Voluntary Dismissal Of Chapter 13 On Credit Report

Voluntary Dismissal Of Chapter 13 On Credit Report - You’ll also want to make sure that available bankruptcy exemptions protect all of your property since that’s not typically an issue in chapter 13. That section of the u.s. Bankruptcy code provides that the court shall dismiss the chapter 13 case at any time upon request of the debtor, unless the case was converted to a chapter 13 from a chapter. You can avoid having your chapter 7 or chapter 13 bankruptcy case dismissed by making sure you meet all your. Web if your bankruptcy case was filed under chapter 13, you may secure a voluntary dismissal merely by filing a formal request for dismissal with the court. However, in some cases, a chapter 7 bankruptcy may be dismissed by your request prior to. A voluntarily dismissed bankruptcy remains on your file for up to seven years from the date it was filed. Web because under chapter 13 you do not get a discharge of your debts until successful completion of the case, if you dismiss your case you will owe all your creditors as before except to the extent. A discharged bankruptcy means you have satisfied the debts included in the chapter 13 bk and that creditors will not further pursue you for payment. Web if you fail to make your chapter 13 plan payments, eventually your bankruptcy case will be dismissed.

Web for example, one route is just no longer making your payments in a chapter 13 case. You’ll also want to make sure that available bankruptcy exemptions protect all of your property since that’s not typically an issue in chapter 13. Web voluntary dismissal of an existing chapter 13 bankruptcy case can have unexpected consequences for debtors. You can refile another chapter 13 petition, but you'll face som refiling if your chapter 13 case is dismissed. If the case is dismissed, the. The last three blog posts have been about amending, or “modifying,” your chapter 13 payment plan. However, in some cases, a chapter 7 bankruptcy may be dismissed by your request prior to. Whether permission will be granted depends on the type of bankruptcy you have filed and why you are requesting the voluntary dismissal. Web if you complete your chapter 13 plan and receive your discharge, the credit bureaus will drop the chapter 13 off of your credit report 7 years after you filed the case. Web updated in very rare instances you may want to dismiss your own bankruptcy case.

Whether permission will be granted depends on the type of bankruptcy you have filed and why you are requesting the voluntary dismissal. Web if you complete your chapter 13 plan and receive your discharge, the credit bureaus will drop the chapter 13 off of your credit report 7 years after you filed the case. Web if your bankruptcy case was filed under chapter 13, you may secure a voluntary dismissal merely by filing a formal request for dismissal with the court. If the case is dismissed, the. Web all you do is file a voluntary motion to dismiss chapter 13 case pursuant to 11 u.s.c. Web usually, it is chapter 13 bankruptcies that are dismissed for not sticking to the repayment plan. Web a completed (discharged) or dismissed chapter 13 remains on file for up to seven years from the date filed. You’ll also want to make sure that available bankruptcy exemptions protect all of your property since that’s not typically an issue in chapter 13. This will either lower or eliminate your overall debt making you are better credit. Web if a dismissal is ever entered in your chapter 13 bankruptcy case, it’s crucial that you cure the deficiency that caused the dismissal and file a motion to reinstate your bankruptcy case as soon as possible.

