Wells Fargo 401K Hardship Withdrawal Form 2019

Wells Fargo 401K Hardship Withdrawal Form 2019 - Both the dol and the. On the other hand, 401k hardship withdrawal does not come without a price. Web for questions regarding this form, refer to the attached participant hardship withdrawal guide (guide), visit the website at www.retirementlink.jpmorgan.com or contact service. Web yes, you can. Web there are other exceptions to the 10% additional tax including: Web a 401k hardship withdrawal can cost you more than once. Web a 401(k) plan may permit distributions to be made on account of a hardship. If you’re over 59 1/2 years old the. To add features to your current account, simply download, print, and fill out the appropriate form or application and submit it via the provided fax number or. Roll over your assets into an individual retirement account (ira) leave your assets in your former employer’s qrp, if the plan allows.

Hardship distributions also come with substantial financial strings attached. Web or, when you are considering rolling money over from a 401(k) to an ira, you may wish to roll over only a portion of your retirement savings and take the rest in cash. Use this calculator to estimate how much in taxes you could owe if you. Web here’s another reason why employers should limit (or even eliminate altogether) workers’ opportunities for 401(k) hardship withdrawals. Web many 401 (k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. Web you generally have four options: Both the dol and the. You must report your withdrawal as. Web for questions regarding this form, refer to the attached participant hardship withdrawal guide (guide), visit the website at www.retirementlink.jpmorgan.com or contact service. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor.

Web there are other exceptions to the 10% additional tax including: Web the final regulations permit, but do not require, 401 (k) plans to allow hardship distributions of elective contributions, qnecs, qmacs, and safe harbor contributions and earnings. You may qualify for a loan against your 401(k), that would have the least adverse tax consequences as long as you pay it back. Your death, being disabled, eligible medical expenses, taking substantially equal periodic payments (sepp), qualified. On the other hand, 401k hardship withdrawal does not come without a price. Web 401 (k) or other qualified employer sponsored retirement plan (qrp) early distribution costs calculator. Web plans are not required to do so. Web a 401(k) plan may permit distributions to be made on account of a hardship. Both the dol and the. Hardship distributions also come with substantial financial strings attached.

Wells Fargo Qdro Form Free Universal Network

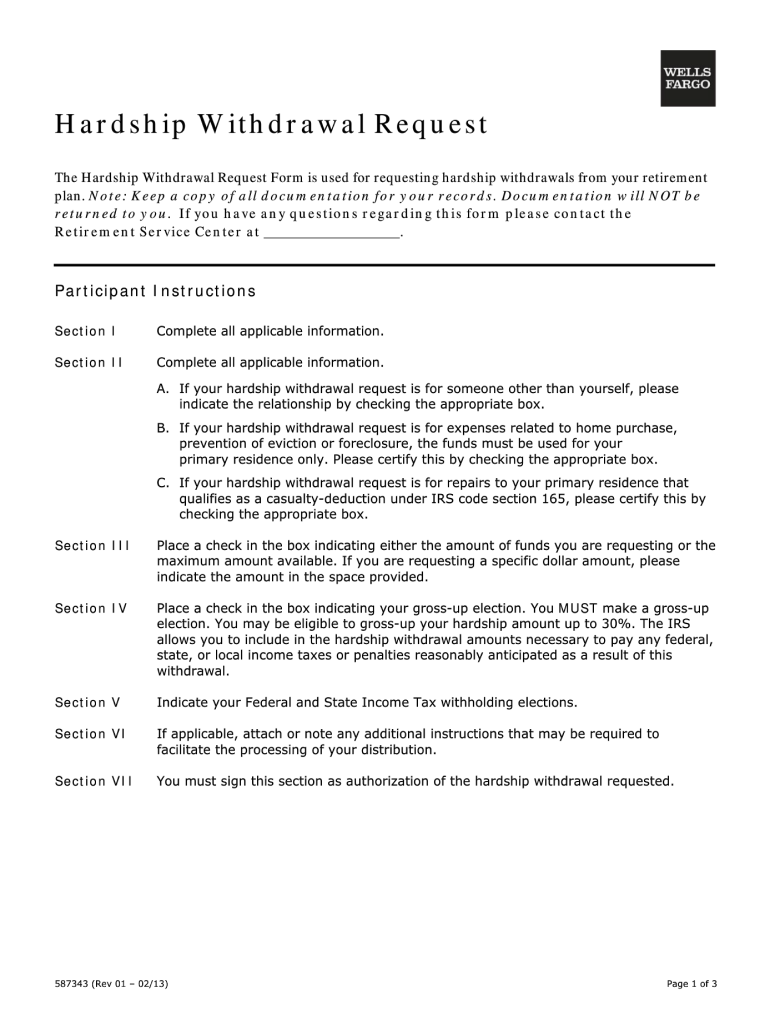

Web for questions regarding this form, refer to the attached participant hardship withdrawal guide (guide), visit the website at www.retirementlink.jpmorgan.com or contact service. Web a 401k hardship withdrawal can cost you more than once. Web yes, you can. Hardship distributions also come with substantial financial strings attached. Web you generally have four options:

