Trustee To Trustee Transfer Form

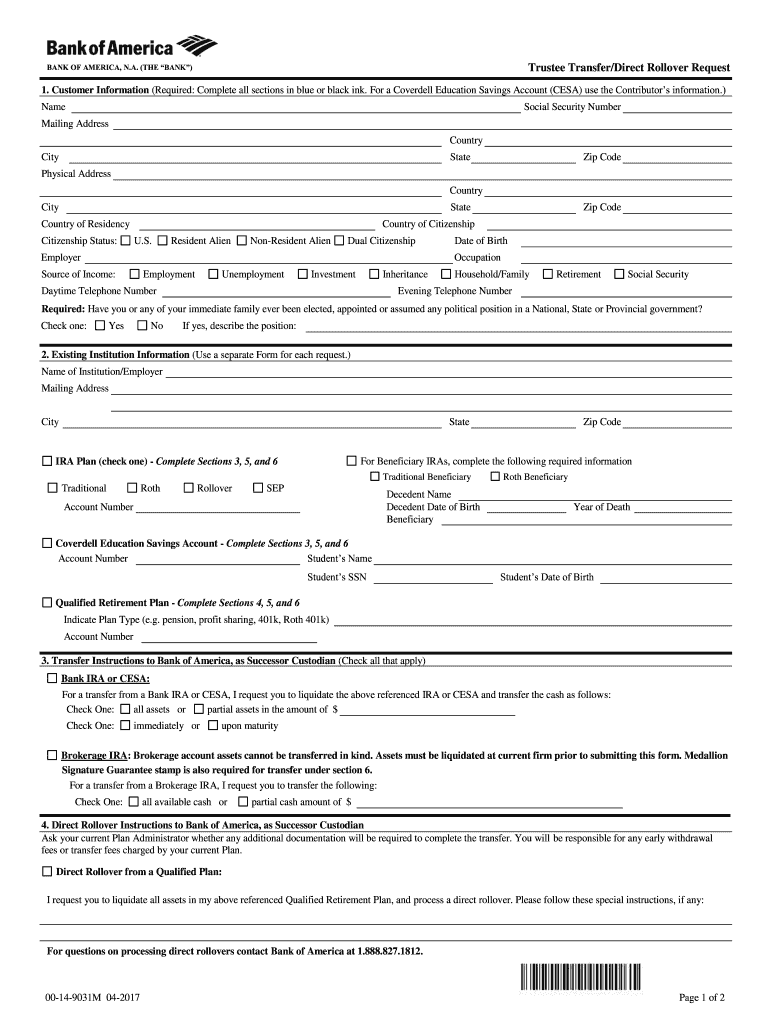

Trustee To Trustee Transfer Form - Create your signature and click. Web there is a direct question for a transfer situation. A typed, drawn or uploaded signature. Web trustee transfer/direct rollover request 1. It will request the funds from the current trustee, who will send a check to the new. Office of the new york state comptroller subject: Complete all sections in blue or black ink. Decide on what kind of signature to create. Web the ira trustee at the receiving institution should be able to handle the details of the transfer for you. Select the document you want to sign and click upload.

Web there is a direct question for a transfer situation. Complete all sections in blue or black ink. It will request the funds from the current trustee, who will send a check to the new. Web the ira trustee at the receiving institution should be able to handle the details of the transfer for you. Decide on what kind of signature to create. Create your signature and click. For a coverdell education savings account (cesa) use the contributor’s information.) Web trustee transfer/direct rollover request 1. Complete this form to transfer funds from another health savings account (hsa) or archer medical savings account (msa) trustee to your hsa held by optum financial. Select the document you want to sign and click upload.

A typed, drawn or uploaded signature. Web there is a direct question for a transfer situation. Complete all sections in blue or black ink. Nontaxable distributions from cesas and qtps are not required to be reported on your income tax return. Create your signature and click. Office of the new york state comptroller subject: For a coverdell education savings account (cesa) use the contributor’s information.) Select the document you want to sign and click upload. No taxes will be withheld from your transfer amount. Web attached trustee transfer letter use this form to complete the movement of assets directly between ira trustees/custodians without distribution to the participant.

