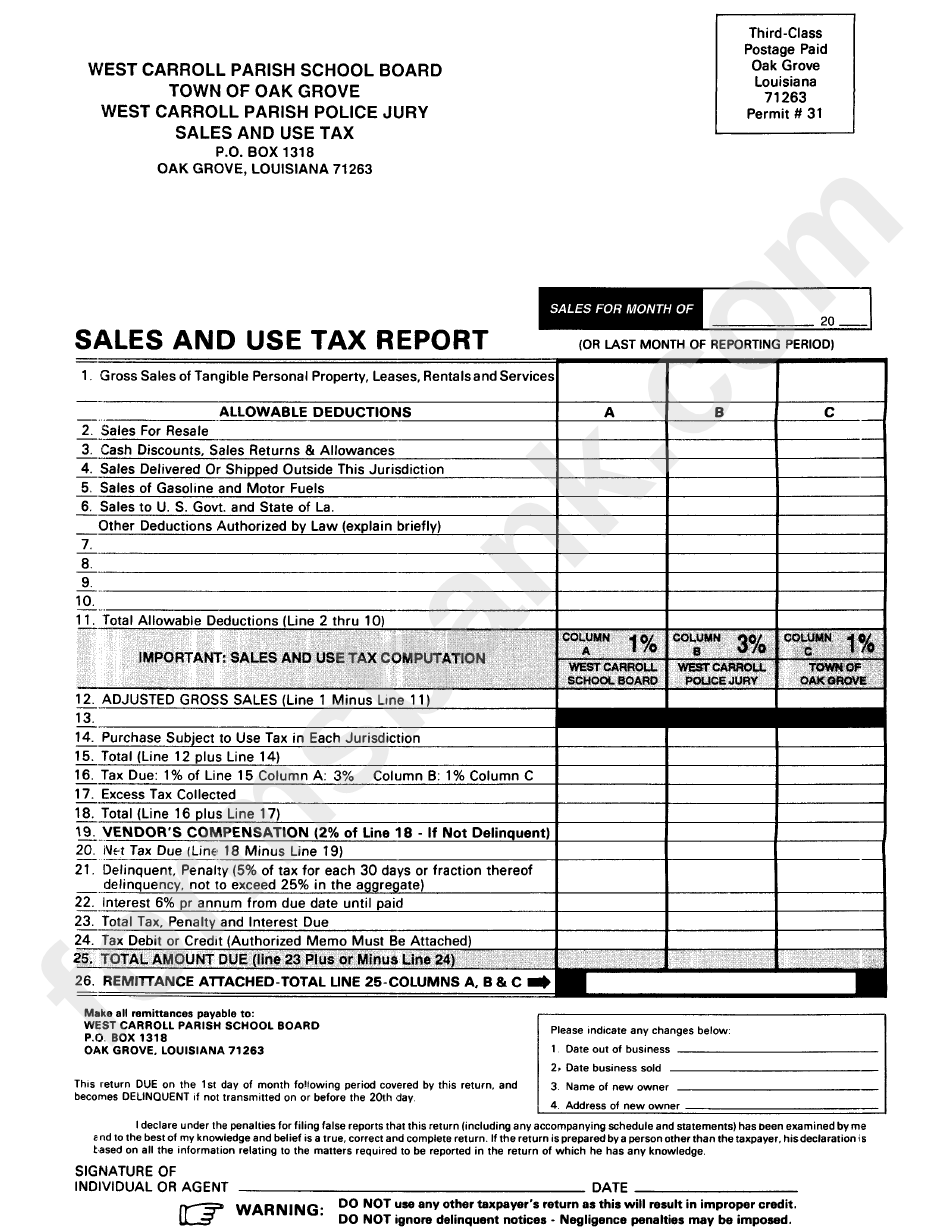

Sales And Use Tax Report Form State Of Louisiana printable pdf download

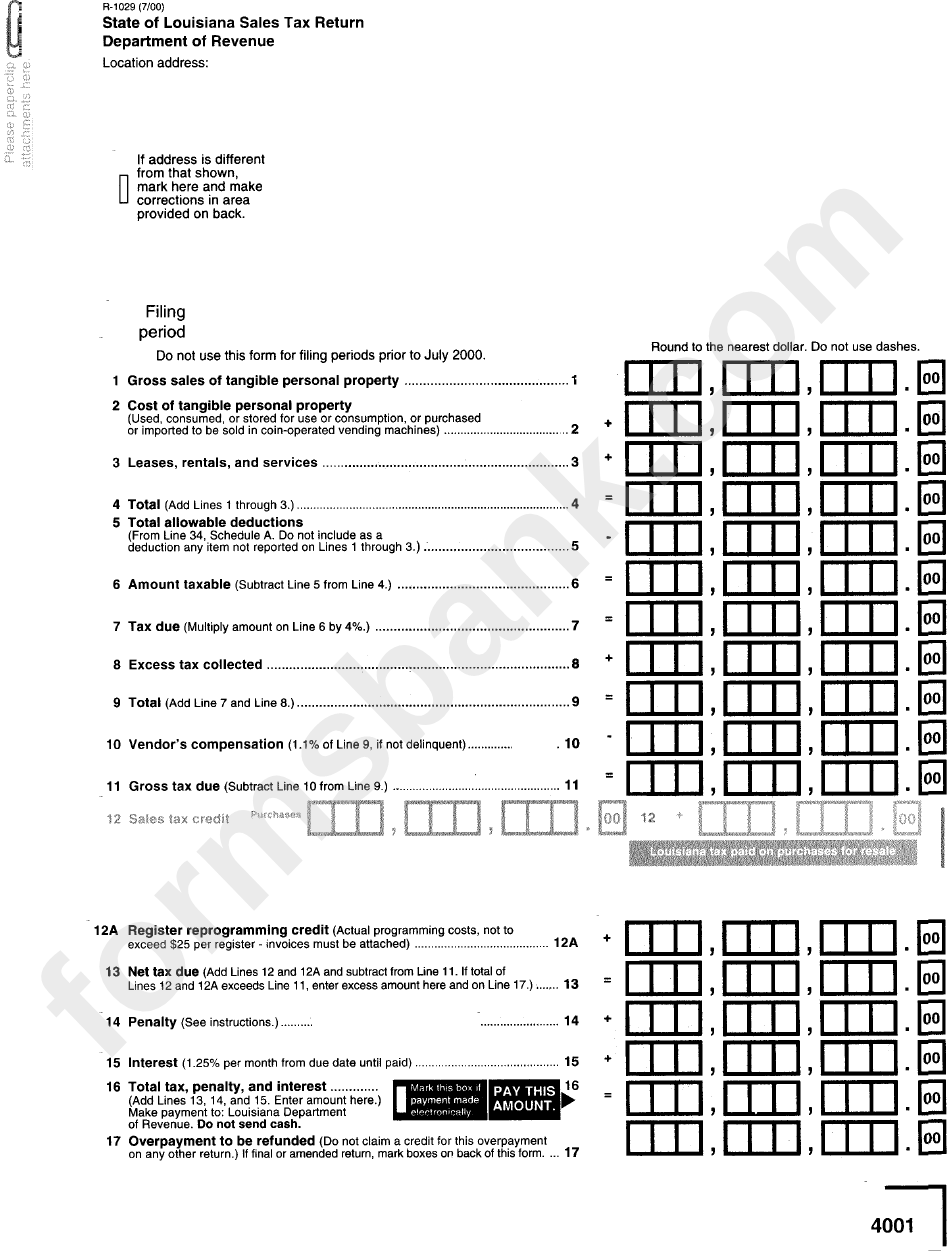

Find forms for your industry in minutes. Web louisiana department of revenue purpose: Web where's my refund. Web your louisiana tax table income subtract lines 8c and 9 from line 7. Web session of the louisiana legislature provides the state of louisiana vendor’s compensation rate is 1.05% of the tax amount due.

