W8 Ben Form Download

W8 Ben Form Download - Certificate of status of beneficial owner for united states tax withholding and reporting (entities). October 2021) department of the treasury internal revenue service. Do not send to the irs. Give this form to the withholding agent or payer. Citizens to certify their foreign status, and if applicable, claim a reduced tax rate or an exemption from tax withholding. February 2006) for united states tax withholding omb no. Section references are to the internal revenue code. Do not send to the irs. October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. Go to www.irs.gov/formw8ben for instructions and the latest information.

October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. October 2021) department of the treasury internal revenue service. It must be completed every three years in order to avoid tax withholdings. Do not send to the irs. Do not send to the irs. Do not use this form for: Citizens to certify their foreign status, and if applicable, claim a reduced tax rate or an exemption from tax withholding. Give this form to the withholding agent or payer. (1) an entity that is an integral part of a foreign government and (2) an entity that is controlled by a foreign government. February 2006) for united states tax withholding omb no.

October 2021) department of the treasury internal revenue service. October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. Do not send to the irs. Section references are to the internal revenue code. Give this form to the withholding agent or payer. Go to www.irs.gov/formw8ben for instructions and the latest information. Do not use this form for: (1) an entity that is an integral part of a foreign government and (2) an entity that is controlled by a foreign government. Certificate of status of beneficial owner for united states tax withholding and reporting (entities). Web department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding section references are to the internal revenue code.

W8BENForm Irs Tax Forms Withholding Tax

Internal revenue service give this form to the withholding agent or payer. (1) an entity that is an integral part of a foreign government and (2) an entity that is controlled by a foreign government. October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for.

IRS W8BEN Form Template Fill & Download Online [+ Free PDF] Tax

Internal revenue service give this form to the withholding agent or payer. Go to www.irs.gov/formw8ben for instructions and the latest information. October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. Web department of the treasury internal revenue service certificate of foreign.

IRS Form W8 BEN YouTube

October 2021) department of the treasury internal revenue service. October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. Go to www.irs.gov/formw8ben for instructions and the latest information. Web department of the treasury internal revenue service certificate of foreign status of beneficial.

2020 IRS Form W8BEN Online Fill Out and Download The W8BEN Form

October 2021) department of the treasury internal revenue service. Go to www.irs.gov/formw8ben for instructions and the latest information. Web department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding section references are to the internal revenue code. Section references are to the internal revenue code. (1) an entity that is an.

How to fill W8BEN Form for affiliate platforms like Chitika, Infolinks

Go to www.irs.gov/formw8ben for instructions and the latest information. October 2021) department of the treasury internal revenue service. October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. February 2006) for united states tax withholding omb no. Do not send to the.

IRS Form W8

It must be completed every three years in order to avoid tax withholdings. Go to www.irs.gov/formw8ben for instructions and the latest information. February 2006) for united states tax withholding omb no. Web department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding section references are to the internal revenue code. October.

Form W8 BEN Edit, Fill, Sign Online Handypdf

February 2006) for united states tax withholding omb no. Give this form to the withholding agent or payer. Certificate of status of beneficial owner for united states tax withholding and reporting (entities). Section references are to the internal revenue code. It must be completed every three years in order to avoid tax withholdings.

W8BEN form Instructions.pdf Google Drive

Internal revenue service give this form to the withholding agent or payer. (1) an entity that is an integral part of a foreign government and (2) an entity that is controlled by a foreign government. Web department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding section references are to the.

Blank 2018 form w 8ben e Fill out & sign online DocHub

Internal revenue service give this form to the withholding agent or payer. (1) an entity that is an integral part of a foreign government and (2) an entity that is controlled by a foreign government. October 2021) department of the treasury internal revenue service. Do not send to the irs. Web department of the treasury internal revenue service certificate of.

