Virginia Form 760 Instructions

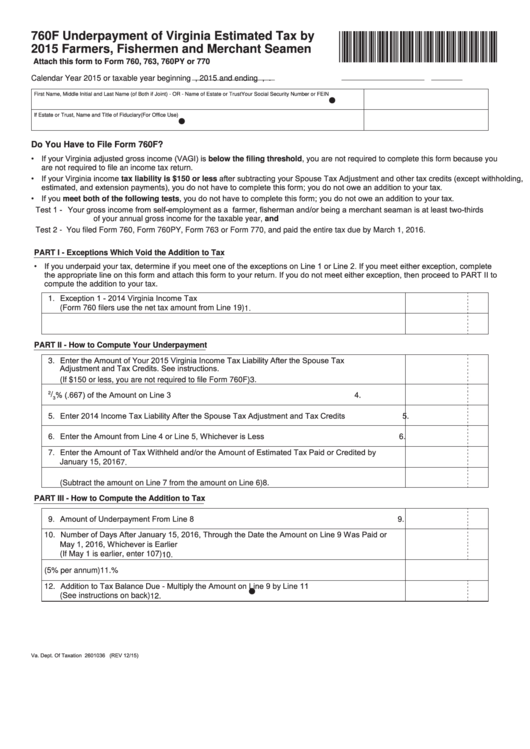

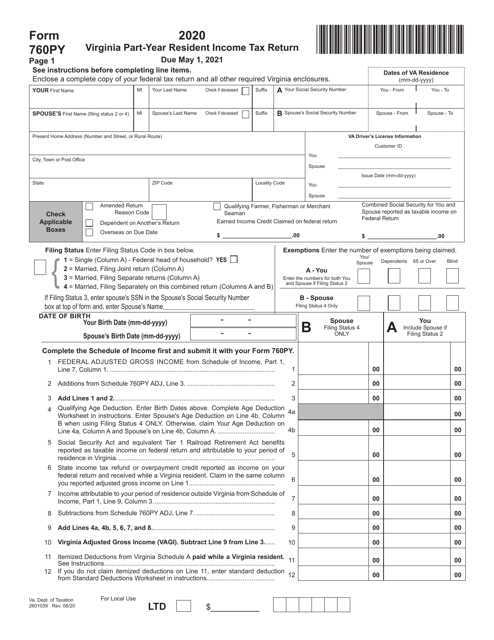

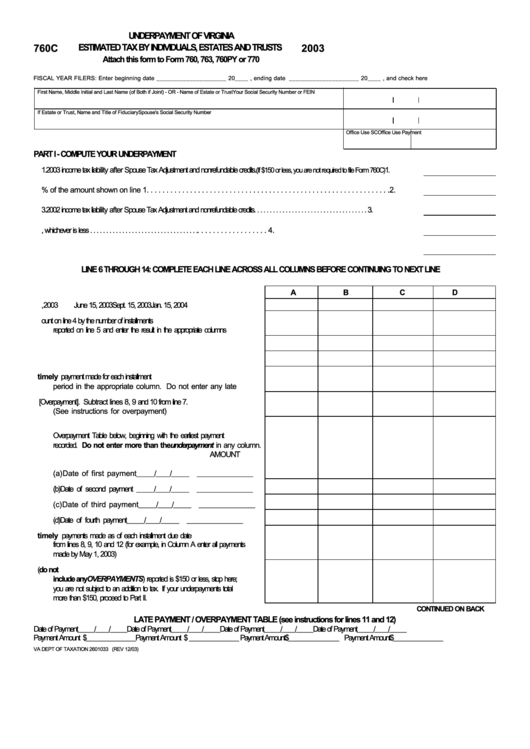

Virginia Form 760 Instructions - If filing form 760, 760py or 763, also check. 4 6rfldo 6hfxulw\ dqg htxlydohqw 7lhu 5dlourdg 5hwluhphqw ehqh¿wv li wd[deoh rq. File by may 1, 2021. Your social security number (ssn) first. (if $150 or less, you are not required to file form 760c) 1. Sign up with your credentials or create a free account to. Subtractions from income to the extent included in federal adjusted gross income, the following subtractions are allowed on the. If the amount on line 9 is less than the amount shown below for your filing. Web virginia form 760 instructions what's new virginia's fixed date conformity with the internal revenue code: 1st quarter (q1) 2nd quarter (q2) 3rd quarter (q3) 4th quarter (q4) demographics.