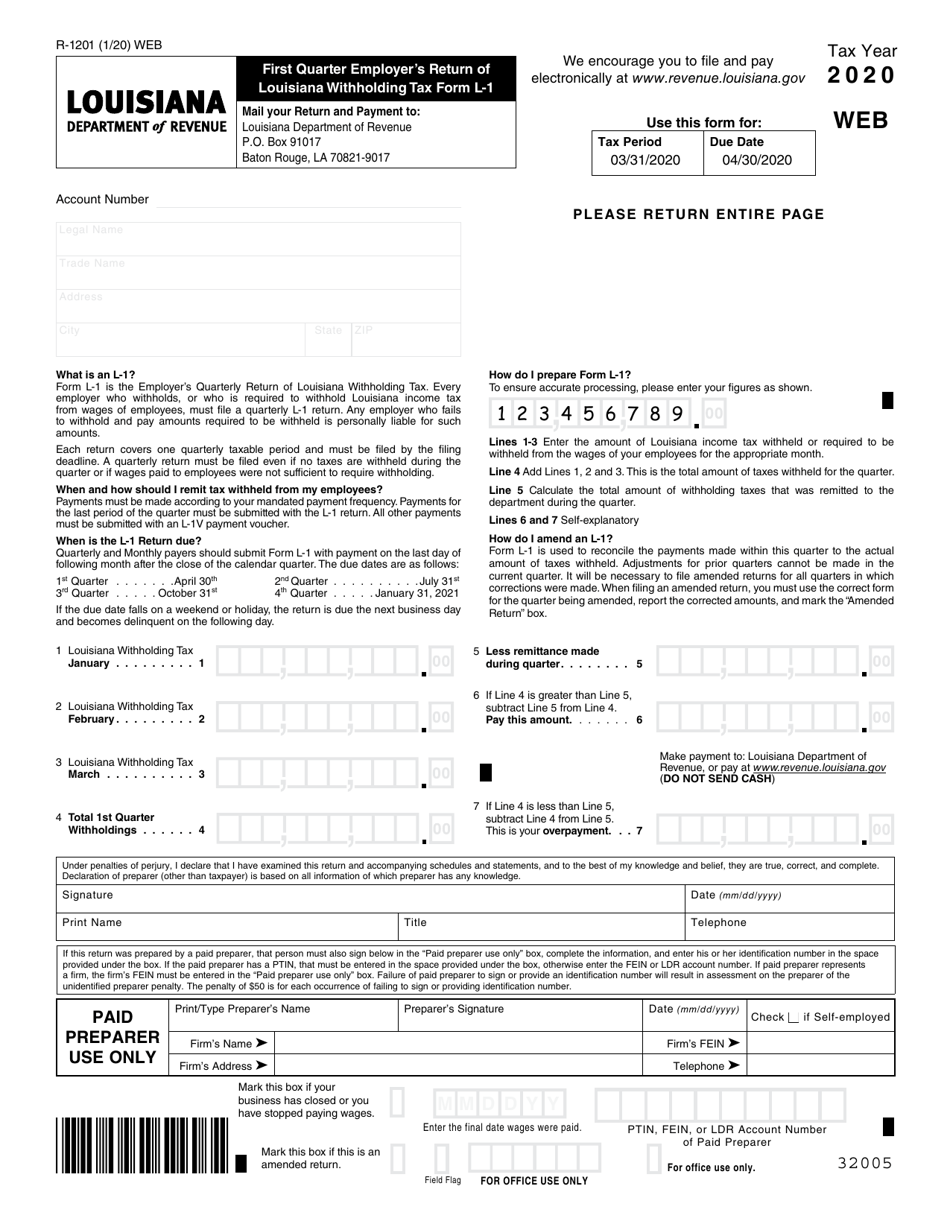

Form L1 (R1201) Download Fillable PDF or Fill Online First Quarter

Request an individual income tax return. We last updated louisiana form it540i from the department of revenue in january 2023. Revenue.louisiana.gov/fileonline are you due a refund? Web when a corporation does business within and without louisiana, the louisiana franchise tax is imposed only on that part of the total taxable capital that is employed in louisiana. Web booklets request a.

Form R1029 State Of Louisiana Sales Tax Return printable pdf download

Find forms for your industry in minutes. If you file this paper return, it will take up to 14 weeks to get your refund check. Web louisiana department of revenue purpose: Web booklets request a tax return please provide your name and address to where we will send your booklet (s). Ad discover 2290 form due dates for heavy use.

