Tarrant County Homestead Exemption Form 2022

Tarrant County Homestead Exemption Form 2022 - The owner must have an ownership interest in the property; View list of entities we. For filing with the appraisal district office in each county in which the property is located generally between jan. Web 80 rows = general homestead exemption : Web apply for exemption (s) learn more about homestead and other exemptions, find exemption forms, or apply online for exemptions in tarrant. Oh = optional homestead exemption : Tarrant county homeowners will get further tax relief this year amid skyrocketing appraisals, after county commissioners approved the. Web paperless billing subscribe to paperless billing to receive electronic statement appraisal district change mailing address, get forms view frequently. Web tarrant county homeowners will get further tax relief this year amid skyrocketing appraisals, after county commissioners approved the creation of two new. The provisions of the texas property tax code govern.

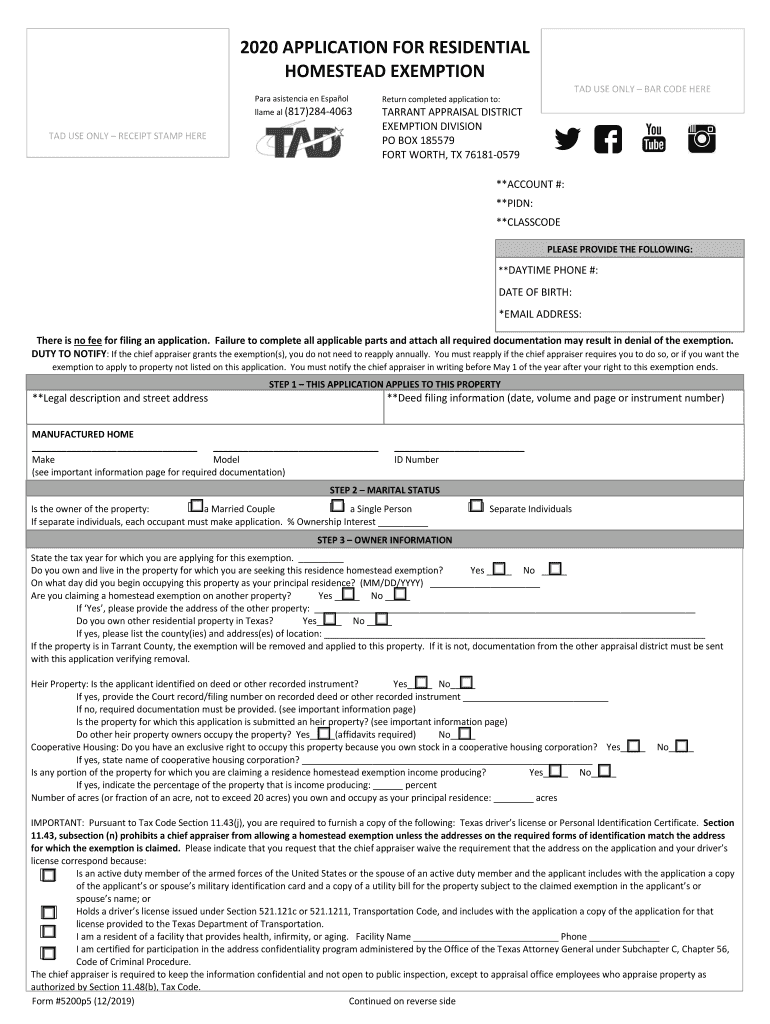

Web to apply for a homestead exemption, you need to submit an application with your county appraisal district. Oh = optional homestead exemption : Web paperless billing subscribe to paperless billing to receive electronic statement appraisal district change mailing address, get forms view frequently. Web type of property tax exemption: Web residence homestead exemption application. 1 and april 30 of the. Web tarrant county homeowners will get further tax relief this year amid skyrocketing appraisals, after county commissioners approved the creation of two new. Tarrant appraisal district (tad) is a political subdivision of the state of texas created effective january 1, 1980. Web a new law effective january 1, 2022 provides property tax relief by allowing home buyers to file for homestead exemptions in the year when they purchase the property. For filing with the appraisal district office in each county in which the property is located generally between jan.

View list of entities we. Web to apply for a homestead exemption, you need to submit an application with your county appraisal district. For filing with the appraisal district office in each county in which the property is located generally between jan. Oo65 = optional over 65 exemption : If you are applying for the 65 or. Web residence homestead exemption application. Applications will be accepted beginning this coming wednesday, january 1, and the final deadline is april 30. Web for the $40,000 general residence homestead exemption, you may submit an application for residential homestead exemption (pdf) and supporting documentation, with the. Web paperless billing subscribe to paperless billing to receive electronic statement appraisal district change mailing address, get forms view frequently. Web a new law effective january 1, 2022 provides property tax relief by allowing home buyers to file for homestead exemptions in the year when they purchase the property.

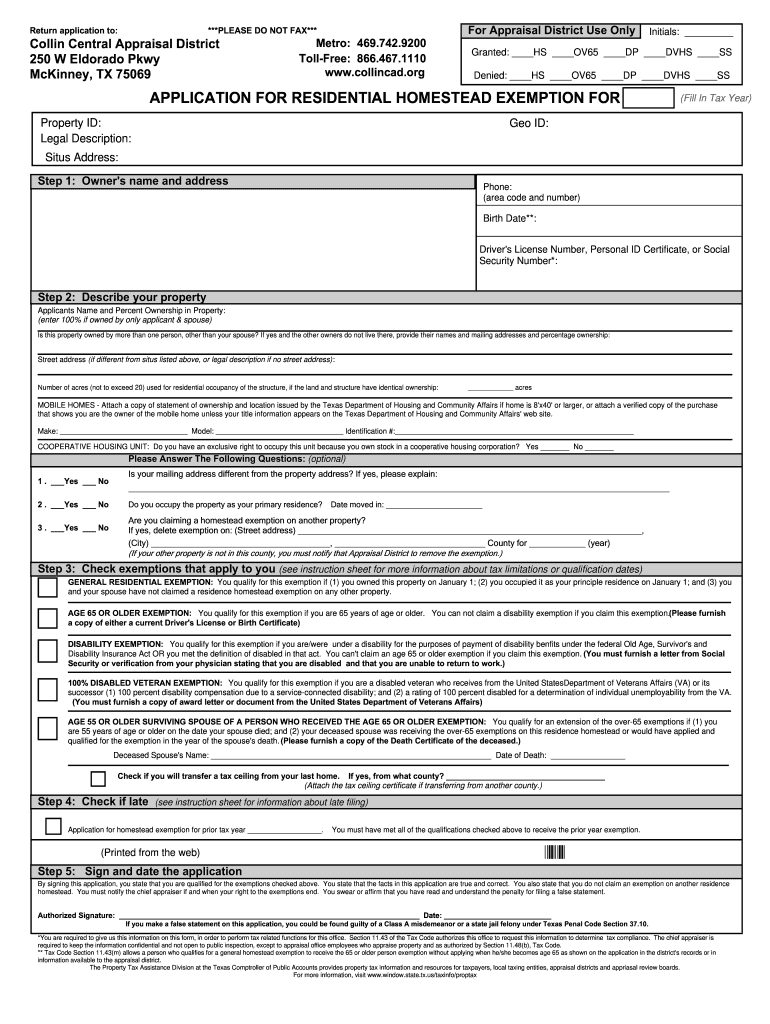

Collin County Homestead Exemption Form Fill Out and Sign Printable

The provisions of the texas property tax code govern. Oo65 = optional over 65 exemption : Oh = optional homestead exemption : The owner must have an ownership interest in the property; Web type of property tax exemption:

How To File Homestead Exemption In Tarrant County Texas mesa

For filing with the appraisal district office in each county in which the property is located generally between jan. Tarrant county homeowners will get further tax relief this year amid skyrocketing appraisals, after county commissioners approved the. Complete, edit or print tax forms instantly. Web apply for exemption (s) learn more about homestead and other exemptions, find exemption forms, or.

Tarrant County Appraisal District Homestead Exemption Form

Web paperless billing subscribe to paperless billing to receive electronic statement appraisal district change mailing address, get forms view frequently. They must use the property as. Tarrant appraisal district documents and publications, available in pdf version to review and download. Web to apply for a homestead exemption, you need to submit an application with your county appraisal district. Oh =.