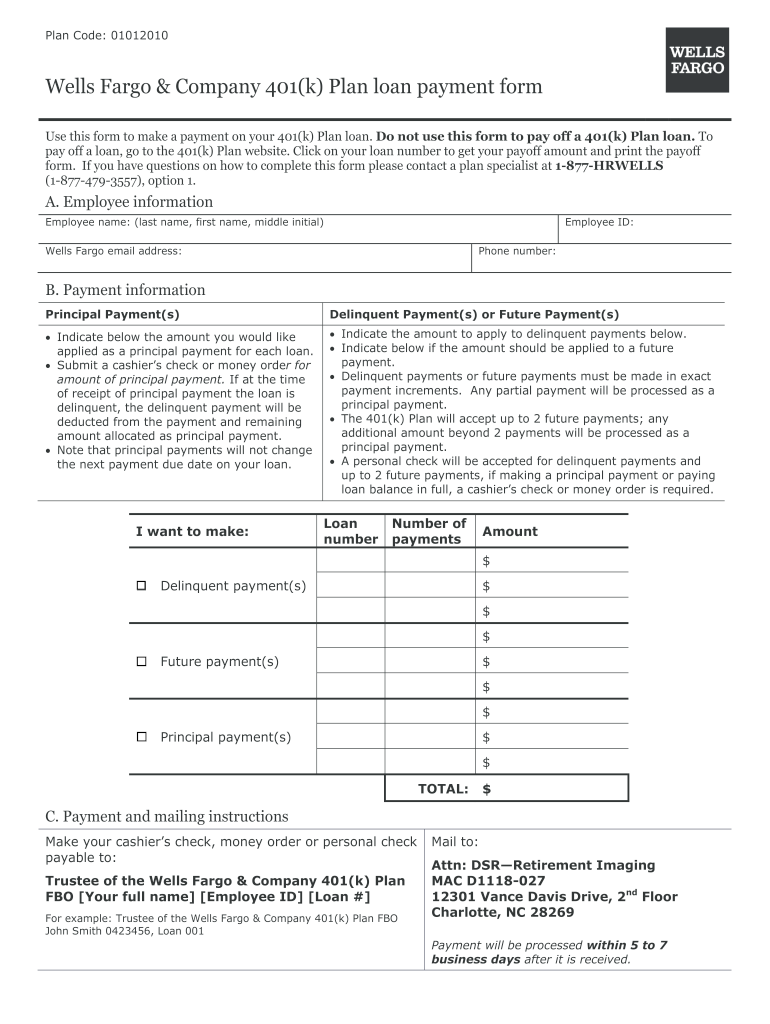

Wells Fargo Loan Payoff Form Fill Out and Sign Printable PDF Template

Web a 401(k) plan may permit distributions to be made on account of a hardship. If you’re over 59 1/2 years old the. Web 401 (k) or other qualified employer sponsored retirement plan (qrp) early distribution costs calculator. To add features to your current account, simply download, print, and fill out the appropriate form or application and submit it via.

