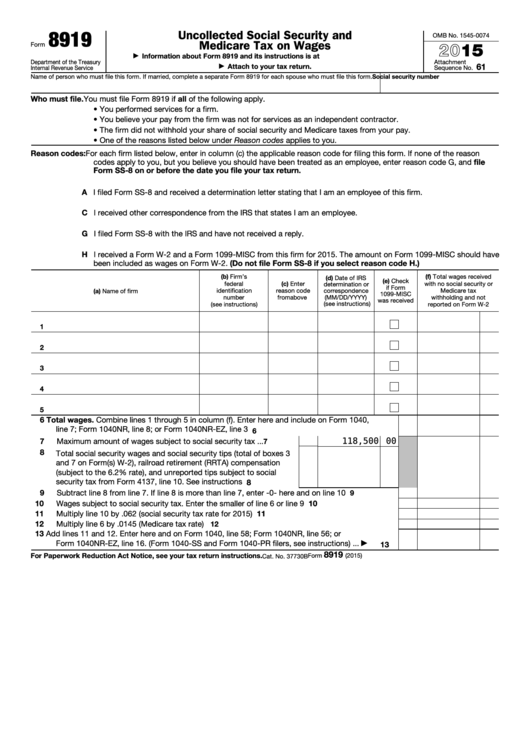

Wages From Form 8919

Wages From Form 8919 - Web medicare tax on wages information about form 8919 and its instructions is at www.irs.gov/form8919. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. Web about form 8919, uncollected social security and medicare tax on wages. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. You must file form 8919 if. Ss8 has been submitted but without an irs answer yet. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Web 1 best answer anthonyc level 7 this information is entered in a different area of the program then regular w2s. Per irs form 8919, you must file this form if all of the following apply.

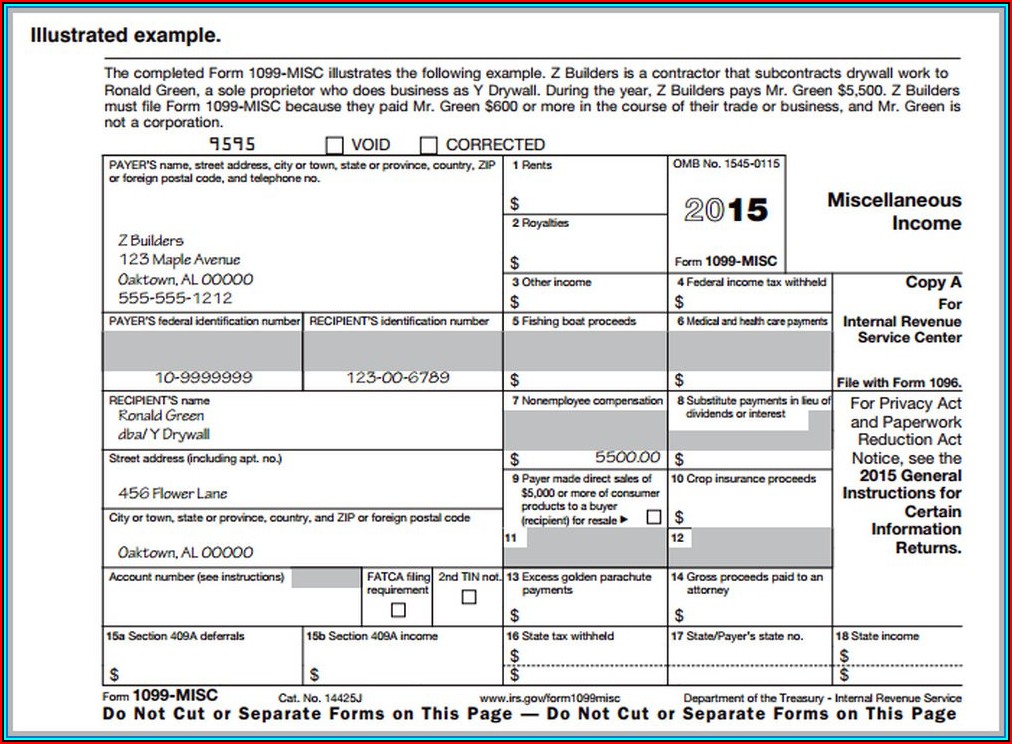

Web workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes withheld from their. Per irs form 8919, you must file this form if all of the following apply. Web if married, complete a separate form 8919 for each spouse who must file this form. You performed services for a. Web form 8919, uncollected social security and medicare tax on wages ines zemelman, ea 22 march 2023 as a seasoned tax expert with years of experience, i've. Web about form 8919, uncollected social security and medicare tax on wages. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. The taxpayer performed services for an individual or a firm. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as.

