Texas Llc Annual Report Form

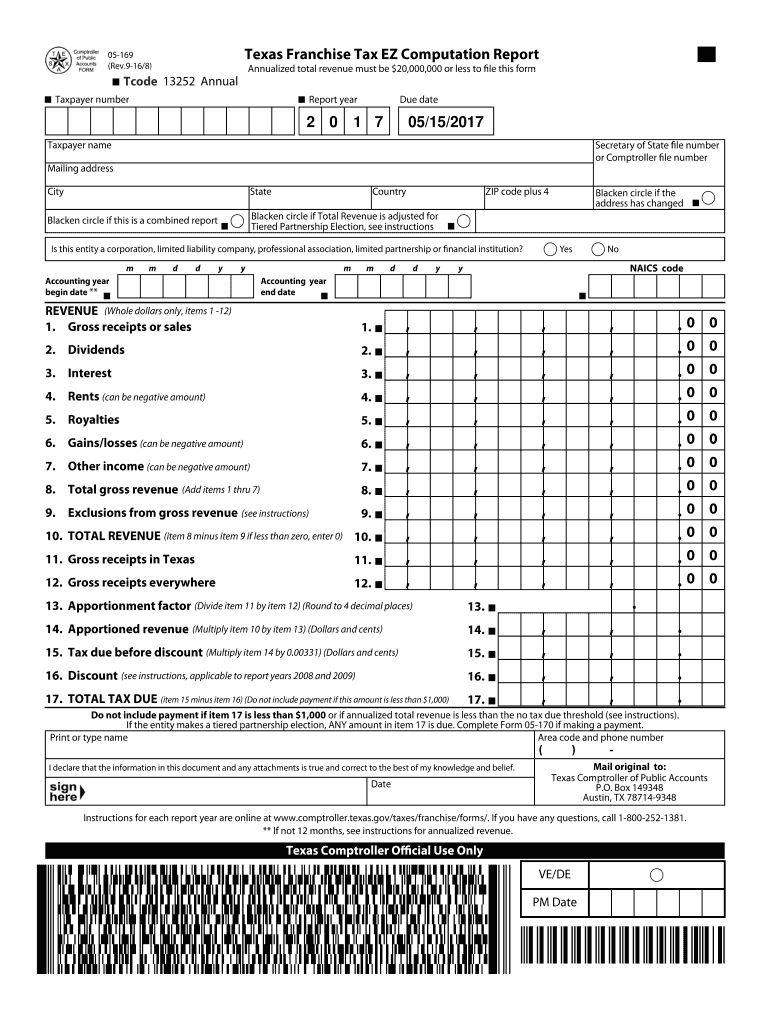

Texas Llc Annual Report Form - Web long form extension payment form questionnaires for franchise tax accountability professional employer organization report (to submit to client companies) historic. Web every texas llc must file a franchise tax report and a public information report every year for their “annual report”. Web the annual franchise tax report is due may 15. Annual report of a limited liability partnership: Web texas annual franchise tax report for corporations vs llcs not every entity has to file a franchise tax report. Web up to 25% cash back this article covers the most important ongoing reporting and state tax filing requirements for texas llcs. Accounting period accounting year begin date: If may 15 falls on a weekend or holiday, the due date will be the next business day. Web our annual report filing services can benefit you in the following ways: Llp annual reports 23 • in january/february of 2019, sos mailed 3,483 annual notices to texas.

Web annual reports are due may 15 of each year. Certificate of formation for a texas nonprofit corporation (form 202) or. Web 2023 report year forms and instructions texas franchise tax reports for 2022 and prior years additional franchise tax forms questionnaires for franchise tax accountability. Web online filing online services are available through our website at sosdirect, including the ability to: Web every texas llc must file a franchise tax report and a public information report every year for their “annual report”. Web corporations section forms corporations section forms the secretary of state has promulgated certain forms designed to meet statutory requirements and facilitate filings. Unlike most states, texas does not. Web up to 25% cash back this article covers the most important ongoing reporting and state tax filing requirements for texas llcs. Web our annual report filing services can benefit you in the following ways: Web texas annual franchise tax report for corporations vs llcs not every entity has to file a franchise tax report.

