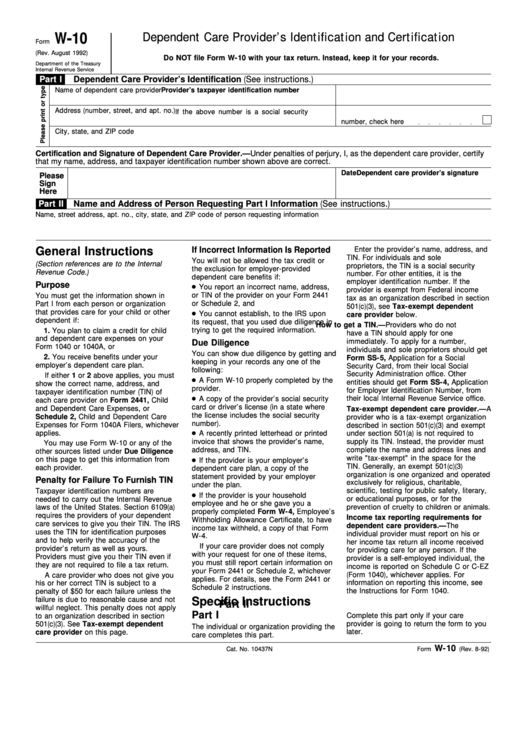

W10 Tax Form

W10 Tax Form - While an itin is not the same as a social. Complete, edit or print tax forms instantly. You plan to claim a credit for child and dependent care expenses on form 1040 or 1040a, or 2. Get ready for tax season deadlines by completing any required tax forms today. Name (as shown on your income tax return). Select 'application for the exercise of option under section. Web learn the steps to file your federal taxes and how to contact the irs if you need help. An individual who performs work services on a contract. Web popular forms & instructions; Form 1040 is used by citizens or residents.

Web the american rescue plan act of 2021 made the child and dependent care credit more generous and potentially refundable (up to $4,000 for one dependent and. Individual tax return form 1040 instructions; Name (as shown on your income tax return). Ad access irs tax forms. You plan to claim a credit for child and dependent care expenses on form 1040 or 1040a, or 2. October 2018) department of the treasury. Complete, edit or print tax forms instantly. Web get federal tax return forms and file by mail. The forms are divided into 7 sections. The forms are issued by the irs.

Complete, edit or print tax forms instantly. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Select 'application for the exercise of option under section. Form 1040 is used by citizens or residents. Web get federal tax return forms and file by mail. Calendar to determine the number of days a payment is late. Web the american rescue plan act of 2021 made the child and dependent care credit more generous and potentially refundable (up to $4,000 for one dependent and. Individual income tax return 2022 department of the treasury—internal revenue service. An individual who performs work services on a contract. You plan to claim a credit for child and dependent care expenses on form 1040 or 1040a, or 2.

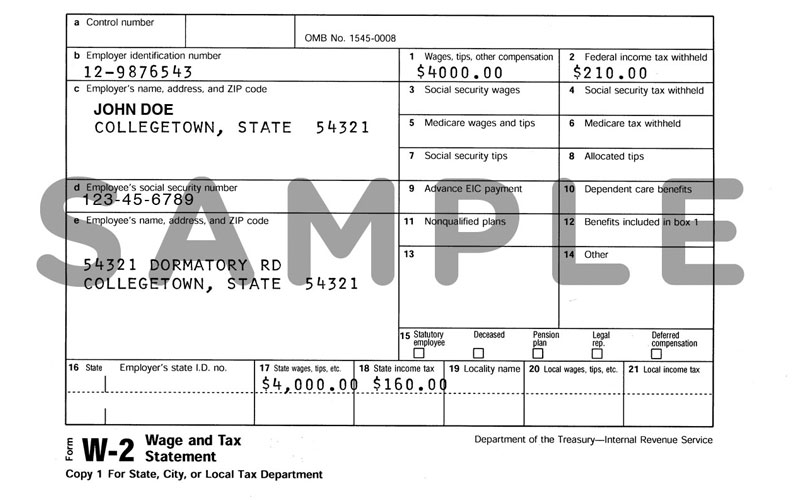

Printable W10 Form Download Sivan.yellowriverwebsites Form Free

Form 1040 is used by citizens or residents. Individual income tax return, including recent updates, related forms and instructions on how to file. Web income tax return all income received for providing care for any person. Select 'application for the exercise of option under section. Calendar to determine the number of days a payment is late.

