W9 Form Reddit

W9 Form Reddit - This is standard procedure and. Web i'm 14 yo and want to sell gigs on fiverr. You put the revenue from the 1099 form on schedule c of your tax return. You do need to certify that you are not subject to tax withholding, and verify your ssn (tax id) in the process. I’m only working for them for about a month and i expect to make about. Getty say that a lawyer settles a case for $1 million, with payment to the lawyer’s trust. Web my account got restricted for trading because of the b9 notice. The information was somewhat useless tho. Web no documentation of my employment, no taxes. Congratulations, you are an independent contractor.

This is standard procedure and. You'll have to file at the end of the year. I sumbitted the w9 form and my ssn card but the reps keep telling me it's voided even though my card doesn't say. Filed paper form 4 as individual. Do not department of the treasury internal revenue. Congratulations, you are an independent contractor. You do need to certify that you are not subject to tax withholding, and verify your ssn (tax id) in the process. You put the revenue from the 1099 form on schedule c of your tax return. Web you get all the taxes back on what you earned if it’s under a certain amount, collectively…like if this is your only income then you’ll get it all back when you file. Web view community ranking in the top 5% of largest communities on reddit.

Web view community ranking in the top 5% of largest communities on reddit. You put the revenue from the 1099 form on schedule c of your tax return. I'm going to be honest i know almost nothing about this stuff, but when i told a. Web you shouldn’t need to submit an actual w9 form. I've already hit $600 and they won't pay me more. Web any pdf should be fillable, or you can make it so. Roughly speaking, you should set aside 30 percent for taxes. You do need to certify that you are not subject to tax withholding, and verify your ssn (tax id) in the process. Web my account got restricted for trading because of the b9 notice. Real estate has been told explicitly to issue form 9 entry notices for all contractors unless under urgent circumstances and despite written requests for a.

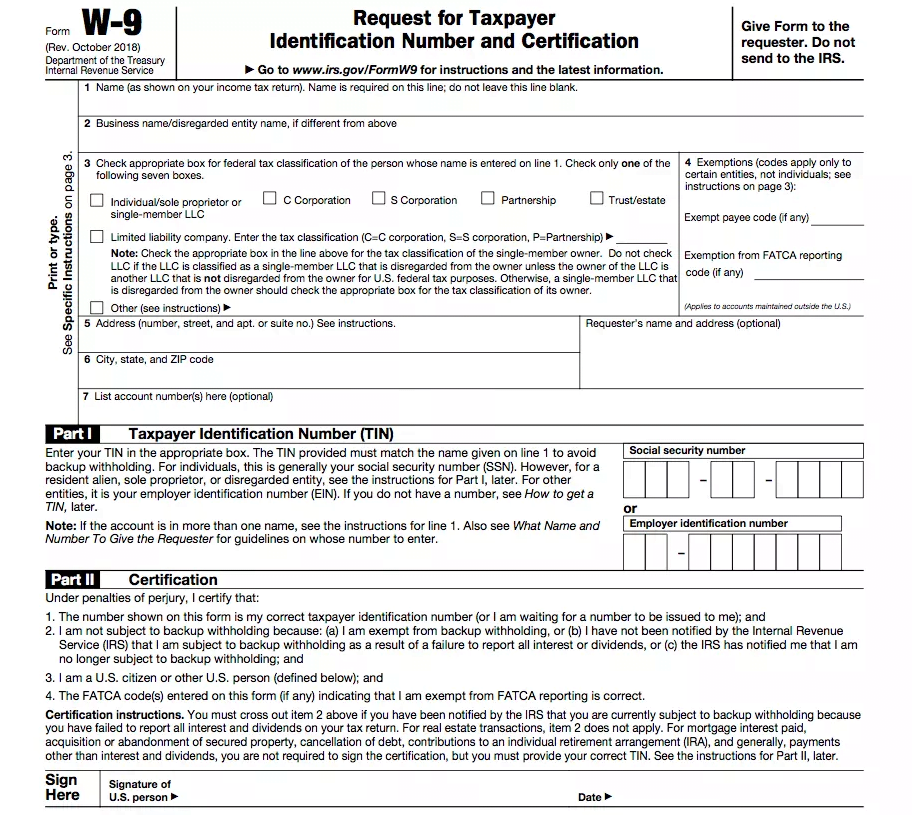

W9 Tax Form Printable 2020 Payroll Calendar

Web my account got restricted for trading because of the b9 notice. You'll have to file at the end of the year. Web view community ranking in the top 5% of largest communities on reddit. Congratulations, you are an independent contractor. I sumbitted the w9 form and my ssn card but the reps keep telling me it's voided even though.

Downloadable W 9 Form W9 Form Mascot Junction In 2020 throughout Free

You'll have to file at the end of the year. Web any pdf should be fillable, or you can make it so. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to. Web you get all the taxes back on what you earned if it’s under a certain amount, collectively…like if this.

Forms FBParts

Web tenancy act and form 9. You do need to certify that you are not subject to tax withholding, and verify your ssn (tax id) in the process. You put the revenue from the 1099 form on schedule c of your tax return. Web view community ranking in the top 5% of largest communities on reddit. October 2018) department of.

W9 Form Printable 2021 W9 Forms TaxUni

If you're using a mac you can just download the w9. I sumbitted the w9 form and my ssn card but the reps keep telling me it's voided even though my card doesn't say. I've already hit $600 and they won't pay me more. Web my account got restricted for trading because of the b9 notice. Do not department of.

Downloadable W9 Tax Form How To Fill Out A W9 Form Line W within Irs

Web no documentation of my employment, no taxes. I'm going to be honest i know almost nothing about this stuff, but when i told a. Client sends you a 1099 form in january. I sumbitted the w9 form and my ssn card but the reps keep telling me it's voided even though my card doesn't say. It asks me for.

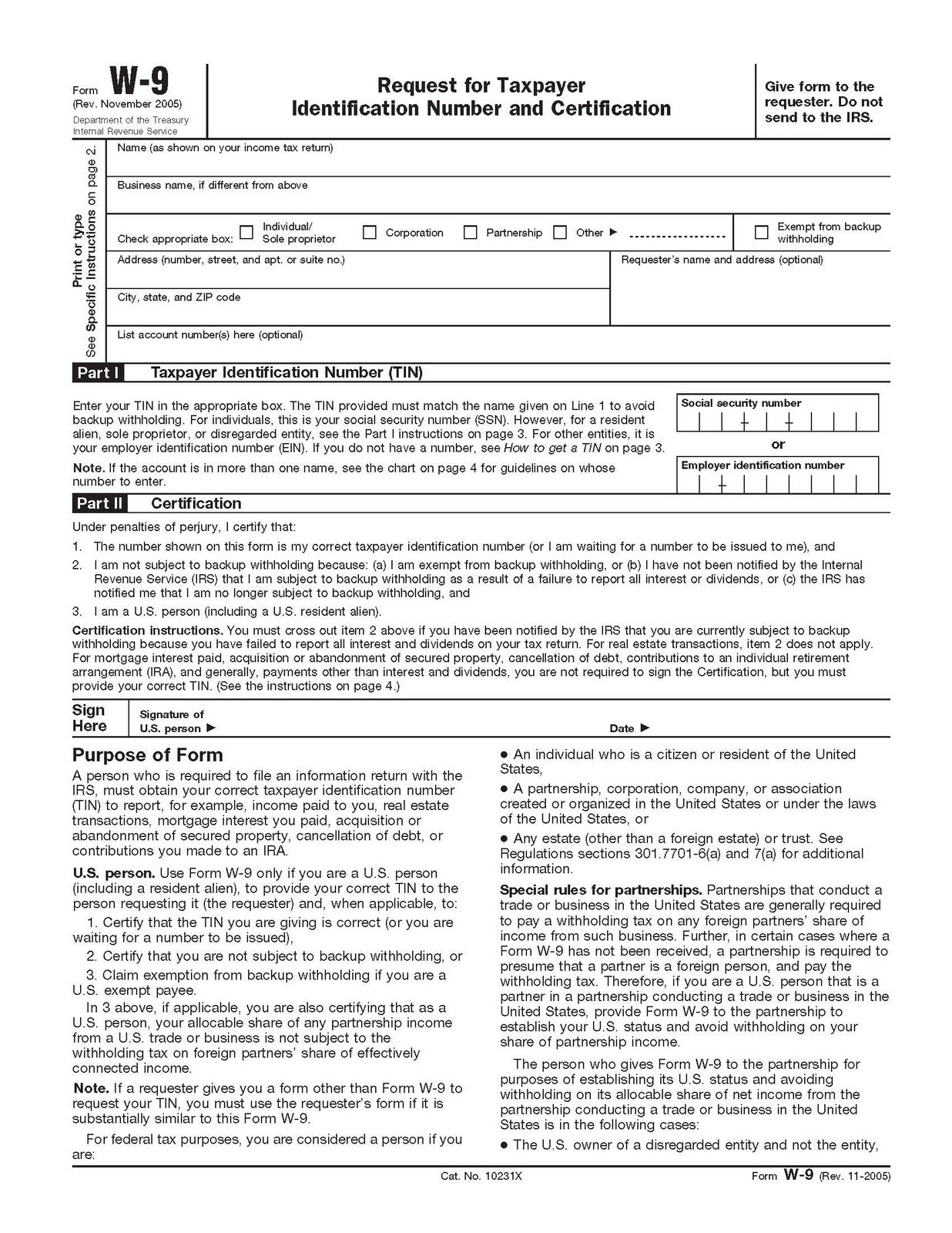

Not Bad To Use Warez DOWNLOAD A W9 FORM

Real estate has been told explicitly to issue form 9 entry notices for all contractors unless under urgent circumstances and despite written requests for a. Web you shouldn’t need to submit an actual w9 form. You put the revenue from the 1099 form on schedule c of your tax return. I'm going to be honest i know almost nothing about.

Fillable Form W9 Request For Taxpayer Identification with Blank W 9

I sumbitted the w9 form and my ssn card but the reps keep telling me it's voided even though my card doesn't say. The thing is, i plan to work much more this year. I’m only working for them for about a month and i expect to make about. Web any pdf should be fillable, or you can make it.

Print Blank W9 Form Calendar Template Printable

Web any pdf should be fillable, or you can make it so. I've already hit $600 and they won't pay me more. Web you get all the taxes back on what you earned if it’s under a certain amount, collectively…like if this is your only income then you’ll get it all back when you file. Client sends you a 1099.

Downlodable Freeware DOWNLOAD W9 TAX FORM

Web i'm 14 yo and want to sell gigs on fiverr. Congratulations, you are an independent contractor. You'll have to file at the end of the year. Filed paper form 4 as individual. Client sends you a 1099 form in january.

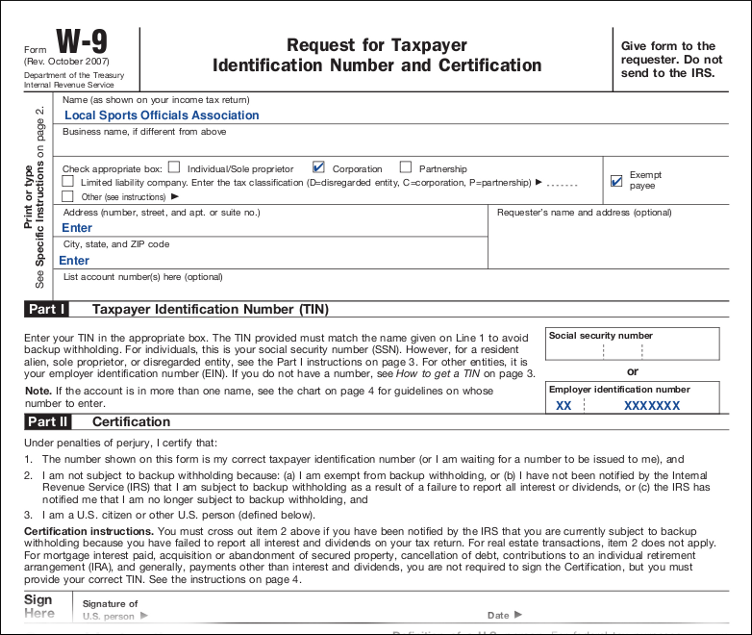

Free Fillable W9 Form W9 Invoice Template Attending W11 pertaining to

If you're using a mac you can just download the w9. It asks me for my home location and social security number and i'm. Web hi all, i run a web development agency and one of my clients' accountants sent me a w9 form. I am a nanny, i just signed a w9 with the family i’m working and i’m.

Do Not Department Of The Treasury Internal Revenue.

Congratulations, you are an independent contractor. I've already hit $600 and they won't pay me more. Web you get all the taxes back on what you earned if it’s under a certain amount, collectively…like if this is your only income then you’ll get it all back when you file. Web view community ranking in the top 5% of largest communities on reddit.

Don't Look Like Repeating As World.

It asks me for my home location and social security number and i'm. Roughly speaking, you should set aside 30 percent for taxes. I am a nanny, i just signed a w9 with the family i’m working and i’m wondering what that means. You'll have to file at the end of the year.

This Is Standard Procedure And.

You put any work expenses on there. The information was somewhat useless tho. Web hi all, i run a web development agency and one of my clients' accountants sent me a w9 form. Web my account got restricted for trading because of the b9 notice.

I Sumbitted The W9 Form And My Ssn Card But The Reps Keep Telling Me It's Voided Even Though My Card Doesn't Say.

Web you shouldn’t need to submit an actual w9 form. Web tenancy act and form 9. Real estate has been told explicitly to issue form 9 entry notices for all contractors unless under urgent circumstances and despite written requests for a. I'm going to be honest i know almost nothing about this stuff, but when i told a.