Wage Chart On Form Nj-W4

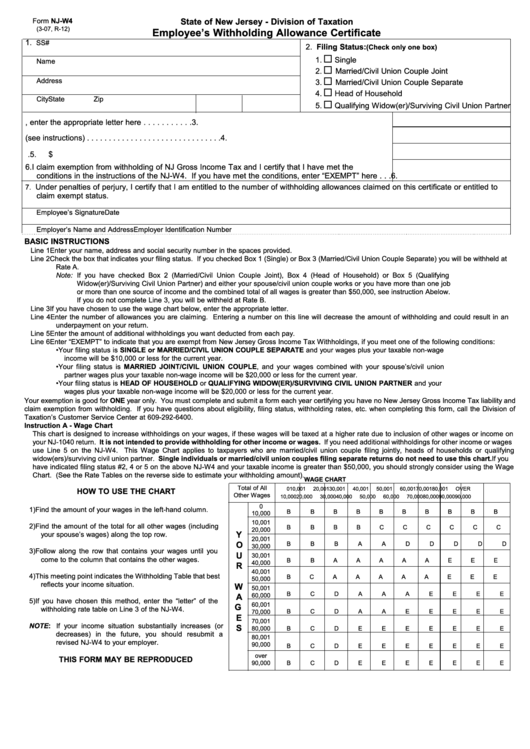

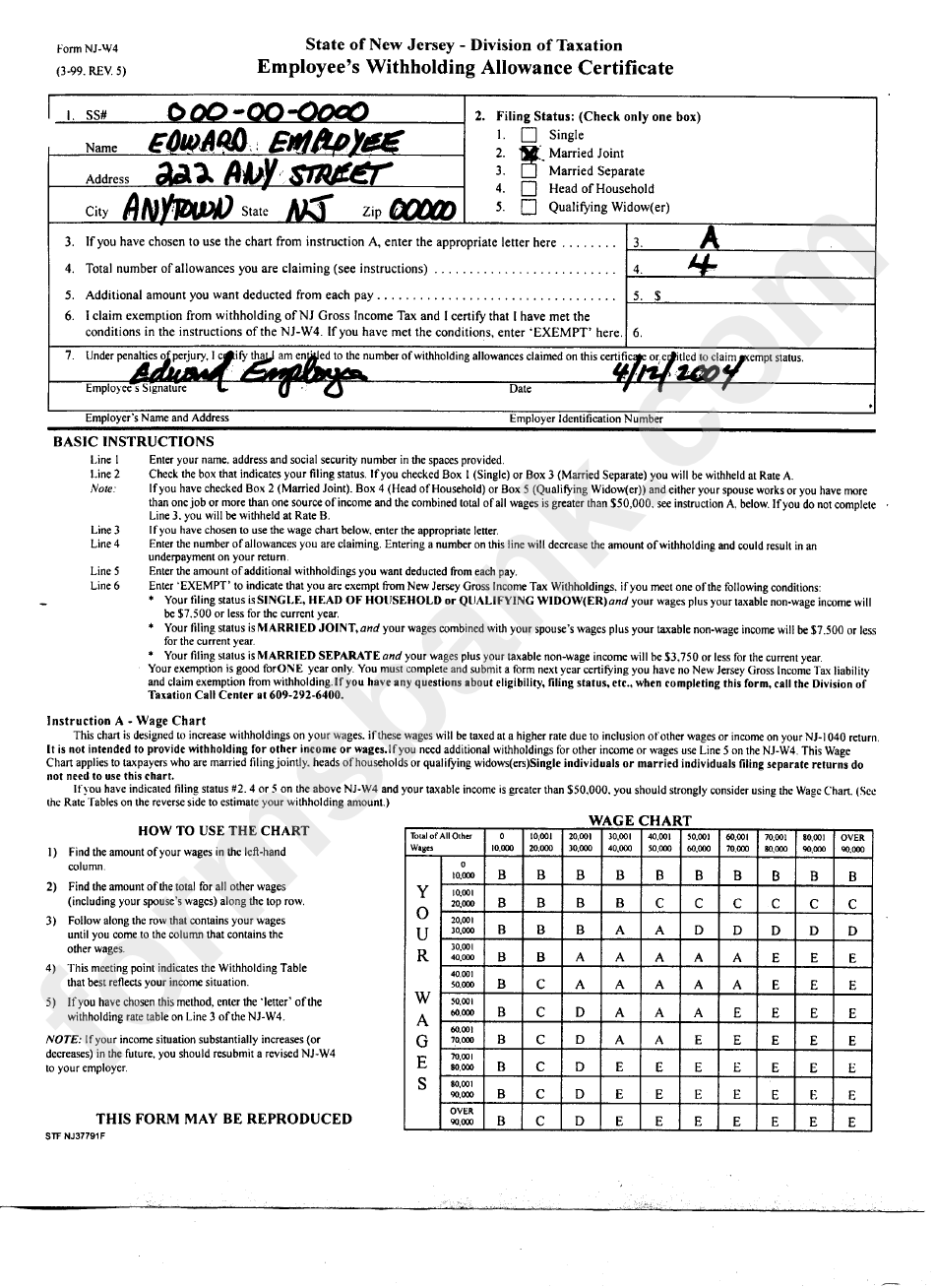

Wage Chart On Form Nj-W4 - Web • mandatory electronic filing of 1099s • how to calculate, withhold, and pay new jersey income tax • withholding rate tables • • • • • • instructions for the employer’s reports. Web you are eligible for a new jersey earned income tax credit or other credit. Thus, one of my employees who is. The tax rate on wages over $1,000,000 and up to $5,000,000 for the state of new jersey has changed from 21.3 percent to 11.8 percent for all tax tables. 2) find the amount of the total for all other wages (including your spouse’s wages) along. Additional information is contained in the new jersey income tax return instructions. Web rate “a” tables for percentage method of withholding applicable to wages, salaries, and commissions paid on and after october 1, 2020 rate “a”. Filing status:(check only one box) 1. Tax to be withheld is: This chart is designed to increase withholdings on your wages, if these wages will be taxed at a higher rate due to inclusion of other wages.

Web rate “a” tables for percentage method of withholding applicable to wages, salaries, and commissions paid on and after october 1, 2020 rate “a”. 2) find the amount of the total for all other wages (including your spouse’s wages) along. This chart is designed to increase withholdings on your wages, if these wages will be taxed at a higher rate due to inclusion of other wages. Web how to use the chart. Additional information is contained in the new jersey income tax return instructions. Web in cases like these, an employee should use the wage chart on the form to determine the rate to use when calculating state withholding amounts when filing. Web the form has a wage chart that corresponds to a letter and employees with filing status of single do not need to use the chart. Web you are eligible for a new jersey earned income tax credit or other credit. Ex, marginal tax rate 10% grab your paycheck. Filing status:(check only one box) 1.