W10 Form J10 Visa Five Reasons Why W100 Form J10 Visa Is Common In USA

Web popular forms & instructions; Web get federal tax return forms and file by mail. Get ready for tax season deadlines by completing any required tax forms today. Calendar to determine the number of days a payment is late. Irs use only—do not write or staple in this.

W10 Form Lost Reasons Why W10 Form Lost Is Getting More Popular In The

Web learn the steps to file your federal taxes and how to contact the irs if you need help. Individual income tax return, including recent updates, related forms and instructions on how to file. Get ready for tax season deadlines by completing any required tax forms today. While an itin is not the same as a social. October 2018) department.

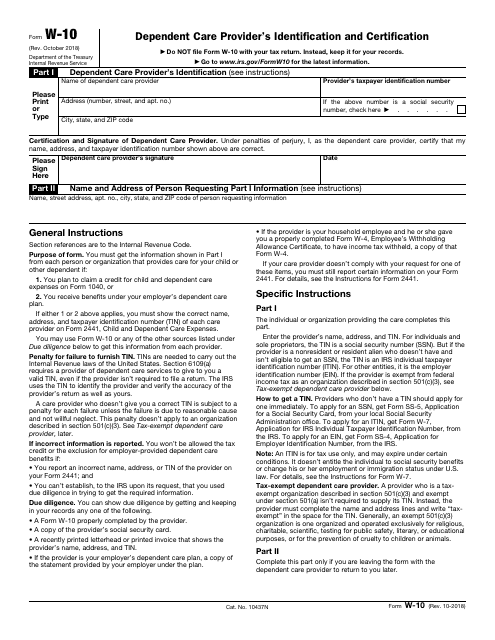

IRS Form W10 Download Fillable PDF or Fill Online Dependent Care

Get ready for tax season deadlines by completing any required tax forms today. Web get federal tax return forms and file by mail. Select 'application for the exercise of option under section. Web learn the steps to file your federal taxes and how to contact the irs if you need help. You will need the forms and receipts that show.

Form W10 Dependent Care Provider'S Identification And Certification

Complete, edit or print tax forms instantly. Web information about form 1040, u.s. The forms are divided into 7 sections. Individual income tax return 2022 department of the treasury—internal revenue service. Web get federal tax return forms and file by mail.