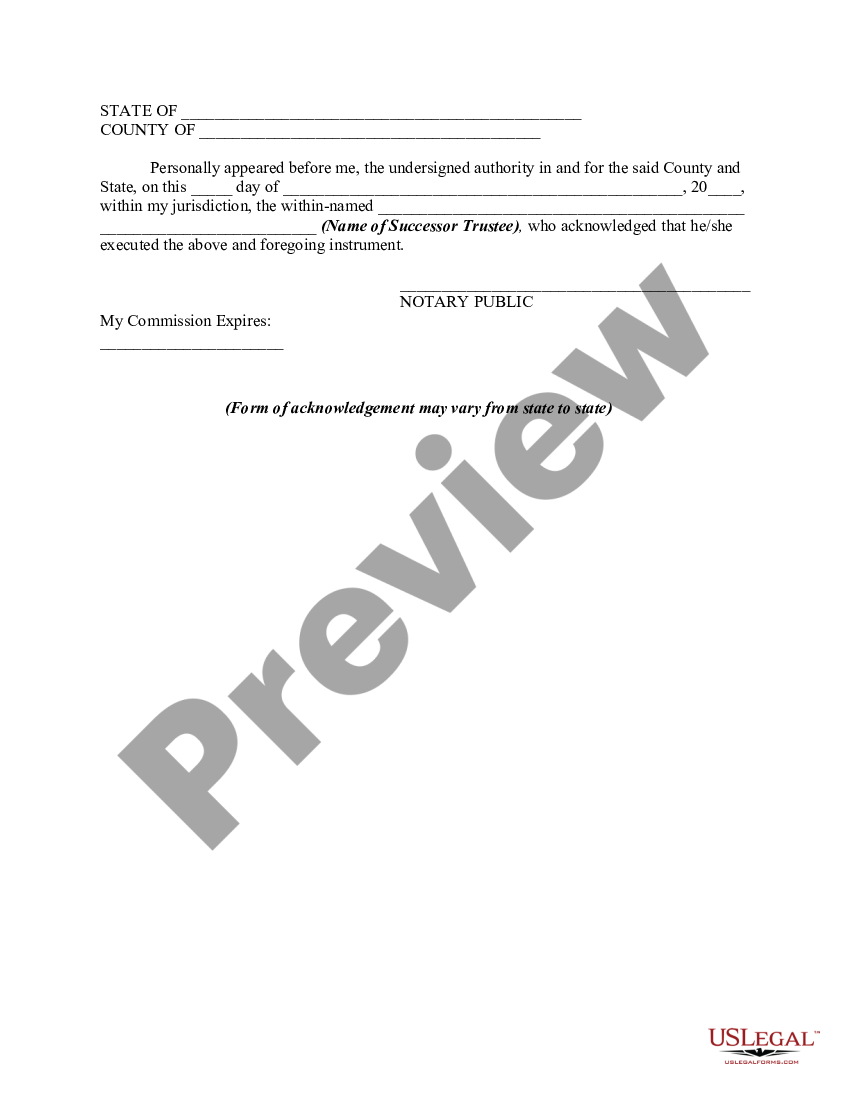

Consent of Successor Trustee to Appointment Following Resignation of

It will request the funds from the current trustee, who will send a check to the new. Complete this form to transfer funds from another health savings account (hsa) or archer medical savings account (msa) trustee to your hsa held by optum financial. Web attached trustee transfer letter use this form to complete the movement of assets directly between ira.

Wells Fargo Living Trust Forms Fill Out and Sign Printable PDF

Decide on what kind of signature to create. Create your signature and click. Complete all sections in blue or black ink. A typed, drawn or uploaded signature. Office of the new york state comptroller subject:

Transfer of the Trust Assets YouTube

Complete all sections in blue or black ink. Select the document you want to sign and click upload. Web the ira trustee at the receiving institution should be able to handle the details of the transfer for you. Office of the new york state comptroller subject: Decide on what kind of signature to create.

What are Trustee Fees? (with pictures)

No taxes will be withheld from your transfer amount. Select the document you want to sign and click upload. For a coverdell education savings account (cesa) use the contributor’s information.) Web the ira trustee at the receiving institution should be able to handle the details of the transfer for you. Web there is a direct question for a transfer situation.

