Ubereats Tax Form

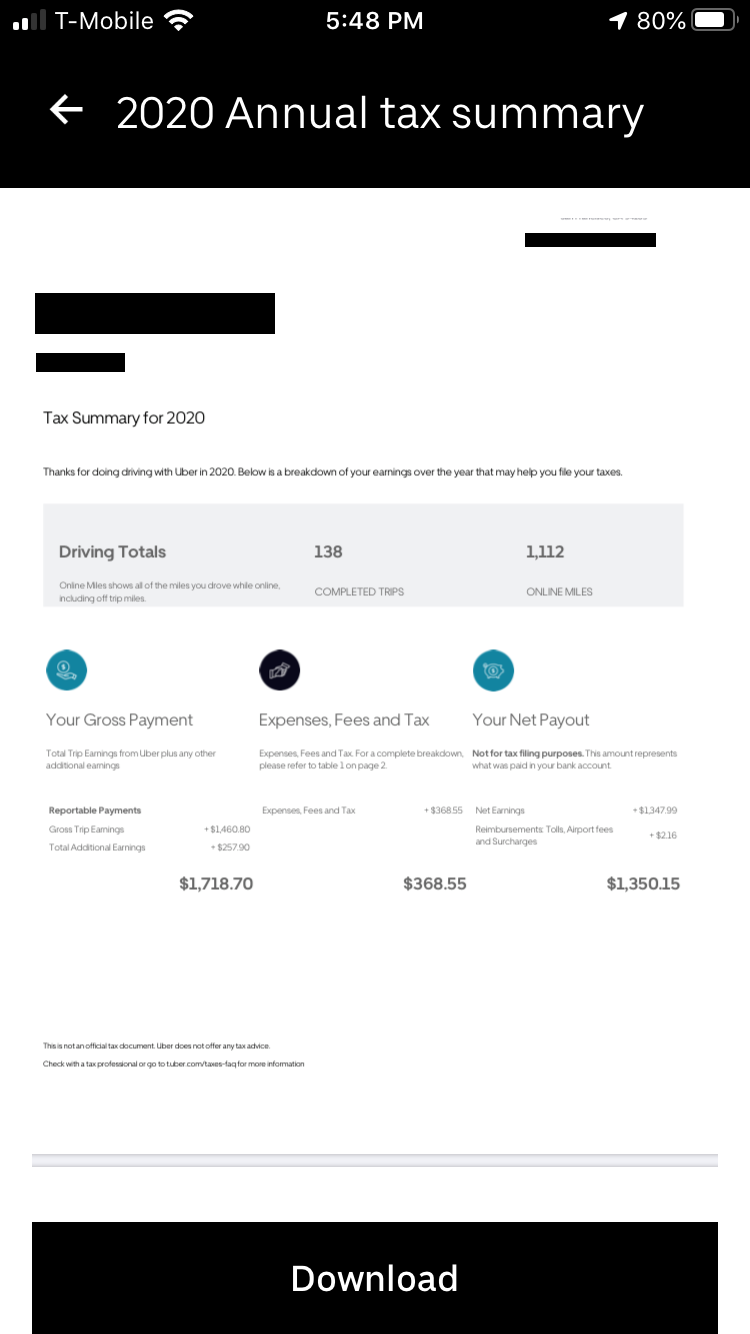

Ubereats Tax Form - Web you are responsible to collect, remit, and file sales tax on all your ridesharing trips to the canada revenue agency (cra). Web chargebacks and refunds how to request a uber eats refund — and get it getting an uber eats refund has never been easier! Click “download” next to your tax forms when they are available. Unlike rides with uber, drivers who earn with uber. In addition, you should be able to. This sets uber taxes apart from most other gigs that only issue one tax form. Web up to $5 cash back turbotax taxes 101 tax tips for uber drivers: Web how to file taxes for uber eats? Log in to drivers.uber.com and click the “tax information” tab. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia.