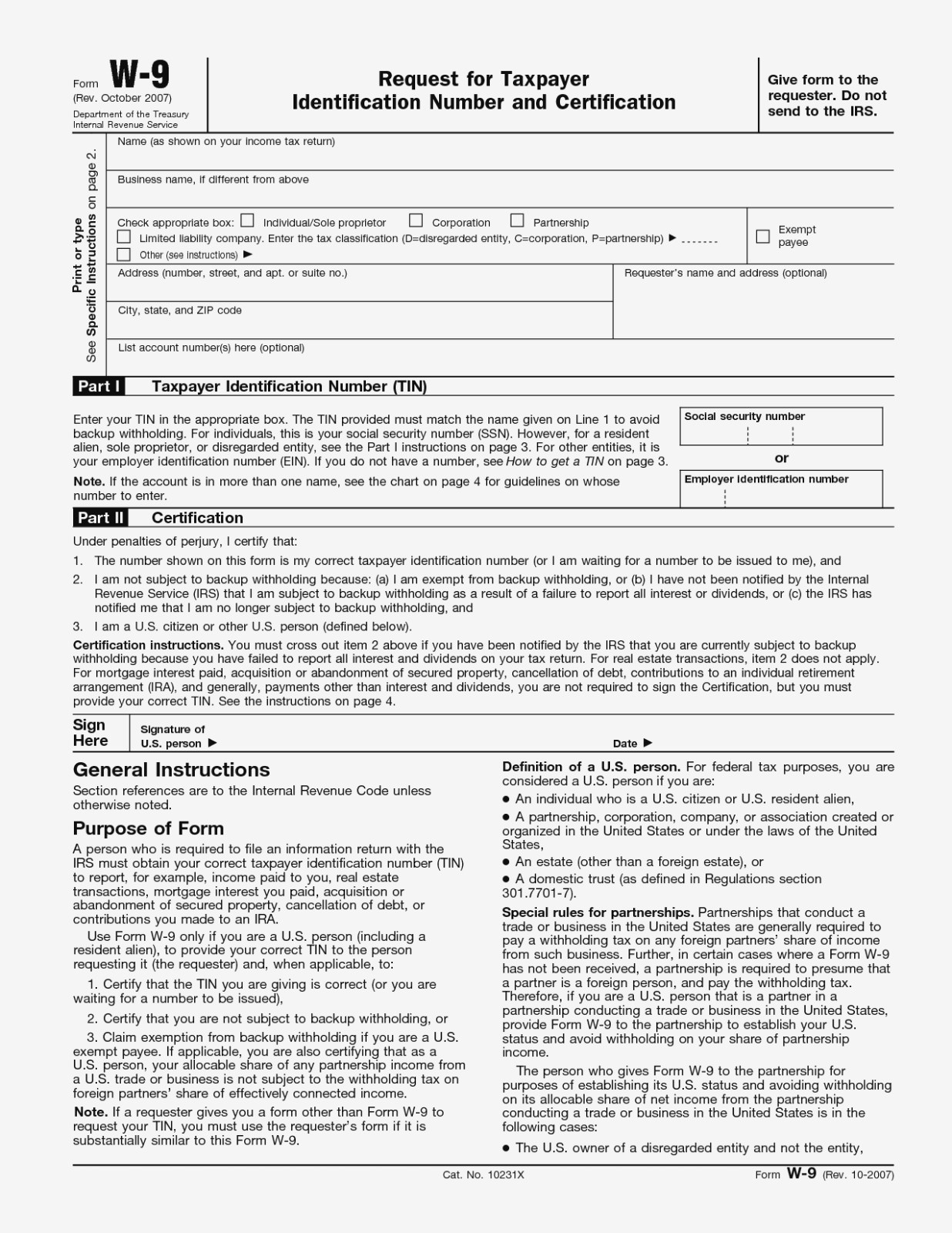

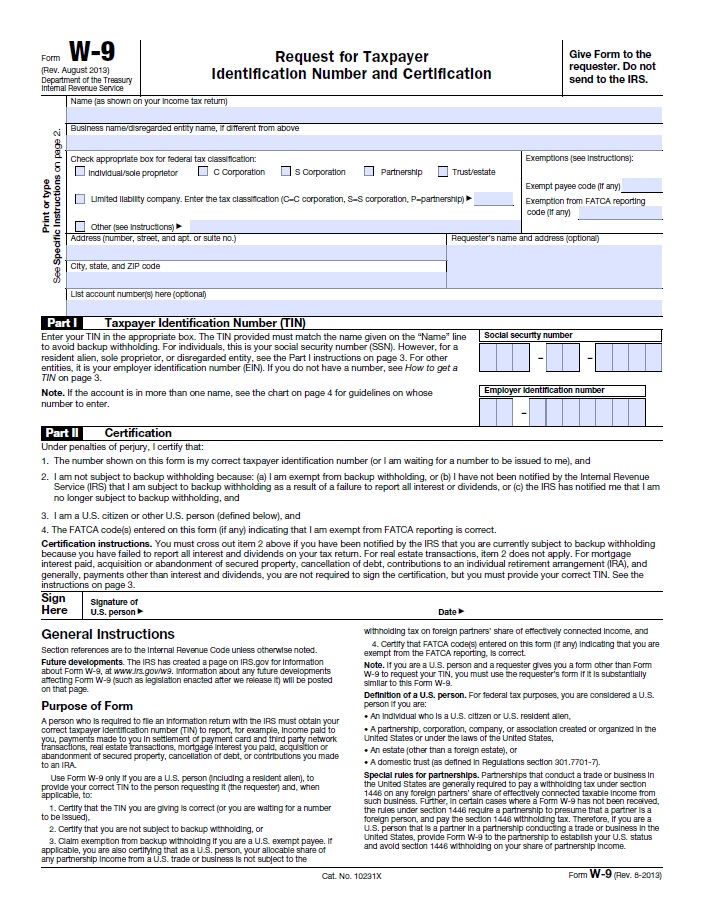

Order Blank W9 Forms Example Calendar Printable

Web popular forms & instructions; Complete, edit or print tax forms instantly. Web information about form 1040, u.s. Ad access irs tax forms. Calendar to determine the number of days a payment is late.

Printable W 9 Forms That are Decisive Clifton Blog

The forms are divided into 7 sections. October 2018) department of the treasury. Complete, edit or print tax forms instantly. Calendar to determine the number of days a payment is late. Web learn the steps to file your federal taxes and how to contact the irs if you need help.

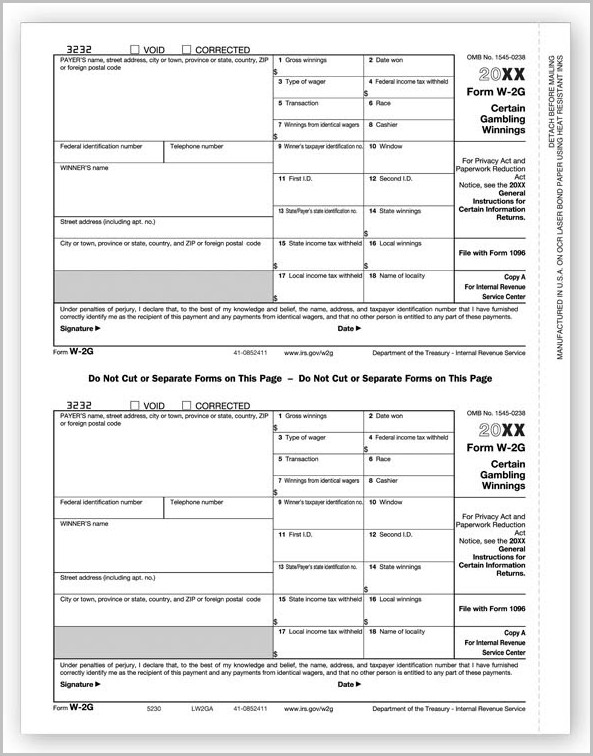

What Is A W8 Form Paul Johnson's Templates

You plan to claim a credit for child and dependent care expenses on form 1040 or 1040a, or 2. Form 1040 is used by citizens or residents. Complete, edit or print tax forms instantly. The forms are issued by the irs. Irs use only—do not write or staple in this.

Form W10 Dependent Care Provider's Identification and Certification

An individual who performs work services on a contract. Web popular forms & instructions; While an itin is not the same as a social. October 2018) department of the treasury. The forms are issued by the irs.

W10 Form 2023

Individual tax return form 1040 instructions; Web it is used for tracking people who do not have a social security number and are required to file their income tax returns. October 2018) department of the treasury. Use this table with form 2210 if you’re completing part iii, section b. Individual income tax return 2022 department of the treasury—internal revenue service.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

An individual who performs work services on a contract. Web popular forms & instructions; Web get federal tax return forms and file by mail. The forms are issued by the irs.

Web Popular Forms & Instructions;

Ad access irs tax forms. Complete, edit or print tax forms instantly. October 2018) department of the treasury. The forms are divided into 7 sections.

Web Income Tax Return All Income Received For Providing Care For Any Person.

Individual tax return form 1040 instructions; Use this table with form 2210 if you’re completing part iii, section b. Individual income tax return 2022 department of the treasury—internal revenue service. Select 'application for the exercise of option under section.

You Plan To Claim A Credit For Child And Dependent Care Expenses On Form 1040 Or 1040A, Or 2.

Calendar to determine the number of days a payment is late. Web learn the steps to file your federal taxes and how to contact the irs if you need help. Name (as shown on your income tax return). Individual income tax return, including recent updates, related forms and instructions on how to file.