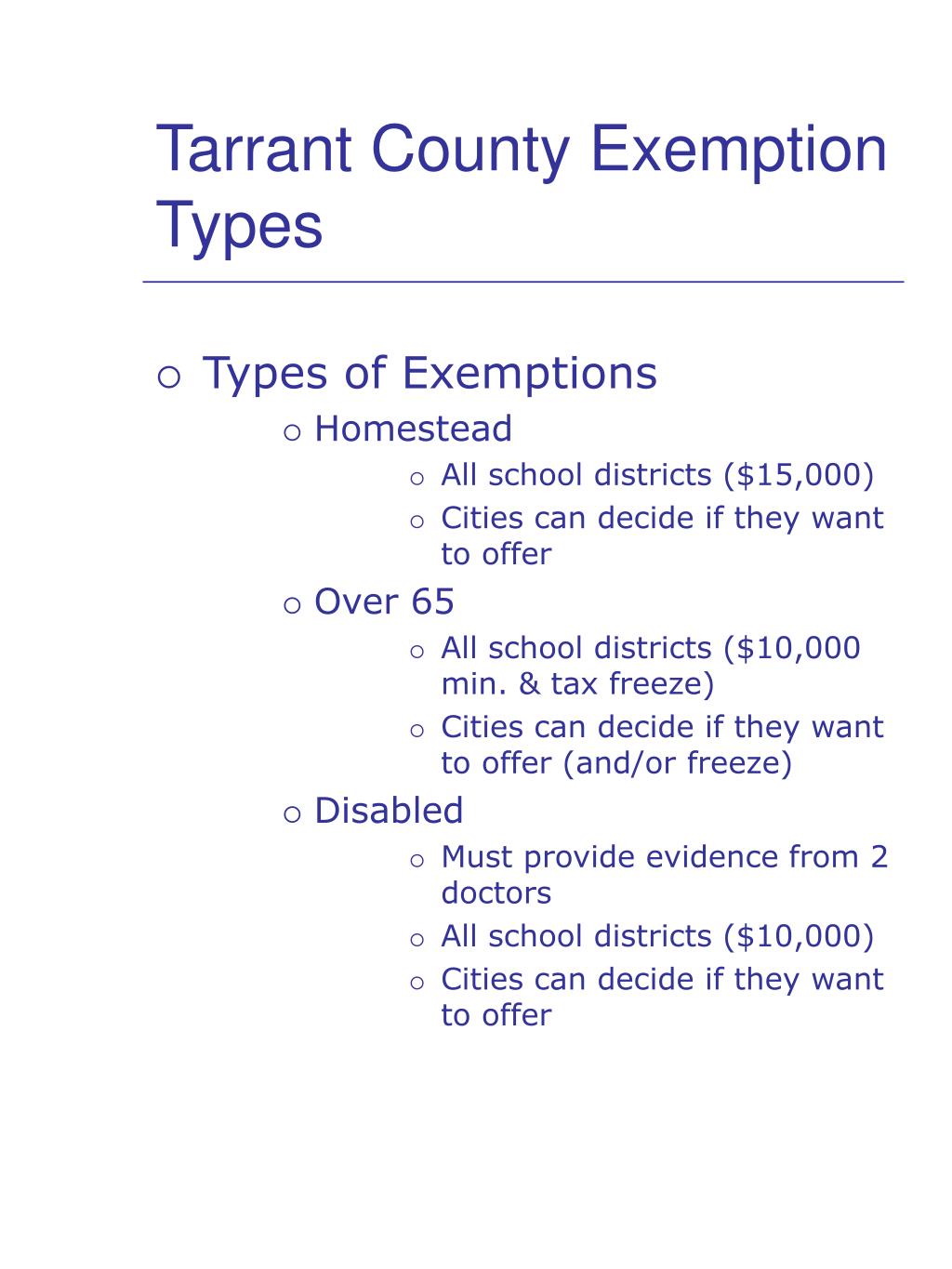

PPT Chapter 4 PowerPoint Presentation, free download ID1156646

If you are applying for the 65 or. Applications will be accepted beginning this coming wednesday, january 1, and the final deadline is april 30. They must use the property as. Tarrant appraisal district (tad) is a political subdivision of the state of texas created effective january 1, 1980. Ov003 = over 65 exemption :

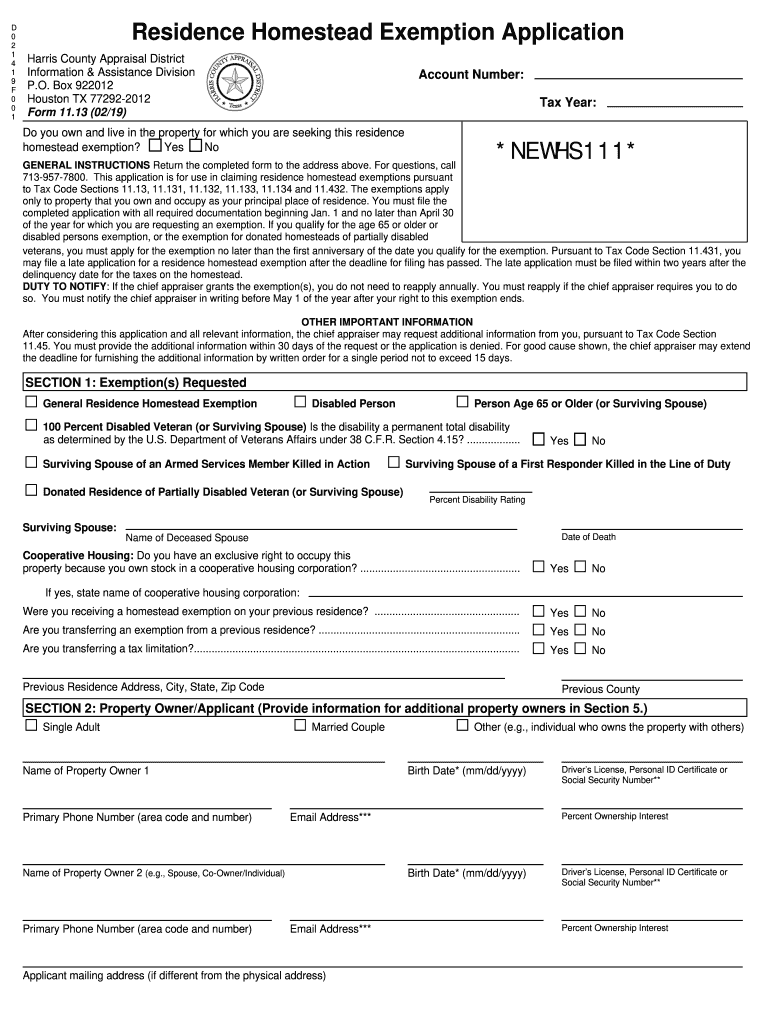

Harris County Homestead Exemption Form

Web a new law effective january 1, 2022 provides property tax relief by allowing home buyers to file for homestead exemptions in the year when they purchase the property. Web residence homestead exemption application. Complete, edit or print tax forms instantly. Applications will be accepted beginning this coming wednesday, january 1, and the final deadline is april 30. They must.

Homestead Exemption Tutorial 2019 Tarrant County, TX YouTube

Web a new law effective january 1, 2022 provides property tax relief by allowing home buyers to file for homestead exemptions in the year when they purchase the property. Oo65 = optional over 65 exemption : They must use the property as. The provisions of the texas property tax code govern. Tarrant county homeowners will get further tax relief this.

Homestead Exemption California 2023 Form Orange County

Tarrant appraisal district (tad) is a political subdivision of the state of texas created effective january 1, 1980. They must use the property as. Web for the $40,000 general residence homestead exemption, you may submit an application for residential homestead exemption (pdf) and supporting documentation, with the. Web type of property tax exemption: Applications will be accepted beginning this coming.

Henry County Homestead Exemption 2020 Fill and Sign Printable

Oh = optional homestead exemption : They must use the property as. Web for the $40,000 general residence homestead exemption, you may submit an application for residential homestead exemption (pdf) and supporting documentation, with the. Tarrant county homeowners will get further tax relief this year amid skyrocketing appraisals, after county commissioners approved the. The provisions of the texas property tax.

How To File Homestead Exemption 🏠 Denton County YouTube

If you are applying for the 65 or. Web a new law effective january 1, 2022 provides property tax relief by allowing home buyers to file for homestead exemptions in the year when they purchase the property. Tarrant appraisal district (tad) is a political subdivision of the state of texas created effective january 1, 1980. Oo65 = optional over 65.

