W2 Form For Babysitter

W2 Form For Babysitter - Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. It communicates to the appropriate. The irs specifically asks that you allow the employer until february 15 before you report it missing. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. Ad care.com® homepay can handle all of your household payroll obligations. The january 31 date is the ‘mail by’ date. Enter this amount on the. Web you may be required to report this amount on form 8959, additional medicare tax. It documents how much they were paid and how much has been withheld in taxes. Amounts over $5,000 are also included.

The irs specifically asks that you allow the employer until february 15 before you report it missing. It communicates to the appropriate. See the form 1040 instructions to determine if you are required to complete form 8959. The january 31 date is the ‘mail by’ date. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. Enter this amount on the. Provide this form to your employee by january 31. Ad care.com® homepay can handle all of your household payroll obligations. Upload, modify or create forms. You'll likely need to pay state taxes as well.

Web if the caregiver employee is a family member, the employer may not owe employment taxes even though the employer needs to report the caregiver's. The january 31 date is the ‘mail by’ date. Provide this form to your employee by january 31. Enter this amount on the. It communicates to the appropriate. Amounts over $5,000 are also included. Upload, modify or create forms. Try it for free now! It documents how much they were paid and how much has been withheld in taxes. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer.

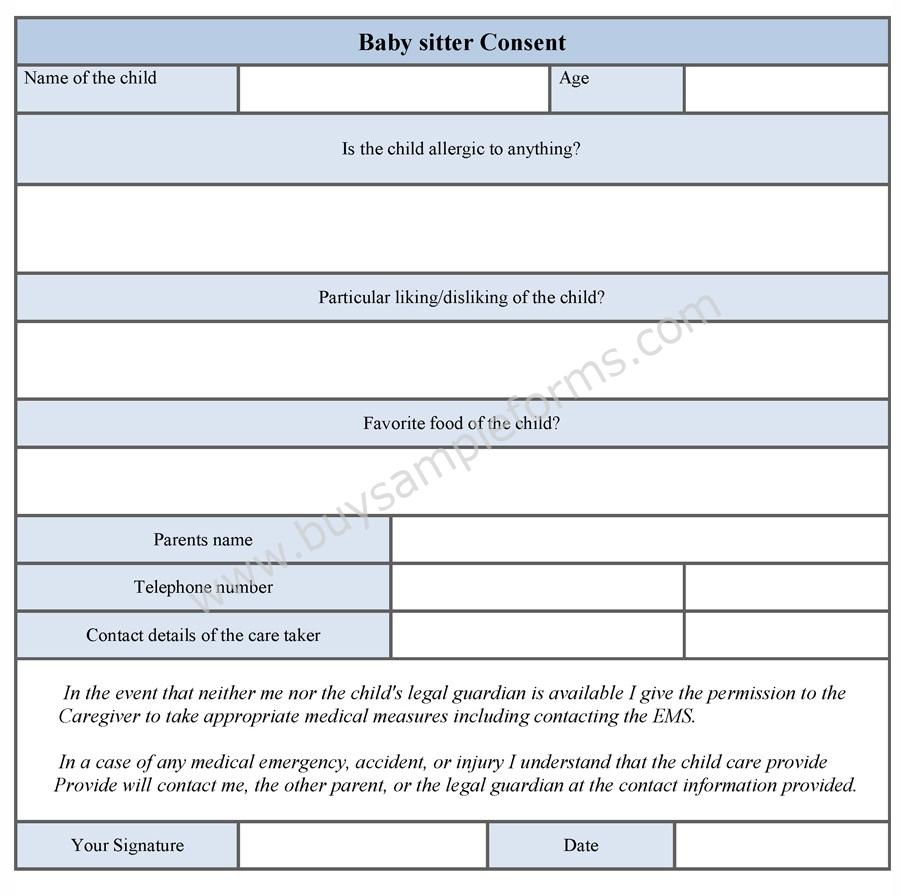

Babysitter Consent Form Sample Forms

Pay them $2,600 or more in 2023 (or paid them $2,400 or more in 2022) or; See the form 1040 instructions to determine if you are required to complete form 8959. Ad care.com® homepay can handle all of your household payroll obligations. The january 31 date is the ‘mail by’ date. Web you must file form 4137 with your income.