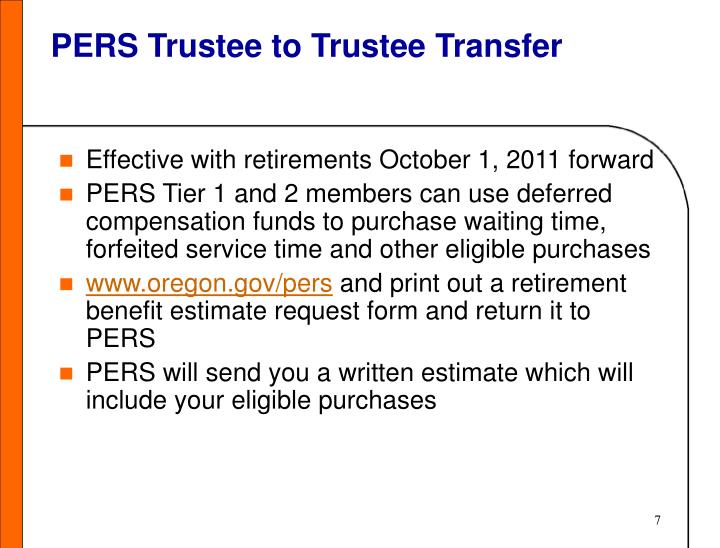

PPT City of Portland 457 Deferred Compensation Plan PowerPoint

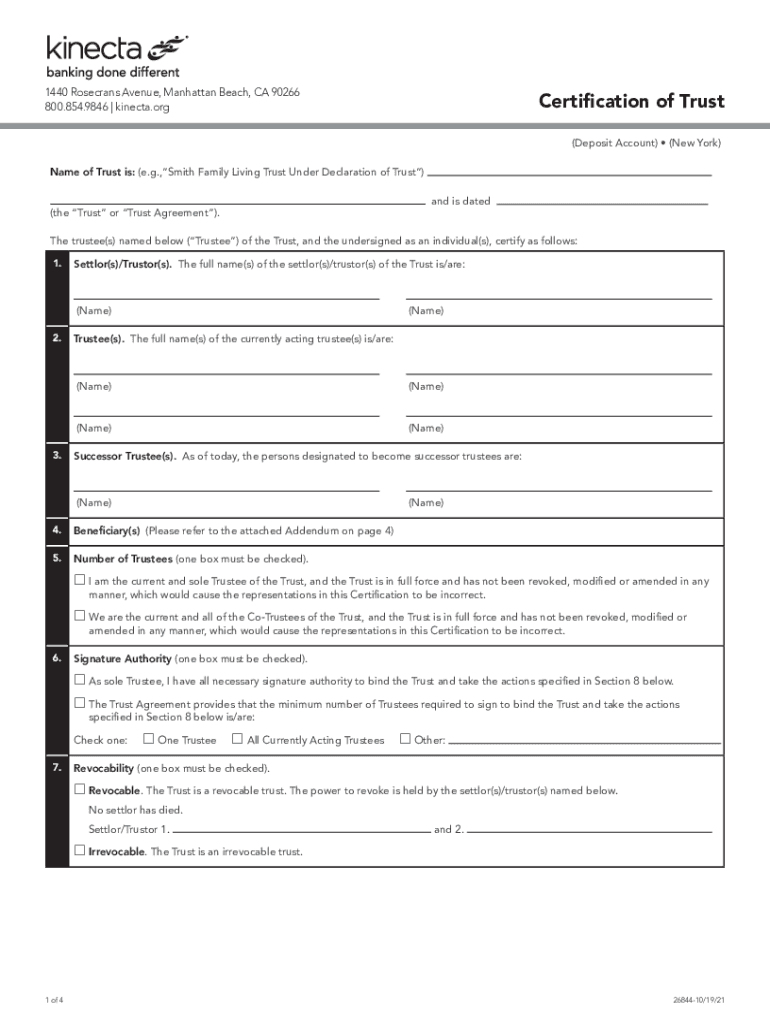

For a coverdell education savings account (cesa) use the contributor’s information.) Web the ira trustee at the receiving institution should be able to handle the details of the transfer for you. Decide on what kind of signature to create. Create your signature and click. Complete all sections in blue or black ink.