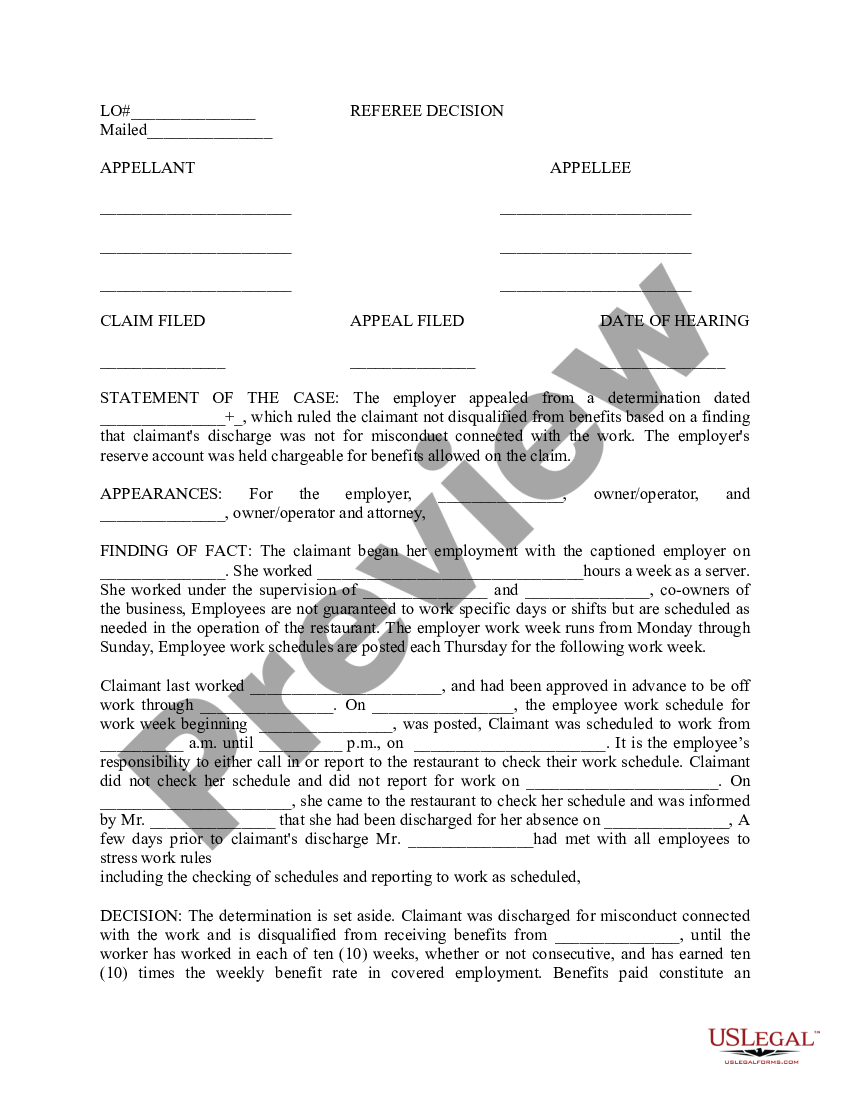

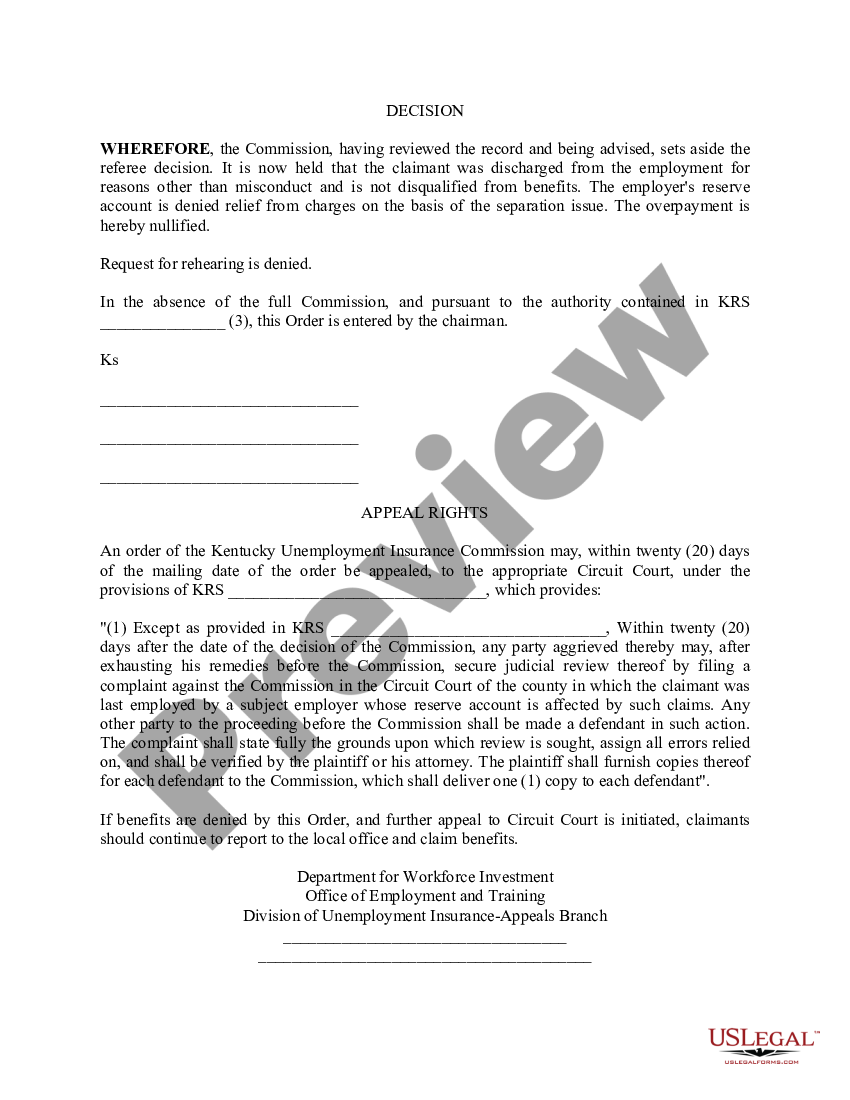

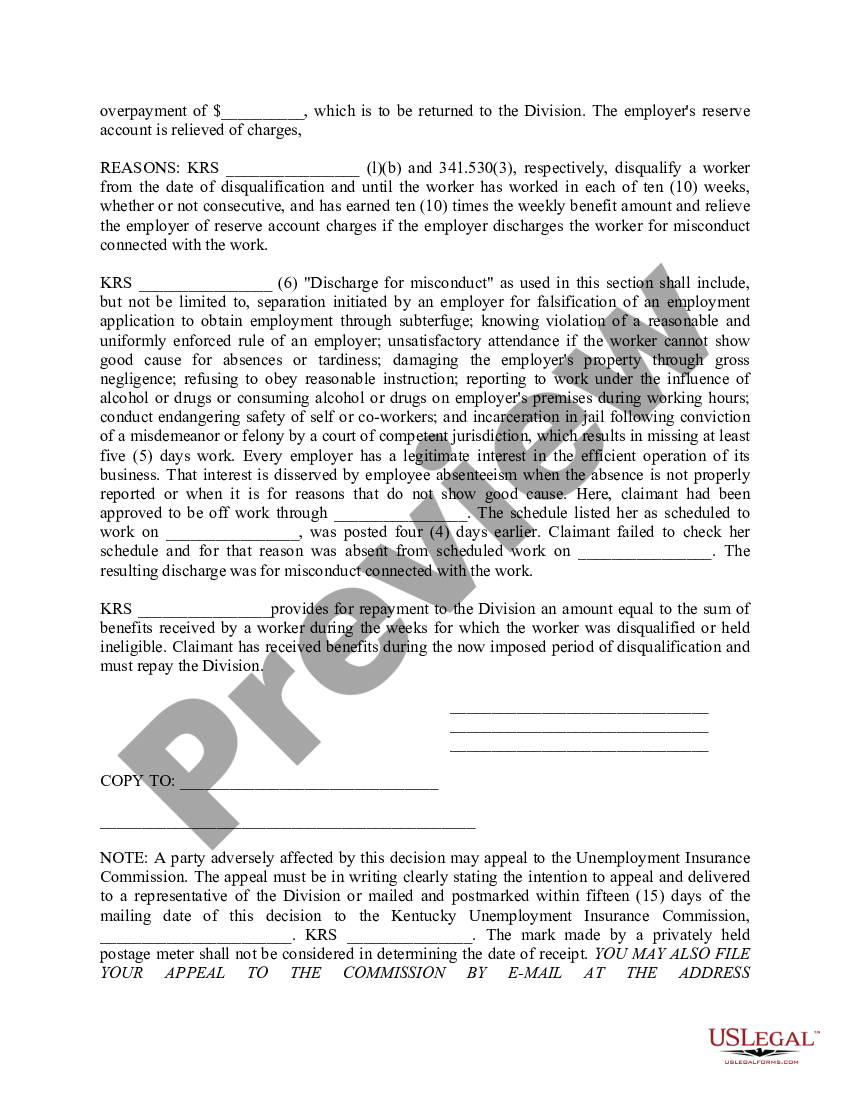

Kentucky Order Of Voluntary Dismissal US Legal Forms

A voluntarily dismissed bankruptcy remains on your file for up to seven years from the date it was filed. Web in order to remove something from your credit report, it has to be inaccurate. Web because under chapter 13 you do not get a discharge of your debts until successful completion of the case, if you dismiss your case you.