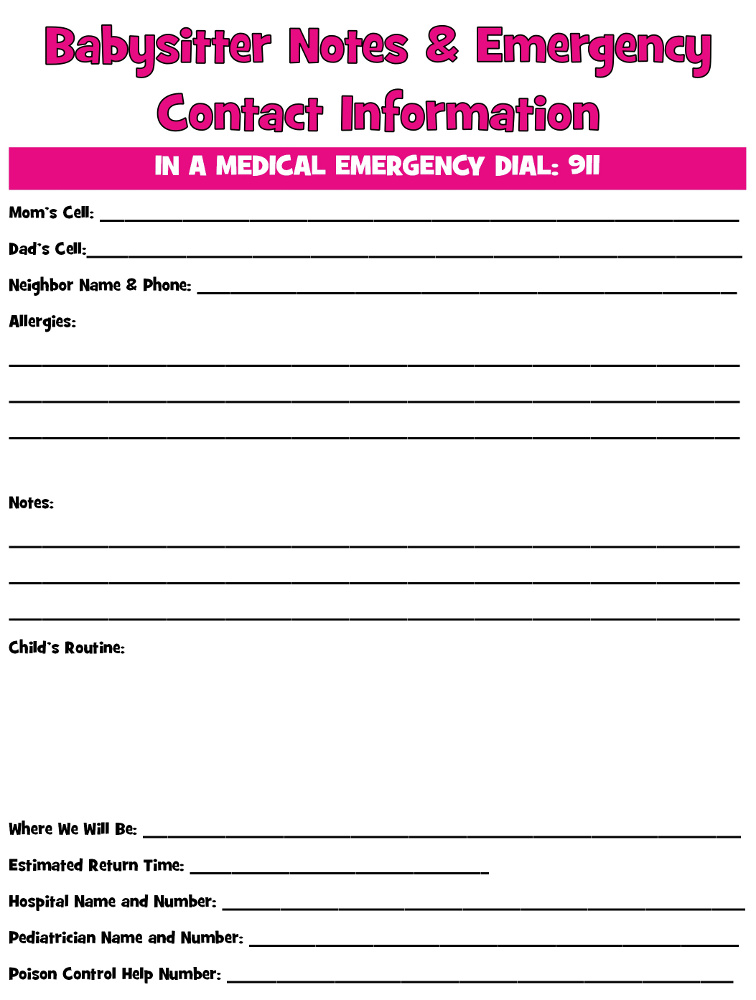

Cutting Down the Cost of Babysitting » Thrifty Little Mom

The irs specifically asks that you allow the employer until february 15 before you report it missing. Web if the caregiver employee is a family member, the employer may not owe employment taxes even though the employer needs to report the caregiver's. Enter this amount on the. Enter this amount on the. It documents how much they were paid and.