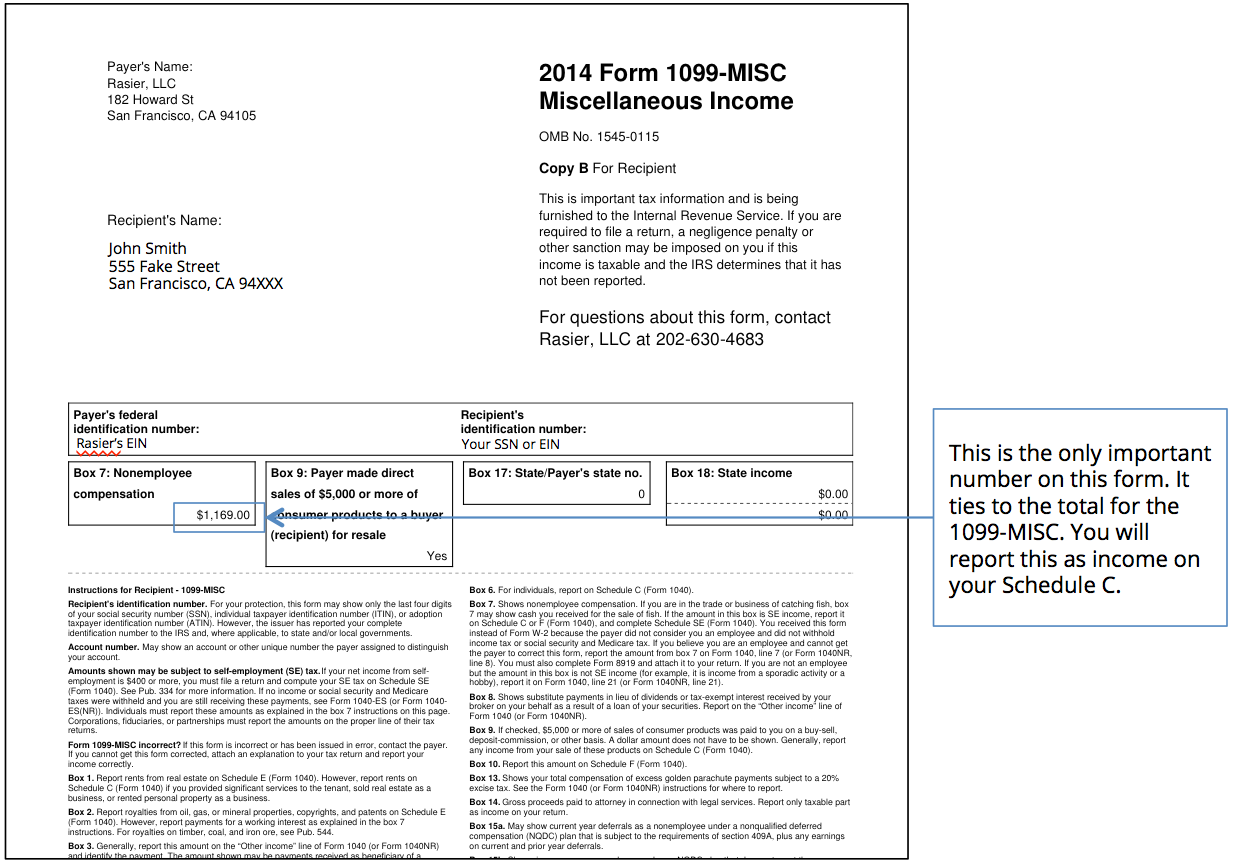

Web what tax forms do you get from uber? Uber eats is the popular online food delivery. Web you are responsible to collect, remit, and file sales tax on all your ridesharing trips to the canada revenue agency (cra). Web chargebacks and refunds how to request a uber eats refund — and get it getting an uber eats refund has never been easier! November 23, 2022 in the first part of this series on uber eats taxes we said schedule c is the most important tax. Web get help with your uber account, a recent trip, or browse through frequently asked questions. Not all restaurants will receive a 1099. Understanding your taxes how to use your uber 1099s: This sets uber taxes apart from most other gigs that only issue one tax form. Web you could receive 3 types of tax documents from us:

An official irs tax document that includes all gross earnings from meal orders. Uber eats is the popular online food delivery. In addition, you should be able to. Web you can access your 1099 in uber eats manager by selecting “tax information” in the menu on the left side of your screen. An unofficial tax document produced by uber and provided to every. Web if using a private delivery service, send your returns to the street address above for the submission processing center (austin, kansas city, or ogden) designated. Web get help with your uber account, a recent trip, or browse through frequently asked questions. Web how to file taxes for uber eats? Log in to drivers.uber.com and click the “tax information” tab. Web a look at how i do my taxes as an independent contractor for ubereats.

Uber Taxes 2014 Tax Summary and Deducting Fees Rideshare Dashboard

Web if using a private delivery service, send your returns to the street address above for the submission processing center (austin, kansas city, or ogden) designated. Other than mileage or car expenses, what else is there?. Web chargebacks and refunds how to request a uber eats refund — and get it getting an uber eats refund has never been easier!.