As mentioned earlier, the texas annual report or the annual franchise tax report has to be filed with the office of the. Accounting period accounting year begin date: Web (form 422 [llc, corp or lp]) new assumed name certificate (form 503). For an llp, an application report must be filed on a yearly basis with the texas secretary of state. Web how to file a texas llc annual report. Final franchise tax reports before getting a. Web as a part of texas llc annual requirements, the pir or annual report has to be filed annually by may 15 in the year following the year your llc was registered. Web annual reports are due may 15 of each year. Llp annual reports 23 • in january/february of 2019, sos mailed 3,483 annual notices to texas. Form to be used to file the annual report required by law of a texas partnership registered as a.

Franchise mailings jabezy

Web texas annual franchise tax report for corporations vs llcs not every entity has to file a franchise tax report. Annual report of a limited liability partnership: Web every texas llc must file a franchise tax report and a public information report every year for their “annual report”. Enter the day after the end date on the previous franchise tax.

Annual Report Form in Word and Pdf formats page 3 of 5

Certificate of formation for a texas nonprofit corporation (form 202) or. Web (form 422 [llc, corp or lp]) new assumed name certificate (form 503). Form to be used to file the annual report required by law of a texas partnership registered as a. Llp annual reports 23 • in january/february of 2019, sos mailed 3,483 annual notices to texas. Web.

Complete 13Step Guide for Starting an LLC in Texas

As mentioned earlier, the texas annual report or the annual franchise tax report has to be filed with the office of the. Web the annual report or public information report is filed with the franchise tax forms. Form to be used to file the annual report required by law of a texas partnership registered as a. To print an adobe.

Free Annual Expense Report Template Templates Resume Template

These must be filed in order to keep your llc. Web series llcs limited liability partnerships (llps) and limited liability limited partnerships (lllps) social purposes public benefit corporations before formation what type of. Certificate of formation for a texas nonprofit corporation (form 202) or. As mentioned earlier, the texas annual report or the annual franchise tax report has to be.