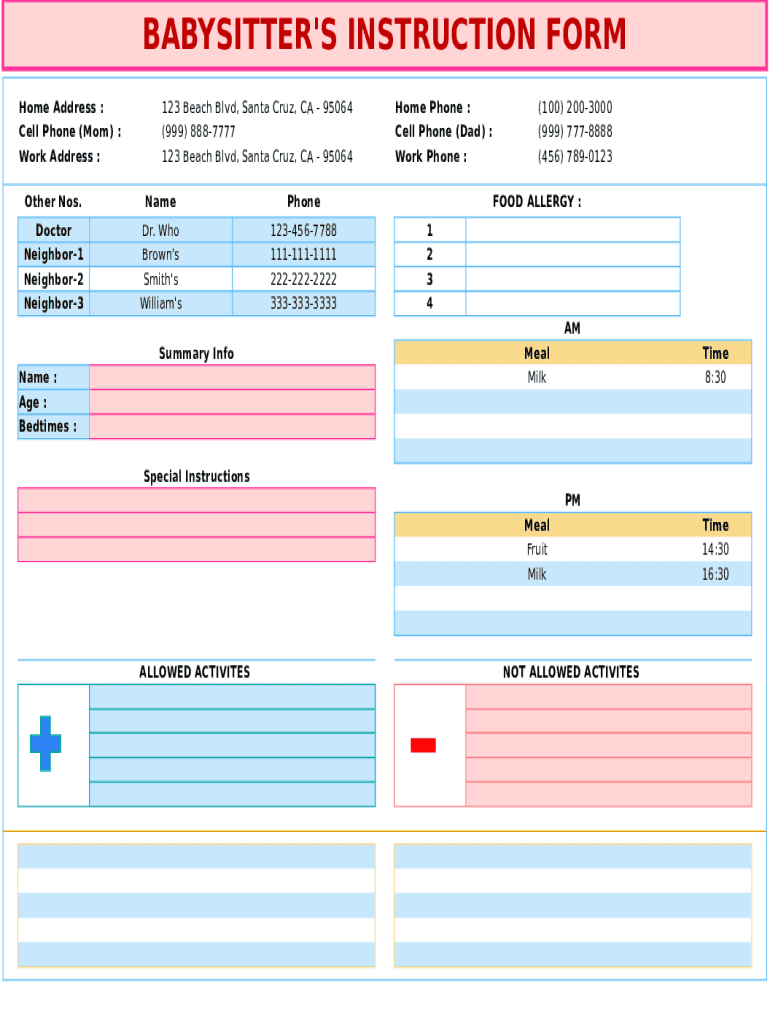

Babysitter Instruction Form Fill and Sign Printable Template Online

Enter this amount on the. Web you may be required to report this amount on form 8959, additional medicare tax. That rule applies to babysitters with a few key things to know. See the form 1040 instructions to determine if you are required to complete form 8959. Try it for free now!

Cutting Down the Cost of Babysitting » Thrifty Little Mom

Web if the caregiver employee is a family member, the employer may not owe employment taxes even though the employer needs to report the caregiver's. The irs specifically asks that you allow the employer until february 15 before you report it missing. Web you must file form 4137 with your income tax return to figure the social security and medicare.

Medical Release form for Babysitter Best Of Would Your Child S

Enter this amount on the. That rule applies to babysitters with a few key things to know. It documents how much they were paid and how much has been withheld in taxes. Upload, modify or create forms. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you.