You performed services for a. Enter here and include on form. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Web if married, complete a separate form 8919 for each spouse who must file this form. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. Web after confirming your employment status, they must file form 8919 to report uncollected social security and medicare tax on wages. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach.

IRS Form 8919 Uncollected Social Security & Medicare Taxes

Meet irs form 8919 jim buttonow, cpa, citp. Attach to your tax return. How do i change the reason. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by. Ss8 has been submitted but without an irs answer yet.

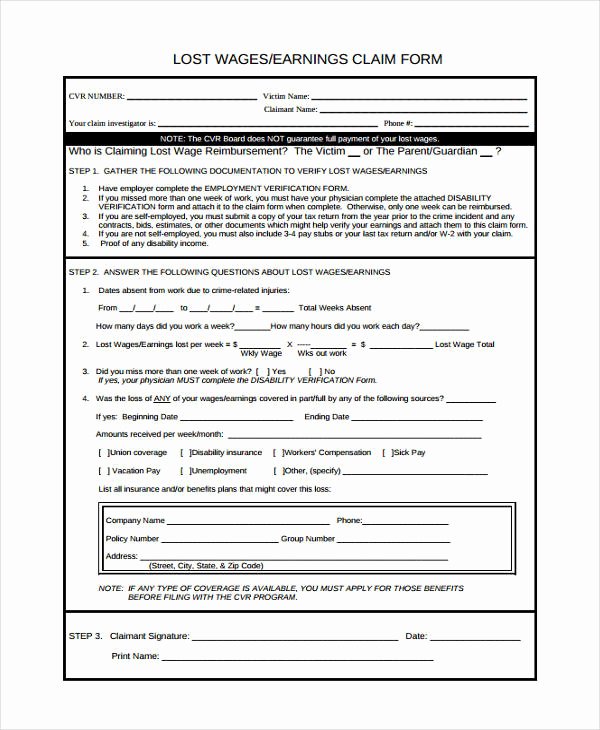

√ 20 Lost Wages form ™ Dannybarrantes Template

Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by. Web use.

Lost Wages Form Car Accident Form Resume Examples l6YN6AlY3z

How do i change the reason. Web 1 best answer anthonyc level 7 this information is entered in a different area of the program then regular w2s. Combine lines 1 through 5 in column (f). Web if married, complete a separate form 8919 for each spouse who must file this form. You performed services for a.

Fill Form 8919 Uncollected Social Security and Medicare Tax

Enter here and include on form. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. You must file form 8919 if..

Fillable Form 8919 Uncollected Social Security And Medicare Tax On

Enter here and include on form. Attach to your tax return. Combine lines 1 through 5 in column (f). Web workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes withheld from their. Web form 8919, uncollected social security and medicare tax on wages ines zemelman, ea.

Lost wages/earnings claim form in Word and Pdf formats page 4 of 4

Web form 8919, uncollected social security and medicare tax on wages ines zemelman, ea 22 march 2023 as a seasoned tax expert with years of experience, i've. Web if married, complete a separate form 8919 for each spouse who must file this form. Web about form 8919, uncollected social security and medicare tax on wages. Web workers must file form.

US Internal Revenue Service f8888 Tax Refund Individual Retirement

Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. You performed services for a. How do i change the reason. Web about form 8919, uncollected social security and medicare tax on wages. Attach to your tax return.

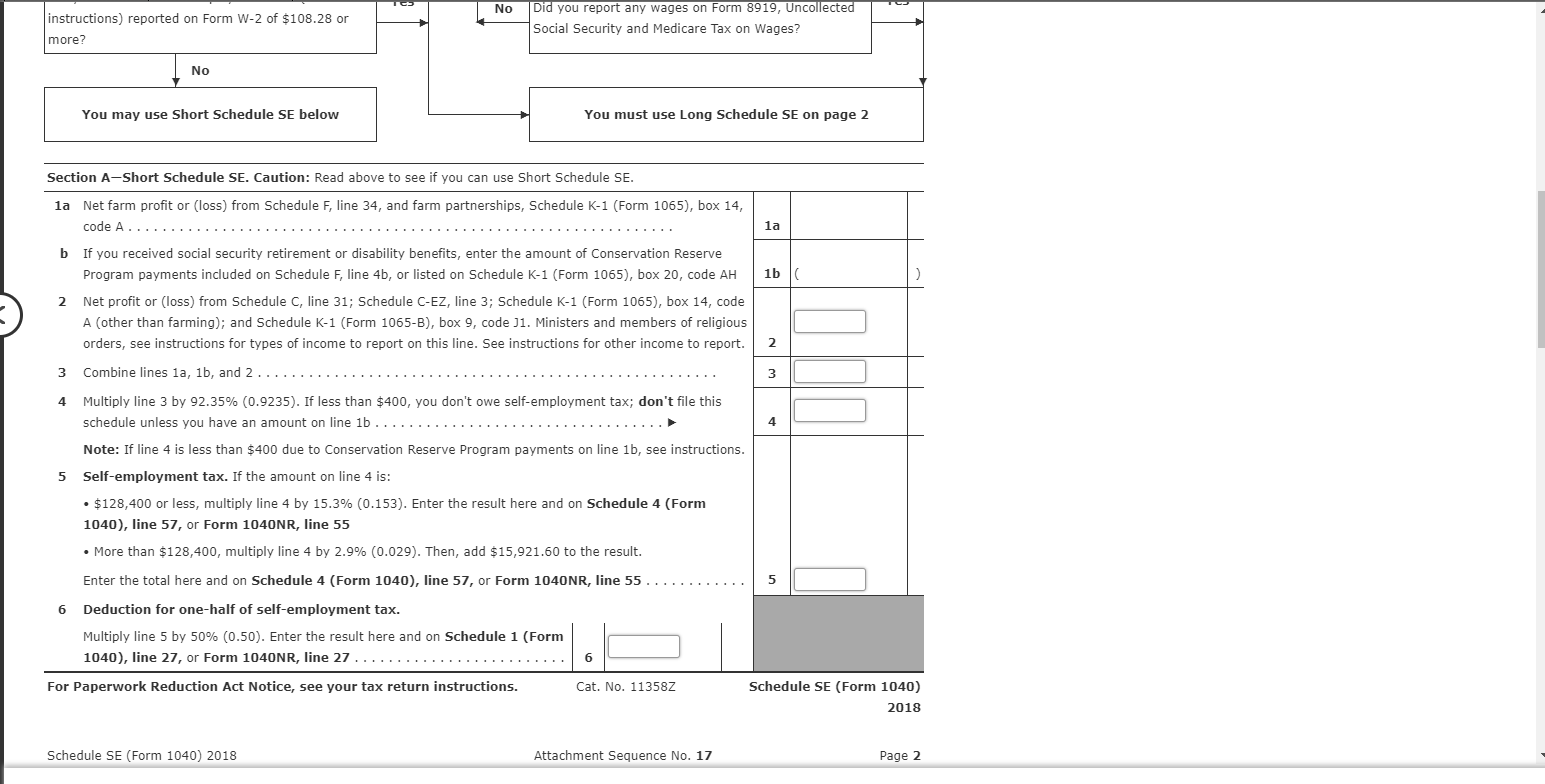

Solved Problem 616 (Algorithmic) SelfEmployment Tax (LO...

Meet irs form 8919 jim buttonow, cpa, citp. Combine lines 1 through 5 in column (f). Per irs form 8919, you must file this form if all of the following apply. Enter here and include on form. Web if married, complete a separate form 8919 for each spouse who must file this form.

Lost wages/earnings claim form in Word and Pdf formats page 3 of 4

Meet irs form 8919 jim buttonow, cpa, citp. Combine lines 1 through 5 in column (f). Web form 8919, uncollected social security and medicare tax on wages ines zemelman, ea 22 march 2023 as a seasoned tax expert with years of experience, i've. Web workers must file form 8919, uncollected social security and medicare tax on wages, if they did.

Financial Concept about Form 8919 Uncollected Social Security and

Web about form 8919, uncollected social security and medicare tax on wages. Enter here and include on form. Combine lines 1 through 5 in column (f). Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Use form 8919.

You Must File Form 8919 If.

Enter here and include on form. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Combine lines 1 through 5 in column (f).

Attach To Your Tax Return.

You performed services for a. Web 1 best answer anthonyc level 7 this information is entered in a different area of the program then regular w2s. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web if married, complete a separate form 8919 for each spouse who must file this form.

Web About Form 8919, Uncollected Social Security And Medicare Tax On Wages.

Web medicare tax on wages information about form 8919 and its instructions is at www.irs.gov/form8919. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Per irs form 8919, you must file this form if all of the following apply. Web workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes withheld from their.

Web Use Form 8919 To Figure And Report Your Share Of The Uncollected Social Security And Medicare Taxes Due On Your Compensation If You Were An Employee But Were Treated As.

Ss8 has been submitted but without an irs answer yet. Web after confirming your employment status, they must file form 8919 to report uncollected social security and medicare tax on wages. Use form 8919 to figure and report your share of the uncollected social. Meet irs form 8919 jim buttonow, cpa, citp.