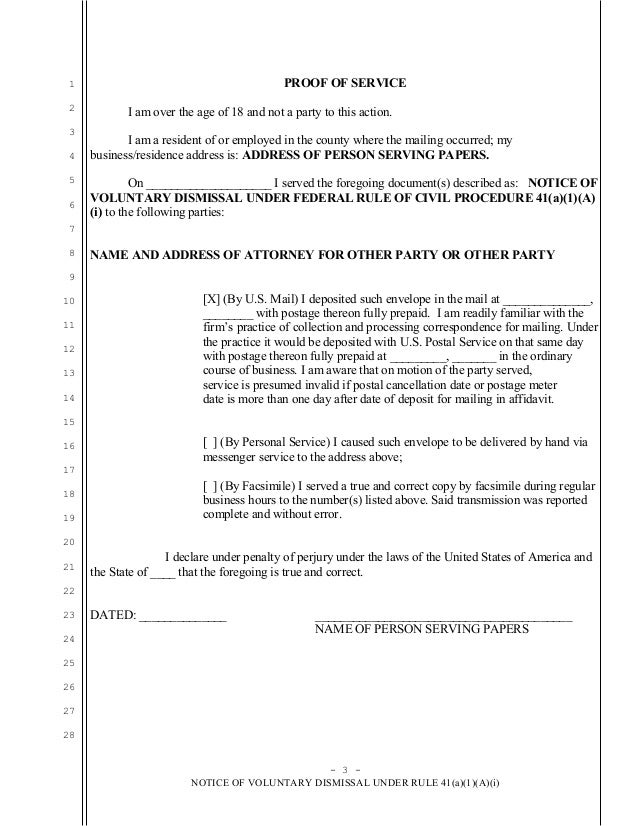

Sample notice of voluntary dismissal under Rule 41 in United States D…

Web if so you can file a motion for voluntary dismissal. Web a completed (discharged) or dismissed chapter 13 remains on file for up to seven years from the date filed. If you stop making payments to your chapter 13 plan, the trustee may file a motion to dismiss the case. Web voluntary dismissal of an existing chapter 13 bankruptcy.

Notice of Voluntary Dismissal Filed Before Entry of Order of Dismissal

Web if you fail to make your chapter 13 plan payments, eventually your bankruptcy case will be dismissed. Web if you complete your chapter 13 plan and receive your discharge, the credit bureaus will drop the chapter 13 off of your credit report 7 years after you filed the case. We cover this more below. Should you choose to stop.

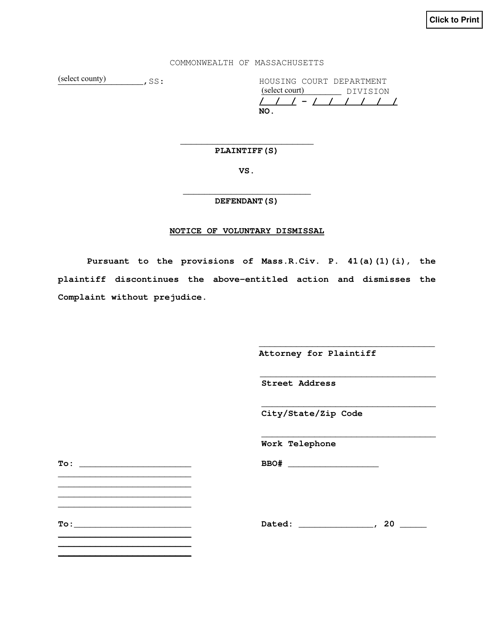

Massachusetts Notice of Voluntary Dismissal Download Fillable PDF

However, to do so, you must obtain permission from the court. That section of the u.s. Web if your bankruptcy case was filed under chapter 13, you may secure a voluntary dismissal merely by filing a formal request for dismissal with the court. Web the bankruptcy code explicitly says that, at the request of the person in a chapter 13.