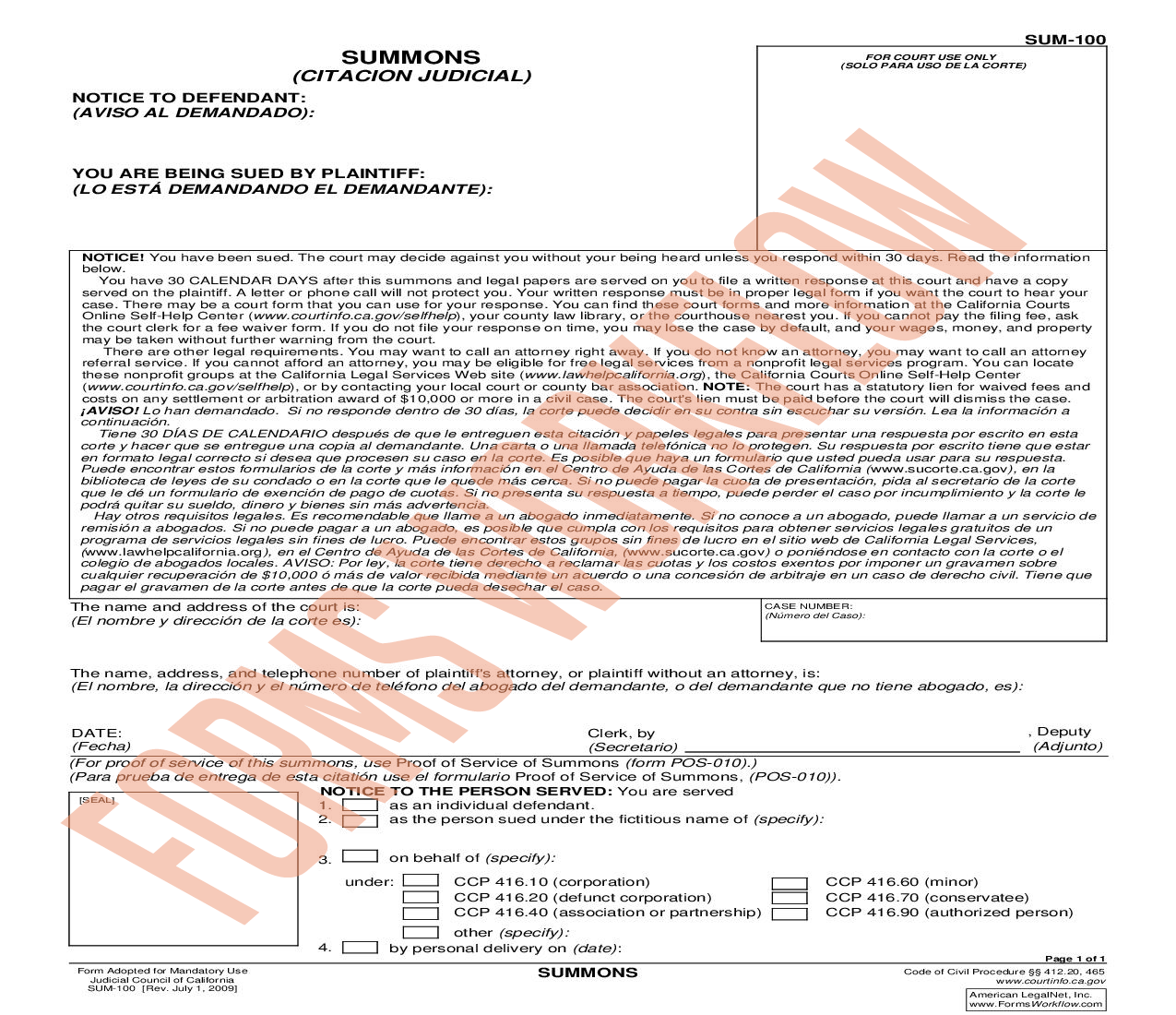

2020 Form TX 5200 Fill Online, Printable, Fillable, Blank pdfFiller

Tarrant county homeowners will get further tax relief this year amid skyrocketing appraisals, after county commissioners approved the. Oh = optional homestead exemption : Web 80 rows = general homestead exemption : Web paperless billing subscribe to paperless billing to receive electronic statement appraisal district change mailing address, get forms view frequently. View list of entities we.

For Filing With The Appraisal District Office In Each County In Which The Property Is Located Generally Between Jan.

Ov003 = over 65 exemption : If you are applying for the 65 or. Tarrant appraisal district documents and publications, available in pdf version to review and download. Web tarrant county homeowners will get further tax relief this year amid skyrocketing appraisals, after county commissioners approved the creation of two new.

Web 80 Rows = General Homestead Exemption :

Tarrant county homeowners will get further tax relief this year amid skyrocketing appraisals, after county commissioners approved the. Web residence homestead exemption application. The owner must have an ownership interest in the property; Web for the $40,000 general residence homestead exemption, you may submit an application for residential homestead exemption (pdf) and supporting documentation, with the.

Web View Exemptions Offered.

Web a new law effective january 1, 2022 provides property tax relief by allowing home buyers to file for homestead exemptions in the year when they purchase the property. Complete, edit or print tax forms instantly. The provisions of the texas property tax code govern. Applications will be accepted beginning this coming wednesday, january 1, and the final deadline is april 30.

Web Paperless Billing Subscribe To Paperless Billing To Receive Electronic Statement Appraisal District Change Mailing Address, Get Forms View Frequently.

Filing an application is free and only needs to be filed once. Oo65 = optional over 65 exemption : Web to apply for a homestead exemption, you need to submit an application with your county appraisal district. 1 and april 30 of the.