Married/civil union couple joint 3. Line 3 if you have chosen to use the wage chart below, enter the appropriate letter. This chart is designed to increase withholdings on your wages, if these wages will be taxed at a higher rate due to inclusion of other wages. Filing status:(check only one box) 1. Tax to be withheld is: Web method 1 use the tax bracket calculator to find out what percent should be withheld to zero out. The tax rate on wages over $1,000,000 and up to $5,000,000 for the state of new jersey has changed from 21.3 percent to 11.8 percent for all tax tables. Web • mandatory electronic filing of 1099s • how to calculate, withhold, and pay new jersey income tax • withholding rate tables • • • • • • instructions for the employer’s reports. Web how to use the chart. Over but not over of excess over $ 0 $ 385 1.5% $ 0 $ 385 $ 673 $ 5.77 + 2.0% $ 385 $ 673 $ 769 $ 11.54 + 3.9% $ 673 biweekly payroll.

njminimumwagechart Abacus Payroll

Additional information is contained in the new jersey income tax return instructions. Filing status:(check only one box) 1. Web the form has a wage chart that corresponds to a letter and employees with filing status of single do not need to use the chart. Web how to use the chart. Ex, marginal tax rate 10% grab your paycheck.

Nj W4 Allowances Instructions 2022 W4 Form

Filing status:(check only one box) 1. Web the form has a wage chart that corresponds to a letter and employees with filing status of single do not need to use the chart. Tax to be withheld is: Line 4 enter the number of allowances you are claiming. This chart is designed to increase withholdings on your wages, if these wages.

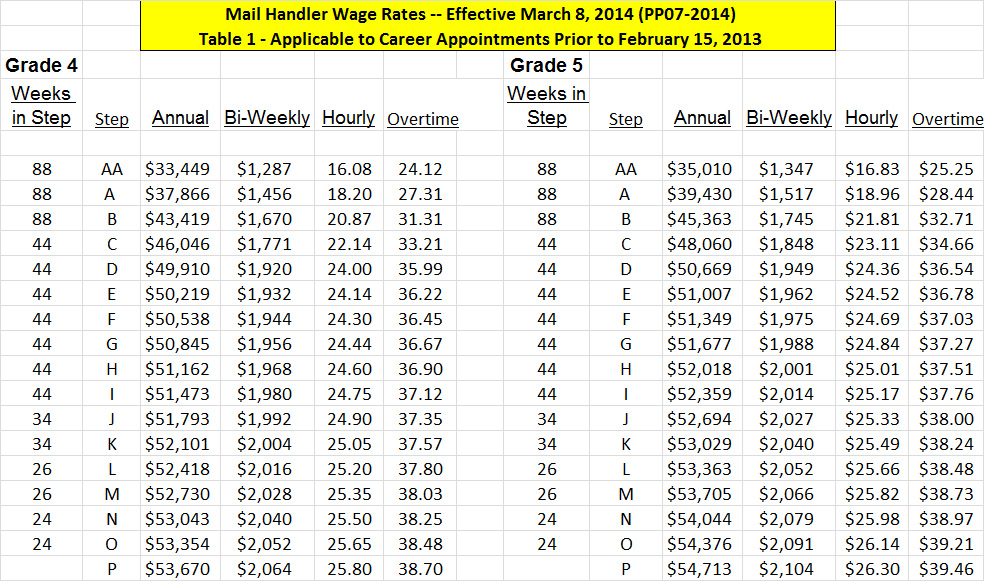

Wage Charts MHU Local 305

Web in cases like these, an employee should use the wage chart on the form to determine the rate to use when calculating state withholding amounts when filing. Ex, marginal tax rate 10% grab your paycheck. This chart is designed to increase withholdings on your wages, if these wages will be taxed at a higher rate due to inclusion of.