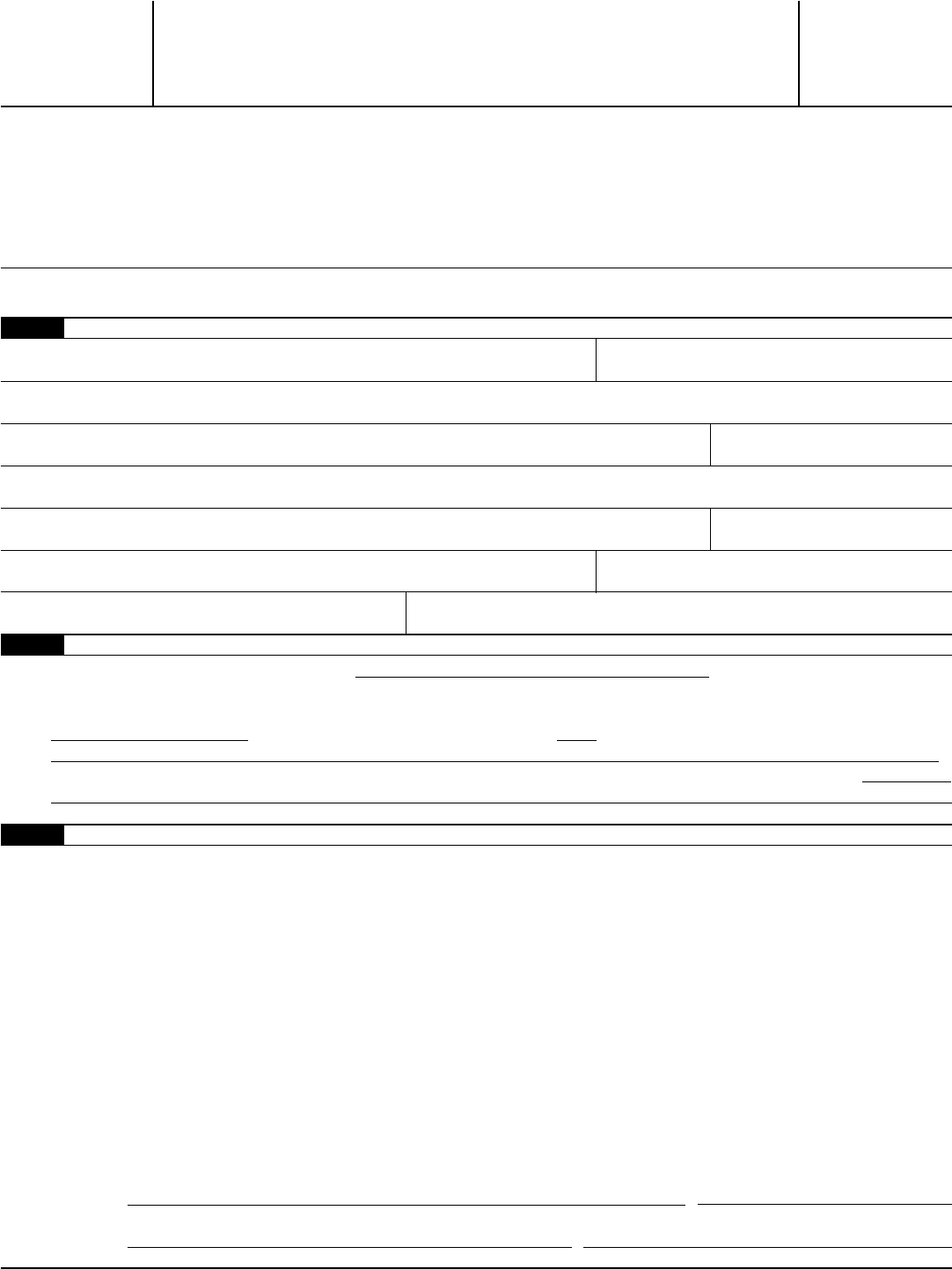

How to complete the W8BENE Form New Brighton Capital

Web department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding section references are to the internal revenue code. Do not send to the irs. (1) an entity that is an integral part of a foreign government and (2) an entity that is controlled by a foreign government. Give this form.

October 2021) Department Of The Treasury Internal Revenue Service.

October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. Go to www.irs.gov/formw8ben for instructions and the latest information. February 2006) for united states tax withholding omb no. (1) an entity that is an integral part of a foreign government and (2) an entity that is controlled by a foreign government.

Do Not Use This Form For:

Give this form to the withholding agent or payer. Citizens to certify their foreign status, and if applicable, claim a reduced tax rate or an exemption from tax withholding. Do not send to the irs. Section references are to the internal revenue code.

Internal Revenue Service Give This Form To The Withholding Agent Or Payer.

Web department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding section references are to the internal revenue code. Certificate of status of beneficial owner for united states tax withholding and reporting (entities). It must be completed every three years in order to avoid tax withholdings. Do not send to the irs.

![IRS W8BEN Form Template Fill & Download Online [+ Free PDF] Tax](https://i.pinimg.com/736x/6a/67/2f/6a672fef1f93458a4354c87127aa404e.jpg)