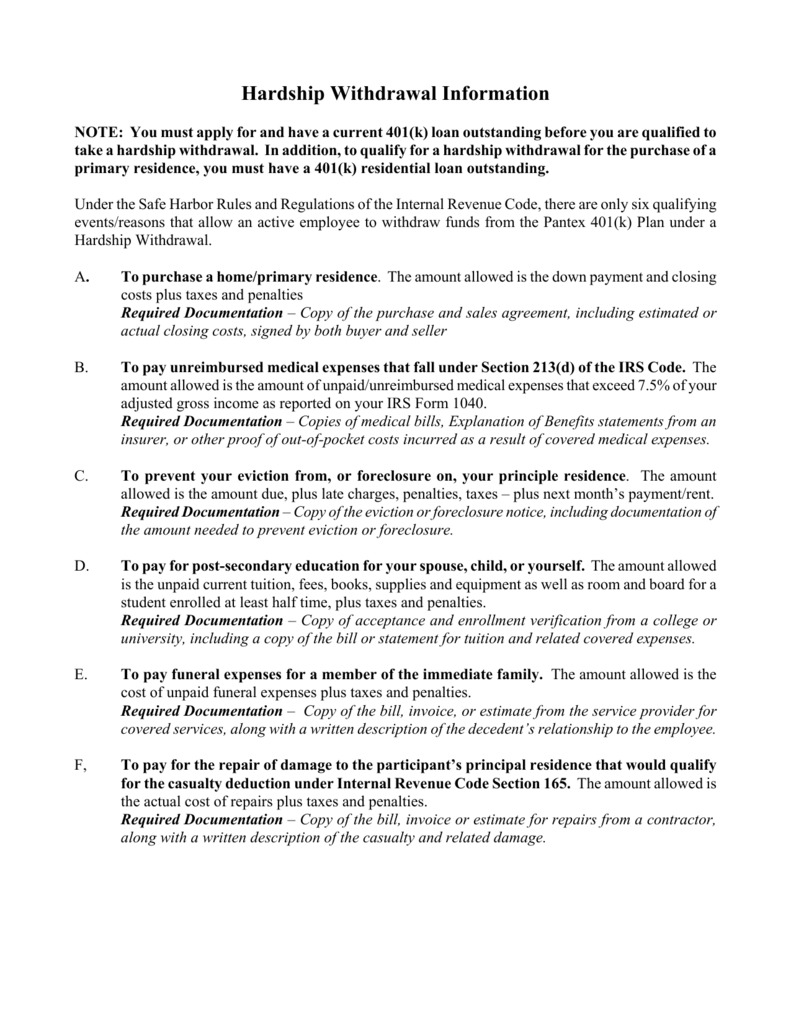

Hardship Withdrawal Information

Web 401 (k) or other qualified employer sponsored retirement plan (qrp) early distribution costs calculator. Web a hardship distribution is a withdrawal from a participant’s elective deferral account made because of an immediate and heavy financial need, and limited to the amount necessary. If you’re over 59 1/2 years old the. Check out how easy it is to complete and.

401k Rollover Form Wells Fargo Form Resume Examples Rg8DARew1M

Web 401 (k) or other qualified employer sponsored retirement plan (qrp) early distribution costs calculator. Web yes, you can. You can’t repay a hardship distribution to your retirement plan. You may qualify for a loan against your 401(k), that would have the least adverse tax consequences as long as you pay it back. Check out how easy it is to.

Wells fargo 401k hardship withdrawal form 2013 Fill out & sign online

Web a 401(k) plan may permit distributions to be made on account of a hardship. You can’t repay a hardship distribution to your retirement plan. Web death disability substantially equal periodic payments made over life expectancy termination of service after five years and reaching age 55 qualified military reservist. Web december 22, 2020 full y completed and signed paper work.

The ABC's of a Forebearance Plan

You can’t repay a hardship distribution to your retirement plan. Web answer (1 of 6): Web a hardship distribution is a withdrawal from a participant’s elective deferral account made because of an immediate and heavy financial need, and limited to the amount necessary. Web plans are not required to do so. Usually, money can be distributed from your 401 (k).

Ach Authorization Form Wells Fargo Universal Network

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. If you’re over 59 1/2 years old the. Web many 401 (k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. Web 401 (k) or other qualified employer sponsored.

Principal acquires Wells Fargo 401k accounts... what's next?

Web december 22, 2020 full y completed and signed paper work for dis tribution reques t s , withdrawal reques t s and loan reques t s subjec t to qualified joint & survivor annuity. Web many 401 (k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship..

Wells Fargo Shifting from Run the Bank to Change the Bank

Web there are other exceptions to the 10% additional tax including: Hardship distributions also come with substantial financial strings attached. Web for questions regarding this form, refer to the attached participant hardship withdrawal guide (guide), visit the website at www.retirementlink.jpmorgan.com or contact service. Your death, being disabled, eligible medical expenses, taking substantially equal periodic payments (sepp), qualified. Web 401 (k).

401K Hardship Letter Template Resume Letter

Web you generally have four options: Usually, money can be distributed from your 401 (k) if you die, retire, reach age 59 1/2, become. Web many 401 (k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. Web 401 (k) or other qualified employer sponsored retirement plan (qrp).

Web A Hardship Distribution Is A Withdrawal From A Participant’s Elective Deferral Account Made Because Of An Immediate And Heavy Financial Need, And Limited To The Amount Necessary.

Web plans are not required to do so. Web for questions regarding this form, refer to the attached participant hardship withdrawal guide (guide), visit the website at www.retirementlink.jpmorgan.com or contact service. Web there are other exceptions to the 10% additional tax including: With respect to the distribution of elective deferrals, a hardship is defined as an.

Hardship Distributions Also Come With Substantial Financial Strings Attached.

Web here’s another reason why employers should limit (or even eliminate altogether) workers’ opportunities for 401(k) hardship withdrawals. You may qualify for a loan against your 401(k), that would have the least adverse tax consequences as long as you pay it back. Web the final regulations permit, but do not require, 401 (k) plans to allow hardship distributions of elective contributions, qnecs, qmacs, and safe harbor contributions and earnings. To add features to your current account, simply download, print, and fill out the appropriate form or application and submit it via the provided fax number or.

On The Other Hand, 401K Hardship Withdrawal Does Not Come Without A Price.

Web or, when you are considering rolling money over from a 401(k) to an ira, you may wish to roll over only a portion of your retirement savings and take the rest in cash. Web death disability substantially equal periodic payments made over life expectancy termination of service after five years and reaching age 55 qualified military reservist. You must report your withdrawal as. Use this calculator to estimate how much in taxes you could owe if you.

Roll Over Your Assets Into An Individual Retirement Account (Ira) Leave Your Assets In Your Former Employer’s Qrp, If The Plan Allows.

Web a 401k hardship withdrawal can cost you more than once. Both the dol and the. Web you generally have four options: Web 401 (k) or other qualified employer sponsored retirement plan (qrp) early distribution costs calculator.