Tennessee Business Tax Form

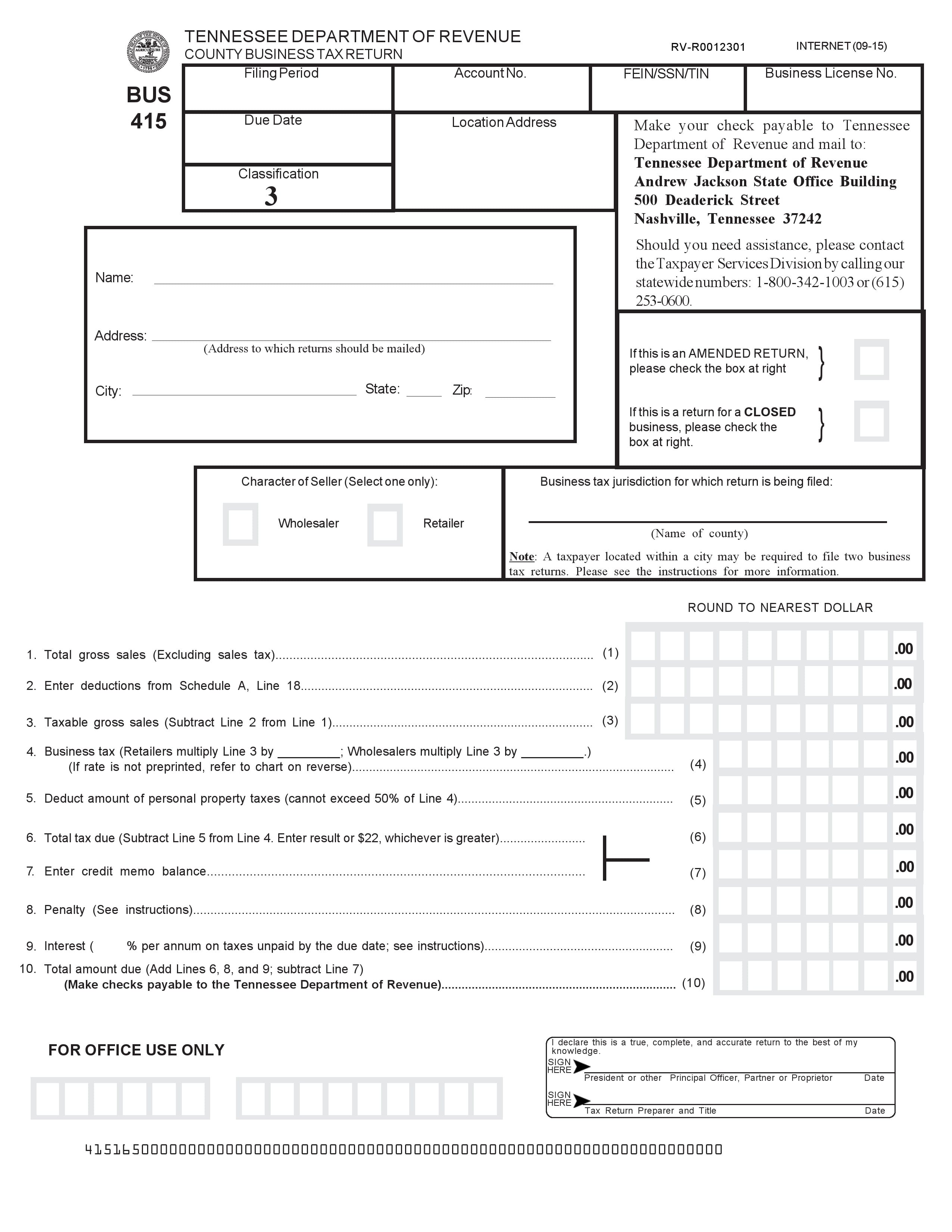

Tennessee Business Tax Form - Web overview generally, if you conduct business within any county and/or incorporated municipality in tennessee, and your business grosses $100,000 or more, then you should register for and remit business tax. Web the business tax rates vary, depending on your classification and whether you are a retailer or a wholesaler. Once this tax is paid each year, the county clerk or city official will provide a license for the next year. Web a standard business license is renewed by the annual payment of business tax to the tennessee department of revenue. Watch this video to learn how to file your business tax return while you are logged into your tntap account. Brief business tax overview the business tax statutes are found in tenn. Web sixteen different business tax rules and regulations, including three rules repealed in their entirety. Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer. The state business tax and the city business tax. 2 and the business tax rules and regulations are found in t enn.

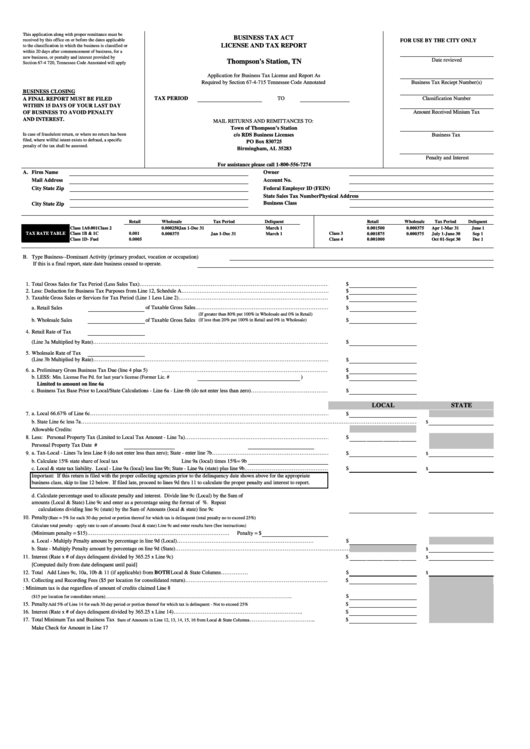

Watch this video to learn how to file your business tax return while you are logged into your tntap account. The state business tax and the city business tax. Web a standard business license is renewed by the annual payment of business tax to the tennessee department of revenue. Once this tax is paid each year, the county clerk or city official will provide a license for the next year. Web business forms & fees county register of deeds fraudulent lien filings uncontested lien affidavit (pdf, 733.0kb) notarized affidavit register of deeds (pdf, 721.1kb) certification form (pdf, 660.1kb) certification form no listing of secured party (pdf, 672.3kb) * additional fees may apply + additional form fee • applies to a taxpayer’s gross receipts • derived from taxable sales per location by the appropriate state and local tax rates to calculate the amount of tax owed per. Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer. Please visit the file and pay section of our website for more information on this process. Filing a business tax return. Web the business tax rates vary, depending on your classification and whether you are a retailer or a wholesaler.

The state business tax and the city business tax. Business tax consists of two separate taxes: 2 and the business tax rules and regulations are found in t enn. • applies to a taxpayer’s gross receipts • derived from taxable sales per location by the appropriate state and local tax rates to calculate the amount of tax owed per. Once this tax is paid each year, the county clerk or city official will provide a license for the next year. Web sixteen different business tax rules and regulations, including three rules repealed in their entirety. Web overview generally, if you conduct business within any county and/or incorporated municipality in tennessee, and your business grosses $100,000 or more, then you should register for and remit business tax. Web the business tax is a tax on the privilege of doing business by making sales of tangible personal property and services* within tennessee and its local jurisdictions. Web the business tax rates vary, depending on your classification and whether you are a retailer or a wholesaler. Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer.

Free Tennessee Department of Revenue County Business Tax Return RV

Web a standard business license is renewed by the annual payment of business tax to the tennessee department of revenue. Web overview generally, if you conduct business within any county and/or incorporated municipality in tennessee, and your business grosses $100,000 or more, then you should register for and remit business tax. Watch this video to learn how to file your.

Business Tax Act / License And Tax Report Form Thompson'S Station, Tn

You may also follow these steps. Business tax consists of two separate taxes: Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer. Filing a business tax return. Watch this video to learn how to file your business tax return while you are logged into your tntap account.

