W-2 Form Vs W4

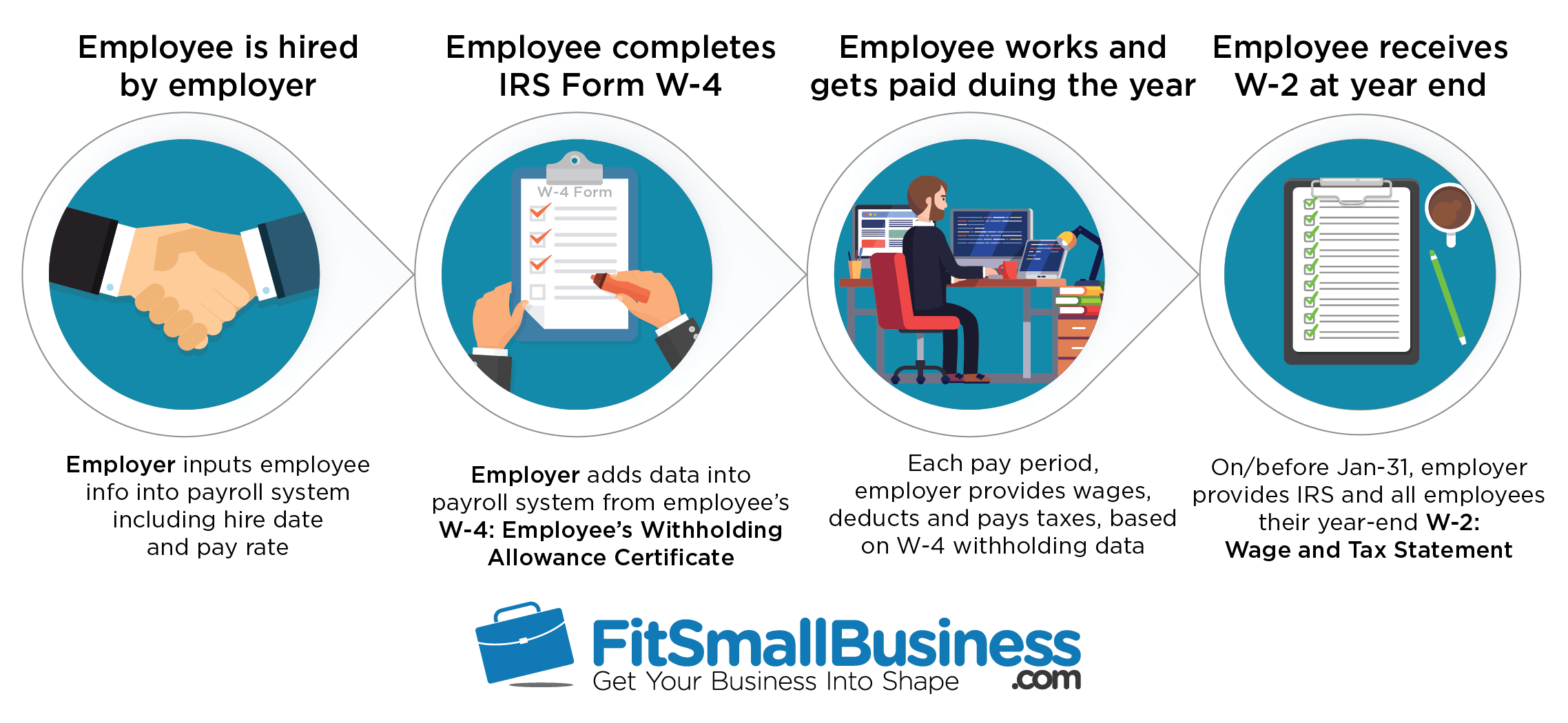

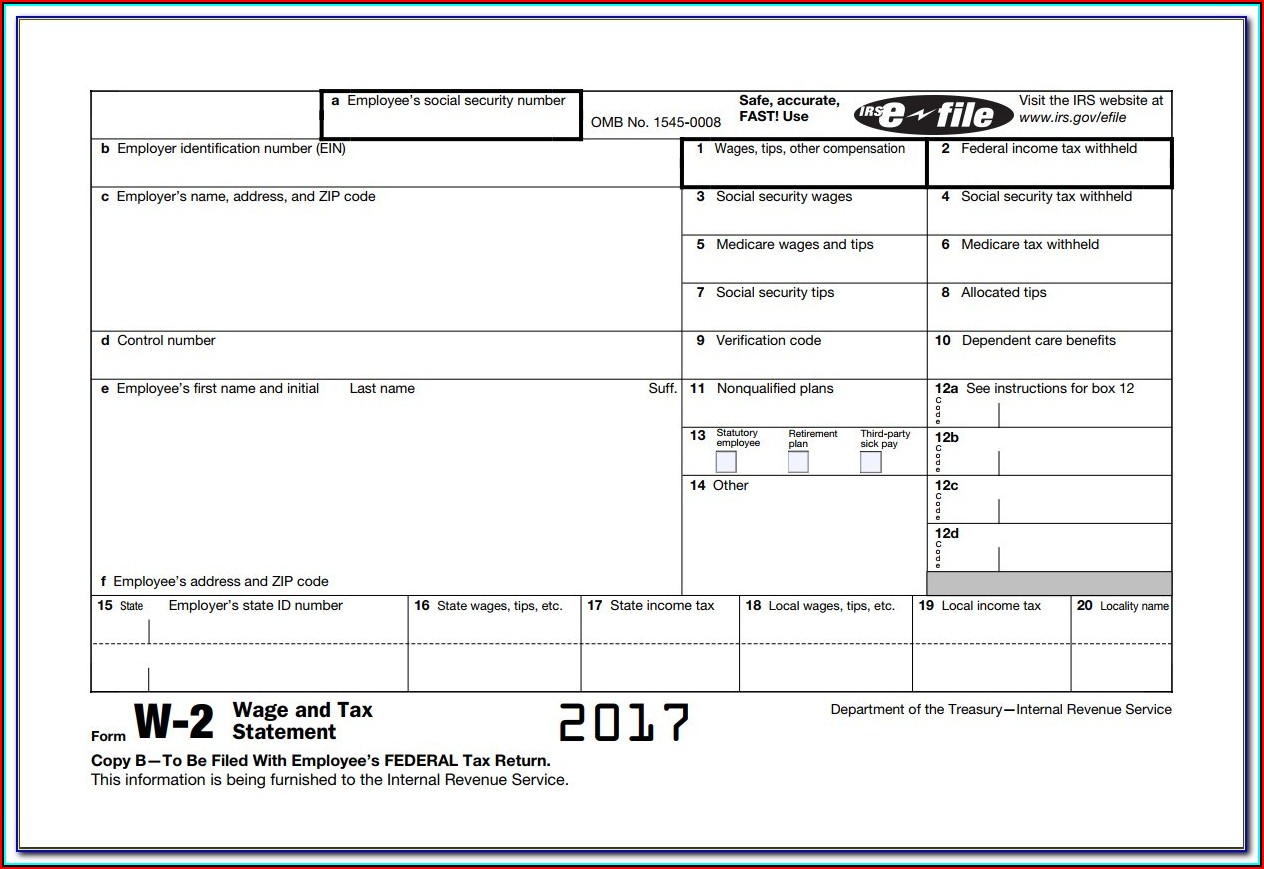

W-2 Form Vs W4 - Employers withhold taxes from employees' paychecks by. Three types of information an employee gives to their. The amount of income earned and. The amount is based on their. These irs forms help employers. Web employers use form w4 to calculate how much federal, state, and local taxes to withhold from an employee’s paycheck for the irs. Web 23 hours agowhat time does panama vs france start? Web one key difference between the w2 vs. The game between jamaica and brazil will be played at aami park, melbourne, on wednesday, 2 august 2023. The game between panama and france will be played at aussie stadium, sydney, on wednesday, 2 august 2023.