1st quarter (q1) 2nd quarter (q2) 3rd quarter (q3) 4th quarter (q4) demographics. Web • enclose this form with form 760, 763, 760py or 770. Web adhere to the instructions below to complete virginia 760 instructions online quickly and easily: If your tax is underpaid as of any installment due date, you. If your filing status is different for federal and virginia. File by may 1, 2021. Subtractions from income to the extent included in federal adjusted gross income, the following subtractions are allowed on the. Complete, edit or print tax forms instantly. Web fiscal year filers should refer to virginia form 760es and the instructions to determine their installment due dates. Corporation and pass through entity tax.

Complete, edit or print tax forms instantly. If filing form 760, 760py or 763, also check. Be sure to provide date of birth above. Web virginia form 760 instructions what's new virginia's fixed date conformity with the internal revenue code: Schedule adj adjustments to income on form 760; Web 760 resident individual income tax return. Web do not submit form 760es if no amount is due. Web adhere to the instructions below to complete virginia 760 instructions online quickly and easily: Web form 760ip is a virginia individual income tax form. Corporation and pass through entity tax.

Top 22 Virginia Form 760 Templates free to download in PDF format

07/21 your first name m.i. 1st quarter (q1) 2nd quarter (q2) 3rd quarter (q3) 4th quarter (q4) demographics. Schedule adj adjustments to income on form 760; If the amount on line 9 is less than the amount shown below for your filing. (if $150 or less, you are not required to file form 760c) 1.

Form 760PY Download Fillable PDF or Fill Online PartYear Resident

07/21 your first name m.i. Sign in to your account. Web find forms & instructions by category. Web make use of the tips about how to fill out the va 760 instructions: Get ready for tax season deadlines by completing any required tax forms today.

Virginia Tax Instructions Form Fill Out and Sign Printable PDF

Web make use of the tips about how to fill out the va 760 instructions: Virginia's date of conformity with the federal enhanced earned. Complete, edit or print tax forms instantly. Web adhere to the instructions below to complete virginia 760 instructions online quickly and easily: (if $150 or less, you are not required to file form 760c) 1.

Form 760c Underpayment Of Virginia Estimated Tax By Individuals

Web 760 resident individual income tax return. Complete, edit or print tax forms instantly. Subtractions from income to the extent included in federal adjusted gross income, the following subtractions are allowed on the. If filing form 760, 760py or 763, also check. If your tax is underpaid as of any installment due date, you.

Best Templates Virginia 760 Form

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. 07/21 your first name m.i. Web find forms & instructions by category. Get ready for tax season deadlines by completing any required tax forms today. Web make use of the tips about how to fill out the va 760 instructions:

2021 Form VA 760 Instructions Fill Online, Printable, Fillable, Blank

Get ready for tax season deadlines by completing any required tax forms today. Be sure to provide date of birth above. Web find forms & instructions by category. Web • enclose this form with form 760, 763, 760py or 770. If your tax is underpaid as of any installment due date, you.