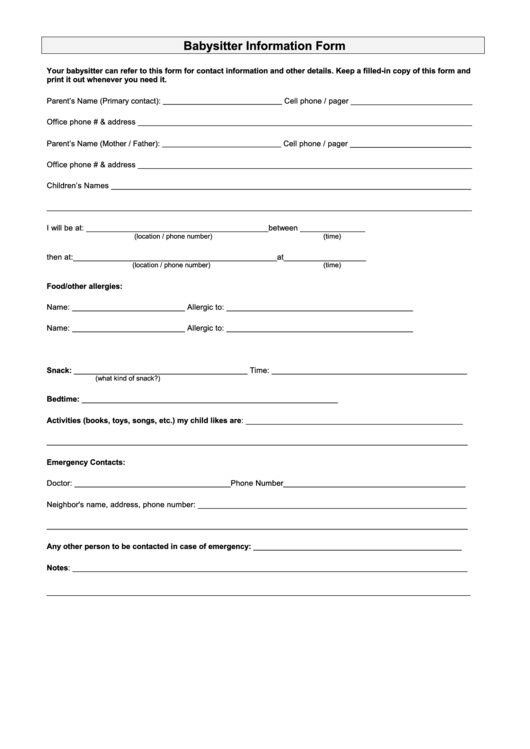

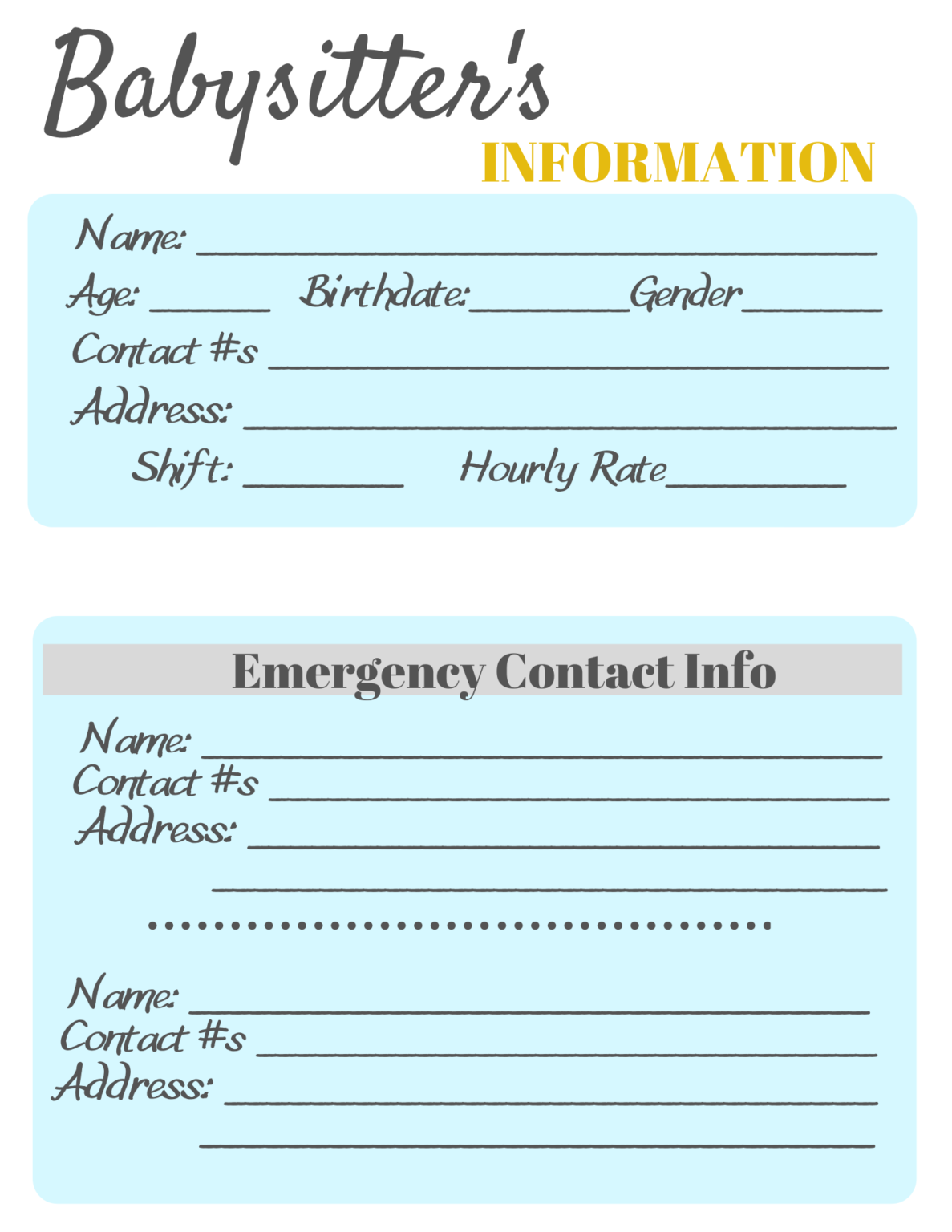

Printable Babysitter Information Sheets Long Wait For Isabella

Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. See the form 1040 instructions to determine if you are required to complete form 8959. Amounts over $5,000 are also included. The january 31 date is the ‘mail by’ date. Upload, modify.

Family Dollar W2 Forms Online New Dollar Wallpaper HD

It communicates to the appropriate. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. Web if the caregiver employee is a family member, the employer may not owe employment taxes even though the employer needs to report the caregiver's. The january.

Top 6 Babysitter Information Sheets free to download in PDF format

Pay them $2,600 or more in 2023 (or paid them $2,400 or more in 2022) or; See the form 1040 instructions to determine if you are required to complete form 8959. Enter this amount on the. Web you may be required to report this amount on form 8959, additional medicare tax. It documents how much they were paid and how.

Babysitter Form Etsy

See the form 1040 instructions to determine if you are required to complete form 8959. Enter this amount on the. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. That rule applies to babysitters with a few key things to know..

Babysitter Form Babysitter Notes Babysitter Sheet

Enter this amount on the. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your.

The January 31 Date Is The ‘Mail By’ Date.

Can you claim a nanny on your taxes? Web you may be required to report this amount on form 8959, additional medicare tax. Upload, modify or create forms. Web if the caregiver employee is a family member, the employer may not owe employment taxes even though the employer needs to report the caregiver's.

See The Form 1040 Instructions To Determine If You Are Required To Complete Form 8959.

Ad care.com® homepay can handle all of your household payroll obligations. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. It communicates to the appropriate. The irs specifically asks that you allow the employer until february 15 before you report it missing.

Pay Them $2,600 Or More In 2023 (Or Paid Them $2,400 Or More In 2022) Or;

Provide this form to your employee by january 31. It documents how much they were paid and how much has been withheld in taxes. Try it for free now! That rule applies to babysitters with a few key things to know.

Enter This Amount On The.

Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. You'll likely need to pay state taxes as well. Enter this amount on the. Amounts over $5,000 are also included.

:max_bytes(150000):strip_icc()/w2-9ca13523f4d74e958b821aab63af2e60.png)