NJ Minimum Wage Rises Today Ocean County Scanner News

Over but not over of excess over $ 0 $ 385 1.5% $ 0 $ 385 $ 673 $ 5.77 + 2.0% $ 385 $ 673 $ 769 $ 11.54 + 3.9% $ 673 biweekly payroll. Web how to use the chart. 2) find the amount of the total for all other wages (including your spouse’s wages) along. Married/civil union.

Wage Charts National Postal Mail Handlers Union

Web how to use the chart. Thus, one of my employees who is. The tax rate on wages over $1,000,000 and up to $5,000,000 for the state of new jersey has changed from 21.3 percent to 11.8 percent for all tax tables. Web method 1 use the tax bracket calculator to find out what percent should be withheld to zero.

NJ W4 FORM Professional Healthcare Staffing

Web in cases like these, an employee should use the wage chart on the form to determine the rate to use when calculating state withholding amounts when filing. Web the form has a wage chart that corresponds to a letter and employees with filing status of single do not need to use the chart. Line 3 if you have chosen.

How To Fill A Employee's Withholding Certificate Form

Ex, marginal tax rate 10% grab your paycheck. Married/civil union couple joint 3. Web how to use the chart. Additional information is contained in the new jersey income tax return instructions. Web you are eligible for a new jersey earned income tax credit or other credit.

MAIL HANDLERS TO RECEIVE GUARANTEED WAGE INCREASE EFFECTIVE NOVEMBER 14

Thus, one of my employees who is. Additional information is contained in the new jersey income tax return instructions. Filing status:(check only one box) 1. Over but not over of excess over $ 0 $ 385 1.5% $ 0 $ 385 $ 673 $ 5.77 + 2.0% $ 385 $ 673 $ 769 $ 11.54 + 3.9% $ 673 biweekly.

Nj w 4 form 2019 Fill out & sign online DocHub

Thus, one of my employees who is. Filing status:(check only one box) 1. Web the form has a wage chart that corresponds to a letter and employees with filing status of single do not need to use the chart. Ex, marginal tax rate 10% grab your paycheck. Tax to be withheld is:

NJ W4 FORM Professional Healthcare Staffing

Ex, marginal tax rate 10% grab your paycheck. Web you are eligible for a new jersey earned income tax credit or other credit. Filing status:(check only one box) 1. This chart is designed to increase withholdings on your wages, if these wages will be taxed at a higher rate due to inclusion of other wages or income. Web the form.

Web • Mandatory Electronic Filing Of 1099S • How To Calculate, Withhold, And Pay New Jersey Income Tax • Withholding Rate Tables • • • • • • Instructions For The Employer’s Reports.

Line 4 enter the number of allowances you are claiming. This chart is designed to increase withholdings on your wages, if these wages will be taxed at a higher rate due to inclusion of other wages or income. Additional information is contained in the new jersey income tax return instructions. Web in cases like these, an employee should use the wage chart on the form to determine the rate to use when calculating state withholding amounts when filing.

Filing Status:(Check Only One Box) 1.

The tax rate on wages over $1,000,000 and up to $5,000,000 for the state of new jersey has changed from 21.3 percent to 11.8 percent for all tax tables. Web you are eligible for a new jersey earned income tax credit or other credit. Line 3 if you have chosen to use the wage chart below, enter the appropriate letter. Ex, marginal tax rate 10% grab your paycheck.

Web Method 1 Use The Tax Bracket Calculator To Find Out What Percent Should Be Withheld To Zero Out.

Married/civil union couple joint 3. Web the form has a wage chart that corresponds to a letter and employees with filing status of single do not need to use the chart. This chart is designed to increase withholdings on your wages, if these wages will be taxed at a higher rate due to inclusion of other wages. Thus, one of my employees who is.

Web Rate “A” Tables For Percentage Method Of Withholding Applicable To Wages, Salaries, And Commissions Paid On And After October 1, 2020 Rate “A”.

Web how to use the chart. 2) find the amount of the total for all other wages (including your spouse’s wages) along. Tax to be withheld is: Over but not over of excess over $ 0 $ 385 1.5% $ 0 $ 385 $ 673 $ 5.77 + 2.0% $ 385 $ 673 $ 769 $ 11.54 + 3.9% $ 673 biweekly payroll.