Ira Trustee Transfer Form Fill Out and Sign Printable PDF Template

Nontaxable distributions from cesas and qtps are not required to be reported on your income tax return. It will request the funds from the current trustee, who will send a check to the new. A typed, drawn or uploaded signature. Web there is a direct question for a transfer situation. Web the ira trustee at the receiving institution should be.

Change of Trustee Form 2 Free Templates in PDF, Word, Excel Download

Create your signature and click. Nontaxable distributions from cesas and qtps are not required to be reported on your income tax return. Web the ira trustee at the receiving institution should be able to handle the details of the transfer for you. No taxes will be withheld from your transfer amount. A typed, drawn or uploaded signature.

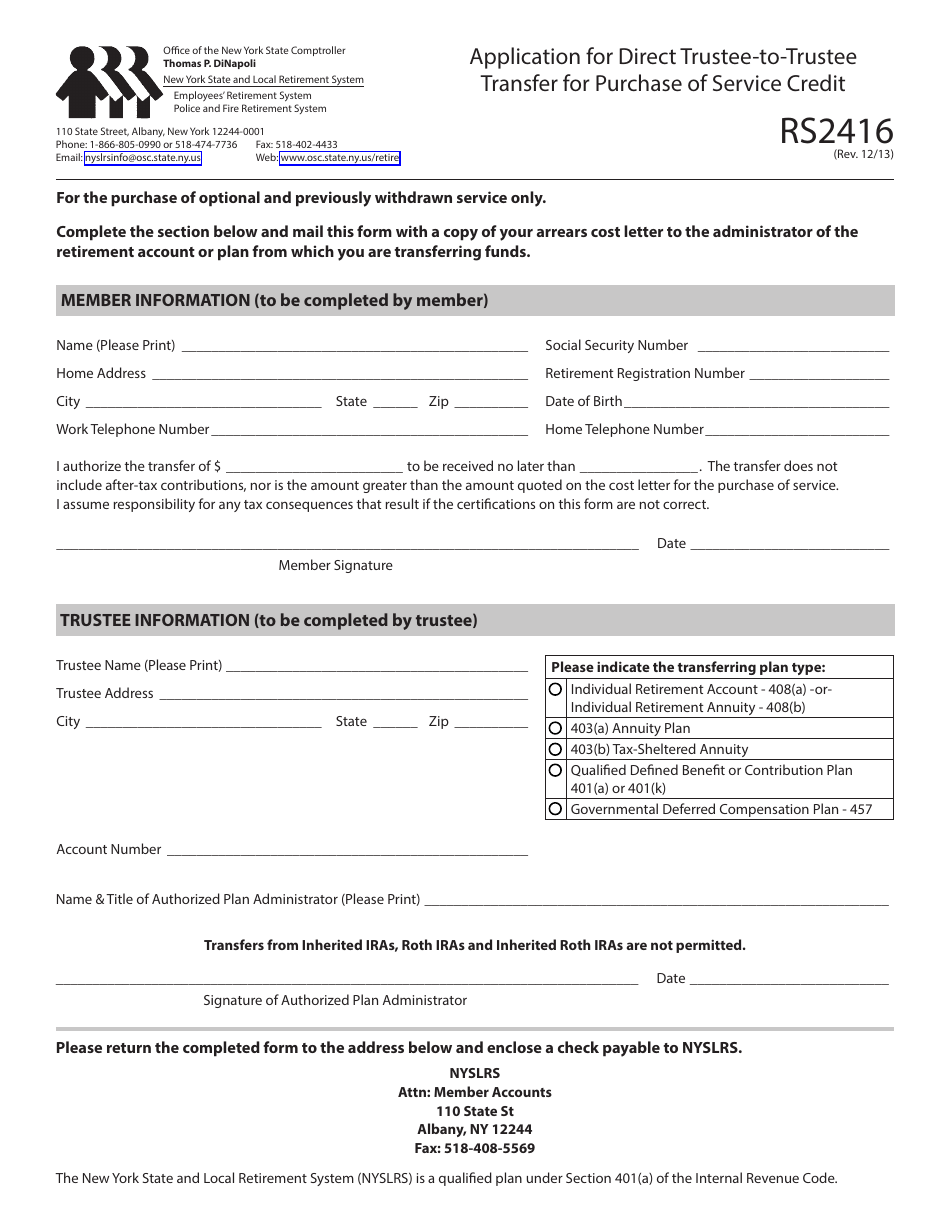

Form RS2416 Download Fillable PDF or Fill Online Application for Direct

Select the document you want to sign and click upload. Web trustee transfer/direct rollover request 1. Decide on what kind of signature to create. No taxes will be withheld from your transfer amount. A typed, drawn or uploaded signature.