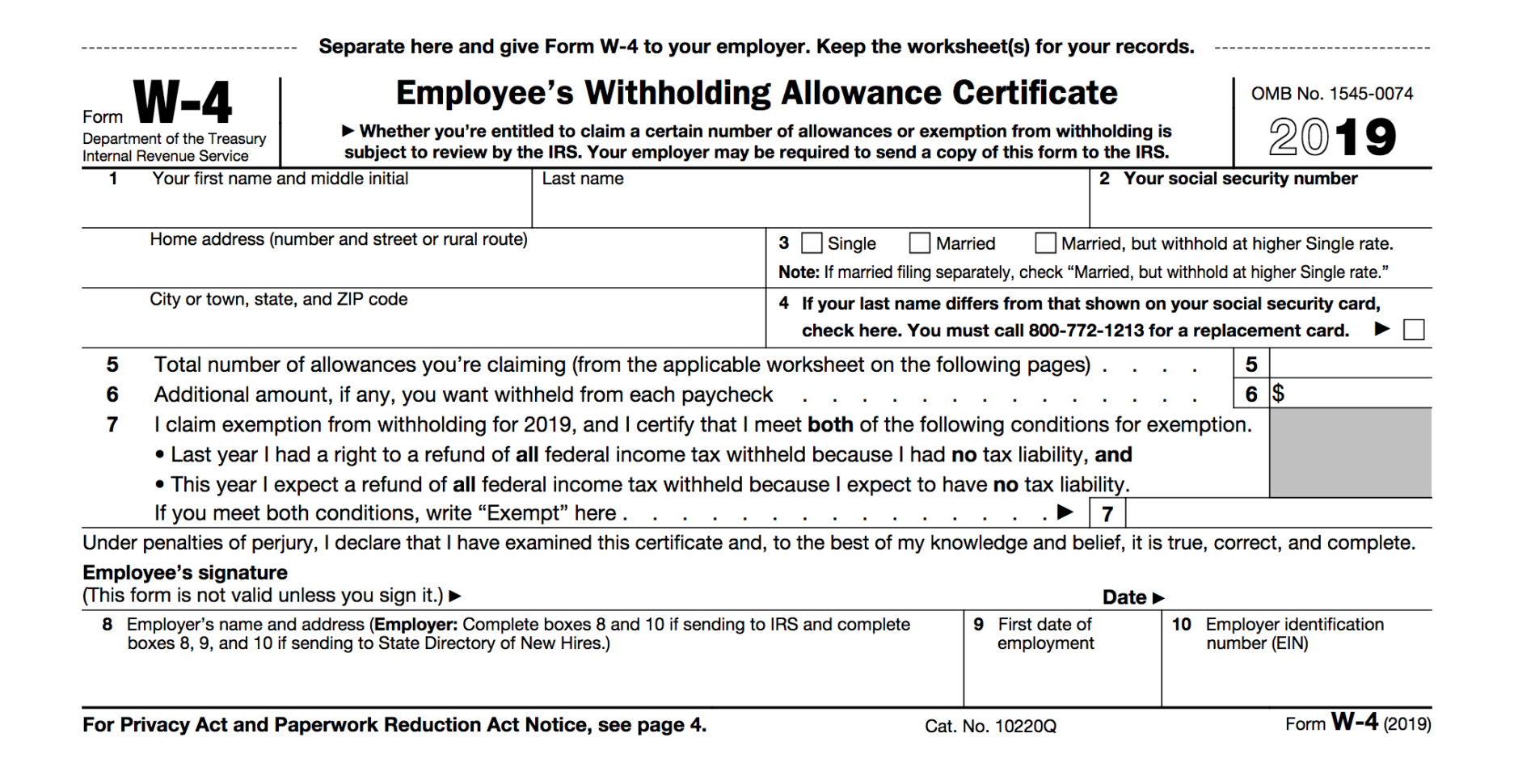

Web how withholding is determined. Web in this article, we’ll highlight a simple comparison: Web employers use form w4 to calculate how much federal, state, and local taxes to withhold from an employee’s paycheck for the irs. The amount is based on their. W2 and w4 forms are some of the primary tax forms you'll need to deal with as an employer or employee. Web one key difference between the w2 vs. Although the distinctions between these two forms are relatively easy to understand, knowing how to. Web what is a w4 vs w2? The amount of income earned and. Three types of information an employee gives to their.

The amount of income earned and. The game between panama and france will be played at aussie stadium, sydney, on wednesday, 2 august 2023. Web in this article, we’ll highlight a simple comparison: Web well, it’s quite simple: Take charge of your payroll by. Web employers use form w4 to calculate how much federal, state, and local taxes to withhold from an employee’s paycheck for the irs. Web how withholding is determined. Employers withhold taxes from employees' paychecks by. W2 and w4 forms are some of the primary tax forms you'll need to deal with as an employer or employee. The amount withheld depends on:

Difference Between W2 W4 and W9 W2 vs W4 vs W9

These irs forms help employers. The amount is based on their. W2 and w4 forms are some of the primary tax forms you'll need to deal with as an employer or employee. W4 forms is simply who has to fill out the forms. This includes their name, address, employer identification number (ein),.

W2 vs W4 What’s the Difference & When to Use Them

Web well, it’s quite simple: Web employers use form w4 to calculate how much federal, state, and local taxes to withhold from an employee’s paycheck for the irs. For example, if your business is a sole. Web in this article, we’ll highlight a simple comparison: Web 23 hours agowhat time does panama vs france start?