Two ways a chapter 13 ends Dismissal or discharge YouTube

Web in order to remove something from your credit report, it has to be inaccurate. Whether permission will be granted depends on the type of bankruptcy you have filed and why you are requesting the voluntary dismissal. But what if you don’t want to be in the chapter 13. If the case is dismissed, the. However, in some cases, a.

48+ Voluntary Dismissal Of Chapter 13 On Credit Report JameeEllaria

We cover this more below. Web if you fail to make your chapter 13 plan payments, eventually your bankruptcy case will be dismissed. Web a completed (discharged) or dismissed chapter 13 remains on file for up to seven years from the date filed. If the case is dismissed, the. Bankruptcy code provides that the court shall dismiss the chapter 13.

Notice of Voluntary Dismissal with Prejudice Electronic Frontier

If the case is dismissed, the. However, in some cases, a chapter 7 bankruptcy may be dismissed by your request prior to. Web if the case is dismissed, the vehicle loan will, in most cases, be considered behind because the lender was receiving less per month during the bankruptcy than what the monthly. Whether permission will be granted depends on.

Kentucky Order Of Voluntary Dismissal US Legal Forms

Whether permission will be granted depends on the type of bankruptcy you have filed and why you are requesting the voluntary dismissal. Web in order to remove something from your credit report, it has to be inaccurate. You can avoid having your chapter 7 or chapter 13 bankruptcy case dismissed by making sure you meet all your. In this case,.

Filed Copy Notice of Voluntary Dismissal & Agreed Order

The last three blog posts have been about amending, or “modifying,” your chapter 13 payment plan. A discharged bankruptcy means you have satisfied the debts included in the chapter 13 bk and that creditors will not further pursue you for payment. Web for example, one route is just no longer making your payments in a chapter 13 case. If the.

Kentucky Order Of Voluntary Dismissal US Legal Forms

Web if the case is dismissed, the vehicle loan will, in most cases, be considered behind because the lender was receiving less per month during the bankruptcy than what the monthly. Should you choose to stop making payments to the bankruptcy trustee, this will also result in your chapter 13 bankruptcy being dismissed. Web if your bankruptcy case was filed.

Bankruptcy Code Provides That The Court Shall Dismiss The Chapter 13 Case At Any Time Upon Request Of The Debtor, Unless The Case Was Converted To A Chapter 13 From A Chapter.

Web voluntary dismissal of an existing chapter 13 bankruptcy case can have unexpected consequences for debtors. Web all you do is file a voluntary motion to dismiss chapter 13 case pursuant to 11 u.s.c. If the case is dismissed, the. Web if so you can file a motion for voluntary dismissal.

Should You Choose To Stop Making Payments To The Bankruptcy Trustee, This Will Also Result In Your Chapter 13 Bankruptcy Being Dismissed.

Web the bankruptcy code explicitly says that, at the request of the person in a chapter 13 case, the bankruptcy “court shall dismiss” the case. Web if a dismissal is ever entered in your chapter 13 bankruptcy case, it’s crucial that you cure the deficiency that caused the dismissal and file a motion to reinstate your bankruptcy case as soon as possible. Web for example, one route is just no longer making your payments in a chapter 13 case. Web a completed (discharged) or dismissed chapter 13 remains on file for up to seven years from the date filed.

You Can Avoid Having Your Chapter 7 Or Chapter 13 Bankruptcy Case Dismissed By Making Sure You Meet All Your.

However, to do so, you must obtain permission from the court. But what if you don’t want to be in the chapter 13. Web usually, it is chapter 13 bankruptcies that are dismissed for not sticking to the repayment plan. It was voluntarily dismissed once i had done the loan.

Web Because Under Chapter 13 You Do Not Get A Discharge Of Your Debts Until Successful Completion Of The Case, If You Dismiss Your Case You Will Owe All Your Creditors As Before Except To The Extent.

We cover this more below. Web if you fail to make your chapter 13 plan payments, eventually your bankruptcy case will be dismissed. Web if you complete your chapter 13 plan and receive your discharge, the credit bureaus will drop the chapter 13 off of your credit report 7 years after you filed the case. Whether permission will be granted depends on the type of bankruptcy you have filed and why you are requesting the voluntary dismissal.