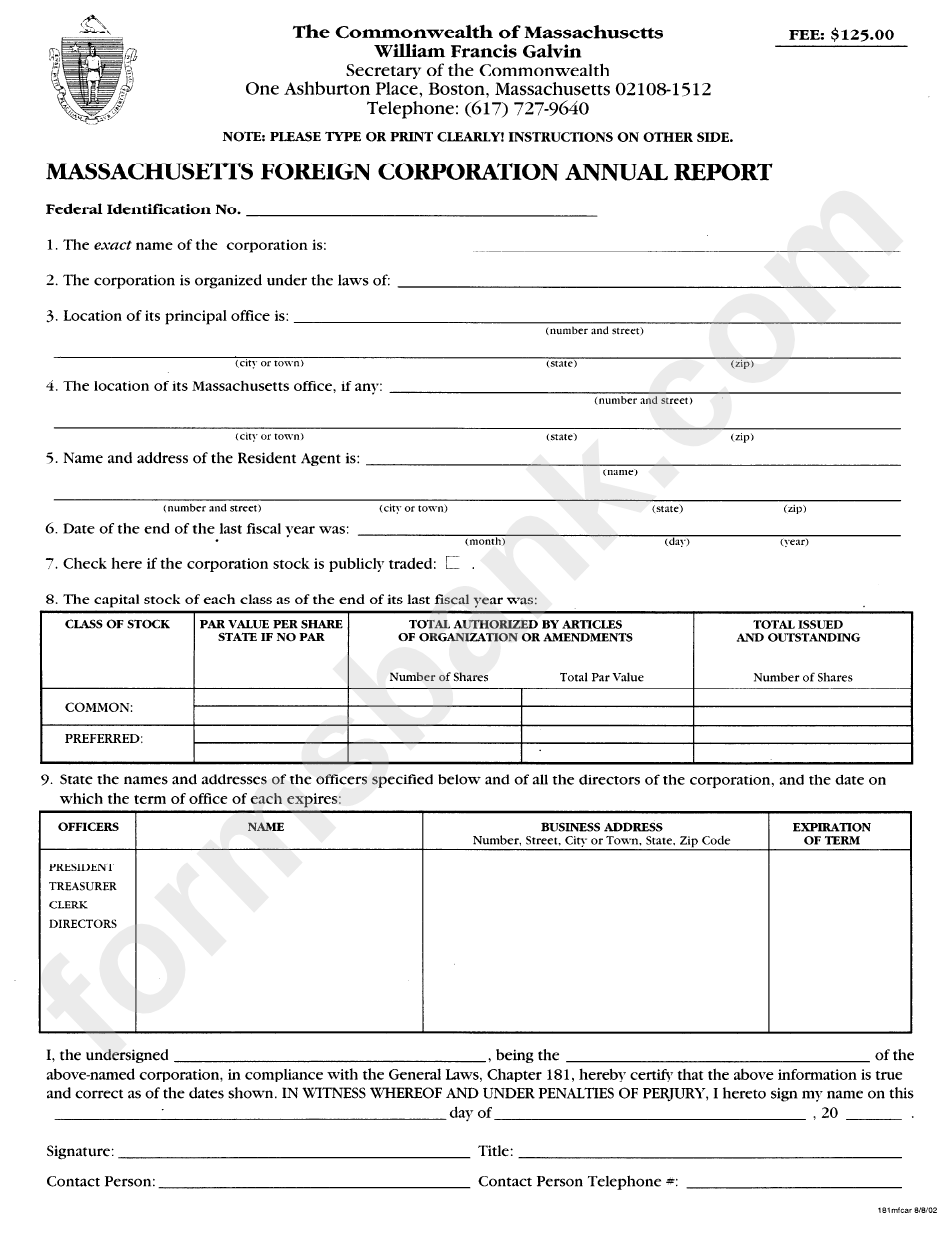

nsbeckdesign When Are Massachusetts Annual Reports Due

Web online filing online services are available through our website at sosdirect, including the ability to: Web as a part of texas llc annual requirements, the pir or annual report has to be filed annually by may 15 in the year following the year your llc was registered. Web in accordance with section 152.806 of the texas business organizations code.

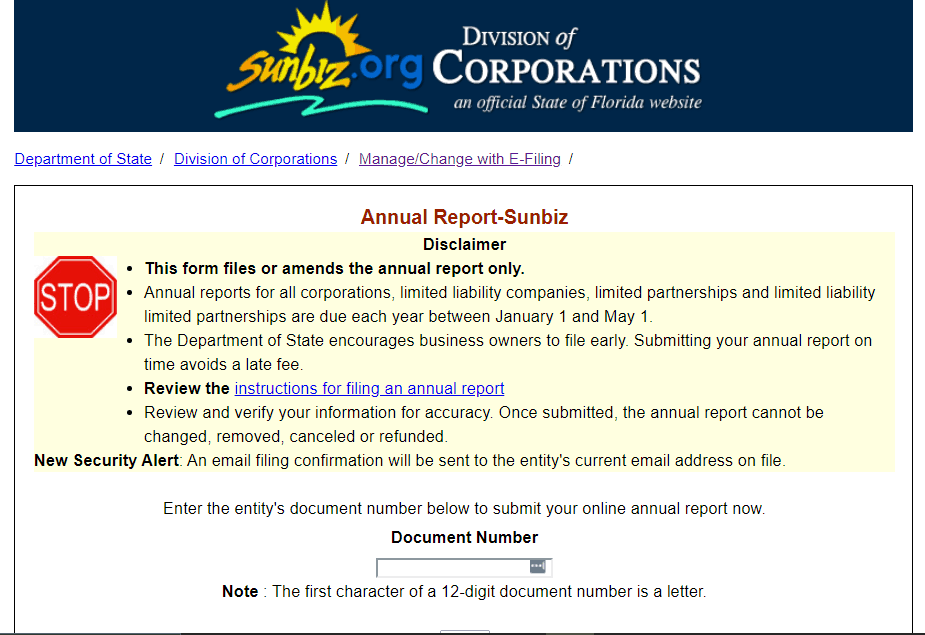

Florida LLC Annual Report Step by Step Guide on How to File

Web online filing online services are available through our website at sosdirect, including the ability to: To print an adobe form, select print from the file menu, under size options select 'actual size', and then click print. Web types of annual reports. Annual report of a limited liability partnership: Web our annual report filing services can benefit you in the.

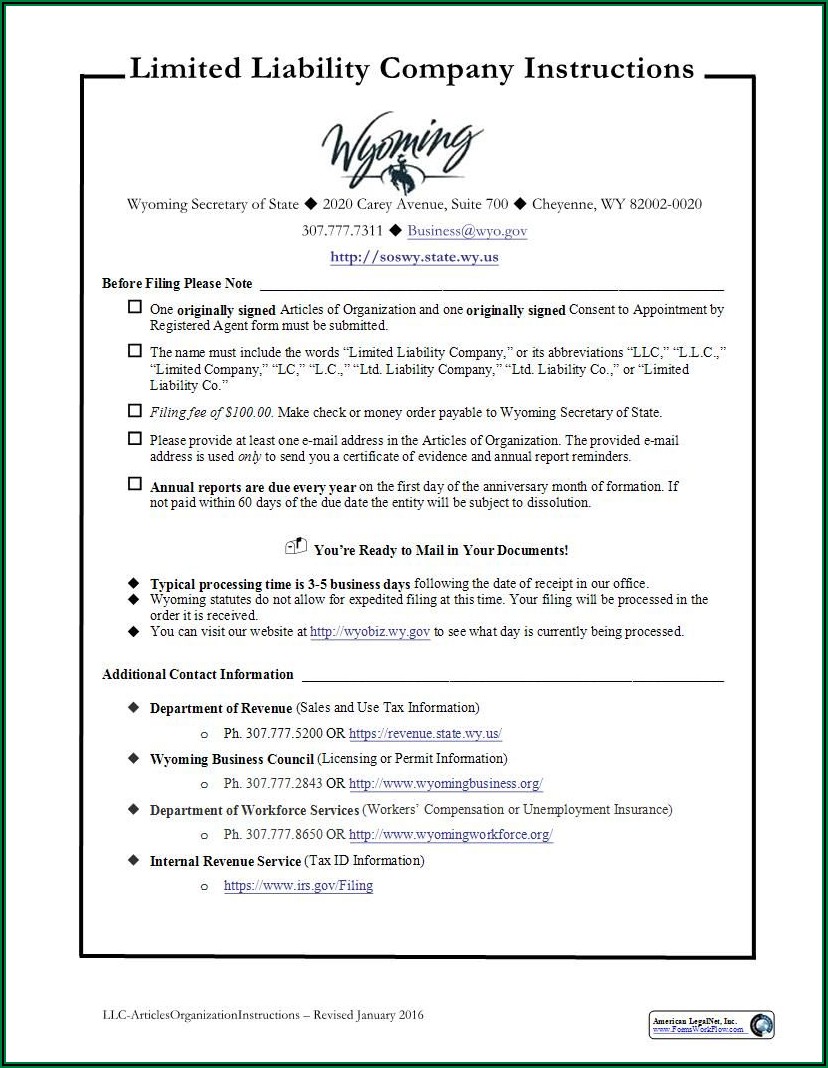

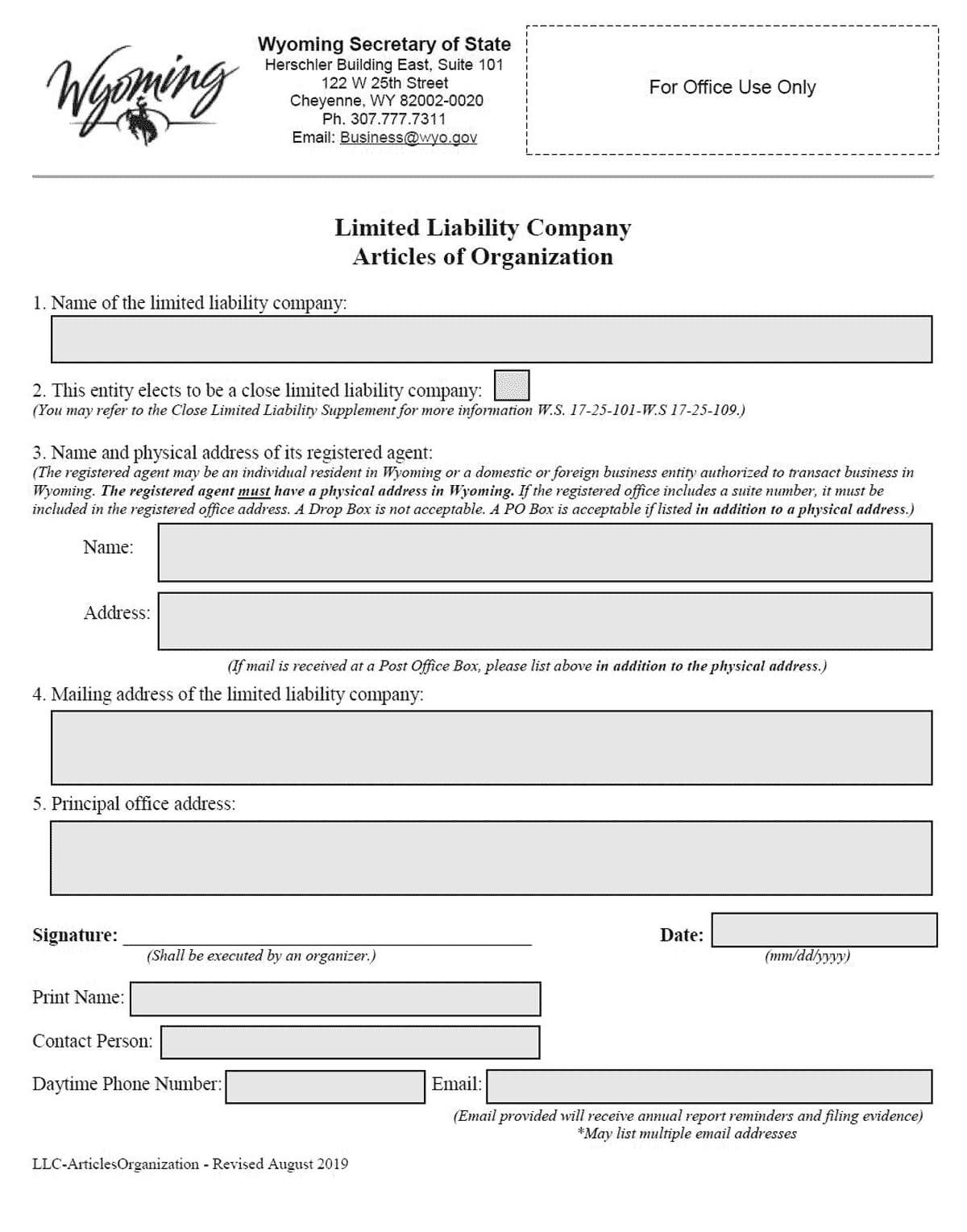

Wyoming Llc How To Form An Llc In Wyoming With Llc Annual Report

If may 15 falls on a weekend or holiday, the due date will be the next business day. Web in accordance with section 152.806 of the texas business organizations code (boc), effective january 1, 2016, a texas general or limited partnership that is registered with. Formation of business entities and nonprofit. Final franchise tax reports before getting a. Web how.

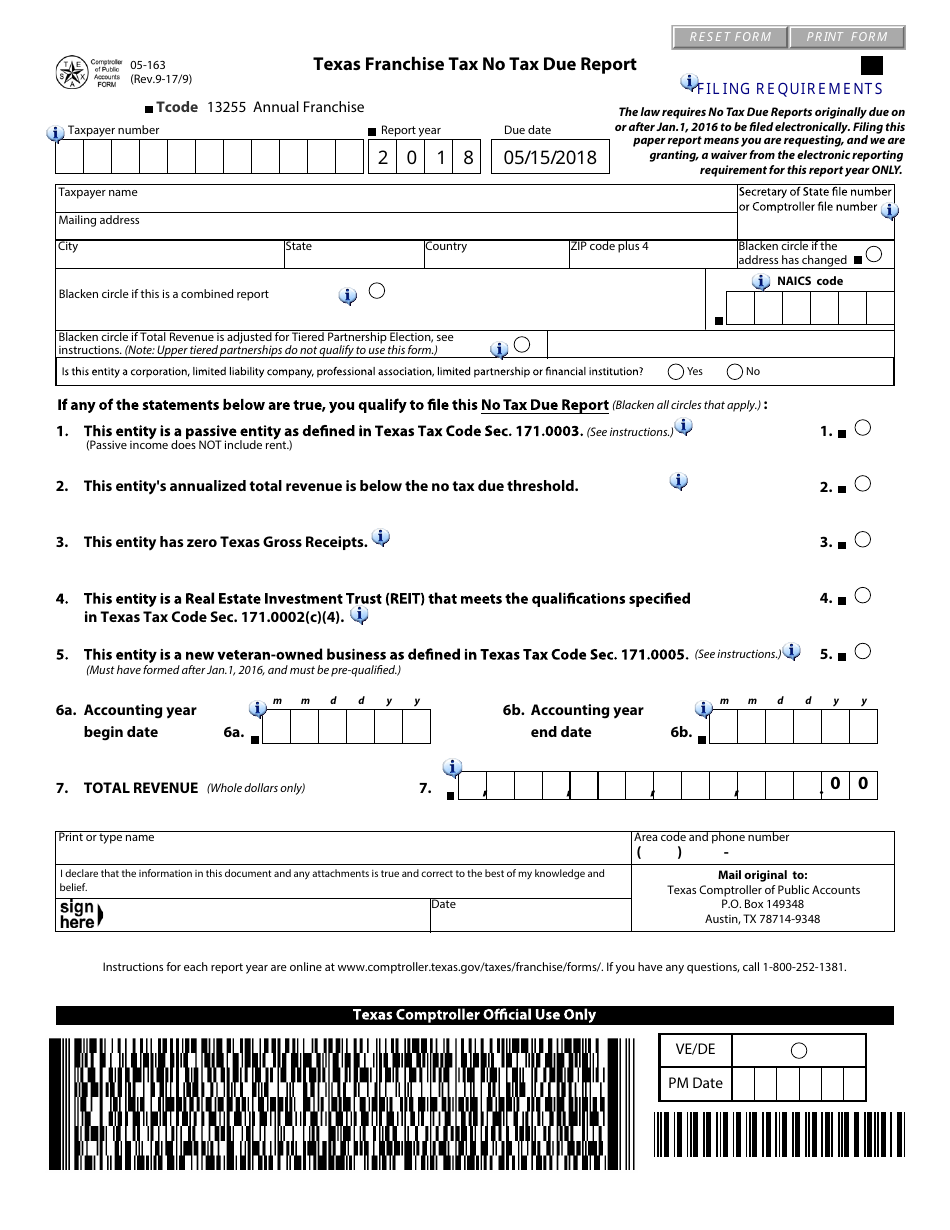

Final Franchise Tax Report

Unlike most states, texas does not. These must be filed in order to keep your llc. Web certificate of formation for a texas professional association or limited partnership (forms 204, 207) $750. Web online filing online services are available through our website at sosdirect, including the ability to: Web 2023 report year forms and instructions texas franchise tax reports for.

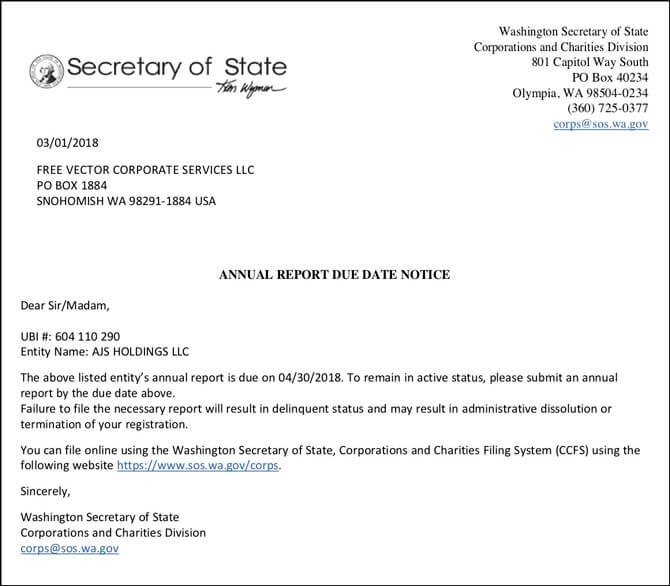

Template Lettr To The Secretary Of State For A Change Of Register How

Llp annual reports 23 • in january/february of 2019, sos mailed 3,483 annual notices to texas. Web long form extension payment form questionnaires for franchise tax accountability professional employer organization report (to submit to client companies) historic. Web the annual report or public information report is filed with the franchise tax forms. Web the annual franchise tax report is due.

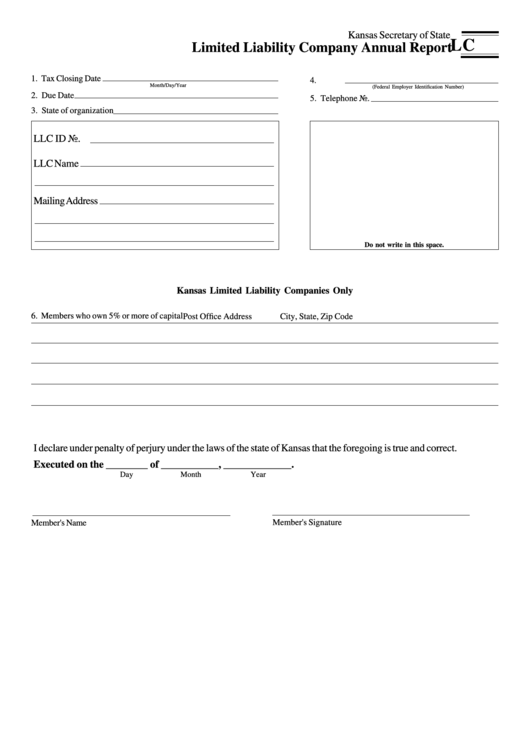

Form Lc Limited Liability Company Annual Report printable pdf download

Llp annual reports 23 • in january/february of 2019, sos mailed 3,483 annual notices to texas. Web how to file a texas llc annual report. To print an adobe form, select print from the file menu, under size options select 'actual size', and then click print. Annual report of a limited liability partnership: Formation of business entities and nonprofit.

Accounting Period Accounting Year Begin Date:

Web long form extension payment form questionnaires for franchise tax accountability professional employer organization report (to submit to client companies) historic. Web 2023 report year forms and instructions texas franchise tax reports for 2022 and prior years additional franchise tax forms questionnaires for franchise tax accountability. Here are the various requirements for completing the report. Web our annual report filing services can benefit you in the following ways:

Web Types Of Annual Reports.

Unlike most states, texas does not. Web certificate of formation for a texas professional association or limited partnership (forms 204, 207) $750. Formation of business entities and nonprofit. Annual report of a limited liability partnership:

Web Up To 25% Cash Back This Article Covers The Most Important Ongoing Reporting And State Tax Filing Requirements For Texas Llcs.

If may 15 falls on a weekend or holiday, the due date will be the next business day. For an llp, an application report must be filed on a yearly basis with the texas secretary of state. Web every texas llc must file a franchise tax report and a public information report every year for their “annual report”. Web in accordance with section 152.806 of the texas business organizations code (boc), effective january 1, 2016, a texas general or limited partnership that is registered with.

Enter The Day After The End Date On The Previous Franchise Tax Report.

“taxable entities” include but are not limited to: Web how to file a texas llc annual report. Certificate of formation for a texas nonprofit corporation (form 202) or. Final franchise tax reports before getting a.