Video Games Tax Relief

Video Games Tax Relief - Web tiga.org who are tiga? Video games tax relief was given approval by the european commission and has been effective for expenditure incurred since 1 april 2014. The new credit will have a rate of relief of 34% on 80% of qualifying expenditure. This article sets out a summary of the key points. The new credit will have a rate of relief of 34% on 80% of qualifying expenditure. Web the government announced that video games tax relief will be replaced with a video games expenditure credit. Tiga now wants to assist its membership in particular and games businesses in general to benefit from video games tax relief. Certified as british by the british film institute. Web since video game tax relief (vgtr) was introduced in 2014, companies have made claims for 1,940 games, with uk expenditure of £5.1 billion. Web your company can claim video games tax relief if the video game is:

Web video games tax relief (vgtr) is one of the uk’s creative sector tax reliefs. Vgtr deductions can be used to reduce the taxable profits. Web since video game tax relief (vgtr) was introduced in 2014, companies have made claims for 1,940 games, with uk expenditure of £5.1 billion. Vgtr allows qualifying companies to claim a payable cash tax credit on eligible expenditure. Video games tax relief (vgtr) is a form of uk corporation tax relief introduced to support the creative industry. Certified as british by the british film institute. Web the government announced in march 2023 that video games tax relief will be replaced with a video games expenditure credit. What video games are eligible for vgtr? Web your company can claim video games tax relief if the video game is: Web what is video games tax relief?

This article sets out a summary of the key points. Web the video game tax relief ( vgtr) is one of seven creative industry tax reliefs in the uk tax system, offering uk developers tax relief on a proportion of the developments costs of. Tiga now wants to assist its membership in particular and games businesses in general to benefit from video games tax relief. What video games are eligible for vgtr? The new credit will have a rate of relief of 34% on 80% of qualifying expenditure. Web your company can claim video games tax relief if the video game is: Tiga has campaigned for a higher rate of relief for many years and in advance of the 2023 budget. Video games tax relief (vgtr) is a form of uk corporation tax relief introduced to support the creative industry. Vgtr deductions can be used to reduce the taxable profits. Video games tax relief was given approval by the european commission and has been effective for expenditure incurred since 1 april 2014.

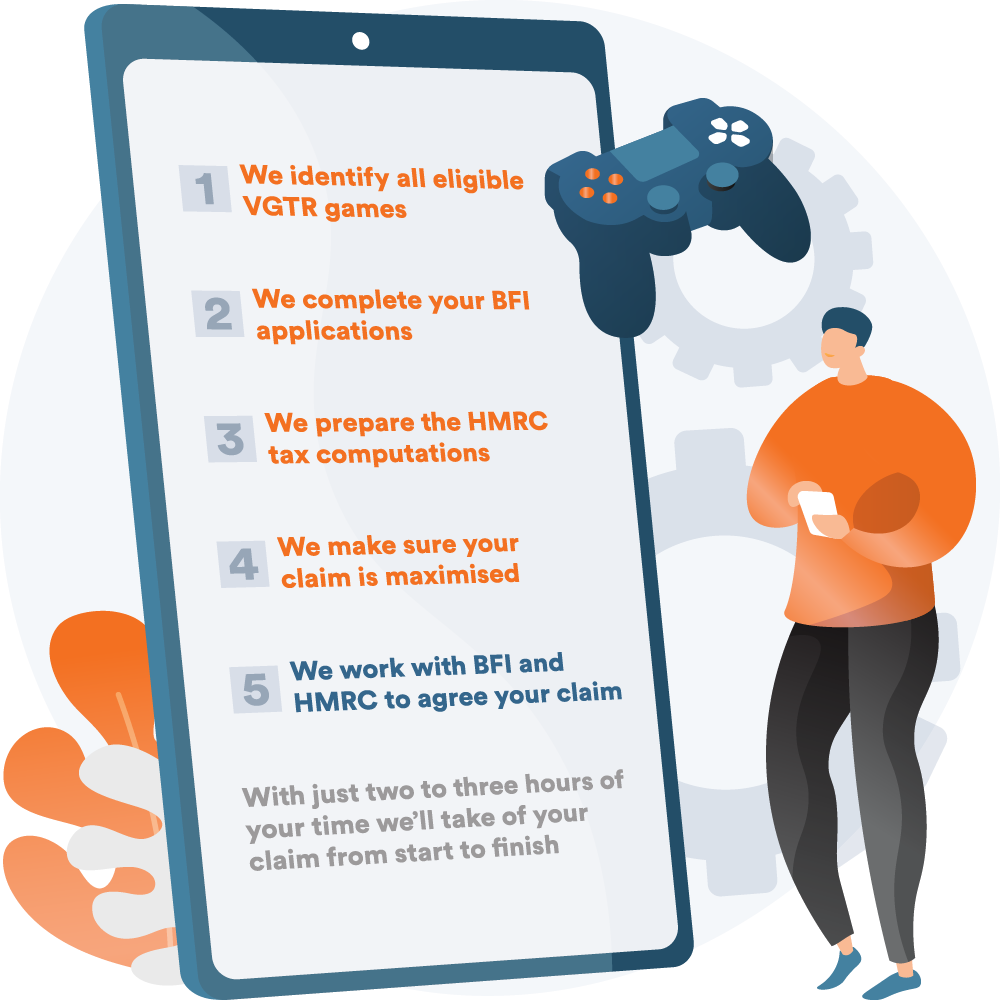

Claiming Video Games Tax Relief (VGTR) Myriad Associates YouTube

Web the video game tax relief ( vgtr) is one of seven creative industry tax reliefs in the uk tax system, offering uk developers tax relief on a proportion of the developments costs of. Vgtr allows qualifying companies to claim a payable cash tax credit on eligible expenditure. Web what is video games tax relief? The new credit will have.

Video Games Tax Relief What is it? What Projects Qualify?

Certified as british by the british film institute. The new credit will have a rate of relief of 34% on 80% of qualifying expenditure. Web the government announced that video games tax relief will be replaced with a video games expenditure credit. Tiga now wants to assist its membership in particular and games businesses in general to benefit from video.

Video Games Tax Relief

Certified as british by the british film institute. Vgtr allows qualifying companies to claim a payable cash tax credit on eligible expenditure. Web your company can claim video games tax relief if the video game is: Video games tax relief (vgtr) is a form of uk corporation tax relief introduced to support the creative industry. Web the government announced that.

Video Games Tax Relief What is it? What Games Qualify?

Tiga has campaigned for a higher rate of relief for many years and in advance of the 2023 budget. Tiga now wants to assist its membership in particular and games businesses in general to benefit from video games tax relief. Intended for supply to the general public. Web what is video games tax relief? Web the government announced that video.

Video Games Tax Relief (VGTR) Accounting Specialists

Web the government announced in march 2023 that video games tax relief will be replaced with a video games expenditure credit. Web tiga.org who are tiga? Web the video game tax relief ( vgtr) is one of seven creative industry tax reliefs in the uk tax system, offering uk developers tax relief on a proportion of the developments costs of..

Video Games Tax Relief What is it? What Games Qualify?

Tiga has campaigned for a higher rate of relief for many years and in advance of the 2023 budget. Video games tax relief was given approval by the european commission and has been effective for expenditure incurred since 1 april 2014. What video games are eligible for vgtr? Vgtr deductions can be used to reduce the taxable profits. Web the.

Video Games Tax Relief ER Grove & Co

What video games are eligible for vgtr? Vgtr deductions can be used to reduce the taxable profits. In an era where innovation is the driving force behind the video games industry, tax reliefs play a crucial role in bolstering development and production. Tiga has campaigned for a higher rate of relief for many years and in advance of the 2023.

What is Video Gaming Tax Relief? WardWilliams Creative

Tiga now wants to assist its membership in particular and games businesses in general to benefit from video games tax relief. Vgtr allows qualifying companies to claim a payable cash tax credit on eligible expenditure. What video games are eligible for vgtr? Video games tax relief (vgtr) is a form of uk corporation tax relief introduced to support the creative.

Video Games Tax Relief What is it? What Projects Qualify?

Video games tax relief (vgtr) is a form of uk corporation tax relief introduced to support the creative industry. In an era where innovation is the driving force behind the video games industry, tax reliefs play a crucial role in bolstering development and production. Web the government announced in march 2023 that video games tax relief will be replaced with.

What is Video Games Tax Relief? Dare Academy YouTube

This article sets out a summary of the key points. The new credit will have a rate of relief of 34% on 80% of qualifying expenditure. Intended for supply to the general public. Video games tax relief (vgtr) is a form of uk corporation tax relief introduced to support the creative industry. What video games are eligible for vgtr?

Web The Government Announced That Video Games Tax Relief Will Be Replaced With A Video Games Expenditure Credit.

Web the government announced in march 2023 that video games tax relief will be replaced with a video games expenditure credit. Tiga has campaigned for a higher rate of relief for many years and in advance of the 2023 budget. This article sets out a summary of the key points. Web video games tax relief (vgtr) is one of the uk’s creative sector tax reliefs.

The New Credit Will Have A Rate Of Relief Of 34% On 80% Of Qualifying Expenditure.

Vgtr allows qualifying companies to claim a payable cash tax credit on eligible expenditure. Web what is video games tax relief? Vgtr deductions can be used to reduce the taxable profits. Web your company can claim video games tax relief if the video game is:

Tiga Has Campaigned For A Higher Rate Of Relief For Many Years And In Advance Of The 2023 Budget.

The new credit will have a rate of relief of 34% on 80% of qualifying expenditure. In an era where innovation is the driving force behind the video games industry, tax reliefs play a crucial role in bolstering development and production. Web the video game tax relief ( vgtr) is one of seven creative industry tax reliefs in the uk tax system, offering uk developers tax relief on a proportion of the developments costs of. Certified as british by the british film institute.

Intended For Supply To The General Public.

Tiga now wants to assist its membership in particular and games businesses in general to benefit from video games tax relief. Web since video game tax relief (vgtr) was introduced in 2014, companies have made claims for 1,940 games, with uk expenditure of £5.1 billion. Video games tax relief (vgtr) is a form of uk corporation tax relief introduced to support the creative industry. Video games tax relief was given approval by the european commission and has been effective for expenditure incurred since 1 april 2014.