Ubereats Logo LogoDix

Uber eats is the popular online food delivery. November 23, 2022 in the first part of this series on uber eats taxes we said schedule c is the most important tax. This is a general overview of what i do for taxes using turbo tax to prepare and file my taxes. If you also opted in to receive. An official.

1099 tax form independent contractor printable 1099 forms independent

Click “download” next to your tax forms when they are available. Web if uber eats is classified as a marketplace facilitator, uber eats is responsible for calculating, collecting, and remitting tax on all restaurant partner transactions made. Uber sends two tax forms. Web you could receive 3 types of tax documents from us: Web december 14, 2022 what can you.

Tax for UberEats & Food Delivery Drivers DriveTax Australia

Uber sends two tax forms. Unlike rides with uber, drivers who earn with uber. This is a general overview of what i do for taxes using turbo tax to prepare and file my taxes. An official irs tax document that includes all gross earnings from meal orders. Web you can access your 1099 in uber eats manager by selecting “tax.

Ultimate Tax Guide for Uber & Lyft Drivers [Updated for 2022] Tax

Web december 14, 2022 what can you write off for your taxes as an uber eats independent contractor? Not all restaurants will receive a 1099. An unofficial tax document produced by uber and provided to every. Web you are responsible to collect, remit, and file sales tax on all your ridesharing trips to the canada revenue agency (cra). Understanding your.

Why does my Uber Eats 1099 or Annual Tax Summary say I made more than I

Unlike rides with uber, drivers who earn with uber. Web chargebacks and refunds how to request a uber eats refund — and get it getting an uber eats refund has never been easier! Uber sends two tax forms. An official irs tax document that includes all gross earnings from meal orders. Web what tax forms do you get from uber?

Filing taxes, Tax, Tax deductions

Web you are responsible to collect, remit, and file sales tax on all your ridesharing trips to the canada revenue agency (cra). Web chargebacks and refunds how to request a uber eats refund — and get it getting an uber eats refund has never been easier! Web how to file taxes for uber eats? Web you could receive 3 types.

How Do Food Delivery Couriers Pay Taxes? Get It Back

An official irs tax document that includes all gross earnings from meal orders. Uber sends two tax forms. Web how to file taxes for uber eats? Not all restaurants will receive a 1099. Click “download” next to your tax forms when they are available.

Free Dinner 20 UberEats Tonight in NYC With Promo Code The Reward Boss

Web you could receive 3 types of tax documents from us: Unlike rides with uber, drivers who earn with uber. This sets uber taxes apart from most other gigs that only issue one tax form. An official irs tax document that includes all gross earnings from meal orders. Web how to file taxes for uber eats?

Uber Tax Forms amulette

Web december 14, 2022 what can you write off for your taxes as an uber eats independent contractor? This sets uber taxes apart from most other gigs that only issue one tax form. Not all restaurants will receive a 1099. Click “download” next to your tax forms when they are available. As a general rule, if you made more than.

Web If Using A Private Delivery Service, Send Your Returns To The Street Address Above For The Submission Processing Center (Austin, Kansas City, Or Ogden) Designated.

Other than mileage or car expenses, what else is there?. If you also opted in to receive. Web december 14, 2022 what can you write off for your taxes as an uber eats independent contractor? An unofficial tax document produced by uber and provided to every.

Web Get Help With Your Uber Account, A Recent Trip, Or Browse Through Frequently Asked Questions.

California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Web what tax forms do you get from uber? Unlike rides with uber, drivers who earn with uber. Web a look at how i do my taxes as an independent contractor for ubereats.

This Sets Uber Taxes Apart From Most Other Gigs That Only Issue One Tax Form.

An official irs tax document that includes all gross earnings from meal orders. Web you can access your 1099 in uber eats manager by selecting “tax information” in the menu on the left side of your screen. This is a general overview of what i do for taxes using turbo tax to prepare and file my taxes. Web if uber eats is classified as a marketplace facilitator, uber eats is responsible for calculating, collecting, and remitting tax on all restaurant partner transactions made.

In Addition, You Should Be Able To.

Uber sends two tax forms. Web chargebacks and refunds how to request a uber eats refund — and get it getting an uber eats refund has never been easier! Web you are responsible to collect, remit, and file sales tax on all your ridesharing trips to the canada revenue agency (cra). Web up to $5 cash back turbotax taxes 101 tax tips for uber drivers:

![Ultimate Tax Guide for Uber & Lyft Drivers [Updated for 2022] Tax](https://i.pinimg.com/originals/c0/1c/7b/c01c7b388399c5fbad499ec3c9310641.png)