Tax Form Daycare Providers Give Parents

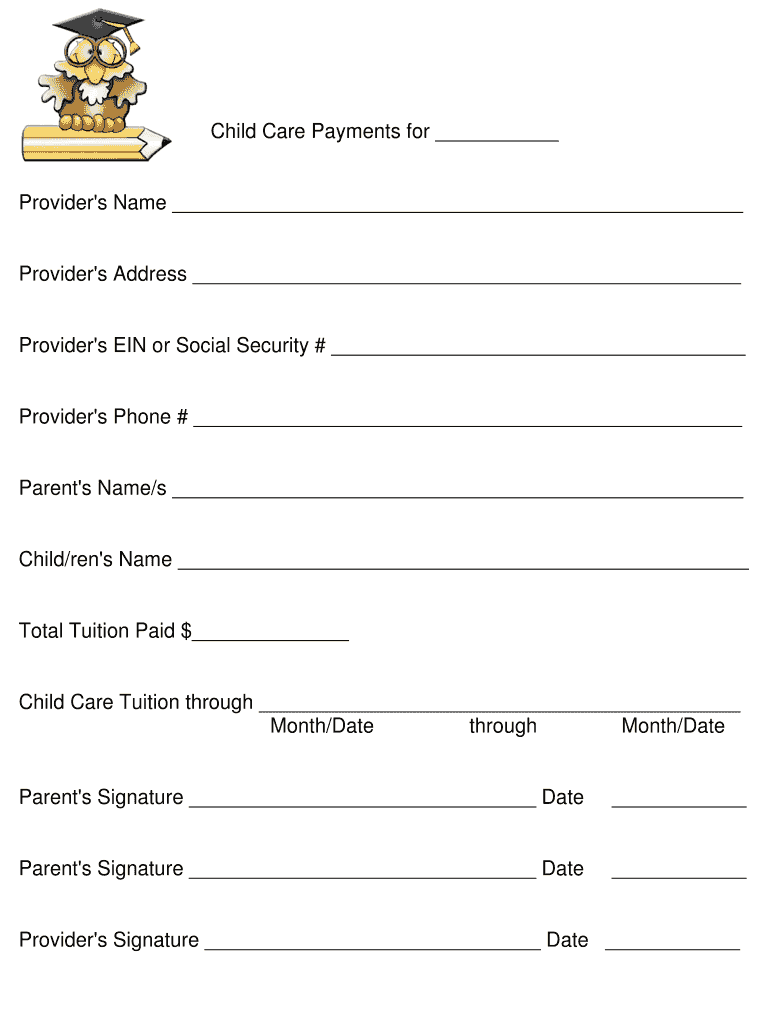

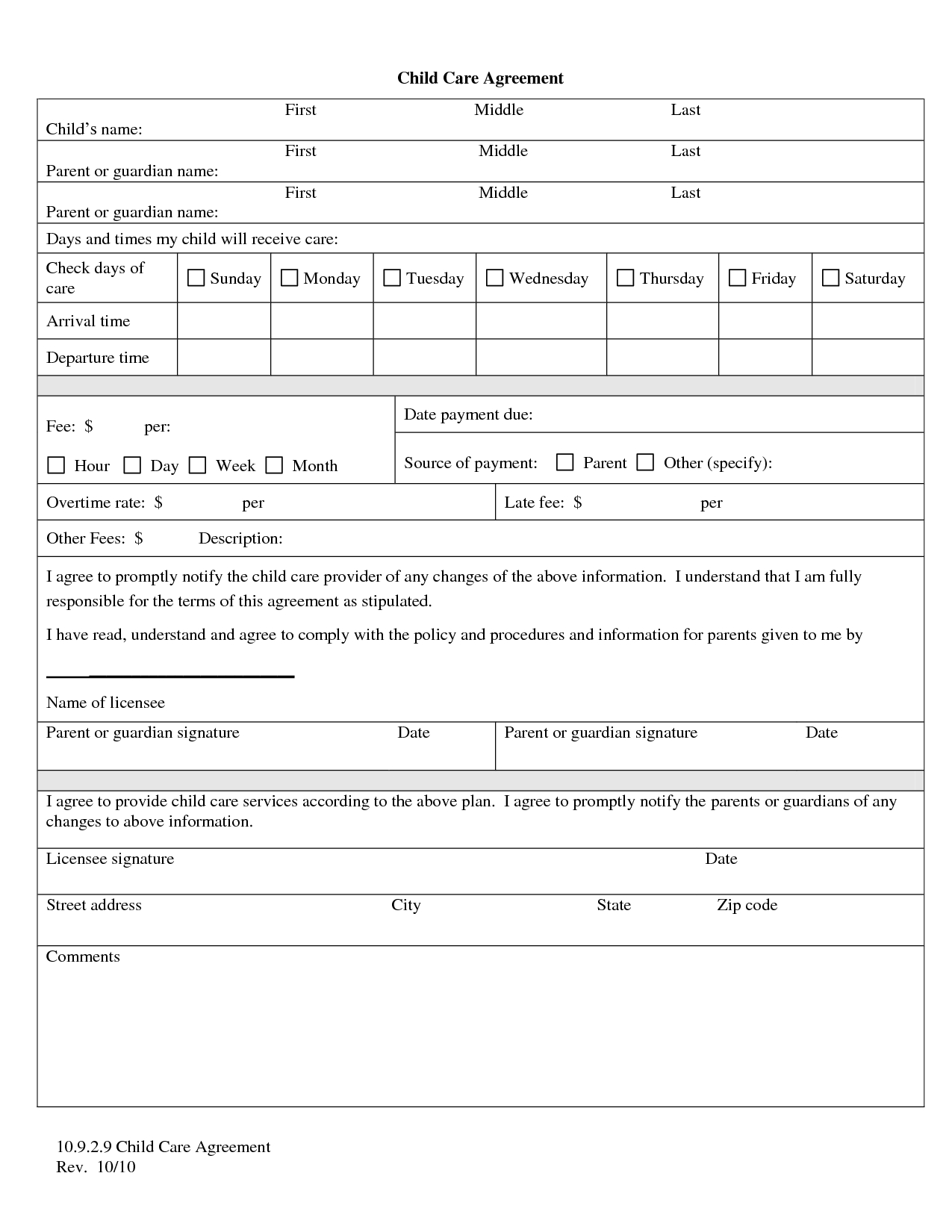

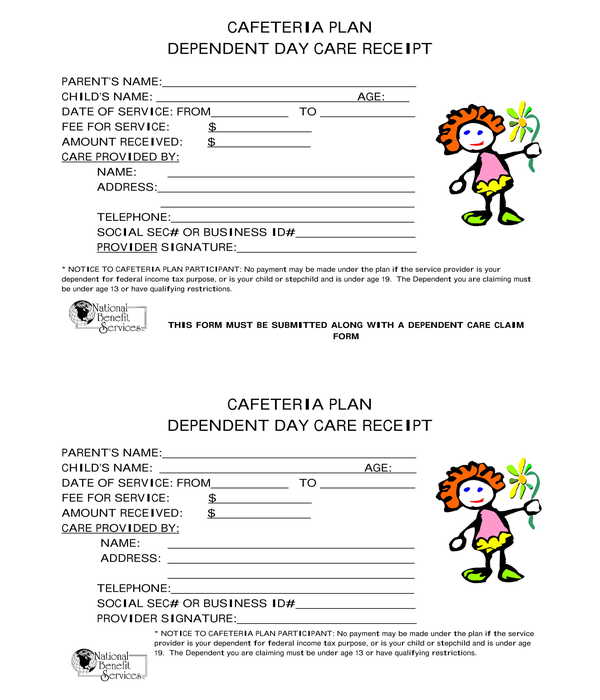

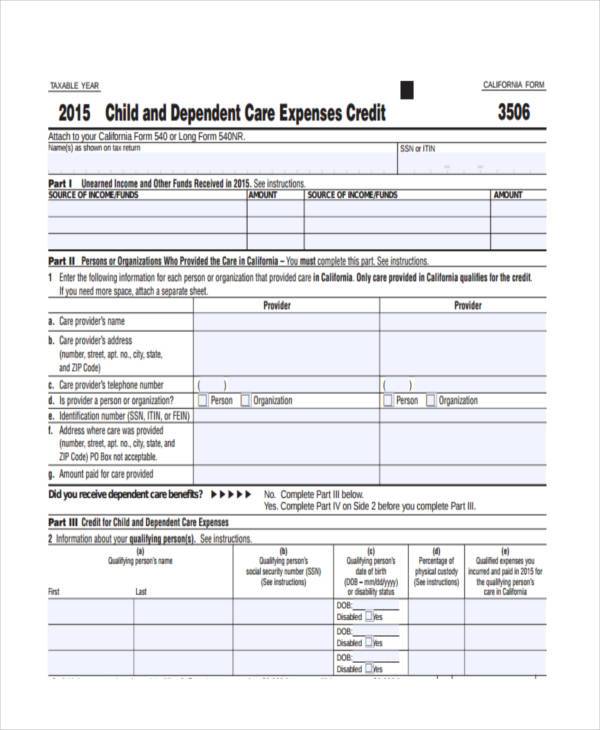

Tax Form Daycare Providers Give Parents - This form is used for certification of the dependent care provider's name, address, and taxpayer identification number to report on form 2441, child and dependent care expenses. Web form 8282, child care year end receipt for parents is required by law for every parent receiving child care payments from child care services. A recently printed letterhead or printed invoice that shows the provider’s name, address, and tin. Web a daycare tax statement must be given to parents at the end of the year. If the provider is your employer’s dependent care plan, a copy of the statement provided by your employer under the plan. Web sample template for use by childcare providers note: You can obtain the child care year end receipt form or download the form from the child care services website. A copy of the provider’s social security card. The amount that you claim must match exactly with the amount parents are claiming. Web a daycare tax form for parents is helpful but not required by law for parents to take the child care tax credit on their taxes.

You can obtain the child care year end receipt form or download the form from the child care services website. Web sample template for use by childcare providers note: Parent</strong>/guardian’s name and address> re: Congress extended this law as part of the fiscal cliff negotiations. Web irs form 2441 is completed by the taxpayer to report child and dependent care expenses paid for the year. They don’t have to have the piece of paper to file the amount, but it’s a good idea to provide them. Web form 8282, child care year end receipt for parents is required by law for every parent receiving child care payments from child care services. Ask your primary childcare provider to copy the template below to its letterhead and input the needed information to replace the guidelines in the brackets < > and the brackets. This will determine your taxes for childcare. Web a daycare tax statement must be given to parents at the end of the year.

Web the irs usually considers childcare providers as independent contractors. Web sample template for use by childcare providers note: You can obtain the child care year end receipt form or download the form from the child care services website. The parents will use it to claim a deduction if they are eligible. Parent</strong>/guardian’s name and address> re: Web a daycare tax form for parents is helpful but not required by law for parents to take the child care tax credit on their taxes. They don’t have to have the piece of paper to file the amount, but it’s a good idea to provide them. Congress extended this law as part of the fiscal cliff negotiations. Keep track during the year of all payments made to you. You also are not required to mail them.

Daycare Tax Statement for Parents Form Fill Out and Sign Printable

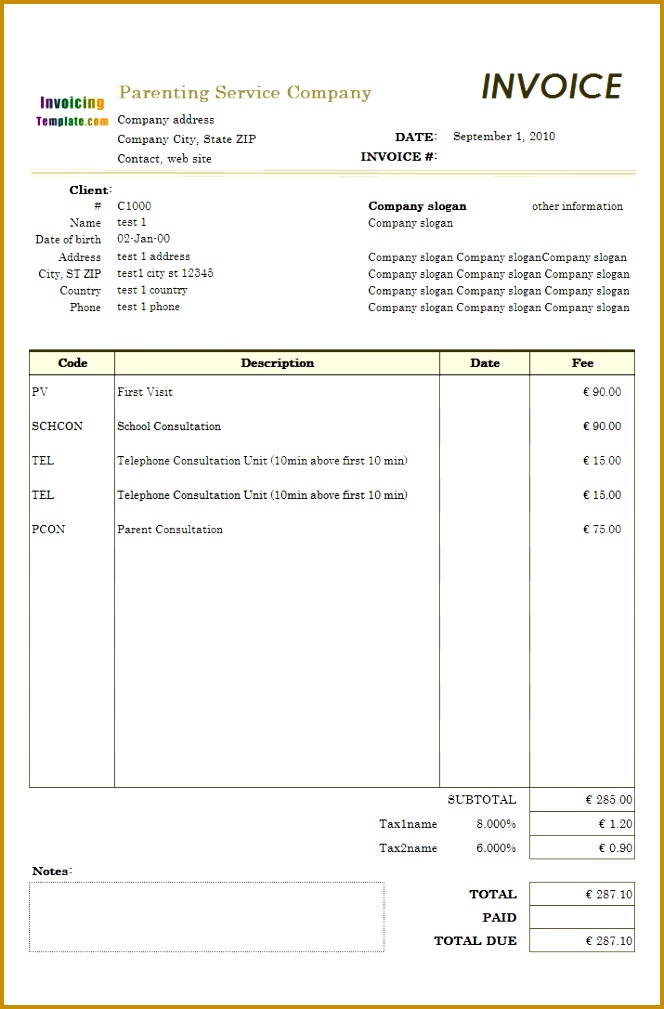

There are a number of eligibility requirements to satisfy before potentially receiving a child or dependent care credit, so it's a good idea to familiarize yourself with the rules before preparing form 2441. You also are not required to mail them. Web sample template for use by childcare providers note: You will use it to claim all income received. Web.

Government figures show parents are still not taking up taxfree

The parents will use it to claim a deduction if they are eligible. A copy of the provider’s social security card. This form must be filed if you’re planning to claim a credit for child and dependent. If the provider is your employer’s dependent care plan, a copy of the statement provided by your employer under the plan. They don’t.

3 Daycare Tax form for Parents FabTemplatez

Web the irs usually considers childcare providers as independent contractors. If the provider is your employer’s dependent care plan, a copy of the statement provided by your employer under the plan. You will use it to claim all income received. There are a number of eligibility requirements to satisfy before potentially receiving a child or dependent care credit, so it's.

Free Printable Daycare Forms For Parents Free Printable

Web irs form 2441 is completed by the taxpayer to report child and dependent care expenses paid for the year. Congress extended this law as part of the fiscal cliff negotiations. You can obtain the child care year end receipt form or download the form from the child care services website. They don’t have to have the piece of paper.

Stationery Paper & Party Supplies PDF and Word Daycare Resource Total

Web form 8282, child care year end receipt for parents is required by law for every parent receiving child care payments from child care services. Ask your primary childcare provider to copy the template below to its letterhead and input the needed information to replace the guidelines in the brackets < > and the brackets. Parent</strong>/guardian’s name and address> re:.

Home Daycare Tax Deductions for Child Care Providers Where

A recently printed letterhead or printed invoice that shows the provider’s name, address, and tin. This form is used for certification of the dependent care provider's name, address, and taxpayer identification number to report on form 2441, child and dependent care expenses. The amount that you claim must match exactly with the amount parents are claiming. Ask your primary childcare.

30 Home Daycare Tax Worksheet Education Template

Web the irs usually considers childcare providers as independent contractors. Parent</strong>/guardian’s name and address> re: The parents will use it to claim a deduction if they are eligible. You can obtain the child care year end receipt form or download the form from the child care services website. Web parents can only count up to $3,000 of child care expenses.

Sample Daycare Tax Forms For Parents Classles Democracy

If the provider is your employer’s dependent care plan, a copy of the statement provided by your employer under the plan. Keep track during the year of all payments made to you. Ask your primary childcare provider to copy the template below to its letterhead and input the needed information to replace the guidelines in the brackets < > and.

Home Daycare Business & Emergency Forms Daycare forms, Home daycare

A recently printed letterhead or printed invoice that shows the provider’s name, address, and tin. If the provider is your employer’s dependent care plan, a copy of the statement provided by your employer under the plan. They don’t have to have the piece of paper to file the amount, but it’s a good idea to provide them. Web a daycare.

FREE 8+ Sample Child Care Expense Forms in PDF MS Word

Parent</strong>/guardian’s name and address> re: Congress extended this law as part of the fiscal cliff negotiations. Web irs form 2441 is completed by the taxpayer to report child and dependent care expenses paid for the year. Web a daycare tax statement must be given to parents at the end of the year. You will use it to claim all income.

This Form Is Used For Certification Of The Dependent Care Provider's Name, Address, And Taxpayer Identification Number To Report On Form 2441, Child And Dependent Care Expenses.

This form must be filed if you’re planning to claim a credit for child and dependent. Web a daycare tax statement must be given to parents at the end of the year. The amount that you claim must match exactly with the amount parents are claiming. You will use it to claim all income received.

A Recently Printed Letterhead Or Printed Invoice That Shows The Provider’s Name, Address, And Tin.

Web irs form 2441 is completed by the taxpayer to report child and dependent care expenses paid for the year. Ask your primary childcare provider to copy the template below to its letterhead and input the needed information to replace the guidelines in the brackets < > and the brackets. Parent/guardian’s name and address> re: A copy of the provider’s social security card.

The Parents Will Use It To Claim A Deduction If They Are Eligible.

You can obtain the child care year end receipt form or download the form from the child care services website. Web a daycare tax form for parents is helpful but not required by law for parents to take the child care tax credit on their taxes. Web updated for tax year 2022 • june 26, 2023 08:58 am. Keep track during the year of all payments made to you.

Web Parents Can Only Count Up To $3,000 Of Child Care Expenses For One Child ($6,000 For 2 Or More) Towards Their Child Care Tax Credit Because That's All That Congress Will Allow.

Congress extended this law as part of the fiscal cliff negotiations. You also are not required to mail them. If the provider is your employer’s dependent care plan, a copy of the statement provided by your employer under the plan. There are a number of eligibility requirements to satisfy before potentially receiving a child or dependent care credit, so it's a good idea to familiarize yourself with the rules before preparing form 2441.