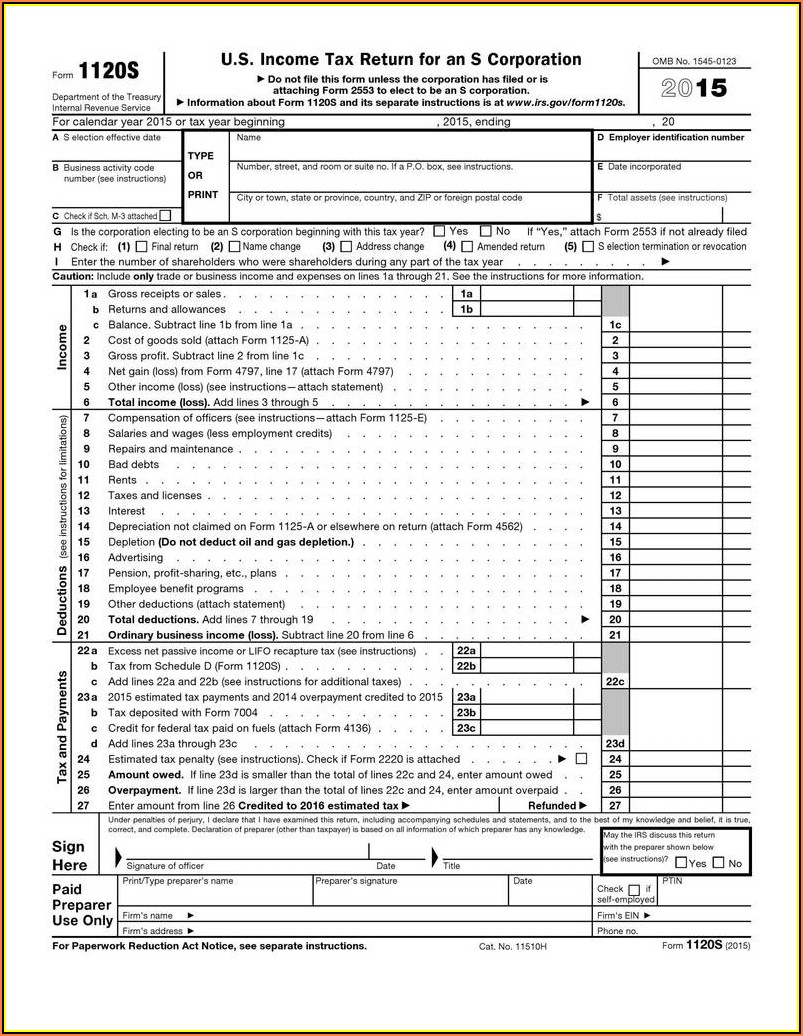

Irs Tax Form 1040ez 2020 Form Resume Examples qeYzgN5V8X

Brief business tax overview the business tax statutes are found in tenn. Business tax minimal activity licenses are renewed each year by payment of an annual $15 lic ense fee to each 2 and the business tax rules and regulations are found in t enn. Web the business tax rates vary, depending on your classification and whether you are a.

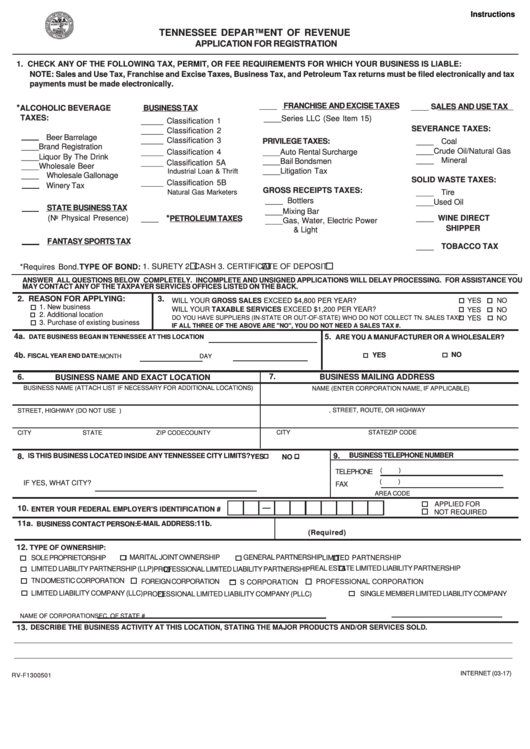

411 Tennessee Department Of Revenue Forms And Templates free to

Business tax minimal activity licenses are renewed each year by payment of an annual $15 lic ense fee to each Web sixteen different business tax rules and regulations, including three rules repealed in their entirety. Please visit the file and pay section of our website for more information on this process. You may also follow these steps. Once this tax.

Sole Proprietorship Business License Tennessee Santos Czerwinski's

Once this tax is paid each year, the county clerk or city official will provide a license for the next year. 2 and the business tax rules and regulations are found in t enn. Business tax consists of two separate taxes: Watch this video to learn how to file your business tax return while you are logged into your tntap.

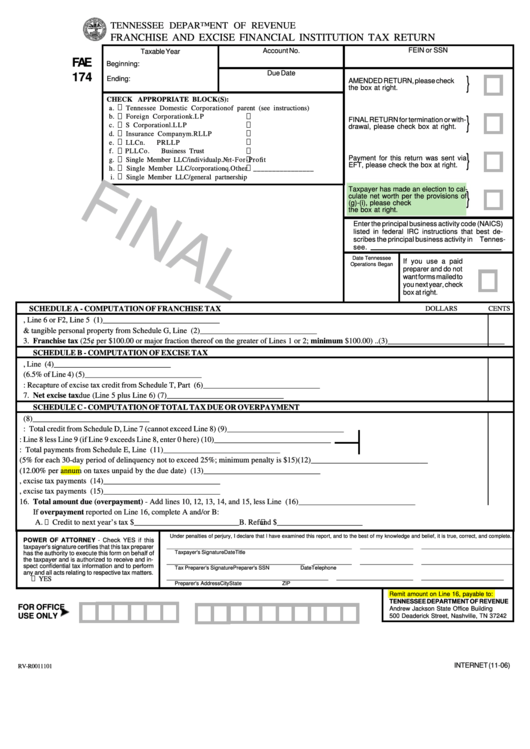

Form Fae 174 Franchise And Excise Financial Institution Tax Return

Business tax minimal activity licenses are renewed each year by payment of an annual $15 lic ense fee to each Watch this video to learn how to file your business tax return while you are logged into your tntap account. Business tax consists of two separate taxes: 2 and the business tax rules and regulations are found in t enn..

Tennessee Sales Tax Permit Application

Brief business tax overview the business tax statutes are found in tenn. You may also follow these steps. Web sixteen different business tax rules and regulations, including three rules repealed in their entirety. Web a standard business license is renewed by the annual payment of business tax to the tennessee department of revenue. Web the business tax is a tax.

20202022 Form TN DoR SLS 450 Fill Online, Printable, Fillable, Blank

2 and the business tax rules and regulations are found in t enn. Business tax consists of two separate taxes: Brief business tax overview the business tax statutes are found in tenn. Once this tax is paid each year, the county clerk or city official will provide a license for the next year. Web the business tax is a tax.

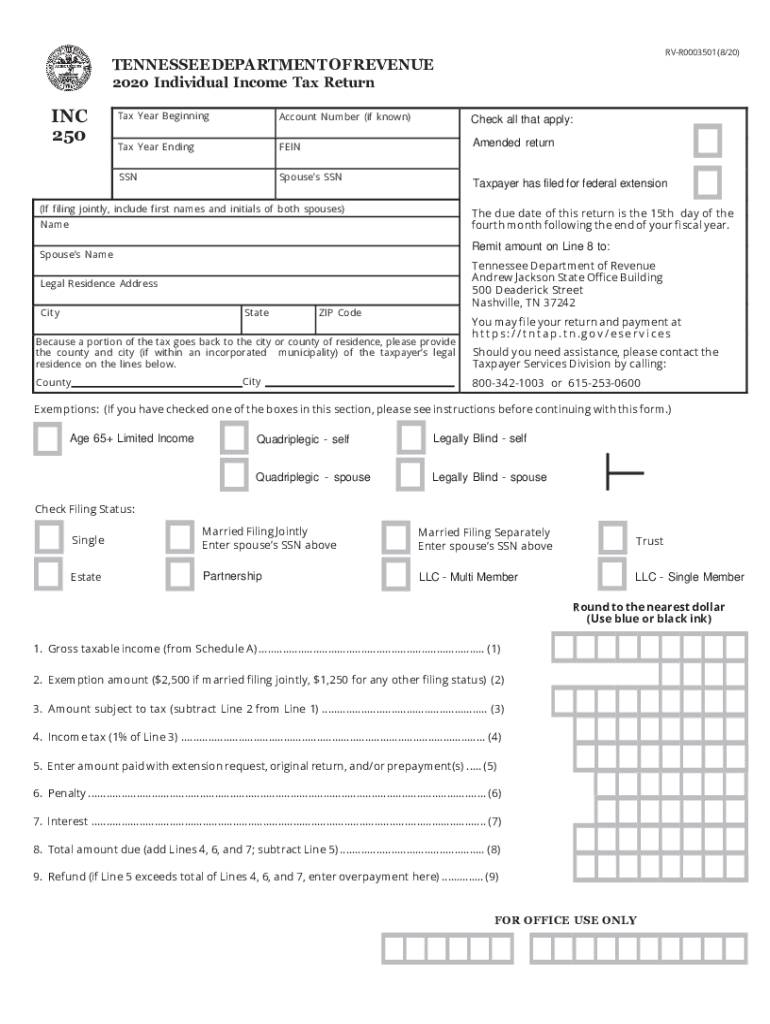

2020 Form TN DoR INC 250 Fill Online, Printable, Fillable, Blank

• applies to a taxpayer’s gross receipts • derived from taxable sales per location by the appropriate state and local tax rates to calculate the amount of tax owed per. 2 and the business tax rules and regulations are found in t enn. Filing a business tax return. Paper returns will not be accepted unless filing electronically creates a hardship.

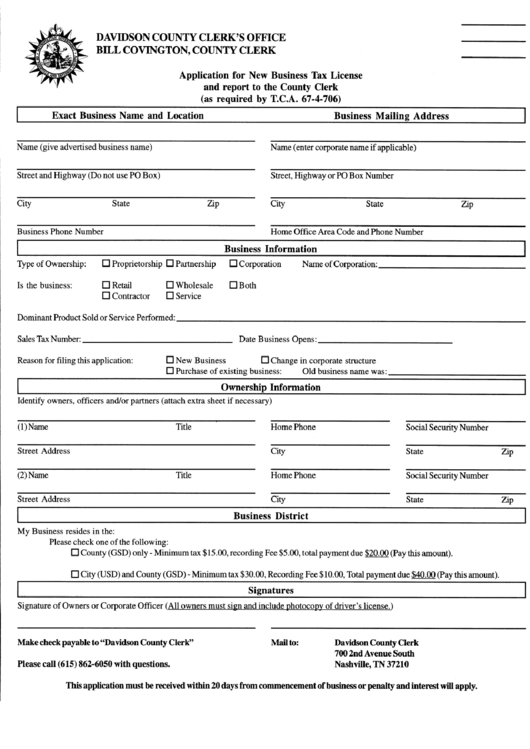

Application For New Business Tax License And Report To The County Clerk

Brief business tax overview the business tax statutes are found in tenn. Web business forms & fees county register of deeds fraudulent lien filings uncontested lien affidavit (pdf, 733.0kb) notarized affidavit register of deeds (pdf, 721.1kb) certification form (pdf, 660.1kb) certification form no listing of secured party (pdf, 672.3kb) * additional fees may apply + additional form fee Once this.

Web Overview Generally, If You Conduct Business Within Any County And/Or Incorporated Municipality In Tennessee, And Your Business Grosses $100,000 Or More, Then You Should Register For And Remit Business Tax.

Web the business tax rates vary, depending on your classification and whether you are a retailer or a wholesaler. Once this tax is paid each year, the county clerk or city official will provide a license for the next year. Business tax consists of two separate taxes: Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer.

Watch This Video To Learn How To File Your Business Tax Return While You Are Logged Into Your Tntap Account.

• applies to a taxpayer’s gross receipts • derived from taxable sales per location by the appropriate state and local tax rates to calculate the amount of tax owed per. Filing a business tax return. Business tax minimal activity licenses are renewed each year by payment of an annual $15 lic ense fee to each Web business forms & fees county register of deeds fraudulent lien filings uncontested lien affidavit (pdf, 733.0kb) notarized affidavit register of deeds (pdf, 721.1kb) certification form (pdf, 660.1kb) certification form no listing of secured party (pdf, 672.3kb) * additional fees may apply + additional form fee

2 And The Business Tax Rules And Regulations Are Found In T Enn.

Web the business tax is a tax on the privilege of doing business by making sales of tangible personal property and services* within tennessee and its local jurisdictions. Web a standard business license is renewed by the annual payment of business tax to the tennessee department of revenue. Please visit the file and pay section of our website for more information on this process. Web sixteen different business tax rules and regulations, including three rules repealed in their entirety.

The State Business Tax And The City Business Tax.

Brief business tax overview the business tax statutes are found in tenn. You may also follow these steps.