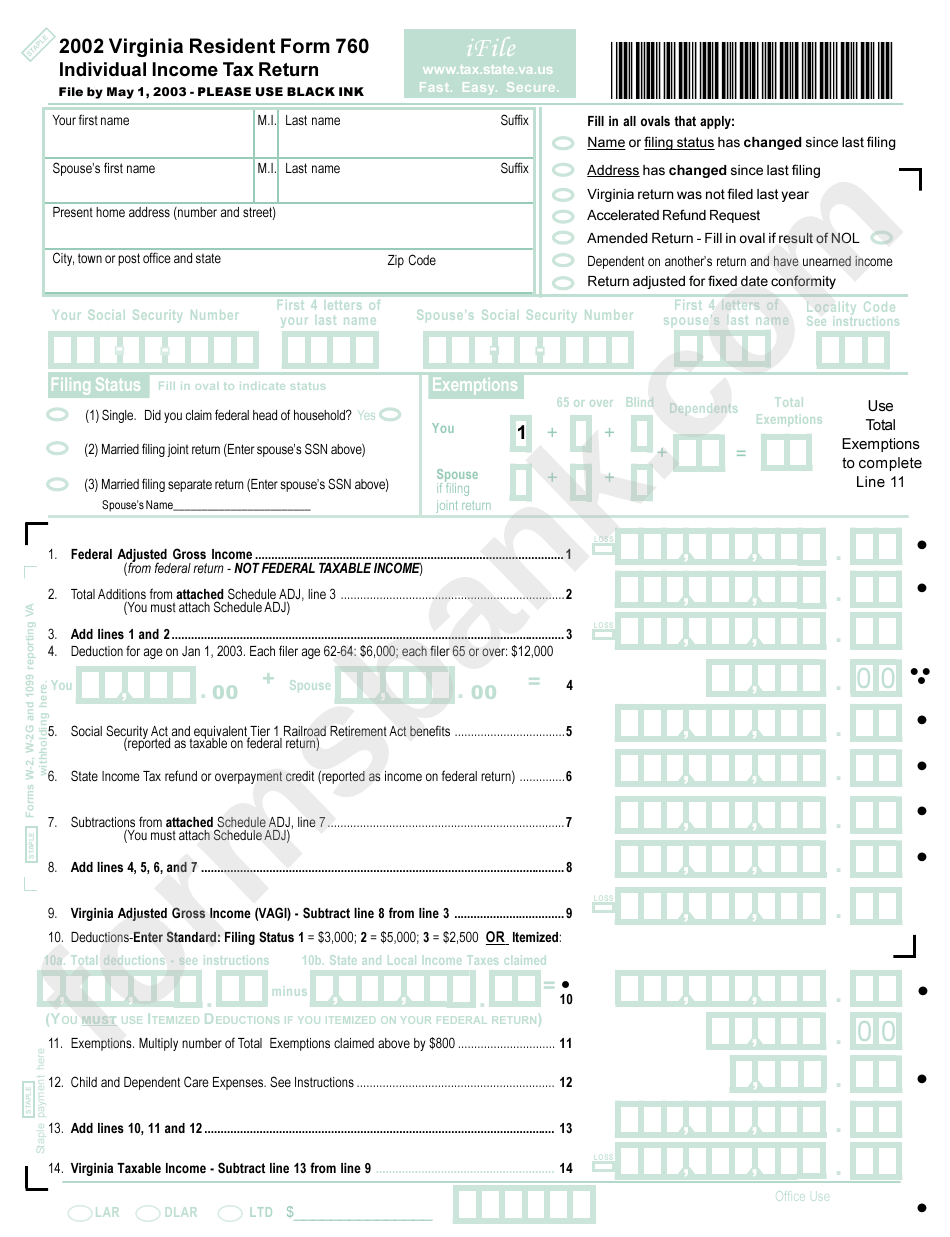

Virginia Resident Form 760 Individual Tax Return 2002

Sign up with your credentials or create a free account to. Web i/we authorize the sharing of certain information from form 760 and schedule hci (as described in the instructions) with the department of medical assistance services. Web form 760 is a virginia individual income tax form. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities,.

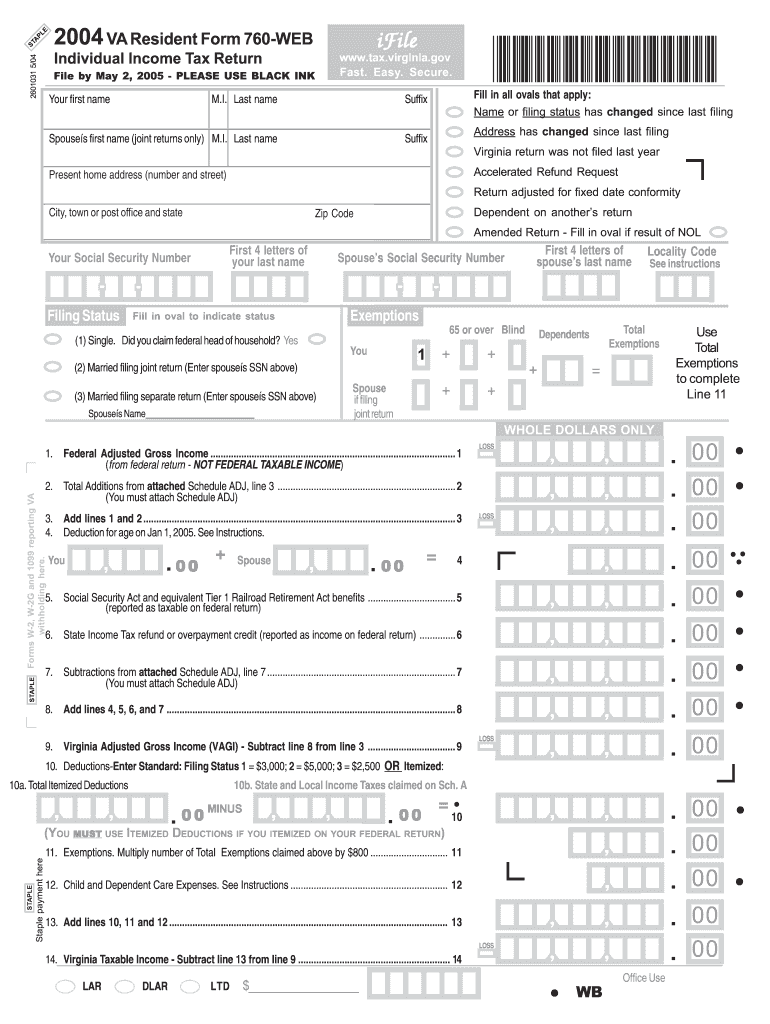

VA Resident Form 760 WEB Fill Out and Sign Printable PDF Template

Filing form 770, check the form 760f box on. Web form 760 is a virginia individual income tax form. Complete, edit or print tax forms instantly. Schedule adj adjustments to income on form 760; Sign in to your account.

2018 virginia resident form 760 Fill out & sign online DocHub

07/21 your first name m.i. Virginia's date of conformity with the federal enhanced earned. Complete, edit or print tax forms instantly. Web do not submit form 760es if no amount is due. Get ready for tax season deadlines by completing any required tax forms today.

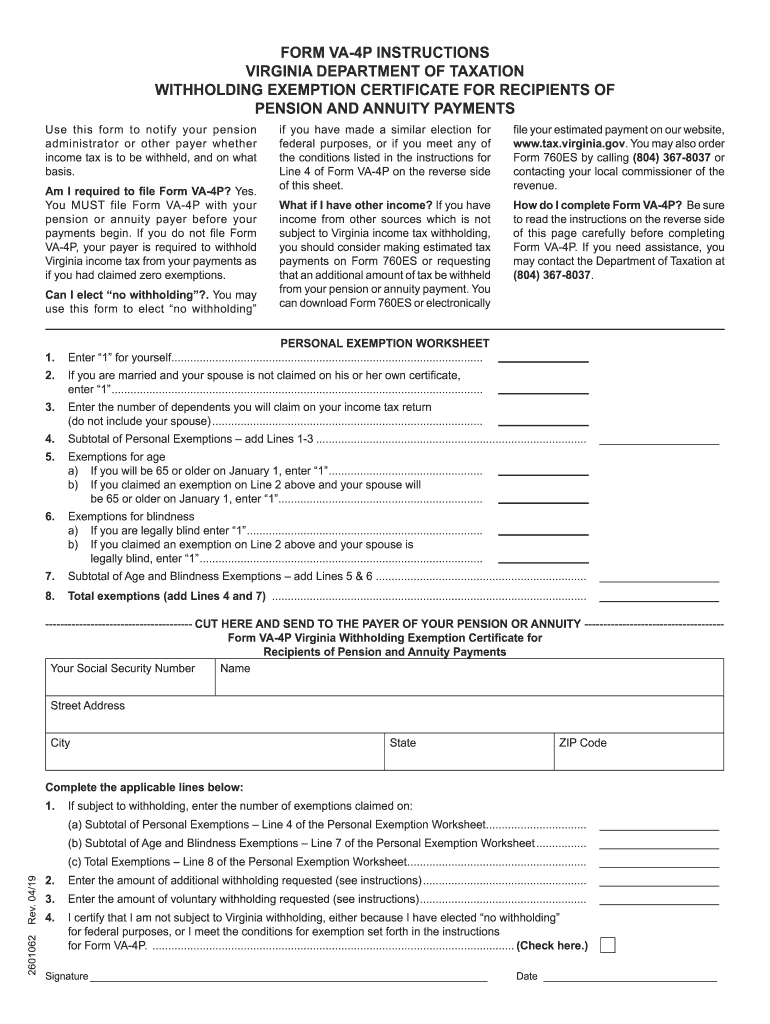

20192021 Form VA DoT VA4P Instructions Fill Online, Printable

The farmers, fishermen, and merchant seamen box on the return. Get ready for tax season deadlines by completing any required tax forms today. Web i/we authorize the sharing of certain information from form 760 and schedule hci (as described in the instructions) with the department of medical assistance services. Web adhere to the instructions below to complete virginia 760 instructions.

(If $150 Or Less, You Are Not Required To File Form 760C) 1.

Web i/we authorize the sharing of certain information from form 760 and schedule hci (as described in the instructions) with the department of medical assistance services. Corporation and pass through entity tax. The farmers, fishermen, and merchant seamen box on the return. Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi).

Select The Orange Button To.

Web enter this amount on line 2 of virginia form 760. Get ready for tax season deadlines by completing any required tax forms today. 4 6rfldo 6hfxulw\ dqg htxlydohqw 7lhu 5dlourdg 5hwluhphqw ehqh¿wv li wd[deoh rq. Web 2021 virginia form 760 *va0760121888* resident income tax return 2601031 file by may 1, 2022 — use black ink rev.

Sign In To Your Account.

If your filing status is different for federal and virginia. Complete, edit or print tax forms instantly. 07/21 your first name m.i. Find the template online within the specific section or via the search engine.

Web Virginia Form 760 Instructions What's New Virginia's Fixed Date Conformity With The Internal Revenue Code:

Web find forms & instructions by category. If filing form 760, 760py or 763, also check. Subtractions from income to the extent included in federal adjusted gross income, the following subtractions are allowed on the. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue.