Virginia Estimated Tax Form 2022

Virginia Estimated Tax Form 2022 - Web 2022 form 760es, estimated income tax payment. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in january 2023, so this is the latest version of form 760c, fully updated for tax year 2022. Web virginia income tax can reasonably be expected to be $150 or less for the 2022 taxable year. Or (d) your expected estimated tax liability exceeds your withholding and tax credits by $150 or less. Web 2022 virginia estimated income tax payment vouchers for estates, trusts, and pass through entities filing on form 770es behalf of unified nonresidents form 770es vouchers and. 1st quarter (q1) 2nd quarter (q2) 3rd quarter (q3) 4th quarter (q4) demographics your. Web we last updated the va estimated income tax payment vouchers and instructions for individuals in january 2022, so this is the latest version of form 760es, fully updated for. Not filed electronic payment guide. To receive the status of your filed income tax refund, enter. If you make $70,000 a year living in california you will be taxed $11,221.

Web 86 rows the current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Web www.tax.virginia.gov efective for payments made on and after july 1, 2021, individuals must submit all income tax payments electronically if any payment exceeds $2,500 or. Web 2022 virginia estimated income tax payment vouchers for estates, trusts, and pass through entities filing on form 770es behalf of unified nonresidents form 770es vouchers and. Web virginia income tax can reasonably be expected to be $150 or less for the 2022 taxable year. Web tax due returns: Web for taxable year voucher numbers do not submit form 760es if no amount is due. If you make $70,000 a year living in california you will be taxed $11,221. Your average tax rate is 11.67% and your marginal tax rate is. Details on how to only prepare and print a. 1st quarter (q1) 2nd quarter (q2) 3rd quarter (q3) 4th quarter (q4) demographics your.

You expect to owe at least $1,000 in tax for 2022, after subtracting your withholding and. Web in most cases, you must pay estimated tax for 2022 if both of the following apply. Web virginia income tax can reasonably be expected to be $150 or less for the 2022 taxable year. Estimated income tax web estimated income tax worksheet on page 3) is less than $11,950; Web 760f underpayment of virginia estimated tax by 2022 farmers, fishermen and merchant seamen *va760f122888* enclose this form with form 760, 763, 760py or 770. Individual income tax 37 corporate income tax 85. Web complete the estimated tax worksheet below to compute your estimated tax for 2022. Web we last updated the underpayment of estimated tax by farmers and fisherman in january 2023, so this is the latest version of form 760f, fully updated for tax year 2022. If you are required to file form 770es, complete the form using the payment. Web 2022 form 760es, estimated income tax payment.

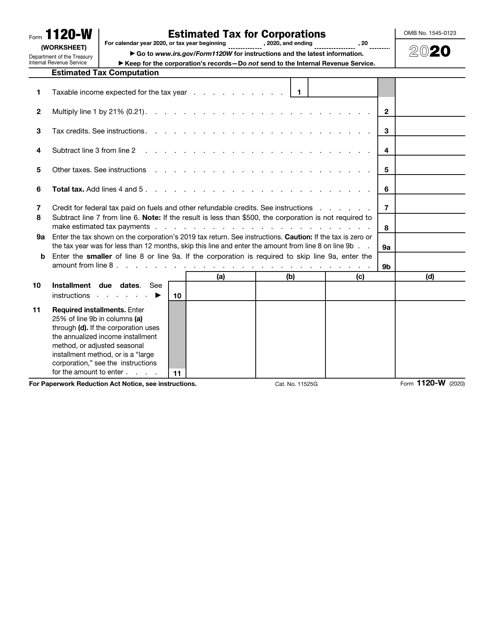

IRS Form 1120W Download Fillable PDF or Fill Online Estimated Tax for

Web 2022 virginia estimated income tax payment vouchers for estates, trusts, and pass through entities filing on form 770es behalf of unified nonresidents form 770es vouchers and. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in january 2023, so this is the latest version of form 760c, fully updated for tax year 2022. Web.

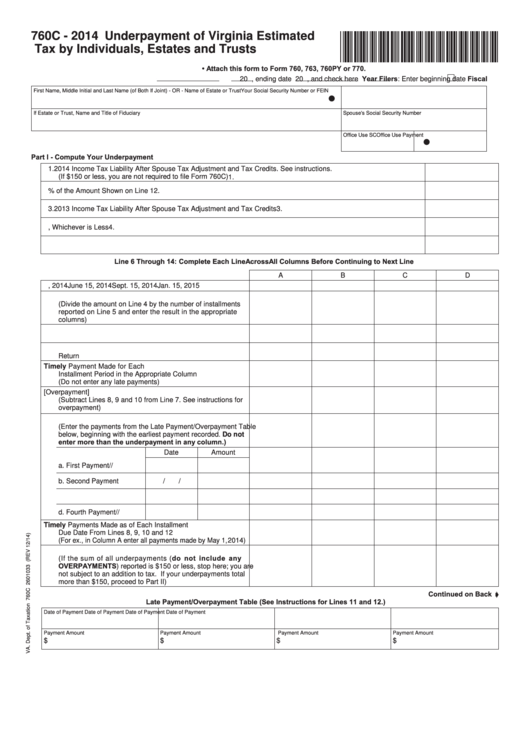

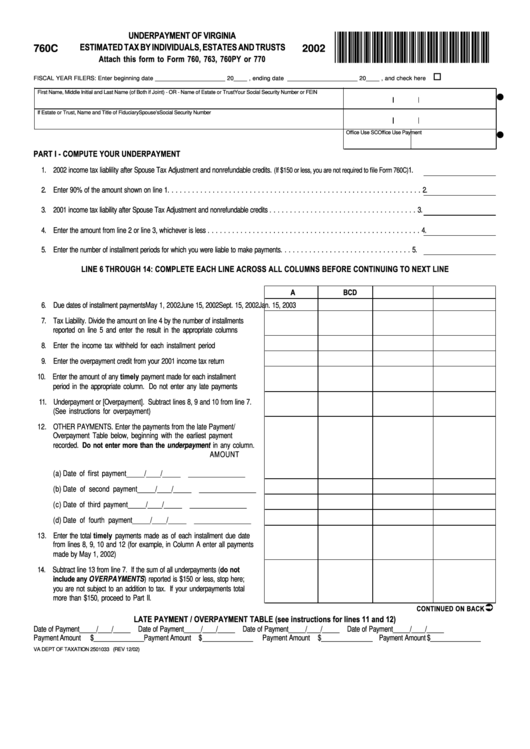

Fillable Form 760c Underpayment Of Virginia Estimated Tax By

Web we last updated the va estimated income tax payment vouchers and instructions for individuals in january 2022, so this is the latest version of form 760es, fully updated for. Web tax due returns: Web 760f underpayment of virginia estimated tax by 2022 farmers, fishermen and merchant seamen *va760f122888* enclose this form with form 760, 763, 760py or 770. Web.

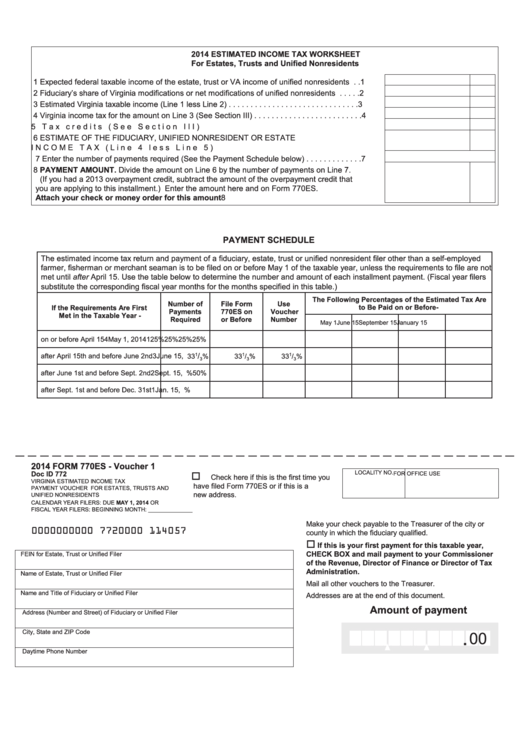

Fillable Form 770es Virginia Estimated Tax Worksheet

Web complete the estimated tax worksheet below to compute your estimated tax for 2022. Web we last updated the underpayment of estimated tax by farmers and fisherman in january 2023, so this is the latest version of form 760f, fully updated for tax year 2022. Web tax due returns: Web virginia state income tax forms for tax year 2022 (jan..

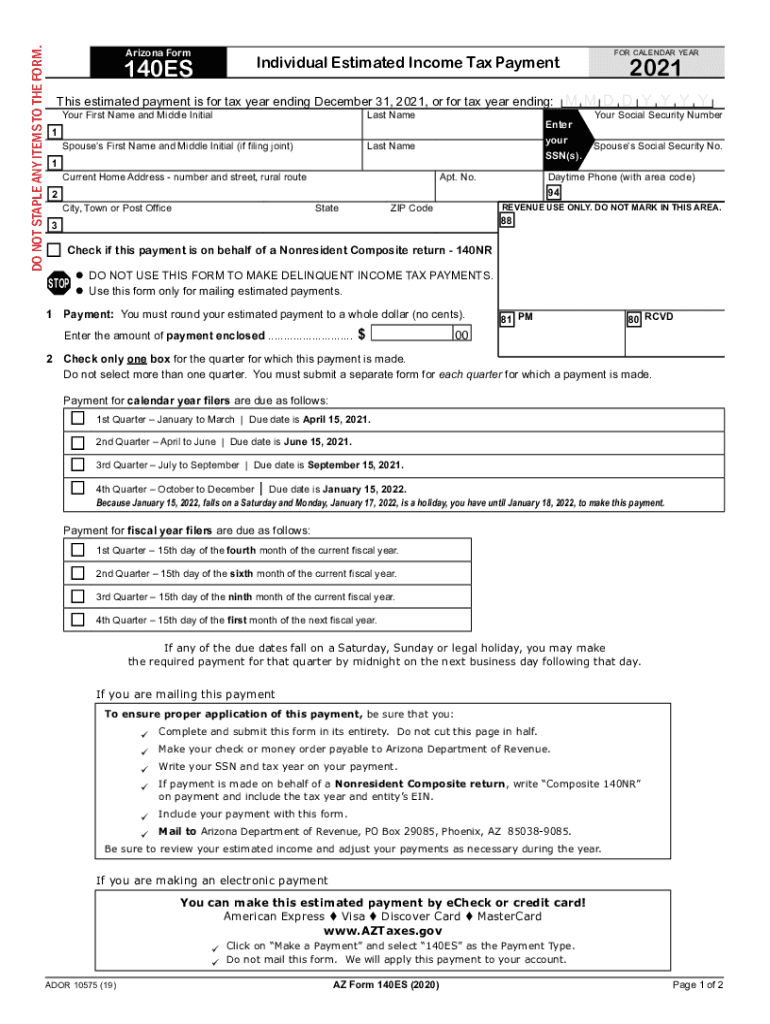

2021 Form AZ DoR 140ES Fill Online, Printable, Fillable, Blank pdfFiller

Or (d) your expected estimated tax liability exceeds your withholding and tax credits by $150 or less. Web we last updated the va estimated income tax payment vouchers and instructions for individuals in january 2022, so this is the latest version of form 760es, fully updated for. Virginia department of taxation, p.o. Web www.tax.virginia.gov efective for payments made on and.

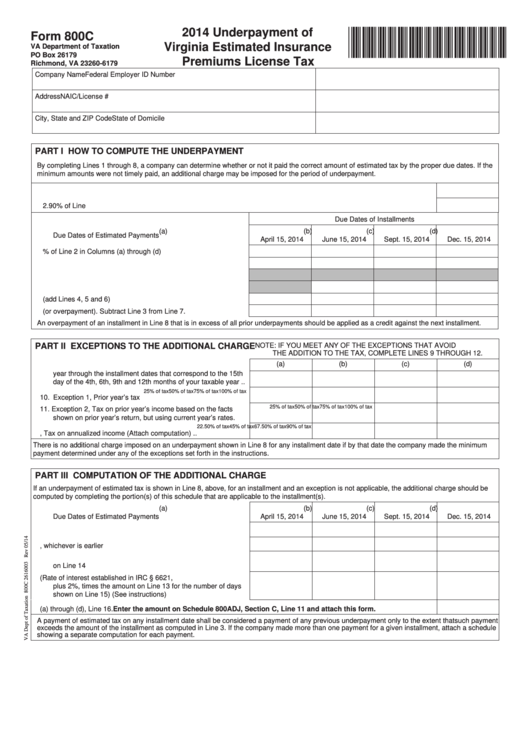

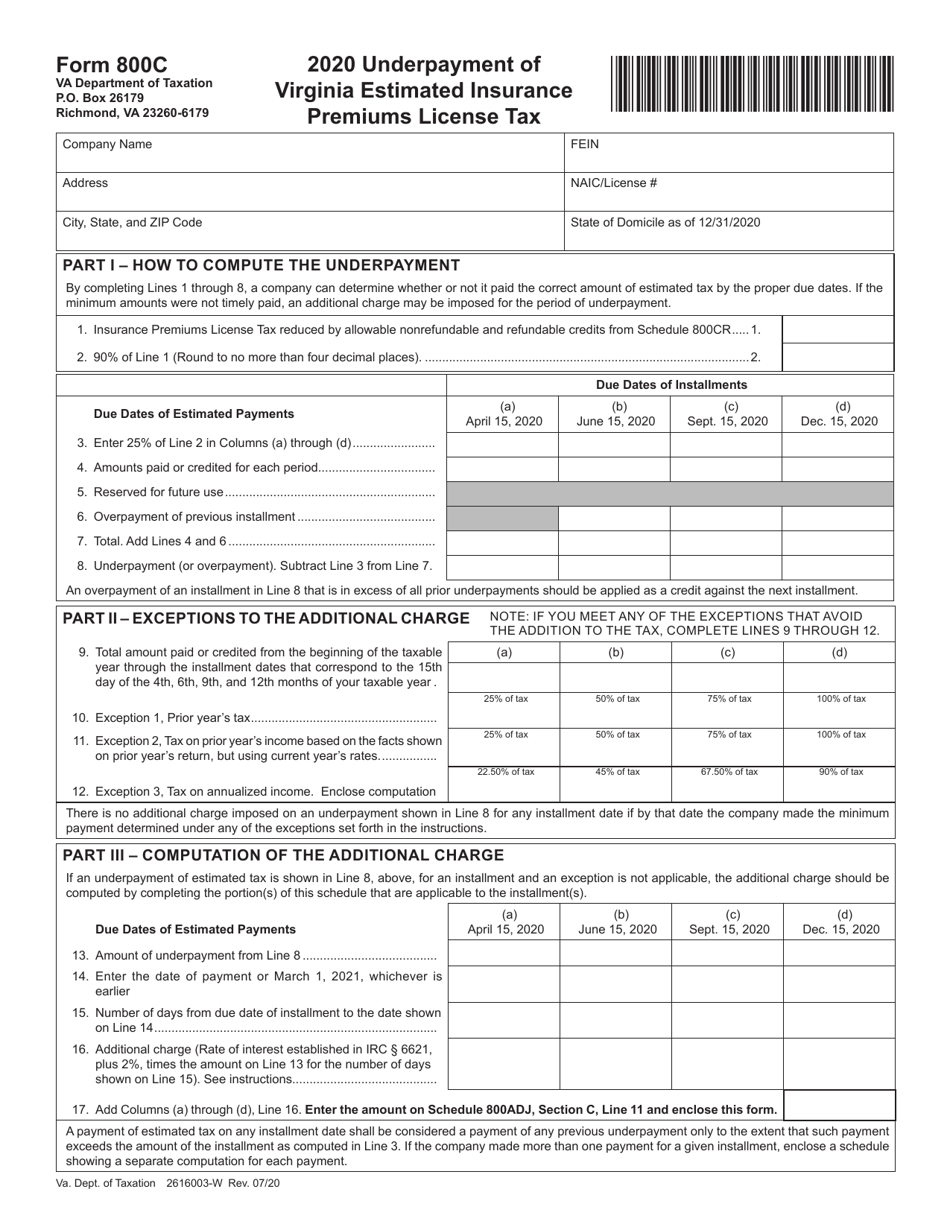

Fillable Form 800c Underpayment Of Virginia Estimated Insurance

Individual income tax 37 corporate income tax 85. 1st quarter (q1) 2nd quarter (q2) 3rd quarter (q3) 4th quarter (q4) demographics your. Web efective for payments made on and after july 1, 2022, individuals must submit all income tax payments electronically if any payment exceeds $1,500 or the sum of all payments is. Web estimated income tax worksheet on page.

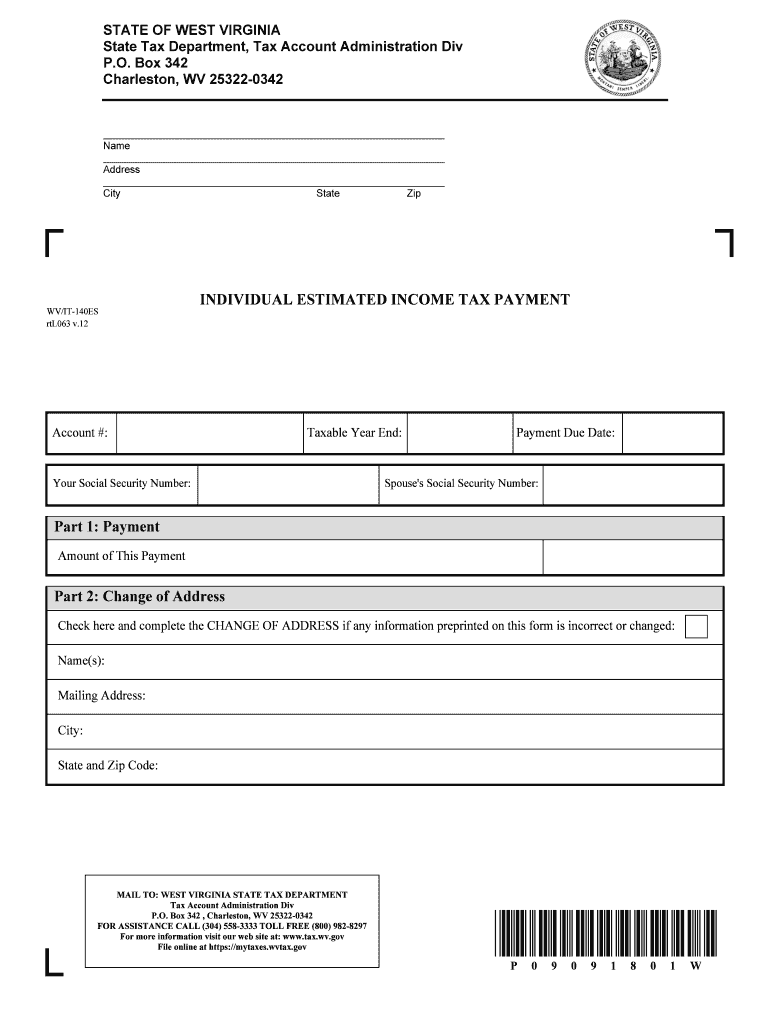

West Virginia Estimated Tax Fill Out and Sign Printable PDF Template

Web complete the estimated tax worksheet below to compute your estimated tax for 2022. Web www.tax.virginia.gov efective for payments made on and after july 1, 2021, individuals must submit all income tax payments electronically if any payment exceeds $2,500 or. If you are required to file form 770es, complete the form using the payment. Or (d) your expected estimated tax.

Form 760c Underpayment Of Virginia Estimated Tax By Individuals

Web corporation has an underpayment of estimated tax and believes an addition to the tax should not be assessed, form 500c, underpayment of virginia estimated tax by. Web 2022 form 760es, estimated income tax payment. Web tax due returns: Virginia department of taxation, p.o. You expect to owe at least $1,000 in tax for 2022, after subtracting your withholding and.

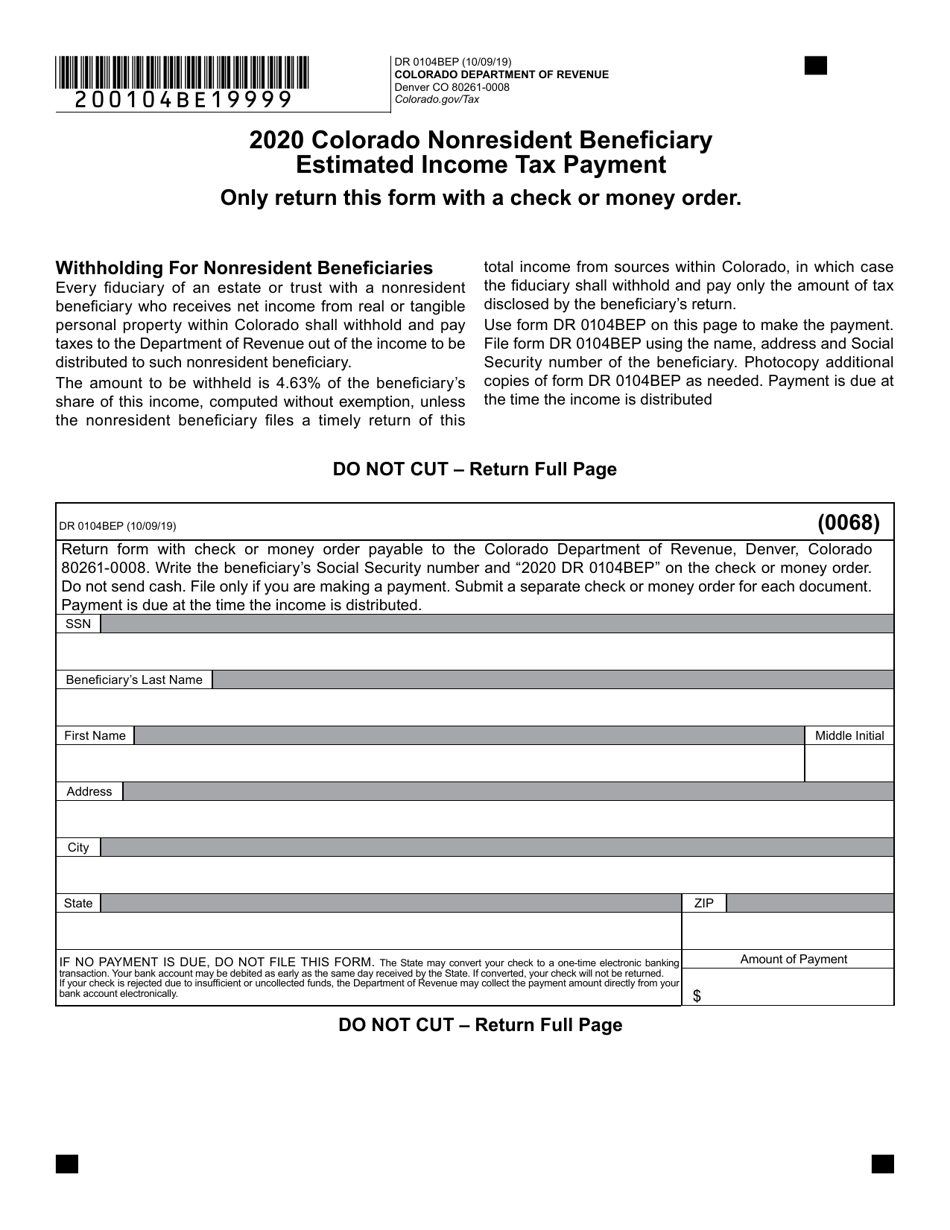

Form DR0104BEP Download Fillable PDF or Fill Online Colorado

You expect to owe at least $1,000 in tax for 2022, after subtracting your withholding and. Not filed electronic payment guide. Web 760f underpayment of virginia estimated tax by 2022 farmers, fishermen and merchant seamen *va760f122888* enclose this form with form 760, 763, 760py or 770. Web 86 rows the current tax year is 2022, and most states will release.

Form 800C Download Fillable PDF or Fill Online Underpayment of Virginia

1st quarter (q1) 2nd quarter (q2) 3rd quarter (q3) 4th quarter (q4) demographics your. If you make $70,000 a year living in california you will be taxed $11,221. Web for taxable year voucher numbers do not submit form 760es if no amount is due. You expect to owe at least $1,000 in tax for 2022, after subtracting your withholding and..

Maryland Estimated Tax Form 2020

Details on how to only prepare and print a. 1st quarter (q1) 2nd quarter (q2) 3rd quarter (q3) 4th quarter (q4) demographics your. Web corporation has an underpayment of estimated tax and believes an addition to the tax should not be assessed, form 500c, underpayment of virginia estimated tax by. Web we last updated the va estimated income tax payment.

Web We Last Updated The Va Estimated Income Tax Payment Vouchers And Instructions For Individuals In January 2022, So This Is The Latest Version Of Form 760Es, Fully Updated For.

1st quarter (q1) 2nd quarter (q2) 3rd quarter (q3) 4th quarter (q4) demographics your. Web tax due returns: Web 2022 form 760es, estimated income tax payment. Or (d) your expected estimated tax liability exceeds your withholding and tax credits by $150 or less.

Individual Income Tax 37 Corporate Income Tax 85.

Estimated income tax web estimated income tax worksheet on page 3) is less than $11,950; Web estimated income tax worksheet on page 3) is less than $11,950; Web complete the estimated tax worksheet below to compute your estimated tax for 2022. Web www.tax.virginia.gov efective for payments made on and after july 1, 2021, individuals must submit all income tax payments electronically if any payment exceeds $2,500 or.

Virginia Department Of Taxation, P.o.

If you are required to file form 770es, complete the form using the payment. Web 86 rows the current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Details on how to only prepare and print a. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in january 2023, so this is the latest version of form 760c, fully updated for tax year 2022.

Web We Last Updated The Underpayment Of Estimated Tax By Farmers And Fisherman In January 2023, So This Is The Latest Version Of Form 760F, Fully Updated For Tax Year 2022.

Web for taxable year voucher numbers do not submit form 760es if no amount is due. Web 2022 virginia estimated income tax payment vouchers for estates, trusts, and pass through entities filing on form 770es behalf of unified nonresidents form 770es vouchers and. Your average tax rate is 11.67% and your marginal tax rate is. Web virginia income tax can reasonably be expected to be $150 or less for the 2022 taxable year.