Supplemental Consumer Information Form

Supplemental Consumer Information Form - This requirement will help facilitate the collection of homeownership education, housing counseling, and language preference information. Web the supplemental consumer information form (scif/form 1103) will be required for new conventional loans sold to fannie mae and freddie mac with application dates on or after march 1, 2023. Web supplemental consumer information form (form 1103) updates. Updated the scif is intended to help lenders capture information during the loan application process on borrower language preference and any homeownership education and housing counseling the borrower has received over the past 12 months. Web what is the supplemental consumer information form (scif) used for? Web supplemental consumer information form published october 26, 2021 fannie mae and freddie mac (the gses) have published the supplemental consumer information form (scif fannie mae/freddie mac 1103). Web 5/3/2022 washington, d.c. Web the purpose of the supplemental consumer information form (scif) is to collect information on homeownership education and housing counseling and/or language preference to help lenders better understand the needs. Web instructions for completing the supplemental consumer information form (scif) form purpose the scif captures information about the homeownership education or housing counseling program completed by the borrower along with the borrower’s language preference. Web the supplemental consumer information form (scif) contains information about the borrower’s language preference, if any, and any homeownership education and housing counseling the borrower may have received.

Web supplemental consumer information form updates july 6, 2022 at the direction of the federal housing finance agency (fhfa), fannie mae and freddie mac (the gses) announced on may 3, 2022, that the supplemental consumer information form (scif fannie mae/freddie mac form 1103) will be a required document in the loan file. Web the supplemental consumer information form (scif/form 1103) will be required for new conventional loans sold to fannie mae and freddie mac with application dates on or after march 1, 2023. Web at the direction of the federal housing finance agency (fhfa), fannie mae and freddie mac (the gses) are announcing that the supplemental consumer information form (scif fannie mae/freddie mac form 1103) will be a required document in the loan file for new conventional loans sold to the gses with application dates on or. Web the purpose of the supplemental consumer information form (scif) is to collect information on homeownership education and housing counseling and/or language preference to help lenders better understand the needs. A copy of this form must be maintained in the loan files for loans sold to the. Web what is the supplemental consumer information form (scif) used for? Web 5/3/2022 washington, d.c. Web supplemental consumer information form published october 26, 2021 fannie mae and freddie mac (the gses) have published the supplemental consumer information form (scif fannie mae/freddie mac 1103). Web instructions for completing the supplemental consumer information form (scif) form purpose the scif captures information about the homeownership education or housing counseling program completed by the borrower along with the borrower’s language preference. Updated the scif is intended to help lenders capture information during the loan application process on borrower language preference and any homeownership education and housing counseling the borrower has received over the past 12 months.

A copy of this form must be maintained in the loan files for loans sold to the. Updated the scif is intended to help lenders capture information during the loan application process on borrower language preference and any homeownership education and housing counseling the borrower has received over the past 12 months. Web the supplemental consumer information form (scif/form 1103) will be required for new conventional loans sold to fannie mae and freddie mac with application dates on or after march 1, 2023. Web the supplemental consumer information form (scif) contains information about the borrower’s language preference, if any, and any homeownership education and housing counseling the borrower may have received. Web supplemental consumer information form published october 26, 2021 fannie mae and freddie mac (the gses) have published the supplemental consumer information form (scif fannie mae/freddie mac 1103). This requirement will help facilitate the collection of homeownership education, housing counseling, and language preference information. Web at the direction of the federal housing finance agency (fhfa), fannie mae and freddie mac (the gses) are announcing that the supplemental consumer information form (scif fannie mae/freddie mac form 1103) will be a required document in the loan file for new conventional loans sold to the gses with application dates on or. Web supplemental consumer information form updates july 6, 2022 at the direction of the federal housing finance agency (fhfa), fannie mae and freddie mac (the gses) announced on may 3, 2022, that the supplemental consumer information form (scif fannie mae/freddie mac form 1103) will be a required document in the loan file. Web the purpose of the supplemental consumer information form (scif) is to collect information on homeownership education and housing counseling and/or language preference to help lenders better understand the needs. Web supplemental consumer information form (form 1103) updates.

Floify the First PointofSale to Support the Supplemental

Web what is the supplemental consumer information form (scif) used for? Web the purpose of the supplemental consumer information form (scif) is to collect information on homeownership education and housing counseling and/or language preference to help lenders better understand the needs. Web supplemental consumer information form updates july 6, 2022 at the direction of the federal housing finance agency (fhfa),.

Benefits Information

This requirement will help facilitate the collection of homeownership education, housing counseling, and language preference information. Web the supplemental consumer information form (scif) contains information about the borrower’s language preference, if any, and any homeownership education and housing counseling the borrower may have received. Web what is the supplemental consumer information form (scif) used for? Web supplemental consumer information form.

Consumer Reports Best Medicare Supplemental Insurance? Insurance Noon

Web the purpose of the supplemental consumer information form (scif) is to collect information on homeownership education and housing counseling and/or language preference to help lenders better understand the needs. Updated the scif is intended to help lenders capture information during the loan application process on borrower language preference and any homeownership education and housing counseling the borrower has received.

Supplemental Security Application Sample Free Download

A copy of this form must be maintained in the loan files for loans sold to the. Web 5/3/2022 washington, d.c. This requirement will help facilitate the collection of homeownership education, housing counseling, and language preference information. Web supplemental consumer information form (form 1103) updates. Web the supplemental consumer information form (scif/form 1103) will be required for new conventional loans.

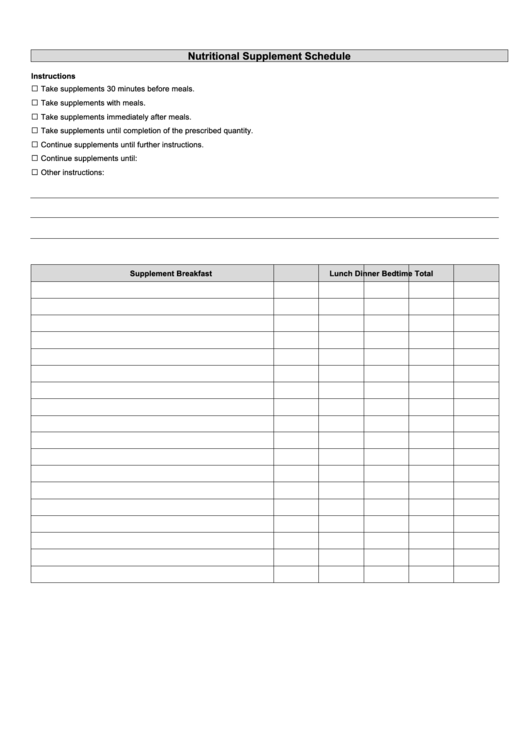

Nutritional Supplement Schedule Template printable pdf download

This requirement will help facilitate the collection of homeownership education, housing counseling, and language preference information. Web instructions for completing the supplemental consumer information form (scif) form purpose the scif captures information about the homeownership education or housing counseling program completed by the borrower along with the borrower’s language preference. Web at the direction of the federal housing finance agency.

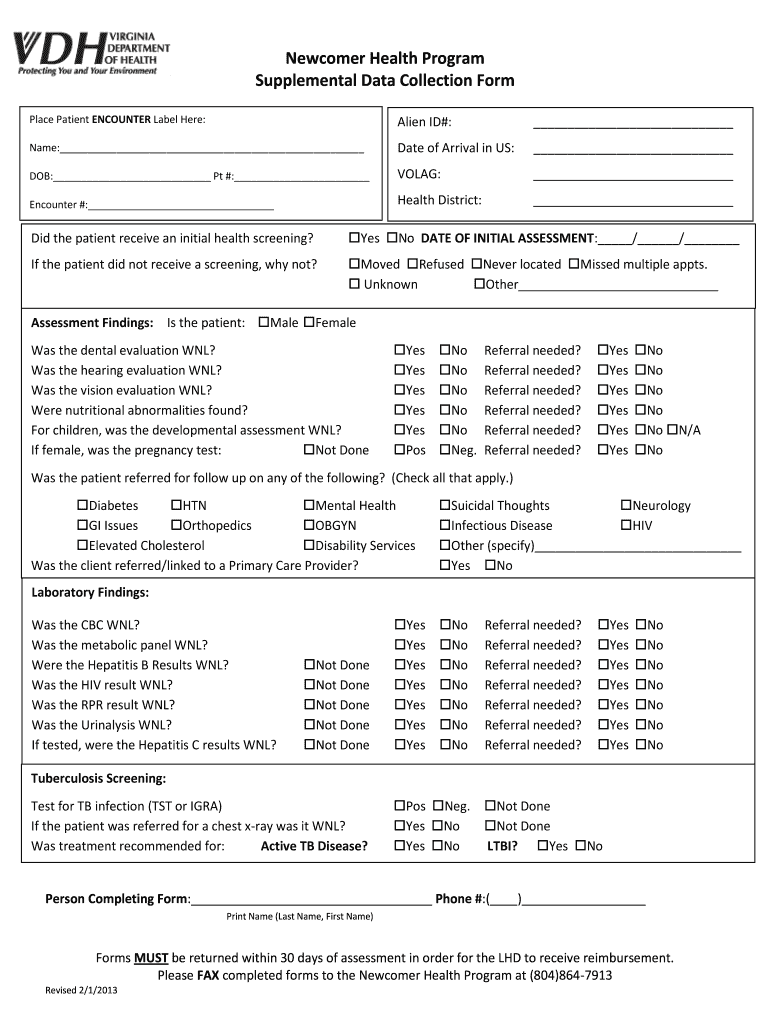

VA Health Program Supplemental Data Collection Form 2013

Web the purpose of the supplemental consumer information form (scif) is to collect information on homeownership education and housing counseling and/or language preference to help lenders better understand the needs. Web at the direction of the federal housing finance agency (fhfa), fannie mae and freddie mac (the gses) are announcing that the supplemental consumer information form (scif fannie mae/freddie mac.

FREE 7+ Sample Consumer Complaint Forms in PDF MS Word

This requirement will help facilitate the collection of homeownership education, housing counseling, and language preference information. Web the purpose of the supplemental consumer information form (scif) is to collect information on homeownership education and housing counseling and/or language preference to help lenders better understand the needs. Web the supplemental consumer information form (scif) contains information about the borrower’s language preference,.

(PDF) Supplemental Information 1

Updated the scif is intended to help lenders capture information during the loan application process on borrower language preference and any homeownership education and housing counseling the borrower has received over the past 12 months. Web what is the supplemental consumer information form (scif) used for? Web 5/3/2022 washington, d.c. Web the supplemental consumer information form (scif) contains information about.

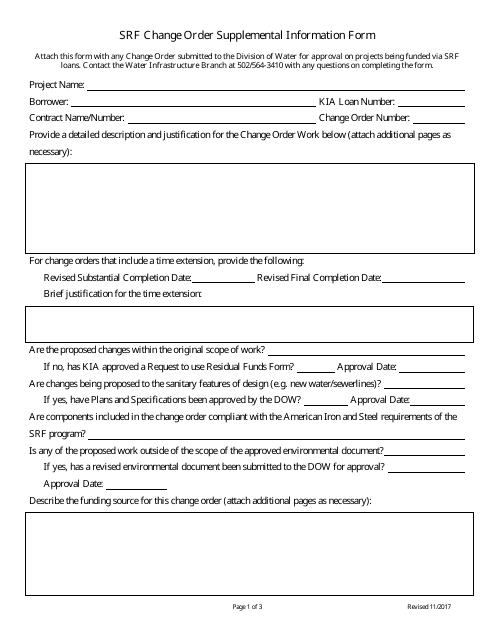

Kentucky Srf Change Order Supplemental Information Form Download

Web what is the supplemental consumer information form (scif) used for? Web the supplemental consumer information form (scif) contains information about the borrower’s language preference, if any, and any homeownership education and housing counseling the borrower may have received. Web at the direction of the federal housing finance agency (fhfa), fannie mae and freddie mac (the gses) are announcing that.

Supplemental Application Form Fill Online, Printable, Fillable, Blank

Web at the direction of the federal housing finance agency (fhfa), fannie mae and freddie mac (the gses) are announcing that the supplemental consumer information form (scif fannie mae/freddie mac form 1103) will be a required document in the loan file for new conventional loans sold to the gses with application dates on or. Web the supplemental consumer information form.

Web The Supplemental Consumer Information Form (Scif) Contains Information About The Borrower’s Language Preference, If Any, And Any Homeownership Education And Housing Counseling The Borrower May Have Received.

Updated the scif is intended to help lenders capture information during the loan application process on borrower language preference and any homeownership education and housing counseling the borrower has received over the past 12 months. Web supplemental consumer information form published october 26, 2021 fannie mae and freddie mac (the gses) have published the supplemental consumer information form (scif fannie mae/freddie mac 1103). Web what is the supplemental consumer information form (scif) used for? Web the supplemental consumer information form (scif/form 1103) will be required for new conventional loans sold to fannie mae and freddie mac with application dates on or after march 1, 2023.

Web At The Direction Of The Federal Housing Finance Agency (Fhfa), Fannie Mae And Freddie Mac (The Gses) Are Announcing That The Supplemental Consumer Information Form (Scif Fannie Mae/Freddie Mac Form 1103) Will Be A Required Document In The Loan File For New Conventional Loans Sold To The Gses With Application Dates On Or.

A copy of this form must be maintained in the loan files for loans sold to the. Web 5/3/2022 washington, d.c. Web supplemental consumer information form (form 1103) updates. Web instructions for completing the supplemental consumer information form (scif) form purpose the scif captures information about the homeownership education or housing counseling program completed by the borrower along with the borrower’s language preference.

Web The Purpose Of The Supplemental Consumer Information Form (Scif) Is To Collect Information On Homeownership Education And Housing Counseling And/Or Language Preference To Help Lenders Better Understand The Needs.

Web supplemental consumer information form updates july 6, 2022 at the direction of the federal housing finance agency (fhfa), fannie mae and freddie mac (the gses) announced on may 3, 2022, that the supplemental consumer information form (scif fannie mae/freddie mac form 1103) will be a required document in the loan file. This requirement will help facilitate the collection of homeownership education, housing counseling, and language preference information.