Difference Between W2 And W4 Irs website, Internal revenue service

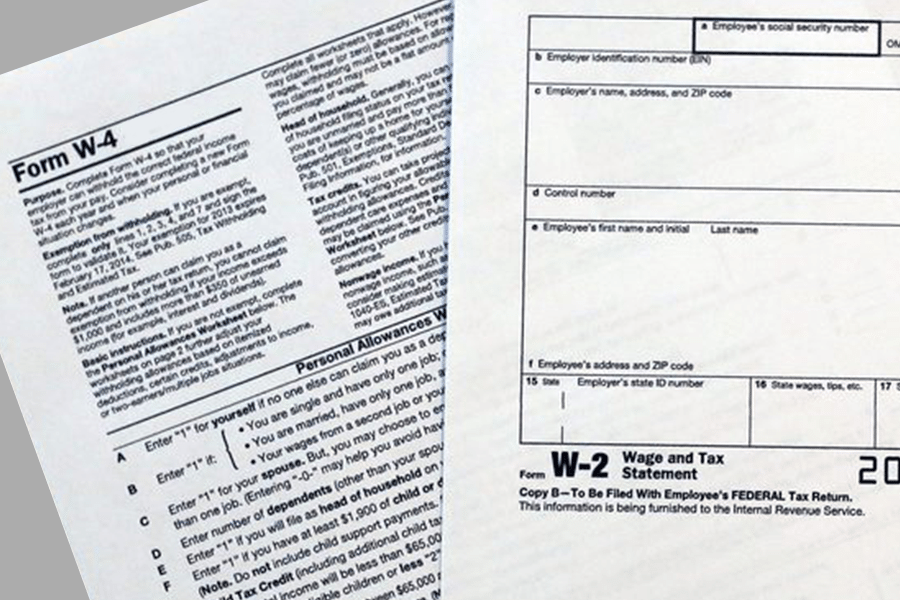

Here’s a bit more detail on what distinguishes the two: For example, if your business is a sole. Web one key difference between the w2 vs. Web form w4 informs an employer how much tax they should withhold from your wages, while form w2 shows you (the employee) your gross wage amount. Whenever someone starts a new job, this form.

W2 vs W4 What’s The Difference?

The game between jamaica and brazil will be played at aami park, melbourne, on wednesday, 2 august 2023. Whenever someone starts a new job, this form should be filled out within. Web well, it’s quite simple: Here’s a bit more detail on what distinguishes the two: Although the distinctions between these two forms are relatively easy to understand, knowing how.

W2 vs W4 What’s the Difference & When to Use Them

The amount is based on their. The amount withheld depends on: W2 and w4 forms are some of the primary tax forms you'll need to deal with as an employer or employee. Although the distinctions between these two forms are relatively easy to understand, knowing how to. Whenever someone starts a new job, this form should be filled out within.

W2 Vs W4 What's The Difference And Which One Do You —

Web one key difference between the w2 vs. Web form w4 informs an employer how much tax they should withhold from your wages, while form w2 shows you (the employee) your gross wage amount. W2 and w4 forms are some of the primary tax forms you'll need to deal with as an employer or employee. Web 23 hours agowhat time.

Employer W2 Form Download Form Resume Examples kLYrgnRV6a

Web employers use form w4 to calculate how much federal, state, and local taxes to withhold from an employee’s paycheck for the irs. Web how withholding is determined. A quick overview of the basics. The game between panama and france will be played at aussie stadium, sydney, on wednesday, 2 august 2023. For example, if your business is a sole.

W2 vs W4 Check City Blog

The amount of income earned and. Web 23 hours agowhat time does panama vs france start? A quick overview of the basics. Web employers use form w4 to calculate how much federal, state, and local taxes to withhold from an employee’s paycheck for the irs. These irs forms help employers.

Did the W4 Form Just Get More Complicated? GoCo.io

Web one key difference between the w2 vs. Whenever someone starts a new job, this form should be filled out within. Web what is a w4 vs w2? Take charge of your payroll by. Web what time does jamaica vs brazil start?

Web How Withholding Is Determined.

This includes their name, address, employer identification number (ein),. Web in this article, we’ll highlight a simple comparison: Web what is a w4 vs w2? Web well, it’s quite simple:

Web 23 Hours Agowhat Time Does Panama Vs France Start?

Whenever someone starts a new job, this form should be filled out within. Three types of information an employee gives to their. The amount is based on their. The amount withheld depends on:

W2 And W4 Forms Are Some Of The Primary Tax Forms You'll Need To Deal With As An Employer Or Employee.

Web one key difference between the w2 vs. The game between jamaica and brazil will be played at aami park, melbourne, on wednesday, 2 august 2023. Although the distinctions between these two forms are relatively easy to understand, knowing how to. W4 forms is simply who has to fill out the forms.

Here’s A Bit More Detail On What Distinguishes The Two:

These irs forms help employers. Take charge of your payroll by. Web form w4 informs an employer how much tax they should withhold from your wages, while form w2 shows you (the employee) your gross wage amount. Employers withhold taxes from employees' paychecks by.