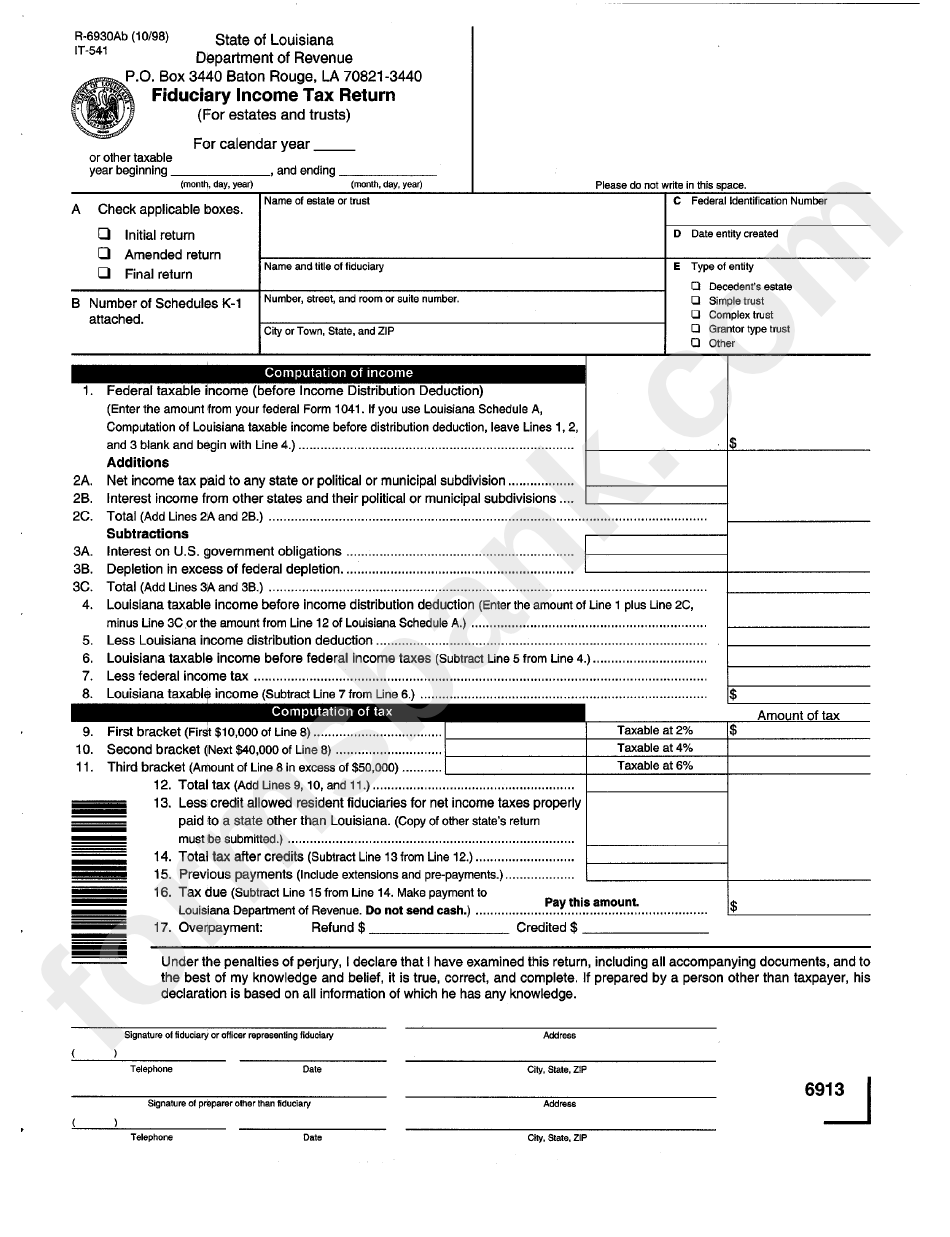

Fillable Form It541 Louisiana Fiduciary Tax Return printable

Web louisiana has a state income tax that ranges between 2% and 6% , which is administered by the louisiana department of revenue. If you file this paper return, it will take up to 14 weeks to get your refund check. Streamlined document workflows for any industry. Our goals are to provide the general public with a centralized place to..

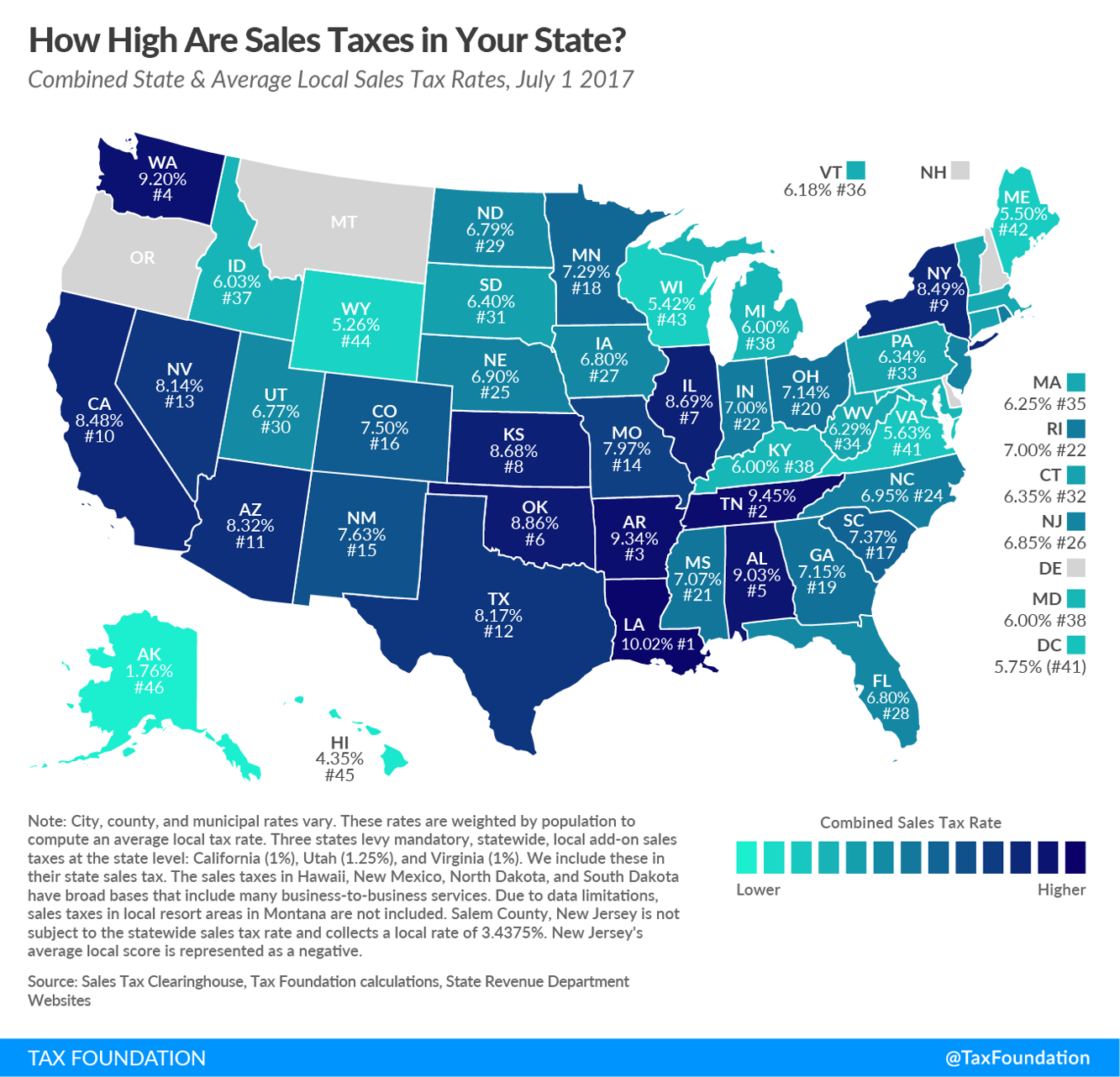

Louisiana sales tax rate remains highest in the U.S. Legislature

You can complete the forms with the help of. We last updated louisiana form it540i from the department of revenue in january 2023. Find forms for your industry in minutes. Web louisiana usually releases forms for the current tax year between january and april. Web when a corporation does business within and without louisiana, the louisiana franchise tax is imposed.

Louisiana Hotel Tax Exempt Form 2020 Fill and Sign Printable Template

Web our mission is to serve louisiana taxpayers fairly and with integrity by administering property tax laws. Web louisiana usually releases forms for the current tax year between january and april. Streamlined document workflows for any industry. Web using louisiana file online and direct deposit, you can receive your refund within 30 days. Web when a corporation does business within.

Louisiana State Tax Form Fill Out and Sign Printable PDF Template

Web where's my refund. Ad discover 2290 form due dates for heavy use vehicles placed into service. Act 15 of the first extraordinary. You can complete the forms with the help of. Web our mission is to serve louisiana taxpayers fairly and with integrity by administering property tax laws.

What are the Louisiana State Tax Filing Requirements? Pocket Sense

Web louisiana usually releases forms for the current tax year between january and april. Ad discover 2290 form due dates for heavy use vehicles placed into service. Web your louisiana tax table income subtract lines 8c and 9 from line 7. Web session of the louisiana legislature provides the state of louisiana vendor’s compensation rate is 1.05% of the tax.

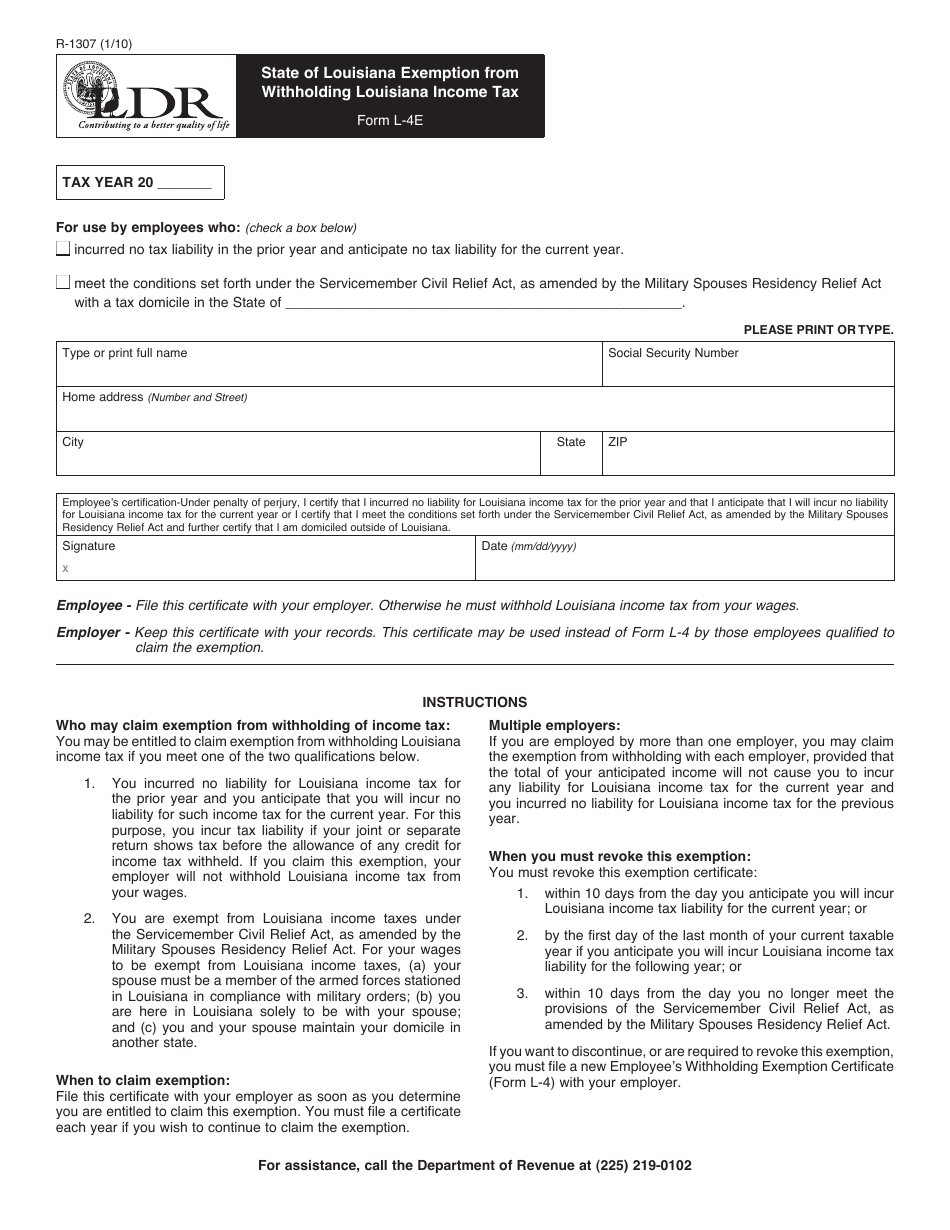

√ Military Spouse Residency Relief Act Tax Form Navy Docs

Act 15 of the first extraordinary. Revenue.louisiana.gov/fileonline are you due a refund? Web session of the louisiana legislature provides the state of louisiana vendor’s compensation rate is 1.05% of the tax amount due. Find forms for your industry in minutes. Our goals are to provide the general public with a centralized place to.

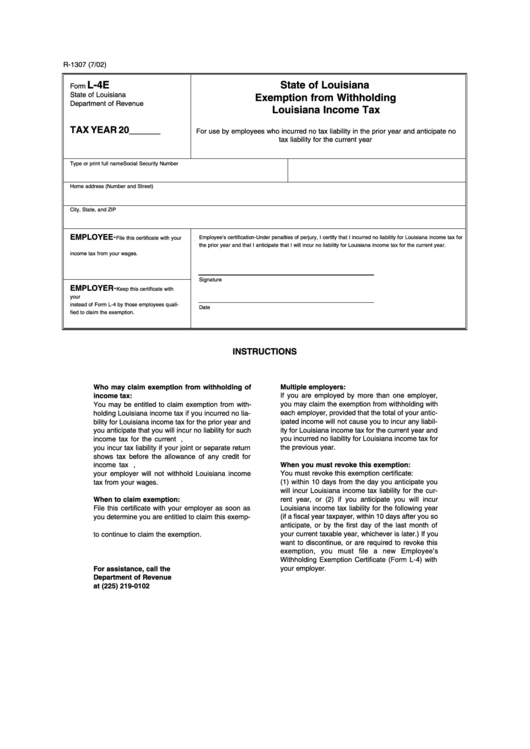

Fillable State Of Louisiana Exemption From Withholding Louisiana

Web louisiana has a state income tax that ranges between 2% and 6% , which is administered by the louisiana department of revenue. We last updated louisiana form it540i from the department of revenue in january 2023. (all fields are required unless otherwise indicated) first name:. Web louisiana usually releases forms for the current tax year between january and april..

(All Fields Are Required Unless Otherwise Indicated) First Name:.

We last updated louisiana form it540i from the department of revenue in january 2023. Ad discover 2290 form due dates for heavy use vehicles placed into service. Check on the status of your individual income refund. Request an individual income tax return.

Act 15 Of The First Extraordinary.

Web using louisiana file online and direct deposit, you can receive your refund within 30 days. You can complete the forms with the help of. Web louisiana department of revenue purpose: Web the louisiana tax forms are listed by tax year below and all la back taxes for previous years would have to be mailed in.

Web Louisiana Has A State Income Tax That Ranges Between 2% And 6% , Which Is Administered By The Louisiana Department Of Revenue.

Web your louisiana tax table income subtract lines 8c and 9 from line 7. Streamlined document workflows for any industry. If you file this paper return, it will take up to 14 weeks to get your refund check. Web louisiana usually releases forms for the current tax year between january and april.

Web Where's My Refund.

Web what’s new for louisiana 2022 individual income tax. New users for online filing in order to use the online tax filing application, you must have already filed a. Web our mission is to serve louisiana taxpayers fairly and with integrity by administering property tax laws. Find forms for your industry in minutes.