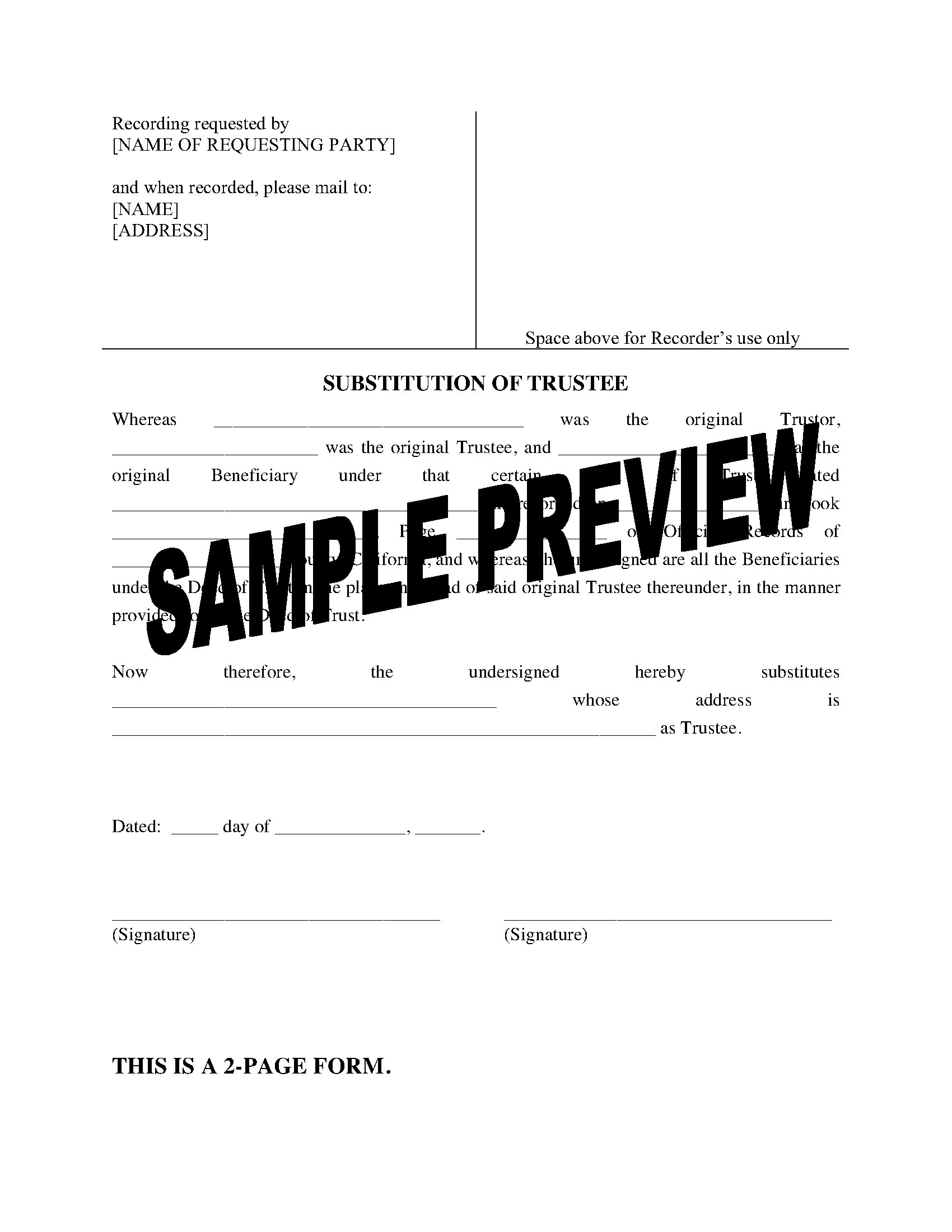

California Substitution of Trustee Legal Forms and Business Templates

Complete this form to transfer funds from another health savings account (hsa) or archer medical savings account (msa) trustee to your hsa held by optum financial. A typed, drawn or uploaded signature. It will request the funds from the current trustee, who will send a check to the new. Web attached trustee transfer letter use this form to complete the.

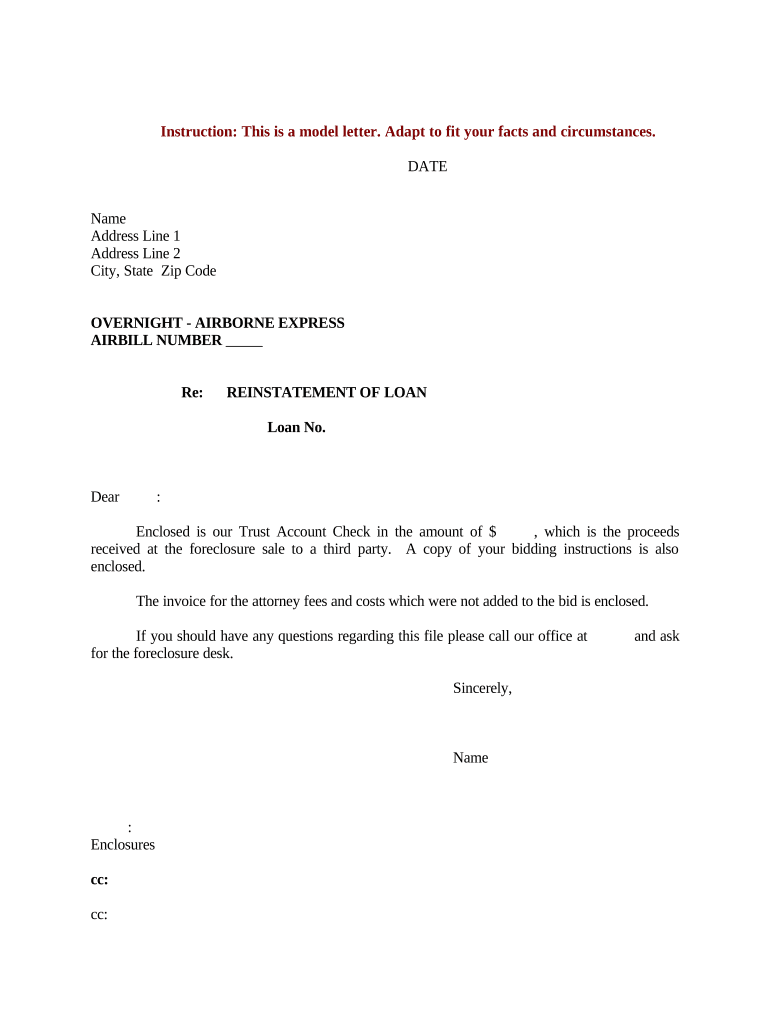

sample letter to close trust account Doc Template pdfFiller

Web the ira trustee at the receiving institution should be able to handle the details of the transfer for you. It will request the funds from the current trustee, who will send a check to the new. Office of the new york state comptroller subject: Decide on what kind of signature to create. Nontaxable distributions from cesas and qtps are.

Select The Document You Want To Sign And Click Upload.

Complete all sections in blue or black ink. Nontaxable distributions from cesas and qtps are not required to be reported on your income tax return. Web the ira trustee at the receiving institution should be able to handle the details of the transfer for you. Web there is a direct question for a transfer situation.

Create Your Signature And Click.

No taxes will be withheld from your transfer amount. Complete this form to transfer funds from another health savings account (hsa) or archer medical savings account (msa) trustee to your hsa held by optum financial. For a coverdell education savings account (cesa) use the contributor’s information.) Web trustee transfer/direct rollover request 1.

Decide On What Kind Of Signature To Create.

A typed, drawn or uploaded signature. It will request the funds from the current trustee, who will send a check to the new. Web attached trustee transfer letter use this form to complete the movement of assets directly between ira trustees/custodians without distribution to the participant. Office of the new york state comptroller subject: